How To Get Workers Comp Insurance

Navigating Workers' Compensation Insurance: A Comprehensive Guide

Ensuring the safety and well-being of your employees is not only a moral obligation but also a legal requirement for any business. Workers' compensation insurance plays a crucial role in protecting both employers and employees in the event of work-related injuries or illnesses. In this comprehensive guide, we will delve into the intricacies of obtaining workers' compensation insurance, offering valuable insights and practical steps to navigate this essential coverage.

Workers' compensation, often referred to as workers' comp, is a form of insurance that provides benefits to employees who suffer work-related injuries or illnesses. It serves as a safety net, ensuring that injured workers receive the necessary medical care and financial support during their recovery period. For employers, it offers protection against potential lawsuits and financial liabilities arising from workplace accidents.

Obtaining workers' compensation insurance is a vital step for any business, regardless of its size or industry. It demonstrates a commitment to employee welfare and compliance with legal obligations. In this guide, we will explore the key aspects of securing workers' comp insurance, including understanding the legal requirements, assessing coverage options, calculating premiums, and making informed decisions to ensure the best coverage for your business and its employees.

Understanding the Legal Landscape: Workers' Comp Requirements

Before delving into the process of obtaining workers' compensation insurance, it is imperative to grasp the legal requirements surrounding this coverage. The laws and regulations pertaining to workers' comp vary from one jurisdiction to another. In the United States, each state has its own set of regulations, which means that the requirements and processes can differ significantly.

Generally, workers' compensation insurance is mandated by state law for most employers. However, the specific requirements can vary based on factors such as the number of employees, the nature of the business, and the industry. For instance, some states may exempt very small businesses or certain professions from mandatory coverage.

To ensure compliance with the law, it is essential to understand the workers' compensation requirements in your state. This involves researching and staying updated on the latest regulations. Most states provide resources and guidance through their official websites or dedicated agencies. These resources often include information on who needs coverage, the types of injuries or illnesses covered, and the procedures for obtaining and maintaining workers' comp insurance.

Additionally, it is crucial to be aware of the penalties for non-compliance. Failing to secure the required workers' compensation insurance can result in significant fines and legal repercussions. In some cases, businesses may even face the suspension of their operations until they obtain the necessary coverage.

By thoroughly understanding the legal landscape, businesses can make informed decisions about their workers' compensation insurance needs and ensure they are in compliance with the law. This foundational knowledge is essential for navigating the subsequent steps in obtaining the right coverage.

Assessing Your Coverage Needs: Understanding Risks and Benefits

When it comes to workers' compensation insurance, one size does not fit all. Every business has unique needs and risks, and understanding these factors is crucial for determining the appropriate coverage. Assessing your coverage needs involves a comprehensive evaluation of your business operations, potential risks, and the benefits provided by workers' comp insurance.

First and foremost, it is essential to identify the specific risks associated with your industry and workplace. Different industries carry varying levels of risk. For example, construction sites are inherently more hazardous than office environments, and the types of injuries and illnesses that can occur differ significantly. By recognizing these risks, you can tailor your coverage to address the most common and severe hazards in your industry.

Additionally, it is important to consider the nature of your workforce. Factors such as the number of employees, their job roles, and the level of physical activity involved in their work can impact the likelihood and severity of injuries. For instance, a business with a large number of manual laborers may face a higher risk of injuries compared to a business with primarily desk-based employees.

Understanding the benefits provided by workers' compensation insurance is equally crucial. This coverage typically includes medical benefits, wage replacement, and rehabilitation services for injured workers. It also provides protection for employers by covering potential legal costs and liabilities arising from workplace accidents. By assessing the benefits and understanding how they align with your business needs, you can make informed decisions about the scope and extent of coverage required.

Furthermore, it is beneficial to conduct a risk assessment to identify potential hazards and implement measures to mitigate them. This proactive approach not only reduces the likelihood of accidents but also demonstrates a commitment to workplace safety, which can impact your workers' comp premiums and overall insurance costs.

