How To Find Life Insurance Policies Of Deceased Parent

Uncovering the Life Insurance Policies of a Deceased Parent: A Comprehensive Guide

The loss of a parent is an emotional and challenging experience, and navigating the aftermath can be overwhelming. One crucial aspect that often arises during this period is locating life insurance policies, which can provide much-needed financial stability and support for the surviving family members. This guide aims to assist you in discovering and understanding the life insurance policies left behind by your deceased parent.

While it may seem like a daunting task, finding and claiming life insurance benefits is a crucial step towards financial security and peace of mind. By systematically gathering information and following the right procedures, you can efficiently navigate this process. This guide will walk you through the essential steps, from understanding the types of life insurance policies to exploring various resources and legal avenues to locate the necessary documentation.

Understanding Life Insurance Policies

Life insurance policies are contracts between an individual (the policyholder) and an insurance company. The policyholder pays regular premiums, and in return, the insurance company promises to pay a specified sum of money (the death benefit) to designated beneficiaries upon the policyholder's death. These policies serve as a financial safety net, ensuring that loved ones are provided for even after the policyholder's passing.

There are several types of life insurance policies, each with its own unique features and benefits:

- Term Life Insurance: This is a basic form of life insurance that provides coverage for a specified term, often ranging from 10 to 30 years. It offers a death benefit only if the policyholder dies during the term of the policy. Term life insurance is typically more affordable than permanent life insurance.

- Whole Life Insurance: Whole life policies provide coverage for the policyholder's entire life, as long as premiums are paid. They include a cash value component that grows over time, offering a savings element alongside the death benefit. Whole life insurance tends to be more expensive due to its comprehensive coverage.

- Universal Life Insurance: Universal life policies offer flexible premium payments and death benefits. Policyholders can adjust the premium and death benefit amounts within certain limits, making it a customizable option. The cash value within the policy also earns interest, adding to its long-term value.

- Variable Life Insurance: This type of policy combines life insurance coverage with the potential for investment growth. The cash value is invested in separate accounts, allowing for the potential of higher returns but also carrying more risk compared to other life insurance policies.

Understanding the type of policy your parent had is crucial, as it can influence the process of locating and claiming the benefits.

Locating Life Insurance Policies

Discovering the existence and details of life insurance policies can be a complex task, but it is not impossible. Here are some steps and resources to help you in your search:

1. Start with Personal Records

Begin your search by gathering any personal records and documents your parent may have left behind. Look for financial statements, tax returns, bank statements, or even a safe deposit box. These documents might contain references to life insurance policies, including policy numbers, insurance company names, and beneficiary information.

If your parent had a will or a trust, these legal documents are excellent places to start. They often list all assets, including life insurance policies, and provide valuable clues about the policies' details.

2. Contact Family Members and Friends

Reach out to close family members, especially those who might have been involved in your parent's financial affairs. They may have knowledge of any life insurance policies, especially if they assisted your parent with financial decisions or had discussions about end-of-life planning.

Friends who were close to your parent might also be aware of any life insurance arrangements. Don't hesitate to ask and gather as much information as possible.

3. Review Mail and Email Correspondence

Go through any mail or email correspondence your parent received before their passing. Insurance companies often send policy updates, premium notices, or other communications that could provide valuable information. Look for any recent mail or emails related to life insurance policies.

If your parent had an email account, log in and search for keywords like "life insurance," "policy," or the name of a potential insurance company. This digital trail can often lead to important discoveries.

4. Explore Online Resources

The internet can be a powerful tool in your search. Visit the websites of major life insurance companies and use their online resources to search for policies. Many companies provide online lookup tools or customer service chat options where you can inquire about potential policies.

Additionally, consider using online search engines to look for your parent's name and keywords related to life insurance. This might help you uncover any publicly available information or news articles that mention life insurance policies.

