Individual Medical Insurance Plans

Navigating Individual Medical Insurance: A Comprehensive Guide

In today’s dynamic healthcare landscape, understanding the intricacies of individual medical insurance is paramount. This guide aims to demystify the process, offering a comprehensive overview to assist those seeking tailored healthcare coverage.

The Importance of Individual Medical Insurance

Individual medical insurance, often referred to as private health insurance, is a vital component of personal financial planning, especially in countries where healthcare is primarily funded by individuals or supplemented by private insurance. It provides a safety net, ensuring access to quality medical care without the financial strain that unexpected health issues can bring.

The benefits extend beyond financial protection. With individual plans, policyholders often have more control over their healthcare choices, including the freedom to select their preferred healthcare providers and specialists. This flexibility is particularly advantageous for those with specific health needs or conditions that may require specialized treatment.

Understanding the Fundamentals

What is Individual Medical Insurance?

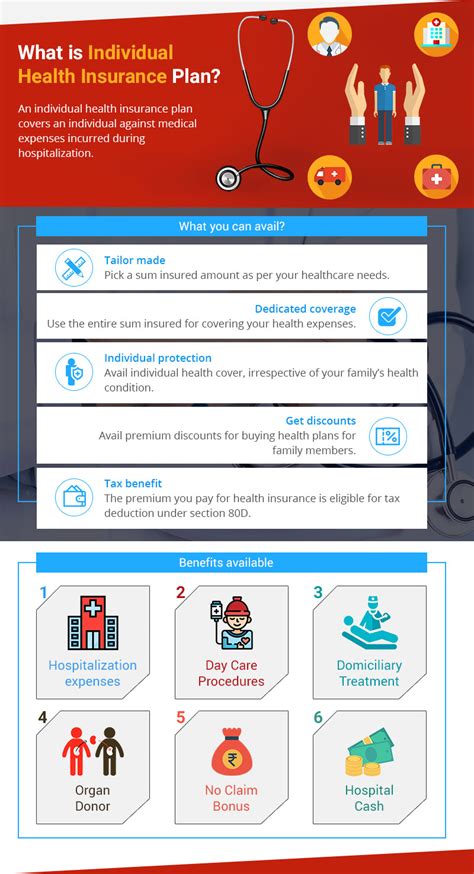

Individual medical insurance is a type of health insurance policy that is purchased by an individual, as opposed to being provided by an employer or government program. These plans offer coverage for a range of medical services, from routine check-ups and preventive care to more complex treatments and surgeries.

The primary objective of these plans is to provide financial support during times of illness or injury, ensuring that individuals can access the medical care they need without facing crippling medical bills. Many individual plans also offer additional benefits, such as coverage for prescription medications, mental health services, and dental care.

Key Components of an Individual Plan

- Premium: This is the regular payment made to the insurance company to maintain coverage. The premium amount can vary based on factors like age, location, and the level of coverage desired.

- Deductible: The deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower premiums.

- Co-payment or Co-insurance: After meeting the deductible, these are the shared costs between the policyholder and the insurance company for covered services. For instance, a co-payment might be a fixed amount for each doctor's visit, while co-insurance is a percentage of the total cost of the service.

- Out-of-Pocket Maximum: This is the limit on the amount a policyholder will pay in a year for covered services. Once this maximum is reached, the insurance company covers 100% of the costs for covered services for the remainder of the year.

- Network of Providers: Many individual plans have a network of preferred healthcare providers. Choosing in-network providers often results in lower out-of-pocket costs.

Selecting the Right Plan

Assessing Your Needs

The first step in choosing an individual medical insurance plan is to evaluate your specific healthcare needs. Consider factors such as your age, existing health conditions, and any regular medical treatments you require. Understanding your healthcare usage patterns can help determine the type of coverage you need.

For instance, if you have a chronic condition that requires regular doctor visits and prescriptions, a plan with a lower deductible and comprehensive coverage might be more suitable. On the other hand, if you're generally healthy and only anticipate occasional doctor visits, a plan with a higher deductible and lower premiums could be a cost-effective option.

Comparing Plan Options

When comparing individual plans, pay attention to the following:

- Coverage Limits: Check for any limits on specific services or treatments. For example, some plans might have restrictions on the number of physical therapy sessions covered annually.

- Prescription Drug Coverage: If you take prescription medications regularly, ensure the plan includes coverage for these drugs and that the costs are manageable.

- Specialist Care: If you require specialist care, verify that the plan covers these services and that there are specialists in your area who participate in the plan's network.

- Maternity and Pediatric Care: If you're planning a family or have young children, ensure the plan provides adequate coverage for these specific needs.

- Mental Health and Substance Abuse Treatment: Some plans offer limited or no coverage for these services. If these are important to you, choose a plan that provides comprehensive coverage.