Exploring Coverage Options: Tailoring Your Workers' Comp Policy

Workers' compensation insurance is not a one-size-fits-all solution. It is a highly customizable form of coverage, allowing businesses to tailor their policies to meet their specific needs and circumstances. Exploring the various coverage options available is an essential step in obtaining the right workers' comp insurance for your business.

One of the primary considerations when tailoring your workers' comp policy is the scope of coverage. This includes deciding on the types of injuries and illnesses that will be covered. While most policies cover a wide range of work-related injuries, some may exclude certain conditions or injuries sustained outside the workplace. Understanding the exclusions and limitations of different policies is crucial to ensure comprehensive coverage for your employees.

Additionally, businesses can choose between different policy structures. Some policies provide coverage for a specific period, such as a year, while others offer ongoing coverage with the option to renew annually. The choice between these structures depends on the stability and predictability of your business operations. For businesses with consistent and stable operations, a fixed-term policy may be more suitable, while those with fluctuating or uncertain operations may benefit from ongoing coverage with flexible renewal options.

Another important aspect of tailoring your workers' comp policy is determining the level of coverage needed. This involves assessing the potential costs associated with workplace injuries and illnesses, including medical expenses, wage replacement, and legal fees. By evaluating these costs, you can determine the appropriate coverage limits to ensure adequate protection for your business and employees.

Furthermore, businesses can explore optional coverage enhancements to address specific needs. For instance, some policies offer additional coverage for specific industries or occupations, such as enhanced benefits for healthcare workers or increased coverage for high-risk occupations. These optional enhancements can provide added protection and peace of mind for both employers and employees.

When exploring coverage options, it is beneficial to consult with insurance professionals who specialize in workers' compensation insurance. They can provide expert guidance and tailor-made solutions based on your business's unique needs and circumstances.

Calculating Premiums: Factors Affecting Workers' Comp Costs

Understanding the factors that influence workers' compensation insurance premiums is crucial for businesses aiming to manage their costs effectively. The premium for workers' comp insurance is not a fixed amount but rather a dynamic calculation that takes into account various factors specific to your business and industry.

One of the primary factors affecting workers' comp premiums is the classification of your business. Insurance providers categorize businesses into different classes based on the nature of their operations and the associated risks. Each classification has a corresponding rate, which serves as a starting point for calculating the premium. For instance, a construction business may have a higher rate compared to an office-based business due to the increased risk of injuries in construction work.

The payroll of your business is another critical factor in determining workers' comp premiums. The premium is often calculated as a percentage of your payroll, with higher payrolls typically resulting in higher premiums. This reflects the understanding that businesses with larger workforces have a higher likelihood of incurring workplace injuries and illnesses.

The claims history of your business also plays a significant role in premium calculations. Insurance providers assess the frequency and severity of previous claims to determine the level of risk associated with your business. Businesses with a history of frequent or severe claims may face higher premiums, as they are considered higher risk. Conversely, businesses with a clean claims history may benefit from lower premiums, as they pose a lower risk to the insurance provider.

Additionally, the loss ratio, which is the ratio of incurred losses to earned premiums, is a key consideration. Insurance providers analyze this ratio to assess the profitability of insuring your business. A high loss ratio may result in increased premiums, as it indicates a higher likelihood of claims and potential financial losses for the insurer.

By understanding these factors and how they influence workers' comp premiums, businesses can take proactive measures to manage their costs. This includes implementing safety measures to reduce the risk of injuries, managing payroll expenses efficiently, and fostering a culture of workplace safety to minimize the likelihood of claims.

Making Informed Decisions: Choosing the Right Workers' Comp Provider

Selecting the right workers' compensation insurance provider is a critical decision that can significantly impact your business's operations and financial health. With a myriad of options available in the market, it is essential to approach this decision with careful consideration and due diligence.

The first step in choosing a workers' comp provider is to conduct thorough research. Explore the market and identify reputable insurance providers who specialize in workers' compensation insurance. Look for providers with a strong track record, positive customer reviews, and a solid financial standing. Consider their experience in your industry and their ability to provide tailored solutions that align with your business's unique needs.

