Illinois Insurance Company

In the heart of the Midwest, Illinois is known for its vibrant cities, diverse landscapes, and a strong sense of community. Among the many businesses that call this state home, the insurance industry plays a vital role in protecting its residents and businesses. One such notable player is the Illinois Insurance Company, a prominent force in the local insurance market.

With a rich history spanning decades, the Illinois Insurance Company has established itself as a trusted partner for individuals and enterprises across the state. Its comprehensive range of insurance products and services has not only catered to the unique needs of Illinois residents but has also contributed significantly to the state's economic stability and growth.

This in-depth article aims to explore the Illinois Insurance Company, delving into its history, services, impact on the local community, and its future prospects. By understanding this company's journey and its pivotal role in the insurance landscape, we can gain valuable insights into the industry's dynamics and its potential evolution.

A Legacy of Protection: The Illinois Insurance Company’s Historical Perspective

The Illinois Insurance Company’s story began in the early 20th century, a time when the insurance industry was rapidly evolving and expanding its reach across the United States. Founded by a group of visionary entrepreneurs, the company set out with a mission to provide comprehensive insurance solutions tailored to the specific needs of Illinois residents and businesses.

In its early years, the Illinois Insurance Company focused on offering a range of insurance products, including property, casualty, and life insurance. These offerings were designed to protect policyholders against various risks, from natural disasters and accidents to health-related concerns. The company's commitment to innovation and adaptability allowed it to navigate the changing insurance landscape successfully.

One of the key factors contributing to the Illinois Insurance Company's early success was its understanding of the local market. By recognizing the unique challenges and opportunities present in Illinois, the company was able to develop insurance products that resonated with its target audience. This localized approach set the Illinois Insurance Company apart from its competitors and established it as a trusted provider within the community.

As the years progressed, the Illinois Insurance Company continued to expand its operations and services. It embraced technological advancements, investing in modern infrastructure and systems to enhance its operational efficiency and customer service. This forward-thinking approach positioned the company for long-term growth and sustainability.

Milestones and Achievements

The Illinois Insurance Company’s journey has been marked by several significant milestones and achievements. In the 1950s, the company expanded its reach beyond the state borders, establishing a national presence. This expansion allowed it to offer its insurance products and services to a broader audience, solidifying its position as a leading insurer.

During the 1970s and 1980s, the Illinois Insurance Company played a pivotal role in the development and implementation of innovative insurance products. It introduced several groundbreaking policies, including specialized coverage for small businesses and unique risk management solutions. These initiatives not only benefited its policyholders but also contributed to the overall growth and evolution of the insurance industry.

In recent years, the Illinois Insurance Company has continued to thrive, adapting to the changing needs of its customers and the evolving insurance landscape. Its commitment to providing exceptional customer service, combined with its extensive product offerings, has ensured its position as a preferred insurer for both individuals and businesses.

A Comprehensive Overview of Services

The Illinois Insurance Company offers a diverse range of insurance products and services, catering to the diverse needs of its customers. Here’s a detailed look at some of its key offerings:

Property Insurance

The company’s property insurance division provides comprehensive coverage for homes, businesses, and commercial properties. Policyholders can benefit from various plans tailored to their specific needs, offering protection against damages caused by fire, storms, theft, and other perils.

Additionally, the Illinois Insurance Company offers specialized coverage for unique property types, such as farms, historical buildings, and high-value residences. This commitment to catering to niche markets demonstrates the company's dedication to providing comprehensive protection to all its clients.

| Property Insurance Coverage | Key Benefits |

|---|---|

| Homeowners Insurance | Protects against damages to homes and personal belongings; offers liability coverage. |

| Business Owners Policy (BOP) | Covers small businesses against property damage, liability, and business interruption. |

| Commercial Property Insurance | Provides coverage for larger commercial properties, including buildings and their contents. |

Casualty Insurance

Casualty insurance is a critical component of the Illinois Insurance Company’s product portfolio. This division offers a range of coverage options, including:

- General Liability Insurance: Protects businesses against third-party claims, including bodily injury and property damage.

- Professional Liability Insurance: Provides coverage for professionals against negligence claims, errors, and omissions.

- Product Liability Insurance: Covers businesses against claims arising from defective products.

- Workers' Compensation Insurance: Provides coverage for medical expenses and lost wages for employees injured on the job.

Life and Health Insurance

The Illinois Insurance Company understands the importance of protecting individuals and their loved ones. Its life and health insurance division offers a range of policies, including:

- Term Life Insurance: Provides coverage for a specified period, offering financial protection to beneficiaries.

- Whole Life Insurance: Offers lifelong coverage with cash value accumulation, providing financial security and peace of mind.

- Health Insurance: The company offers various health insurance plans, including individual, family, and group policies, covering medical expenses and providing access to quality healthcare.

