Humana Supplemental Insurance

In the complex landscape of healthcare coverage, Humana Supplemental Insurance stands out as a comprehensive solution designed to bridge gaps and provide additional financial security. This form of insurance is an essential tool for individuals seeking to enhance their existing health plans and ensure comprehensive protection against unforeseen medical expenses.

Understanding Humana Supplemental Insurance

Humana Supplemental Insurance is a collection of insurance policies offered by Humana Inc., a leading American health insurance company. These policies are tailored to supplement traditional health insurance plans, offering additional coverage for expenses that may not be fully covered by a primary plan.

The Importance of Supplemental Insurance

Healthcare costs are often unpredictable and can quickly become overwhelming, even with a solid primary insurance plan. Supplemental insurance steps in to cover these unexpected expenses, ensuring individuals and families have the financial support they need to focus on their health and recovery without the added stress of financial burden.

Some of the key benefits of Humana Supplemental Insurance include:

- Coverage for co-pays and deductibles: These policies can help cover the out-of-pocket costs that often come with medical treatments.

- Extended coverage for specific conditions: Certain plans offer enhanced benefits for conditions like cancer, heart disease, or accidents.

- Income protection: Some policies provide income replacement if an individual becomes unable to work due to illness or injury.

- Travel benefits: Supplemental insurance can also cover emergency medical treatment while traveling, ensuring peace of mind for those on the move.

The Humana Supplemental Insurance Portfolio

Humana offers a diverse range of supplemental insurance products, each designed to meet specific needs. These policies can be tailored to an individual's circumstances, providing a customizable approach to health insurance coverage.

Hospital Indemnity Plans

Hospital indemnity plans provide a fixed daily, weekly, or monthly benefit when an insured individual is confined to a hospital. This benefit is paid directly to the insured, offering financial support during periods of hospitalization. Humana's hospital indemnity plans offer benefits for a variety of hospital stays, including surgical procedures, intensive care unit admissions, and other specialized treatments.

| Plan | Benefit Period | Benefit Amount |

|---|---|---|

| Standard Hospital Indemnity | Up to 365 days | $50 - $500 per day |

| Surgical Indemnity | Varies by procedure | $500 - $5,000 per procedure |

| ICU Indemnity | Up to 10 days | $200 - $1,000 per day |

Accident Insurance

Accident insurance plans provide coverage for injuries sustained in an accident, offering benefits for a range of medical expenses. These plans can cover ambulance services, hospital stays, surgical procedures, and even rehabilitative care. Humana's accident insurance plans are designed to be flexible and can be customized to meet an individual's specific needs.

| Plan | Benefit Amount | Coverage |

|---|---|---|

| Basic Accident Insurance | Up to $5,000 | Covers emergency room visits, hospital stays, and surgical procedures |

| Comprehensive Accident Insurance | Up to $10,000 | Includes benefits for rehabilitative care, physical therapy, and ambulance services |

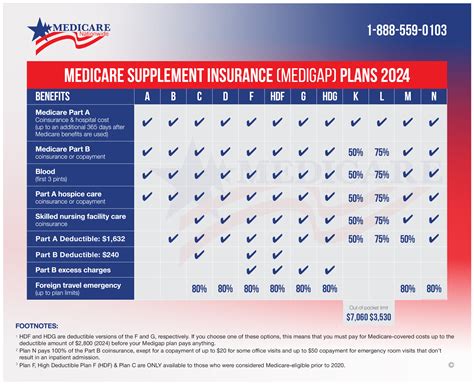

Critical Illness Insurance

Critical illness insurance plans provide a lump-sum benefit upon diagnosis of a specified critical illness, such as cancer, heart attack, or stroke. This benefit can be used to cover a variety of expenses, including medical bills, travel for treatment, and even to replace lost income. Humana's critical illness insurance plans offer comprehensive coverage for a range of critical illnesses, providing financial security during challenging times.

| Plan | Benefit Amount | Covered Illnesses |

|---|---|---|

| Standard Critical Illness Plan | Up to $50,000 | Covers cancer, heart attack, stroke, and more |

| Enhanced Critical Illness Plan | Up to $100,000 | Includes additional coverage for diseases like kidney failure and multiple sclerosis |

Enrolling in Humana Supplemental Insurance

Enrolling in Humana Supplemental Insurance is a straightforward process. Individuals can either apply directly through Humana's website or work with an independent insurance agent who can guide them through the process and help them choose the right plan for their needs. It's important to review the policy details and understand the coverage limits, exclusions, and any waiting periods before enrolling.