5. Contact Financial Institutions

Reach out to banks, credit unions, or investment firms where your parent had accounts. Financial institutions often offer life insurance products as part of their services, and they might have records of any policies your parent held with them.

Provide the institution with your parent's name, date of birth, and any other relevant details to assist them in locating potential life insurance policies.

6. Consult an Estate Planning Attorney

If your search for life insurance policies remains fruitless, consider consulting an estate planning attorney. They have experience dealing with financial matters and can guide you through the legal processes of locating and claiming life insurance benefits.

An attorney can help you understand your rights and obligations as a beneficiary and provide valuable insights into the next steps you should take.

Claiming Life Insurance Benefits

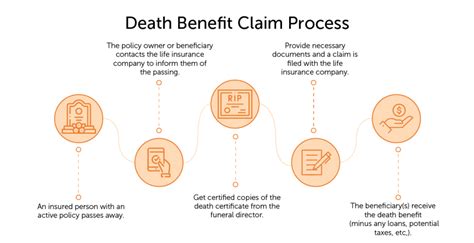

Once you've located the life insurance policies, the next step is to claim the benefits. Here's a general outline of the process:

1. Gather Required Documents

Each insurance company will have its own set of requirements, but generally, you'll need to provide the following documents:

- A certified copy of your parent's death certificate

- The original life insurance policy or a copy

- Proof of your identity and relationship to the deceased (e.g., birth certificate, marriage certificate)

- Any other specific documents requested by the insurance company

2. Contact the Insurance Company

Reach out to the insurance company and inform them of your parent's passing. Provide them with all the necessary documents and request a claim form. Insurance companies typically have dedicated customer service representatives who can guide you through the process.

3. Complete and Submit the Claim Form

Carefully review and complete the claim form, ensuring all the information is accurate and up-to-date. Provide any additional information or supporting documents as requested.

Submit the claim form along with all the required documents to the insurance company. You can typically do this via mail, email, or an online portal, depending on the company's preferences.

4. Wait for the Claim Processing

The time it takes for a life insurance claim to be processed and paid out can vary. It often depends on the complexity of the policy and the insurance company's procedures. Stay in touch with the insurance company and provide any additional information they may request.

5. Receive the Death Benefit

Once the claim is approved, the insurance company will issue a check or wire the funds to the designated beneficiary(ies). The death benefit can provide much-needed financial support during a difficult time.

Frequently Asked Questions

What if I can't find any life insurance policies?

+If your search remains unsuccessful, consider reaching out to state-run insurance departments or unclaimed property offices. They might have records of any life insurance policies that were not claimed. Additionally, consulting an estate planning attorney can provide legal guidance and help you explore other options.

How long does it take to receive the death benefit after filing a claim?

+The time it takes to receive the death benefit can vary depending on the insurance company and the complexity of the policy. Typically, it can range from a few weeks to several months. Stay in touch with the insurance company to ensure a smooth and timely process.

Can I contest a life insurance policy if I believe I should be the beneficiary?

+If you believe you have a valid claim to be the beneficiary of a life insurance policy but have been excluded or overlooked, you can contest the policy. This is a legal process that requires the assistance of an attorney. An attorney can help you understand your rights and guide you through the necessary steps to contest the policy.

Are there any tax implications when receiving a life insurance death benefit?

+In most cases, life insurance death benefits are not subject to federal income tax in the United States. However, it's essential to consult a tax professional to understand any potential state or local tax implications. They can provide guidance on how to properly report and manage the death benefit to ensure compliance with tax laws.

Conclusion

Finding and claiming life insurance policies of a deceased parent is a critical step towards financial security and emotional closure. By understanding the types of life insurance policies and systematically exploring various resources, you can increase your chances of success. Remember to keep thorough records, communicate with relevant parties, and seek professional guidance when needed.

This guide aims to empower you with the knowledge and tools to navigate this complex process. With patience, persistence, and the right support, you can discover and claim the life insurance benefits your parent left behind, providing much-needed stability during a challenging time.