It is also crucial to compare the coverage options and premium rates offered by different providers. While price is an important factor, it should not be the sole consideration. Evaluate the scope and limitations of the coverage, ensuring that it adequately addresses the risks specific to your business. Assess the value proposition of each provider, considering factors such as the level of customer service, claims handling process, and additional benefits or services they may offer.

Seeking recommendations and referrals from trusted sources can provide valuable insights into the performance and reliability of different workers' comp providers. Talk to other business owners or industry peers who have experience with these providers. Their firsthand experiences and insights can help you make an informed decision and avoid potential pitfalls.

Additionally, it is beneficial to consult with insurance brokers or agents who have expertise in workers' compensation insurance. These professionals can provide impartial advice, guide you through the selection process, and negotiate the best terms and rates on your behalf. Their knowledge and connections in the insurance industry can be invaluable in securing the right coverage for your business.

The Application Process: Steps to Obtain Workers' Comp Insurance

Once you have made an informed decision about the right workers' compensation insurance provider for your business, the next step is to navigate the application process. While the specifics may vary depending on the provider and your jurisdiction, the general steps involved in obtaining workers' comp insurance are relatively standard.

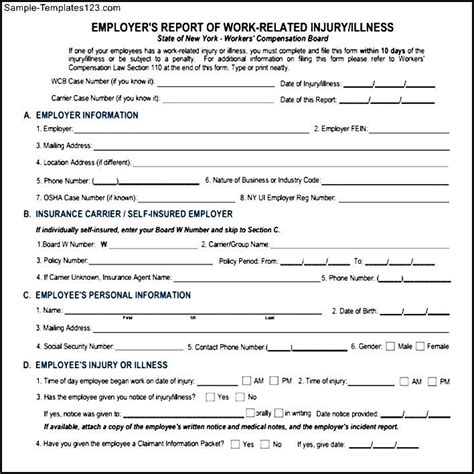

The first step is to complete and submit an application form. This form typically requires detailed information about your business, including its legal structure, nature of operations, and the number of employees. It may also seek information about your business's financial health, such as annual revenue and payroll expenses. Providing accurate and comprehensive information is crucial to ensure a smooth application process and accurate premium calculations.

After submitting the application, the insurance provider will conduct an assessment of your business to determine the level of risk and set the appropriate premium. This assessment may involve a review of your business's safety record, claims history, and other relevant factors. The provider may also request additional documentation or information to support the application.

Once the assessment is complete, the insurance provider will provide a quote for the workers' comp insurance policy. The quote will outline the coverage details, including the types of injuries and illnesses covered, the policy limits, and the premium amount. It is important to review the quote carefully, ensuring that it aligns with your business's needs and expectations.

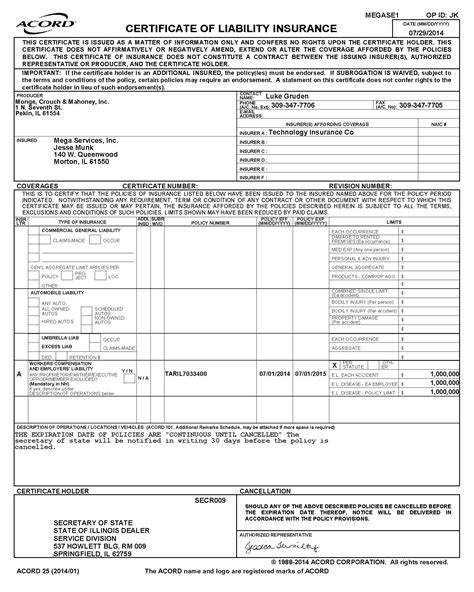

If you are satisfied with the quote, the next step is to accept the offer and finalize the policy. This typically involves signing the necessary documentation and paying the initial premium. The insurance provider will then issue the policy, providing you with the necessary certificates and documentation to demonstrate compliance with workers' compensation insurance requirements.

Throughout the application process, it is beneficial to maintain open communication with the insurance provider. They can address any concerns or questions you may have and guide you through the process, ensuring a seamless and efficient experience.

