How To Obtain Homeowners Insurance

Securing homeowners insurance is an essential step for every property owner, as it provides financial protection against various risks and unforeseen events. This comprehensive guide will walk you through the process of obtaining homeowners insurance, offering valuable insights and practical steps to ensure you make informed decisions. By understanding the factors that influence coverage and the steps involved, you can navigate the insurance landscape with confidence.

Understanding the Fundamentals of Homeowners Insurance

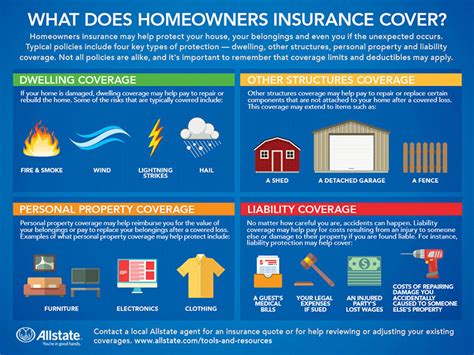

Homeowners insurance is a vital component of responsible property ownership, offering protection against a range of potential hazards and losses. It serves as a financial safety net, covering the cost of repairs or replacements for damages caused by events like fires, storms, theft, or accidental damage. Additionally, it provides liability coverage, safeguarding homeowners from legal claims arising from injuries or property damage incurred on their premises.

The coverage provided by homeowners insurance typically extends to the structure of the home, personal belongings, and additional living expenses in the event of a covered loss that renders the home uninhabitable. It's crucial to note that standard policies often exclude specific risks, such as floods and earthquakes, which may require additional coverage.

The process of obtaining homeowners insurance involves a series of well-defined steps. Initially, it's essential to research and compare various insurance providers to identify those offering policies that align with your specific needs and budget. Subsequently, you'll need to gather pertinent information about your home, including its age, square footage, construction materials, and any recent renovations or upgrades.

Factors Influencing Homeowners Insurance Rates

Numerous factors influence the rates and coverage offered by homeowners insurance policies. These include the location and value of the property, the age and condition of the home, and the specific coverage options selected. Other considerations may encompass the presence of security systems, the proximity to fire hydrants or fire stations, and the homeowner’s claims history.

For instance, properties located in areas prone to natural disasters like hurricanes or wildfires may incur higher insurance premiums due to the increased risk of claims. Similarly, older homes may require more extensive coverage to account for potential structural issues or outdated electrical systems.

To obtain accurate quotes and suitable coverage, it's advisable to provide detailed and accurate information to insurance providers. This transparency ensures that the policy adequately addresses your specific needs and circumstances.

The Process of Acquiring Homeowners Insurance

Acquiring homeowners insurance involves a series of meticulous steps, each designed to ensure that the policy you select aligns seamlessly with your specific needs and circumstances. Let’s delve into these steps, offering practical guidance and valuable insights to streamline the process.

Step 1: Research and Compare Insurance Providers

Embarking on your search for homeowners insurance begins with a thorough investigation of various insurance providers. This step is pivotal, as it empowers you to identify companies that offer policies tailored to your unique requirements and budget constraints. To facilitate this process, consider utilizing online comparison tools that aggregate quotes from multiple providers, enabling you to swiftly evaluate and contrast different options.

During your research, pay particular attention to the reputation and financial stability of each insurance provider. Opting for a reputable company with a strong financial standing ensures that they will be able to honor your claims in the event of a covered loss. Additionally, scrutinize the coverage options and policy terms offered by each provider to identify those that best align with your needs.

As you compare policies, take note of the deductible amounts, coverage limits, and any exclusions or restrictions that may apply. Understanding these nuances is crucial, as they can significantly impact the level of protection provided by your policy.

Step 2: Gather Information About Your Home

To obtain accurate quotes and suitable coverage, it’s imperative to provide insurance providers with detailed and precise information about your home. This step is pivotal in ensuring that your policy adequately addresses your specific needs and circumstances.

Begin by collecting essential data, including the age and size of your home, the materials used in its construction, and any recent renovations or upgrades. Additionally, gather information about the neighborhood and surrounding area, such as crime rates and the proximity to fire stations or hydrants. These details are crucial as they influence the risk assessment and, consequently, the insurance rates.

It's also advisable to document the value of your personal belongings, as this information can assist in determining the appropriate amount of coverage for your possessions. Accurate documentation, whether through photographs, videos, or itemized lists, can streamline the claims process should you ever need to file a claim.

