How To Get Health Insurance For Small Business

Health insurance is a vital aspect of running a small business, ensuring the well-being of your employees and promoting a productive work environment. In this guide, we will delve into the world of small business health insurance, exploring the options, considerations, and steps to obtain the best coverage for your company. With the right approach, you can provide comprehensive healthcare benefits while managing costs effectively.

Understanding the Importance of Health Insurance for Small Businesses

Health insurance is not just a legal requirement in many countries; it is a crucial investment in the health and happiness of your employees. By offering health coverage, small businesses can attract and retain talented individuals, boost morale, and reduce absenteeism. Moreover, it provides peace of mind to employees, knowing they have access to necessary medical care without financial strain.

For small businesses, the impact of health insurance extends beyond employee satisfaction. It can also enhance productivity, reduce turnover rates, and foster a positive company culture. Furthermore, providing health benefits demonstrates a commitment to the overall well-being of your workforce, fostering loyalty and dedication.

Navigating the Options: Types of Health Insurance for Small Businesses

Group Health Insurance Plans

Group health insurance is a popular choice for small businesses, offering a range of benefits to employees. These plans typically provide coverage for medical, dental, and vision expenses, with the option to include additional benefits such as prescription drug coverage, mental health services, and more. The cost of group plans is shared between the employer and employees, with the employer often contributing a significant portion.

Association Health Plans (AHPs)

Association Health Plans are an alternative for small businesses, allowing them to join forces with other businesses to obtain group coverage. AHPs can offer more affordable rates due to the larger pool of participants. However, it’s important to note that AHPs may not provide the same level of customization as traditional group plans.

Individual Health Insurance Plans

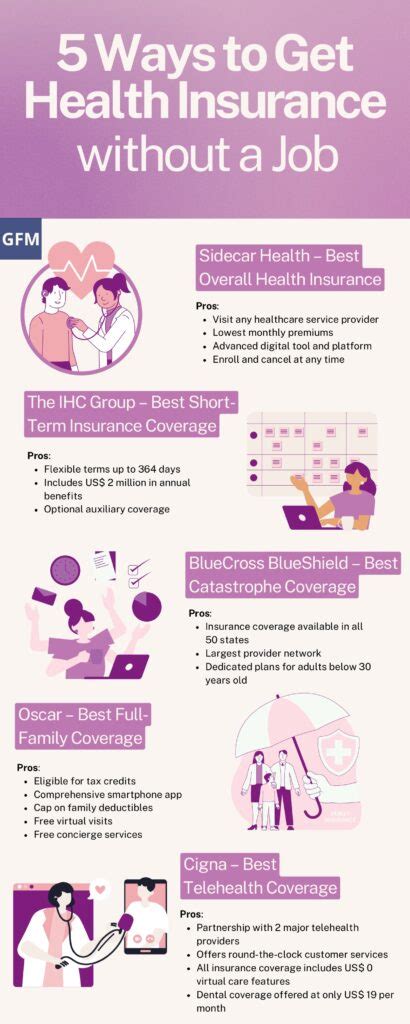

Individual health insurance plans are an option for small businesses that may not qualify for group coverage or prefer more flexibility. These plans can be tailored to the needs of individual employees, but they may come with higher premiums and less comprehensive coverage compared to group plans. It’s crucial to weigh the benefits and costs before opting for individual plans.

Key Considerations When Choosing Health Insurance for Your Small Business

Assessing Your Employees’ Needs

Understanding the healthcare needs of your employees is crucial when selecting a health insurance plan. Consider the age, gender, and health conditions of your workforce. Some employees may require coverage for chronic illnesses, while others may prioritize mental health services or prescription drug coverage. By assessing these needs, you can choose a plan that provides adequate coverage without unnecessary expenses.

Evaluating Plan Costs and Benefits

Health insurance plans vary significantly in terms of costs and benefits. It’s essential to review the details of each plan, including premiums, deductibles, copayments, and out-of-pocket maximums. Consider the balance between cost and coverage, ensuring that the plan aligns with your budget and provides the necessary benefits for your employees. Additionally, evaluate the network of providers to ensure access to preferred healthcare professionals.

Exploring Government Programs and Tax Benefits

Small businesses may be eligible for government programs and tax benefits that can reduce the cost of health insurance. Research programs like the Small Business Health Options Program (SHOP) in the United States, which offers tax credits and other incentives to small businesses. Understanding these opportunities can help you make informed decisions and potentially save on insurance expenses.