Maintaining Compliance: Post-Acquisition Workers' Comp Management

Obtaining workers' compensation insurance is a crucial step, but the journey doesn't end there. Maintaining compliance with the legal requirements and effectively managing your workers' comp policy is essential for long-term success and peace of mind. Here are some key considerations for post-acquisition workers' comp management.

Regularly reviewing and updating your workers' comp policy is crucial to ensure it remains aligned with your business's evolving needs and circumstances. As your business grows, changes in operations, workforce, or industry regulations may impact the scope and coverage requirements. By conducting periodic reviews, you can identify any gaps or areas where additional coverage may be necessary.

Staying updated on any changes in workers' compensation laws and regulations is equally important. These changes can impact the coverage requirements, reporting procedures, and premium calculations. By monitoring these changes, you can ensure your business remains in compliance and takes advantage of any new benefits or coverage options that may become available.

Effective claims management is another critical aspect of workers' comp policy management. Promptly reporting and managing claims is essential to minimize the impact on your business and employees. It is crucial to have clear procedures in place for reporting injuries or illnesses, and to work closely with the insurance provider to ensure a smooth claims process. Timely and accurate reporting can help mitigate potential delays or disputes, ensuring that injured workers receive the necessary support and benefits in a timely manner.

Additionally, fostering a culture of workplace safety and health is beneficial for both your employees and your workers' comp policy. By implementing safety measures, providing adequate training, and promoting a proactive approach to health and wellness, you can reduce the likelihood of workplace injuries and illnesses. This not only benefits your employees but also positively impacts your claims history and premium calculations.

Lastly, staying in regular communication with your insurance provider is essential. They can provide valuable guidance and support throughout the policy management process. By building a strong relationship with your provider, you can leverage their expertise and resources to optimize your workers' comp coverage and ensure long-term compliance and success.

Conclusion: Empowering Your Business with Workers' Comp Coverage

Obtaining workers' compensation insurance is a pivotal step in safeguarding your business and its employees. By understanding the legal requirements, assessing your coverage needs, exploring options, calculating premiums, and making informed decisions, you can secure the right workers' comp coverage for your business. This comprehensive guide has provided you with the essential knowledge and tools to navigate the process effectively.

Remember, workers' compensation insurance is not just a legal obligation but a demonstration of your commitment to the well-being and safety of your workforce. By providing adequate coverage, you can ensure that injured workers receive the necessary support and benefits, allowing them to recover and return to work. Additionally, workers' comp insurance protects your business from potential liabilities and legal repercussions, providing peace of mind and financial stability.

As you embark on the journey of obtaining workers' compensation insurance, keep in mind the key takeaways from this guide. Stay informed about the legal requirements in your jurisdiction, tailor your coverage to address your specific risks and needs, and choose a reputable insurance provider who can offer expert guidance and support. By doing so, you will empower your business to thrive while prioritizing the welfare of your most valuable asset - your employees.

What happens if I don’t have workers’ compensation insurance as an employer?

+Failing to have workers’ compensation insurance as an employer can result in significant penalties, including fines and legal repercussions. In some cases, businesses may face the suspension of their operations until they obtain the required coverage. It is crucial to understand the legal requirements in your jurisdiction to avoid non-compliance.

Can I choose my own doctor for workers’ compensation claims?

+The ability to choose your own doctor for workers’ compensation claims may vary depending on your jurisdiction and the terms of your policy. Some states or insurance providers may allow employees to choose their own healthcare providers, while others may have specific networks or designated providers. It is important to review your policy and understand the options available to you.

How long does it take to receive workers’ compensation benefits after an injury?

+The timeframe for receiving workers’ compensation benefits after an injury can vary depending on several factors, including the severity of the injury, the complexity of the claim, and the efficiency of the claims handling process. Generally, it is recommended to report the injury promptly to ensure a timely response and initiation of the benefits process. The insurance provider will work with you to gather the necessary information and assess the claim, after which benefits should be provided according to the terms of your policy.