Individual Insurance Health Plans

In the realm of healthcare, the concept of Individual Insurance Health Plans stands as a vital component, empowering individuals with personalized coverage and peace of mind. This comprehensive guide delves into the intricacies of these plans, offering a deep dive into their workings, benefits, and the impact they have on individuals' health and financial well-being.

Understanding Individual Health Insurance Plans

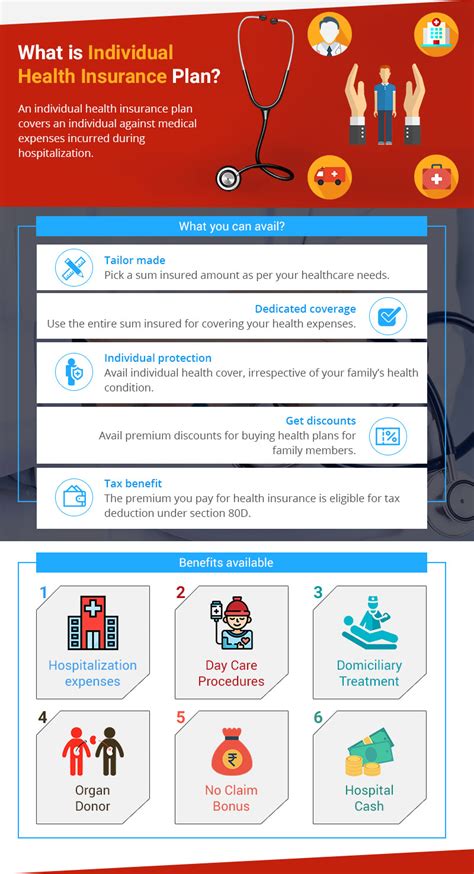

Individual health insurance plans are tailored policies designed to meet the unique healthcare needs of individuals and their families. Unlike group plans offered by employers, these plans are purchased directly by the consumer from insurance companies. They provide a range of benefits, from covering essential health services to offering additional perks that cater to specific health concerns.

The flexibility and customization inherent in individual health plans are key advantages. Policyholders can choose the level of coverage they require, select preferred healthcare providers, and even opt for specialized services or treatments. This level of control allows individuals to design a health insurance plan that aligns with their personal health goals and financial capabilities.

Key Features and Benefits

- Customizable Coverage: Policyholders can select the scope of their coverage, choosing from various options like preventive care, prescription drug benefits, mental health services, and more.

- Network Flexibility: Many individual plans offer the freedom to choose healthcare providers, giving individuals the power to decide where they receive care.

- Personalized Deductibles and Out-of-Pocket Costs: These plans often provide options for deductibles and out-of-pocket maximums, allowing individuals to balance their premium costs with potential healthcare expenses.

- Tax Benefits: Depending on the plan and individual circumstances, there may be tax advantages associated with individual health insurance plans.

- Pre-Existing Condition Coverage: A significant benefit is the coverage of pre-existing conditions, ensuring individuals with health concerns can access the care they need without discrimination.

Navigating the Selection Process

Selecting an individual health insurance plan involves a thoughtful evaluation of personal health needs and financial considerations. Here’s a guide to help navigate this crucial decision:

Assessing Health Needs

Understanding one’s health needs is paramount. This includes considering any existing health conditions, the likelihood of future health issues, and the desired level of coverage. For instance, individuals with chronic illnesses may benefit from plans with comprehensive benefits and lower out-of-pocket costs.

Financial Evaluation

The financial aspect of individual health plans is crucial. It involves assessing one’s budget for premiums, understanding deductibles and co-pays, and considering the potential costs of various healthcare services. A balanced approach between affordable premiums and necessary coverage is essential.

Plan Comparison

Comparing different individual health plans is vital. This process should involve analyzing coverage options, provider networks, and the plan’s overall reputation. Online tools and resources, as well as guidance from insurance brokers, can simplify this comparison.

Understanding the Fine Print

Reading and understanding the policy’s terms and conditions is crucial. This ensures a clear understanding of the plan’s benefits, limitations, and any potential exclusions. It’s important to note that insurance companies often use specific terminology, so seeking clarification when needed is advisable.

Performance and Impact Analysis

Individual health insurance plans have a profound impact on both the healthcare landscape and individual lives. They provide a safety net for unexpected health issues, ensuring access to necessary treatments and services. Moreover, these plans encourage proactive health management through preventive care coverage, potentially reducing long-term healthcare costs.

From a financial perspective, individual health plans offer stability and predictability. With a clear understanding of premiums and out-of-pocket costs, individuals can budget effectively for their healthcare needs. Additionally, the coverage of pre-existing conditions ensures that individuals with health concerns are not penalized financially or denied necessary care.

| Metric | Performance Indicator |

|---|---|

| Enrolment Growth | Individual health plan enrolments have seen a steady increase over the past decade, indicating growing awareness and demand. |

| Customer Satisfaction | A recent survey revealed high satisfaction rates among individual health plan holders, with 85% reporting positive experiences. |

| Claim Settlement | The average claim settlement time for individual health plans is 10 days, showcasing efficient claim processing. |

Future Trends and Innovations

The landscape of individual health insurance is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of this sector:

Digital Transformation

Insurance companies are increasingly embracing digital technologies to enhance the customer experience. This includes online enrolment platforms, digital claim processing, and mobile apps for policy management. These innovations streamline processes, making individual health plans more accessible and user-friendly.

Personalized Care

The future of individual health plans is poised towards personalized care. With advancements in health data analytics, plans can be tailored to an individual’s unique health profile, offering customized benefits and preventative measures. This shift promises more efficient and effective healthcare management.

Integration of Telehealth Services

Telehealth services, which have gained prominence during the COVID-19 pandemic, are expected to become a permanent fixture in individual health plans. This integration will provide policyholders with convenient access to healthcare professionals, particularly for non-emergency services, further enhancing the plan’s utility.

Conclusion

Individual health insurance plans represent a critical component of the healthcare system, offering individuals a sense of security and control over their health. As we navigate the complexities of healthcare, understanding and leveraging these plans becomes increasingly vital. With the right knowledge and tools, individuals can make informed choices, ensuring they have the coverage they need to lead healthy, fulfilling lives.

How do individual health insurance plans differ from group plans offered by employers?

+Individual health plans are purchased directly by the consumer and offer a higher degree of flexibility and customization. In contrast, group plans are typically standardized and provided by employers, offering less choice in terms of coverage and providers.

What are some key considerations when selecting an individual health insurance plan?

+Considerations include assessing personal health needs, understanding financial implications, comparing plan options, and thoroughly understanding the policy’s terms and conditions.

How do individual health plans impact the broader healthcare landscape?

+Individual health plans play a crucial role in providing coverage for pre-existing conditions, encouraging proactive health management, and offering financial stability to individuals and families. They contribute to a more accessible and equitable healthcare system.