Additional Considerations

Other factors to consider when selecting an individual plan include the plan's reputation, financial stability, and customer service. It's also beneficial to read reviews and seek recommendations from trusted sources to ensure you're choosing a reliable insurance provider.

Additionally, be mindful of any additional benefits the plan might offer, such as discounts on fitness memberships or access to wellness programs. These can further enhance the value of your insurance coverage.

The Application Process

Applying for individual medical insurance typically involves the following steps:

- Obtain Quotes: Get quotes from multiple insurance providers to compare premiums and coverage.

- Review and Compare: Carefully review the policy details, including coverage, exclusions, and any waiting periods.

- Choose a Plan: Based on your assessment of needs and budget, select the plan that best suits your requirements.

- Complete the Application: This will involve providing personal and health-related information. Be accurate and honest to avoid issues with your coverage later.

- Submit Supporting Documents: Depending on the plan and your health status, you might need to provide additional documentation, such as medical records.

- Wait for Approval: The insurance company will review your application and either approve or decline coverage. If approved, you'll receive a policy document outlining the terms and conditions of your coverage.

Maximizing Your Coverage

Understanding Your Policy

Once you’ve secured your individual medical insurance, it’s crucial to thoroughly understand your policy. This includes knowing what’s covered, what’s excluded, and any specific conditions or limitations. Familiarize yourself with the policy’s terms, especially regarding emergency care, pre-existing conditions, and any waiting periods for specific services.

Utilizing Your Coverage

To make the most of your coverage, stay informed about your plan's benefits and how to access them. Regularly review your policy and take advantage of any wellness programs or preventive care services offered. These can help identify potential health issues early on, when they're often more treatable and less costly.

Additionally, maintain a good relationship with your healthcare providers and keep them informed about your insurance coverage. Many providers can help you navigate the billing process and ensure you receive the maximum benefit from your plan.

Monitoring and Managing Costs

Managing healthcare costs is a significant aspect of individual medical insurance. Here are some strategies to help keep costs down:

- Stay in-network: Using healthcare providers within your plan's network can result in significant savings compared to out-of-network providers.

- Understand your costs: Be aware of your deductible, co-payments, and co-insurance amounts. Knowing these can help you budget for healthcare expenses.

- Shop around: For services like lab tests or imaging, prices can vary significantly. Shopping around can lead to cost savings without compromising quality.

- Consider High-Deductible Plans: If you're generally healthy and anticipate minimal healthcare needs, a high-deductible plan with a Health Savings Account (HSA) can be a cost-effective option.

Future Implications and Considerations

As the healthcare landscape continues to evolve, staying informed about changes to individual medical insurance plans is crucial. Keep an eye on any policy updates, especially those related to coverage changes, premium increases, or network provider changes.

Additionally, as you progress through different life stages, your healthcare needs are likely to change. Regularly reassessing your insurance coverage and making adjustments as needed will ensure you maintain adequate protection throughout your life.

| Plan Type | Premium | Deductible | Co-Insurance |

|---|---|---|---|

| Standard Plan | $350/month | $1,500 | 80/20 |

| Comprehensive Plan | $420/month | $1,000 | 70/30 |

| High-Deductible Plan | $280/month | $3,000 | 90/10 |

FAQs

Can I switch individual medical insurance plans during the year?

+In most cases, you can switch plans during the year if you experience a qualifying life event, such as marriage, divorce, birth or adoption of a child, or loss of other health coverage. These events are often referred to as “qualifying events” and allow you to make changes outside of the typical open enrollment period.

What happens if I need to visit a healthcare provider outside my network?

+Out-of-network visits typically result in higher out-of-pocket costs. Your insurance plan may cover a portion of the expenses, but you’ll likely pay more than you would with an in-network provider. It’s always best to check with your insurance provider beforehand to understand the costs involved.

How do I know if my preferred healthcare providers are in-network with my insurance plan?

+Most insurance providers offer online tools to search for in-network providers. You can also contact your insurance company directly to verify if a specific provider is in their network. It’s advisable to confirm this information before scheduling an appointment to avoid unexpected out-of-network charges.

Are there any tax benefits associated with individual medical insurance plans?

+Yes, in many countries, there are tax advantages for individuals who purchase medical insurance. These benefits can vary depending on your country’s tax laws. It’s advisable to consult with a tax professional to understand the specific tax benefits available to you.

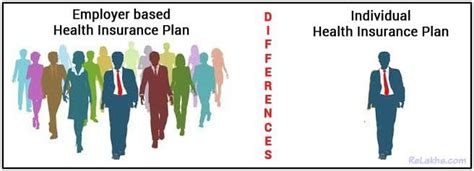

What is the difference between individual and group medical insurance plans?

+Individual plans are purchased by an individual directly from an insurance company, while group plans are typically offered by employers or organizations and cover a group of people. Group plans often offer more comprehensive coverage and lower premiums due to the larger pool of participants. However, individual plans offer more flexibility and can be tailored to an individual’s specific needs.