How To Get Blue Cross Insurance Directly In Massachusetts

In the state of Massachusetts, having access to comprehensive health insurance coverage is essential for individuals and families. Blue Cross Blue Shield of Massachusetts (BCBSMA) is a leading healthcare provider, offering a range of insurance plans to cater to different needs. This guide will walk you through the process of obtaining Blue Cross insurance directly in Massachusetts, highlighting the key steps, requirements, and options available to residents.

Understanding Blue Cross Blue Shield of Massachusetts

Blue Cross Blue Shield of Massachusetts, often referred to as BCBSMA, is a not-for-profit healthcare organization with a rich history dating back to the 1930s. The company’s mission is to provide high-quality, affordable healthcare solutions to the people of Massachusetts, ensuring access to essential medical services. BCBSMA offers a diverse range of insurance plans, including individual, family, and employer-sponsored options, making it a popular choice for residents seeking comprehensive coverage.

Eligibility and Enrollment

To be eligible for Blue Cross insurance in Massachusetts, individuals must meet certain criteria. Here are the key requirements:

- Residency: Applicants must be legal residents of Massachusetts. BCBSMA verifies residency through various documents, including driver's licenses, state-issued IDs, or utility bills.

- Age: There are no specific age restrictions for enrolling in Blue Cross insurance. Both young adults and seniors can find suitable plans to meet their healthcare needs.

- Citizenship/Visa Status: While US citizenship is not a requirement, individuals on certain visa types may have different eligibility criteria. It is advisable to check with BCBSMA for specific guidelines based on visa status.

- Pre-Existing Conditions: Blue Cross insurance plans in Massachusetts do not discriminate based on pre-existing conditions. All applicants are guaranteed coverage, regardless of their medical history.

Enrollment Periods and Special Enrollment

Open Enrollment: The annual open enrollment period for individual and family plans typically occurs in the fall. During this time, residents can enroll, renew, or make changes to their coverage. It is essential to be aware of the deadlines to ensure a seamless transition.

Special Enrollment: Outside the open enrollment period, individuals may qualify for special enrollment if they experience specific life events, such as losing job-based coverage, getting married, or having a baby. These qualifying events allow for a special enrollment period, ensuring individuals can obtain coverage promptly.

Choosing the Right Blue Cross Plan

Blue Cross Blue Shield of Massachusetts offers a wide array of insurance plans to cater to different lifestyles, healthcare needs, and budgets. Here’s a breakdown of the key plan types:

Individual and Family Plans

These plans are designed for individuals, couples, and families. They offer a range of coverage options, including:

- Bronze Plans: Offering the lowest premiums, these plans typically have higher deductibles and out-of-pocket expenses. They are ideal for those who prioritize lower monthly costs and anticipate fewer medical expenses.

- Silver Plans: Striking a balance between cost and coverage, Silver plans provide a good mix of premiums and out-of-pocket costs. They are suitable for individuals and families with moderate healthcare needs.

- Gold Plans: Gold plans offer extensive coverage with higher premiums and lower deductibles. They are ideal for individuals with chronic conditions or those who anticipate significant medical expenses.

- Platinum Plans: Providing the highest level of coverage, Platinum plans have the highest premiums and lowest out-of-pocket costs. These plans are perfect for individuals who want comprehensive coverage without worrying about unexpected medical bills.

Employer-Sponsored Plans

Many employers in Massachusetts offer Blue Cross insurance as part of their benefits package. These plans are typically more cost-effective as employers often contribute to the premiums. The specific plans and coverage options vary based on the employer’s arrangement with BCBSMA.

Student Plans

Blue Cross Blue Shield of Massachusetts also provides insurance plans tailored to the needs of students. These plans often have more flexible options and may be available at reduced rates. It is essential for students to explore their options and understand the coverage limits and exclusions.

Applying for Blue Cross Insurance

The application process for Blue Cross insurance in Massachusetts is straightforward and can be completed online, by phone, or in person. Here’s a step-by-step guide:

- Gather Documentation: Before starting the application, ensure you have all the necessary documents ready. This includes proof of residency, identification, and any relevant medical records if applicable.

- Choose Your Plan: Based on your healthcare needs and budget, select the plan that best suits your requirements. Consider factors such as premiums, deductibles, and coverage limits.

- Complete the Application: Fill out the online application form or contact BCBSMA's customer service to apply over the phone. Provide accurate and detailed information to ensure a smooth enrollment process.

- Submit Supporting Documents: If required, upload or mail any supporting documents to BCBSMA. This may include proof of income, residency, or other relevant information.

- Review and Confirm: Carefully review the plan details, including coverage limits, exclusions, and any add-on options. Ensure you understand the terms and conditions before confirming your enrollment.

- Pay Premiums: Set up automatic payments or pay your premiums manually. It is crucial to stay up-to-date with premium payments to maintain continuous coverage.

