How To Reduce Car Insurance Premium

Car insurance is an essential financial protection for vehicle owners, but it can sometimes feel like a significant expense. The cost of car insurance premiums varies widely and is influenced by numerous factors, from personal circumstances to the type of vehicle insured. While it's challenging to control some of these factors, there are strategic approaches to reduce car insurance premiums. This comprehensive guide will explore practical strategies, backed by industry insights and real-world examples, to help you minimize your insurance costs without compromising on coverage.

Understanding the Factors Influencing Car Insurance Premiums

Before delving into strategies to reduce your car insurance premium, it’s crucial to understand the factors that insurance companies consider when calculating your premium. These factors fall into several categories, each playing a significant role in determining the cost of your insurance.

Vehicle-Related Factors

The type of vehicle you drive is a primary consideration for insurance companies. Factors such as the make, model, and age of your car can impact your premium. For instance, sports cars or luxury vehicles are often more expensive to insure due to their higher repair costs and potential for theft.

| Vehicle Category | Premium Impact |

|---|---|

| Sports Cars | Higher Premiums |

| Family Sedans | Moderate Premiums |

| Hybrid/Electric Vehicles | Varies; sometimes lower due to eco-friendly incentives |

Additionally, the safety features of your vehicle can also influence your premium. Cars equipped with advanced safety technologies, such as collision avoidance systems or lane departure warnings, may qualify for discounts.

Driver-Related Factors

Your personal driving history and demographics are key considerations for insurance providers. Younger drivers, especially those under 25, often face higher premiums due to their lack of driving experience and higher risk profile. Similarly, drivers with a history of accidents or traffic violations may see their premiums increase significantly.

| Driver Profile | Premium Impact |

|---|---|

| Young Drivers (16-25) | Higher Premiums |

| Experienced Drivers (Over 50) | Lower Premiums (with a clean driving record) |

| Drivers with Traffic Violations | Increased Premiums |

Your annual mileage can also affect your premium. Insurance companies may offer lower rates to drivers who log fewer miles, as this reduces the risk of accidents.

Location-Based Factors

Where you live and where you typically drive your vehicle can impact your insurance premium. Areas with a higher incidence of car theft, vandalism, or natural disasters may have higher insurance rates. Similarly, if you frequently drive in high-traffic areas or on risky roads, your premium might be higher.

Usage-Based Insurance (UBI)

Some insurance companies offer Usage-Based Insurance programs, where your premium is calculated based on your actual driving behavior. This can be a good option for safe drivers, as it allows them to potentially save on insurance costs.

Strategies to Reduce Your Car Insurance Premium

Now that we have a clearer understanding of the factors influencing car insurance premiums, let’s explore some effective strategies to reduce your insurance costs.

Shop Around and Compare Quotes

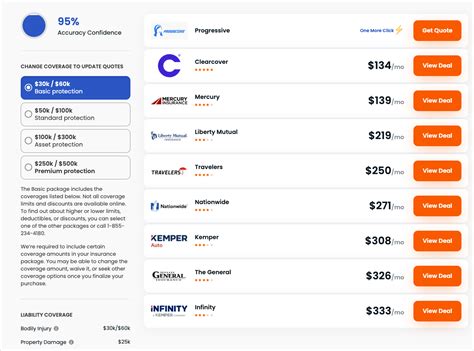

One of the simplest yet most effective ways to reduce your car insurance premium is to compare quotes from multiple insurance providers. Insurance rates can vary significantly between companies, so getting quotes from at least three providers can help you find the best deal.

Utilize online comparison tools and insurance broker services to make this process more efficient. These tools can provide a snapshot of the market and help you identify the most competitive rates.

Understand Your Coverage Needs

Review your current insurance policy to ensure you’re not overpaying for coverage you don’t need. Assess your personal risk tolerance and financial situation to determine the appropriate level of coverage for your needs. For example, if you drive an older vehicle that’s paid off, you might consider dropping collision and comprehensive coverage to reduce your premium.

However, it's important to strike a balance. While reducing coverage can lower your premium, it also means you'll have to pay more out-of-pocket in the event of an accident or other covered incident.

Explore Discounts and Bundling Options

Insurance companies offer a variety of discounts that can significantly reduce your premium. Some common discounts include:

- Safe Driver Discount: For drivers with a clean driving record.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer.

