Hra Insurance Meaning

HRA, or Health Reimbursement Arrangement, is a popular healthcare financing strategy employed by businesses and organizations to provide additional support for their employees' healthcare expenses. This article aims to delve into the intricacies of HRAs, shedding light on their definition, benefits, and implications.

Unraveling the Concept of HRA Insurance

Health Reimbursement Arrangements are a form of employee benefit that allows employers to reimburse their staff for qualified medical expenses. These arrangements offer a flexible and cost-effective way to enhance healthcare coverage, providing employees with greater control over their healthcare choices.

Unlike traditional health insurance plans, HRAs are designed to reimburse employees for a wide range of medical costs, including co-pays, deductibles, prescription medications, and even certain over-the-counter drugs. This flexibility empowers employees to make informed decisions about their healthcare, aligning their choices with their personal needs and preferences.

The Mechanics of HRA Insurance

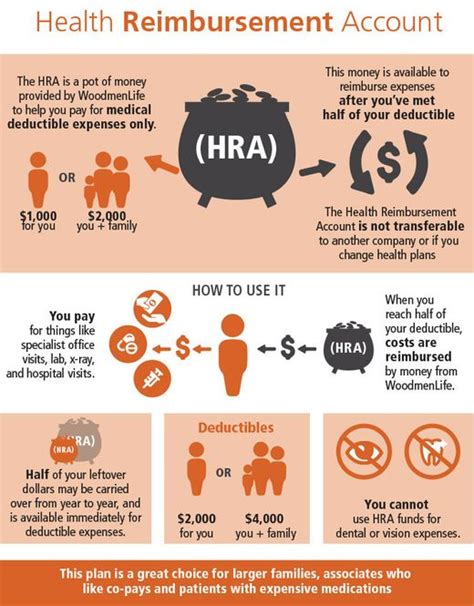

HRAs operate on a straightforward premise: employers allocate a certain amount of funds, often referred to as the reimbursement account, which can be used to cover eligible healthcare expenses. These accounts are typically funded by the employer, and the funds are set aside exclusively for healthcare-related reimbursements.

Employees can then submit their medical bills or receipts to their employer or a designated third-party administrator, who will verify the eligibility of the expenses and process the reimbursement accordingly. The reimbursement process can be automated, ensuring a timely and efficient flow of funds to cover medical costs.

One of the key advantages of HRAs is their adaptability. Employers can tailor the reimbursement accounts to suit their business needs and the preferences of their workforce. For instance, they can set specific limits on the reimbursement amounts, designate certain expenses as eligible or ineligible, and even offer additional benefits such as wellness program incentives.

| HRA Benefit | Description |

|---|---|

| Flexibility | Employees can choose how to spend their healthcare dollars. |

| Cost Savings | HRAs can reduce the overall cost of healthcare for both employers and employees. |

| Control | Employees have greater control over their healthcare decisions and spending. |

| Tax Benefits | HRAs offer tax advantages, with contributions and reimbursements being tax-free for employees. |

Key Considerations for Implementing HRA Insurance

While HRAs offer numerous benefits, there are several crucial considerations to ensure a successful implementation.

Firstly, employers must carefully assess their workforce's healthcare needs and preferences. This involves understanding the common medical conditions, prescription requirements, and overall healthcare costs among employees. By gaining insights into these factors, employers can design HRAs that provide adequate coverage and support.

Secondly, compliance with regulatory frameworks is essential. HRAs must adhere to the provisions of the Affordable Care Act (ACA) and other relevant laws and regulations. Employers should consult legal and tax professionals to ensure that their HRA plans are compliant and avoid any potential penalties.

Lastly, effective communication is key. Employers should educate their employees about the benefits and mechanics of HRAs. Clear and concise communication ensures that employees understand how to utilize their reimbursement accounts, submit claims, and maximize the advantages of this employee benefit.

The Impact of HRA Insurance on Employee Healthcare

The introduction of HRAs has had a significant impact on the healthcare landscape for employees. By offering a more flexible and customizable approach to healthcare financing, HRAs empower employees to take a more active role in managing their health and well-being.

One of the most notable advantages is the increased affordability of healthcare. HRAs can reduce the financial burden of medical expenses, especially for those with high deductibles or frequent medical needs. By reimbursing a portion or all of these expenses, employees can better manage their healthcare budgets and make more informed decisions about their health.

Furthermore, HRAs promote a culture of preventive care. With the flexibility to allocate their healthcare funds as needed, employees are more likely to prioritize preventive measures such as regular check-ups, vaccinations, and screenings. This proactive approach to healthcare can lead to early detection of health issues, improved health outcomes, and potentially reduced long-term healthcare costs.

Real-World Examples of HRA Success Stories

Several organizations have successfully implemented HRAs and witnessed positive outcomes for their employees.

For instance, a mid-sized tech company introduced an HRA program with a focus on promoting wellness and preventive care. The company offered reimbursement for gym memberships, healthy lifestyle programs, and annual wellness check-ups. This initiative not only improved the overall health and well-being of employees but also reduced absenteeism and increased productivity.

Similarly, a healthcare provider implemented an HRA plan to support its staff's diverse healthcare needs. The plan included reimbursement for alternative therapies, such as acupuncture and chiropractic care, which are often not covered by traditional insurance plans. This approach not only provided comprehensive coverage but also demonstrated the company's commitment to holistic well-being.

The Future of HRA Insurance

As the healthcare landscape continues to evolve, HRAs are poised to play an increasingly significant role in employee benefits. With their flexibility and cost-effectiveness, HRAs offer a viable solution to address the rising costs of healthcare and the changing needs of the workforce.

Looking ahead, we can expect to see further innovation in HRA design. Employers may explore the integration of HRAs with other employee benefits, such as wellness programs or financial planning services. This holistic approach could enhance the overall employee experience and further reinforce the value of HRAs.

Additionally, advancements in technology will likely streamline the administration and management of HRAs. Automated reimbursement systems, digital claim submissions, and real-time tracking of healthcare expenses will make HRAs more accessible and user-friendly for both employers and employees.

What are the tax implications of HRAs for employees?

+HRAs offer significant tax benefits for employees. Contributions made by employers to HRA accounts are tax-free, and reimbursements for eligible expenses are also tax-free. This means that employees can use their HRA funds to cover healthcare costs without incurring additional taxes.

Can HRAs be combined with other health insurance plans?

+Yes, HRAs can be integrated with other health insurance plans. In fact, many employers use HRAs as a complementary benefit to enhance their existing health insurance offerings. This combination provides employees with a more comprehensive and flexible healthcare coverage package.

Are there any limitations on the types of expenses that can be reimbursed through HRAs?

+While HRAs offer flexibility, there are certain limitations on reimbursable expenses. Generally, eligible expenses include deductibles, co-pays, prescription medications, and certain over-the-counter drugs. However, specific HRA plans may have additional restrictions or exclusions, so it’s important to review the plan details carefully.