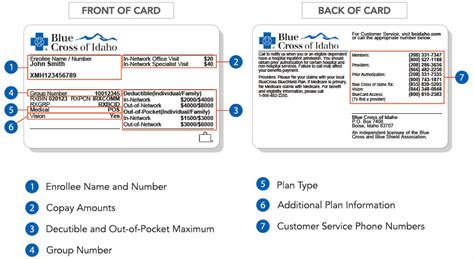

Understanding Your Policy and Benefits

Once enrolled, it is essential to familiarize yourself with your insurance policy. Here are some key aspects to consider:

- Network Providers: Blue Cross insurance plans typically have a network of preferred providers. It is beneficial to choose in-network providers to maximize your coverage and minimize out-of-pocket costs.

- Coverage Limits and Exclusions: Review the policy document to understand the specific coverage limits and any exclusions. This ensures you are aware of any services or treatments that may not be covered by your plan.

- Out-of-Pocket Costs: Understand your deductible, co-payments, and co-insurance amounts. Knowing these costs helps you budget for potential medical expenses.

- Add-On Benefits: Explore optional add-on benefits, such as dental, vision, or prescription drug coverage. These can enhance your overall healthcare experience and provide additional peace of mind.

Utilizing Your Blue Cross Insurance

Once you have your Blue Cross insurance, it’s important to understand how to make the most of your coverage. Here are some key considerations:

Choosing a Primary Care Physician (PCP)

Most Blue Cross insurance plans require you to choose a primary care physician (PCP) who will coordinate your healthcare needs. Selecting a PCP who is in-network and aligns with your healthcare preferences is crucial. Consider factors such as location, specialization, and availability when making your choice.

Understanding Referrals and Pre-Authorization

Some medical services, such as specialist visits or certain procedures, may require a referral from your PCP. Additionally, certain treatments or tests may need pre-authorization from your insurance provider. It is essential to understand the referral and pre-authorization process to ensure seamless coverage and avoid unexpected costs.

Using In-Network Providers

Utilizing in-network providers is key to maximizing your insurance benefits. These providers have negotiated rates with Blue Cross, ensuring more affordable services. While out-of-network providers may be an option, they typically come with higher costs and may not be fully covered by your insurance plan.

Understanding Your EOB (Explanation of Benefits)

After receiving medical services, you will receive an EOB from Blue Cross detailing the charges, payments made, and any remaining balances. It is important to review these statements carefully to ensure accuracy and understand your financial responsibilities.

Making Changes to Your Plan

Life is full of changes, and your insurance plan should adapt accordingly. Here’s what you need to know about making changes to your Blue Cross insurance:

Changing Plans During Open Enrollment

During the annual open enrollment period, you have the opportunity to switch plans or make adjustments to your current coverage. This is the ideal time to reassess your healthcare needs and budget, ensuring you have the right plan for the upcoming year.

Life Events and Special Enrollment

Certain life events, such as marriage, divorce, birth of a child, or loss of job-based coverage, qualify for a special enrollment period. During this time, you can make changes to your insurance plan to reflect your new circumstances. It is important to act promptly to ensure continuous coverage.

Updating Personal Information

It is crucial to keep your personal information up-to-date with Blue Cross. Changes in address, phone number, or email should be reported promptly to ensure accurate communication and prevent any disruptions in coverage.

Conclusion

Obtaining Blue Cross insurance directly in Massachusetts is a straightforward process that ensures access to high-quality healthcare. By understanding the eligibility criteria, exploring the various plan options, and following the application process, residents can secure comprehensive coverage to meet their healthcare needs. Remember to review your policy regularly, utilize in-network providers, and stay informed about any changes to your plan to make the most of your Blue Cross insurance.

Can I enroll in Blue Cross insurance outside the open enrollment period?

+Yes, you can enroll outside the open enrollment period if you experience a qualifying life event, such as losing job-based coverage, getting married, or having a baby. These events allow for a special enrollment period to ensure continuous coverage.

What happens if I miss the open enrollment deadline?

+If you miss the open enrollment deadline, you will need to wait until the next open enrollment period to make changes to your plan or enroll in a new one. However, if you experience a qualifying life event, you may be eligible for a special enrollment period.

Are there any discounts or subsidies available for Blue Cross insurance in Massachusetts?

+Yes, Blue Cross Blue Shield of Massachusetts offers various discounts and subsidies to make insurance more affordable. These may include employer contributions, tax credits, or government subsidies for low-income individuals. It’s worth exploring these options to reduce your insurance costs.

Can I add my spouse and children to my Blue Cross insurance plan?

+Yes, you can add your spouse and dependent children to your Blue Cross insurance plan. The process may vary depending on your specific plan and the age of your dependents. Contact BCBSMA for guidance on adding family members to your coverage.