- Good Student Discount: Available for young drivers who maintain good grades.

- Loyalty Discount: For long-term customers who've been with the insurer for several years.

- Safe Vehicle Discount: For vehicles equipped with advanced safety features.

Additionally, consider bundling your car insurance with other policies, such as home or renters insurance. Many insurers offer discounts when you bundle multiple policies, which can lead to substantial savings.

Improve Your Driving Record

Your driving record is a significant factor in determining your insurance premium. Maintaining a clean driving record, free of accidents and traffic violations, can lead to substantial savings over time. Even a single traffic violation or accident can increase your premium, so safe and defensive driving is essential.

If you've had an accident or violation in the past, focus on improving your driving habits and taking steps to improve your record. This might involve taking a defensive driving course, which can sometimes lead to a premium reduction.

Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premium. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. By increasing your deductible, you assume more financial responsibility in the event of a claim, which can lead to lower premiums.

However, it's important to choose a deductible that you can afford. If you select a deductible that's too high, you may struggle to pay it in the event of a claim, defeating the purpose of having insurance.

Maintain a Good Credit Score

Your credit score is another factor that insurance companies consider when calculating your premium. In many states, insurance companies are allowed to use credit-based insurance scores to determine rates. Generally, individuals with higher credit scores are seen as less risky and may qualify for lower premiums.

Focus on maintaining a good credit score by making timely payments, keeping your credit utilization low, and regularly reviewing your credit report for accuracy.

Review Your Policy Annually

Insurance rates and your personal circumstances can change over time. It’s important to review your insurance policy annually to ensure you’re still getting the best value. This review should include assessing your coverage levels, exploring potential discounts, and comparing quotes from other providers.

Choose a Safe Vehicle

When purchasing a new vehicle, consider the insurance implications. Some vehicles are more expensive to insure due to their repair costs or theft risk. Opting for a vehicle with good safety ratings and a lower theft rate can help keep your insurance premiums lower.

The Future of Car Insurance: Telematics and Usage-Based Insurance

The insurance industry is evolving, and one of the most significant developments is the rise of Usage-Based Insurance (UBI) and telematics. UBI programs use telematics devices or smartphone apps to monitor your driving behavior, including speed, acceleration, braking, and mileage. This data is then used to calculate your insurance premium.

For safe drivers, UBI can be a great way to save on insurance costs. By demonstrating responsible driving habits, you can qualify for lower premiums. However, it's important to note that UBI may not be suitable for everyone, as it requires constant monitoring of your driving behavior.

Additionally, the advent of autonomous vehicles and advanced driver-assistance systems is likely to further revolutionize car insurance. As these technologies become more prevalent, insurance companies may adjust their underwriting models to account for the reduced risk associated with these advanced safety features.

Conclusion: Taking Control of Your Insurance Costs

Reducing your car insurance premium is within your reach. By understanding the factors that influence your premium and implementing strategic approaches, you can significantly lower your insurance costs. Whether it’s shopping around for better rates, optimizing your coverage, or adopting safe driving habits, there are numerous ways to save.

Remember, car insurance is a vital financial protection, and while reducing your premium is important, it should not compromise your coverage needs. Strike a balance between cost savings and adequate protection to ensure you're prepared for any eventuality on the road.

How often should I review my car insurance policy?

+

It’s recommended to review your car insurance policy annually to ensure you’re getting the best value and coverage. This review should include assessing your current needs, exploring potential discounts, and comparing quotes from other providers.

Can I negotiate my car insurance premium?

+

While insurance premiums are largely based on objective factors, it doesn’t hurt to ask your insurer about potential discounts or rate adjustments. Some insurers may be willing to negotiate, especially if you’ve been a long-term customer with a good payment history.

What is the best way to save on car insurance for young drivers?

+

Young drivers can save on car insurance by maintaining a clean driving record, taking a defensive driving course, and exploring discounts like the Good Student Discount. Additionally, consider adding your young driver to an existing policy with a safe driver to take advantage of multi-car and loyalty discounts.

How does my credit score impact my car insurance premium?

+

In many states, insurance companies use credit-based insurance scores to determine rates. Generally, individuals with higher credit scores are seen as less risky and may qualify for lower premiums. Maintaining a good credit score can therefore lead to savings on your car insurance.