The Process of Obtaining Health Insurance for Your Small Business

Step 1: Research and Compare Plans

Start by researching and comparing various health insurance plans available in your region. Consider factors such as coverage, network of providers, and cost. Online marketplaces and insurance brokers can provide valuable insights and help you narrow down your options.

Step 2: Evaluate Provider Networks

Assess the network of healthcare providers offered by each plan. Ensure that your employees will have access to their preferred doctors, specialists, and hospitals. A robust provider network can make a significant difference in the quality of healthcare received.

Step 3: Determine Employee Contribution Levels

Decide on the level of employee contribution towards the insurance plan. Some businesses choose to cover the entire premium, while others may opt for a cost-sharing approach. It’s important to strike a balance that is fair and affordable for both the business and employees.

Step 4: Enroll and Communicate

Once you’ve selected a plan, enroll your business and ensure a smooth transition for your employees. Communicate the benefits and coverage details effectively, addressing any concerns or questions they may have. Providing clear and concise information will help employees understand their coverage and utilize it effectively.

Maximizing the Value of Your Health Insurance Plan

Utilizing Preventive Care Services

Encourage your employees to take advantage of preventive care services offered by your health insurance plan. These services, such as annual check-ups, screenings, and immunizations, can help detect health issues early on and prevent more serious conditions. By promoting preventive care, you can reduce healthcare costs and improve the overall health of your workforce.

Negotiating with Healthcare Providers

As a small business owner, you have the power to negotiate with healthcare providers to obtain better rates and services. Explore opportunities to establish preferred provider arrangements or bulk purchase agreements. By leveraging your business’s purchasing power, you can secure more favorable terms and potentially reduce healthcare costs.

Educating Employees on Cost-Saving Strategies

Educate your employees about cost-saving strategies within the health insurance plan. Teach them about the importance of using in-network providers, understanding their plan’s benefits, and utilizing generic medications when appropriate. By empowering your employees with this knowledge, you can help them make informed decisions and reduce unnecessary healthcare expenses.

Future Trends and Innovations in Small Business Health Insurance

Telehealth and Virtual Care

The rise of telehealth and virtual care services has revolutionized healthcare access. Small businesses can leverage these technologies to provide employees with convenient and cost-effective healthcare options. From virtual doctor visits to mental health counseling, telehealth services offer flexibility and can reduce the need for in-person appointments, saving time and resources.

Value-Based Care Models

Value-based care models are gaining traction in the healthcare industry, focusing on outcomes and patient satisfaction rather than purely on volume. These models aim to improve the quality of care while reducing costs. Small businesses can explore partnerships with healthcare providers that adopt value-based care, ensuring their employees receive high-quality, cost-effective healthcare.

Employee Wellness Programs

Employee wellness programs are becoming increasingly popular, with small businesses recognizing the benefits of promoting a healthy workforce. These programs can include incentives for healthy behaviors, such as gym memberships, smoking cessation programs, or weight loss challenges. By investing in employee wellness, small businesses can reduce healthcare costs and improve overall productivity.

Conclusion

Obtaining health insurance for your small business is a crucial step towards ensuring the well-being of your employees and the success of your company. By understanding the options, considering key factors, and following a systematic process, you can navigate the complex world of health insurance and choose a plan that suits your business's needs. Remember, health insurance is an investment in your most valuable asset—your employees.

FAQ

How can I reduce the cost of health insurance for my small business?

+To reduce health insurance costs, consider negotiating with healthcare providers, exploring government programs and tax benefits, and encouraging employees to utilize cost-saving strategies like using in-network providers and generic medications. Additionally, promoting preventive care can help reduce long-term healthcare expenses.

What are the tax implications of providing health insurance to employees?

+Providing health insurance to employees can have tax advantages for small businesses. You may be eligible for tax credits and deductions, depending on your jurisdiction. It’s recommended to consult with a tax professional to understand the specific tax benefits available to your business.

Can small businesses offer flexible spending accounts (FSAs) for healthcare expenses?

+Yes, small businesses can offer flexible spending accounts to help employees manage their healthcare expenses. FSAs allow employees to set aside pre-tax dollars for eligible medical expenses, providing a tax-efficient way to cover out-of-pocket costs.