Step 3: Obtain Quotes and Assess Coverage Options

Once you’ve gathered the necessary information about your home, it’s time to request quotes from the insurance providers you’ve identified as potential candidates. This step is crucial, as it allows you to compare the cost and coverage of various policies, ensuring that you select the option that best suits your needs and budget.

When reviewing quotes, pay close attention to the policy details, including the coverage limits, deductibles, and any exclusions or restrictions. Understand the differences between replacement cost coverage, which reimburses you for the cost of repairing or replacing your home and its contents, and actual cash value coverage, which considers depreciation and may result in a lower payout.

Additionally, consider the additional coverage options available, such as flood insurance or earthquake coverage, if your home is located in an area prone to these natural disasters. Assessing these options and their associated costs is essential to ensuring that your policy provides comprehensive protection.

Step 4: Review Policy Terms and Conditions

After obtaining quotes and selecting a suitable policy, it’s imperative to thoroughly review the terms and conditions outlined in the insurance contract. This step is critical, as it ensures that you fully understand the scope of coverage, any limitations or exclusions, and the obligations you must fulfill as a policyholder.

Begin by scrutinizing the policy's coverage limits, deductibles, and any special provisions or endorsements that may apply. Understand the process for filing claims, including the required documentation and timeframes, to ensure a smooth and efficient claims experience should the need arise.

It's also crucial to review the policy's liability coverage, which protects you from lawsuits resulting from injuries or property damage incurred on your premises. Ensure that the liability limits are sufficient to cover potential legal expenses and damages, providing you with the necessary financial protection.

Tips for Securing the Best Homeowners Insurance

Securing the best homeowners insurance involves more than just comparing quotes and selecting a policy. It requires a nuanced understanding of your specific needs, the risks associated with your property, and the factors that influence coverage and rates. Here are some expert tips to guide you in making informed decisions and securing the most suitable coverage for your home.

Evaluate Your Coverage Needs

Start by assessing your unique coverage needs. Consider the value of your home, the cost of rebuilding or repairing it, and the value of your personal belongings. This evaluation will help you determine the appropriate coverage limits and ensure that you’re not overpaying for coverage you don’t need.

Additionally, evaluate the risks specific to your location and property. For instance, if you live in an area prone to natural disasters like hurricanes or earthquakes, you may require additional coverage to adequately protect your home. Understanding these risks and their potential impact on your property is crucial in selecting the right policy.

Consider Bundle Discounts

Many insurance providers offer bundle discounts when you purchase multiple policies, such as homeowners insurance and auto insurance, from the same company. These discounts can significantly reduce your overall insurance costs, making it a cost-effective strategy to consider.

By bundling your policies, you not only save money but also streamline the management of your insurance portfolio. It simplifies the renewal process and ensures that all your policies are aligned, providing a seamless and efficient experience.

Review Your Policy Regularly

Homeownership is a dynamic journey, and your insurance needs may evolve over time. Regularly reviewing your policy ensures that your coverage remains up-to-date and aligned with your changing circumstances. This review process is particularly important if you’ve made significant renovations, added valuable possessions, or experienced changes in your financial situation.

During your policy review, assess whether your coverage limits and deductibles still adequately protect your assets. Consider any changes in your neighborhood or community that may impact your risk profile, such as an increase in crime rates or the construction of new infrastructure. Staying informed about these changes allows you to make adjustments to your policy as necessary.

Frequently Asked Questions

What is covered by homeowners insurance?

+Homeowners insurance typically covers damage to your home and personal belongings caused by events like fires, storms, theft, and vandalism. It also provides liability coverage for injuries or property damage that occur on your property. Additional coverages may include flood or earthquake insurance, depending on your location and needs.

How much does homeowners insurance cost?

+The cost of homeowners insurance varies based on factors such as the location, size, and value of your home, as well as your chosen coverage limits and deductibles. On average, homeowners insurance premiums range from 500 to 2,000 per year, but rates can differ significantly depending on individual circumstances.

What factors influence homeowners insurance rates?

+Several factors influence homeowners insurance rates, including the location and value of your home, the age and condition of the property, and the coverage options you select. Other considerations may include your claims history, the presence of security systems, and the proximity to fire hydrants or fire stations.

Can I customize my homeowners insurance policy?

+Absolutely! Homeowners insurance policies can be customized to fit your specific needs. You can choose different coverage limits, deductibles, and additional endorsements to tailor your policy. This customization ensures that your insurance provides the right level of protection for your home and personal belongings.

How often should I review my homeowners insurance policy?

+It’s recommended to review your homeowners insurance policy annually or whenever there are significant changes to your home, personal belongings, or financial situation. Regular reviews ensure that your coverage remains adequate and aligned with your evolving needs.