How To Get Florida Health Insurance

Navigating Health Insurance Options in Florida: A Comprehensive Guide

Florida, known for its vibrant lifestyle and diverse population, offers a unique landscape when it comes to health insurance. Understanding the intricacies of the healthcare system and insurance options is crucial for residents seeking comprehensive coverage. This guide aims to provide an in-depth analysis of the process, shedding light on the steps, considerations, and available resources to help Floridians make informed decisions about their health insurance.

Understanding the Florida Health Insurance Market

Florida's health insurance market is diverse and complex, offering a range of plans and providers to cater to the needs of its residents. With a large population and a significant proportion of retirees, the state has developed a unique healthcare ecosystem. Here's an overview of the key aspects:

- Marketplace Options: Florida participates in the federal Health Insurance Marketplace, providing a platform for residents to compare and enroll in health plans. This marketplace offers a variety of plans from different insurance carriers, allowing individuals and families to find coverage that suits their needs and budgets.

- Private Insurance Carriers: Apart from the marketplace, Florida is home to numerous private insurance companies that offer a wide range of health plans. These carriers often provide additional benefits and tailor their offerings to specific demographics or regions within the state.

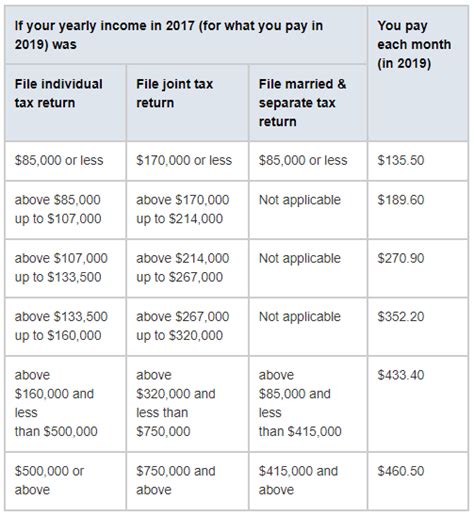

- Medicaid and Medicare: Florida's Medicaid program provides healthcare coverage to eligible low-income residents, including children, pregnant women, and certain adults. Medicare, on the other hand, is a federal program primarily for individuals aged 65 and older, offering healthcare benefits to retirees and those with certain disabilities.

- Special Enrollment Periods: Floridians have the opportunity to enroll in health insurance plans outside of the open enrollment period through special enrollment periods. These periods are triggered by specific life events, such as losing job-based coverage, getting married, or having a baby. Understanding these periods is crucial for ensuring timely enrollment.

Step-by-Step Guide to Obtaining Health Insurance in Florida

Securing health insurance in Florida involves a series of well-defined steps. By following this process, residents can navigate the system effectively and find the coverage that best suits their needs.

Assess Your Eligibility and Needs

The first step is to determine your eligibility for different types of health insurance. This involves understanding your income, family size, and any pre-existing health conditions. Assess whether you qualify for Medicaid, Medicare, or if you're better suited for a private insurance plan through the marketplace or a carrier.

| Eligibility Criteria | Description |

|---|---|

| Medicaid | Income level, family size, and specific eligibility groups (e.g., children, pregnant women) |

| Medicare | Age (65+), disability status, or end-stage renal disease |

| Marketplace Plans | Income, family size, and whether you qualify for premium tax credits or cost-sharing reductions |

Explore Your Options

Once you understand your eligibility, it's time to explore the available health insurance plans. Florida's marketplace offers a user-friendly platform where you can compare plans based on coverage, costs, and provider networks. Consider factors such as deductibles, copays, and the inclusion of your preferred healthcare providers.

- Compare Plans: Use the marketplace's comparison tool to evaluate different plans side by side. Look for plans that offer comprehensive coverage for your specific healthcare needs, whether it's prescription medications, chronic condition management, or specialty care.

- Research Carriers: Explore the reputation and financial stability of insurance carriers. Check reviews and ratings to ensure you're choosing a reliable provider.