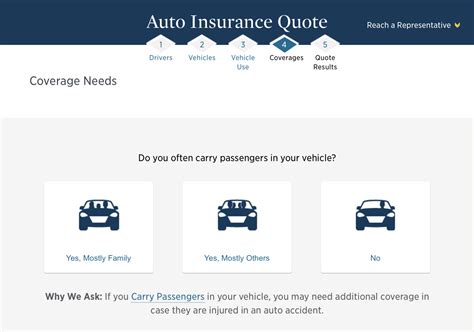

Auto Insurance

The Illinois Insurance Company’s auto insurance division provides comprehensive coverage for vehicles. Policyholders can choose from a range of plans, including liability, collision, and comprehensive coverage. The company’s auto insurance policies offer protection against damages caused by accidents, vandalism, and natural disasters.

Impact on the Local Community

The Illinois Insurance Company’s influence extends beyond its insurance products and services. As a prominent local business, the company has made significant contributions to the Illinois community in numerous ways.

Economic Impact

The company’s presence in Illinois has had a substantial economic impact. It has provided numerous job opportunities, employing a diverse workforce of insurance professionals, underwriters, claims adjusters, and support staff. These jobs contribute to the local economy, supporting families and driving economic growth.

Furthermore, the Illinois Insurance Company's success has attracted other businesses to the state, fostering a thriving insurance industry cluster. This has led to increased competition, innovation, and a broader range of insurance products and services available to Illinois residents and businesses.

Community Engagement and Philanthropy

Beyond its economic contributions, the Illinois Insurance Company is deeply committed to giving back to the community. It actively engages in various philanthropic initiatives, supporting local charities, educational institutions, and community development projects.

The company's community engagement efforts focus on areas such as education, healthcare, and social welfare. Through financial donations, volunteer programs, and partnerships with local organizations, the Illinois Insurance Company strives to make a positive impact on the lives of Illinois residents.

Risk Management Education

Recognizing the importance of educating the public about risk management and insurance, the Illinois Insurance Company actively participates in various educational initiatives. It offers resources, workshops, and seminars to help individuals and businesses understand the importance of insurance and make informed decisions about their coverage needs.

Future Prospects and Innovations

As the insurance industry continues to evolve, the Illinois Insurance Company remains at the forefront of innovation and technological advancements. Here’s a glimpse into its future prospects and the innovations it is pursuing:

Digital Transformation

The company is investing heavily in digital transformation, aiming to enhance its online presence and customer experience. It is developing advanced online platforms and mobile applications, allowing policyholders to manage their insurance policies, file claims, and access information seamlessly.

By embracing digital technologies, the Illinois Insurance Company aims to improve operational efficiency, reduce costs, and provide a more personalized and convenient service to its customers.

Data Analytics and Risk Assessment

Data analytics plays a crucial role in the insurance industry, and the Illinois Insurance Company is leveraging advanced analytics techniques to improve its risk assessment processes. By analyzing vast amounts of data, the company can identify trends, predict potential risks, and develop more accurate insurance products.

This approach not only benefits the company by optimizing its operations but also provides policyholders with more tailored and affordable insurance coverage.

Collaborative Partnerships

The Illinois Insurance Company understands the value of collaborative partnerships. It actively seeks alliances with other industry leaders, technology companies, and startups to stay ahead of the curve. These partnerships enable the company to access new technologies, innovative ideas, and expertise, enhancing its competitive advantage.

Sustainability and Environmental Initiatives

In response to the growing importance of sustainability and environmental concerns, the Illinois Insurance Company is committed to adopting eco-friendly practices and supporting green initiatives. It is exploring ways to reduce its environmental footprint, promote sustainable business practices, and encourage its policyholders to adopt more eco-conscious behaviors.

Conclusion

The Illinois Insurance Company stands as a testament to the strength and resilience of the insurance industry in Illinois. Its rich history, comprehensive range of services, and deep commitment to the local community have solidified its position as a trusted partner for individuals and businesses across the state.

As the company continues to innovate and adapt to the changing landscape, its future looks bright. With a focus on digital transformation, data analytics, collaborative partnerships, and sustainability, the Illinois Insurance Company is well-positioned to thrive in an increasingly competitive and dynamic insurance market. Its journey serves as an inspiring example of how a local business can thrive while making a positive impact on its community.

What makes the Illinois Insurance Company unique in the insurance market?

+The Illinois Insurance Company’s uniqueness lies in its deep understanding of the local market and its commitment to catering to the specific needs of Illinois residents and businesses. Its comprehensive range of insurance products, combined with its focus on community engagement and philanthropy, sets it apart from competitors.

How has the company adapted to technological advancements in the insurance industry?

+The Illinois Insurance Company has embraced digital transformation by developing advanced online platforms and mobile applications. This allows policyholders to manage their policies and access information conveniently. Additionally, the company leverages data analytics to improve risk assessment and develop more accurate insurance products.

What are the company’s future prospects and key areas of focus?

+The Illinois Insurance Company’s future prospects are promising, with a focus on digital transformation, data analytics, collaborative partnerships, and sustainability. By investing in these areas, the company aims to enhance its operations, provide a more personalized service, and remain competitive in the evolving insurance market.