Eligibility and Enrollment Periods

Humana Supplemental Insurance plans are generally available to anyone, regardless of age or health status. However, certain plans may have specific eligibility requirements or enrollment periods. For example, critical illness insurance plans often have age restrictions and may require a medical exam for those over a certain age. It's important to review the plan details carefully and consult with a professional if needed.

The Benefits of Choosing Humana

Humana has established itself as a trusted name in the health insurance industry, known for its comprehensive coverage and customer-centric approach. When choosing Humana Supplemental Insurance, individuals benefit from the company's extensive experience and commitment to providing quality healthcare solutions.

Expertise and Reputation

With decades of experience in the healthcare industry, Humana has a deep understanding of the challenges and complexities that come with health insurance. Their team of experts works tirelessly to develop innovative solutions that meet the evolving needs of their customers. Humana's reputation for excellence and customer satisfaction speaks to their commitment to providing reliable and accessible healthcare coverage.

Customizable Plans

One of the key advantages of Humana Supplemental Insurance is the ability to customize plans to individual needs. Whether it's adjusting coverage limits, adding optional benefits, or selecting specific plan features, Humana allows its customers to create a personalized insurance portfolio that aligns with their unique circumstances and financial goals. This level of flexibility ensures that individuals can get the precise coverage they need without paying for unnecessary benefits.

Conclusion: Ensuring Comprehensive Healthcare Coverage

In today's healthcare landscape, supplemental insurance plays a vital role in filling coverage gaps and providing financial security. Humana Supplemental Insurance offers a range of customizable plans that cater to a variety of needs, ensuring individuals and families have the protection they need to navigate the complexities of healthcare expenses. With its commitment to innovation, customer service, and customizable solutions, Humana stands out as a trusted partner in the world of health insurance.

Frequently Asked Questions

Can I customize my Humana Supplemental Insurance plan to fit my specific needs?

+

Yes, Humana offers a high degree of customization with its supplemental insurance plans. You can choose the level of coverage, add optional benefits, and select specific plan features to create a personalized insurance portfolio that suits your unique circumstances and financial goals.

Are there any age restrictions for enrolling in Humana Supplemental Insurance plans?

+

While Humana Supplemental Insurance plans are generally available to anyone, certain plans may have specific age restrictions. For example, critical illness insurance plans often have age limits, and individuals over a certain age may need to undergo a medical exam before enrolling. It’s important to review the plan details carefully and consult with a professional if needed.

What is the process for enrolling in Humana Supplemental Insurance?

+

Enrolling in Humana Supplemental Insurance is straightforward. You can apply directly through Humana’s website or work with an independent insurance agent who can guide you through the process and help you choose the right plan. It’s important to review the policy details and understand the coverage limits, exclusions, and any waiting periods before enrolling.

How does Humana Supplemental Insurance differ from traditional health insurance plans?

+

Humana Supplemental Insurance is designed to supplement traditional health insurance plans, providing additional coverage for expenses that may not be fully covered by a primary plan. These policies offer benefits for specific situations, such as hospital stays, accidents, and critical illnesses, ensuring individuals have the financial support they need to navigate unexpected healthcare costs.

What are the key benefits of choosing Humana Supplemental Insurance over other providers?

+

Humana Supplemental Insurance stands out for its customizable plans, allowing individuals to create a personalized insurance portfolio. Additionally, Humana’s expertise and reputation in the healthcare industry provide peace of mind, ensuring customers receive reliable and accessible healthcare coverage. Their commitment to innovation and customer service further enhances the overall experience.