- Understand Network Providers: Review the list of in-network doctors, hospitals, and specialists covered by each plan. Ensure that your preferred healthcare providers are included in the network to avoid out-of-network charges.

Enroll in a Health Insurance Plan

After careful consideration, it's time to enroll in a health insurance plan. The enrollment process typically involves the following steps:

- Choose a Plan: Select the plan that best aligns with your healthcare needs and budget. Consider the coverage, cost, and any additional benefits offered.

- Provide Information: You'll need to provide personal details, including your name, date of birth, Social Security number, and income information. Accurate income reporting is crucial for determining eligibility for premium tax credits or cost-sharing reductions.

- Review and Submit: Carefully review all the plan details, including coverage, costs, and any exclusions. Ensure that the information you've provided is correct and then submit your enrollment application.

- Make Payments: Depending on your plan, you may need to make an initial premium payment to activate your coverage. Some plans offer payment flexibility, while others require monthly payments.

Utilize Available Resources

Navigating the health insurance landscape can be complex, but Florida provides various resources to assist residents. Here are some key resources to leverage:

- Health Insurance Marketplace: The official website of the marketplace offers a wealth of information, including plan comparisons, eligibility criteria, and enrollment guidance. It's a one-stop shop for all your health insurance needs.

- Florida Department of Health: The state's Department of Health provides resources and information on Medicaid, Medicare, and other health insurance programs. They can assist with eligibility determinations and enrollment processes.

- Insurance Agents and Brokers: Consider working with licensed insurance agents or brokers who can provide personalized advice and guidance based on your specific circumstances. They can help you navigate the complexities of the insurance market and find the best plan for you.

Key Considerations for Florida Residents

When navigating the Florida health insurance market, it's important to keep certain considerations in mind to make the most informed decisions.

Cost of Coverage

Health insurance costs can vary significantly based on factors such as age, location, and the level of coverage desired. Consider your budget and prioritize plans that offer comprehensive coverage without straining your finances. Take advantage of premium tax credits and cost-sharing reductions if eligible to make coverage more affordable.

Network Providers and Coverage

Understanding the network of providers covered by your chosen plan is crucial. Ensure that your primary care physicians, specialists, and preferred hospitals are included in the network to avoid unexpected out-of-network charges. Review the plan's coverage for specific procedures, medications, and treatments to ensure they align with your healthcare needs.

Prescription Drug Coverage

For individuals who rely on prescription medications, it's essential to choose a plan that offers comprehensive prescription drug coverage. Review the plan's formulary (list of covered drugs) to ensure your medications are included. Consider the cost of prescriptions, including any copays or coinsurance, to avoid unexpected expenses.

Specialty Care and Chronic Condition Management

If you have specific healthcare needs, such as managing a chronic condition or accessing specialty care, choose a plan that provides coverage for these services. Ensure that the plan includes specialists in your field of need and covers the necessary treatments, therapies, or procedures.

Dental and Vision Coverage

Dental and vision care are often separate from standard health insurance plans. Consider whether you require additional coverage for these services and explore standalone dental and vision plans or bundled packages that include these benefits.

Frequently Asked Questions

Can I enroll in health insurance outside of the open enrollment period in Florida?

+Yes, Florida residents can enroll outside of the open enrollment period through special enrollment periods. These periods are triggered by specific life events, such as losing job-based coverage, getting married, or having a baby. It’s important to act promptly when these events occur to ensure uninterrupted coverage.

Are there any financial assistance programs available for health insurance in Florida?

+Absolutely! Florida offers various financial assistance programs to make health insurance more affordable. Through the Health Insurance Marketplace, eligible individuals and families can receive premium tax credits and cost-sharing reductions. Additionally, Medicaid provides coverage for low-income residents, ensuring access to healthcare services.

How do I choose the right health insurance plan for my family in Florida?

+When choosing a health insurance plan for your family, consider factors such as coverage, cost, and provider networks. Evaluate the plan’s coverage for essential services like pediatric care, maternity benefits, and specialist visits. Ensure that your preferred healthcare providers are included in the network. Compare plans using the marketplace’s tools and seek advice from licensed insurance professionals if needed.