Instant Home Insurance Quote

In today's fast-paced world, convenience and efficiency are highly valued, and this extends to every aspect of our lives, including the often-daunting task of securing home insurance. The traditional process of obtaining home insurance can be time-consuming and tedious, involving multiple phone calls, paperwork, and appointments. However, the landscape is evolving, and the rise of instant home insurance quotes has revolutionized the way we protect our homes and belongings.

The Evolution of Home Insurance Quoting

The concept of home insurance has been around for centuries, but the process of obtaining a quote has undergone a remarkable transformation. In the past, individuals seeking home insurance had limited options. They would often need to visit an insurance agent’s office, provide extensive details about their home and possessions, and wait days or even weeks for a quote. This cumbersome process often resulted in delays and frustration for both parties involved.

However, with the advent of the internet and advancements in technology, the home insurance industry has experienced a digital revolution. Today, instant home insurance quotes are not just a convenience; they are a necessity for modern consumers who demand speed, accuracy, and transparency in their insurance journey.

The Power of Instant Home Insurance Quotes

Instant home insurance quotes offer a host of benefits that cater to the needs of today’s homeowners. Let’s explore some of the key advantages and why this innovation is a game-changer in the insurance sector.

Convenience and Accessibility

One of the most significant advantages of instant home insurance quotes is the unparalleled convenience they provide. Homeowners can now obtain a quote from the comfort of their own homes, at a time that suits them best. No more waiting on hold or coordinating schedules with insurance agents. With just a few clicks, individuals can receive a personalized quote, often within minutes.

This level of accessibility is particularly beneficial for busy individuals, those in remote locations, or anyone who values their time. It empowers consumers to take control of their insurance needs and make informed decisions without the hassle of traditional quoting processes.

Real-Time Personalization

Instant home insurance quotes leverage advanced algorithms and data analytics to provide highly personalized quotes. These systems take into account a multitude of factors, including the location, size, and construction of the home, as well as the specific coverage needs of the homeowner. By inputting these details, individuals receive a quote tailored to their unique circumstances.

This real-time personalization ensures that homeowners are not overpaying for coverage they don't need. It also helps identify any gaps in their current insurance plan, allowing them to make informed adjustments to better protect their assets.

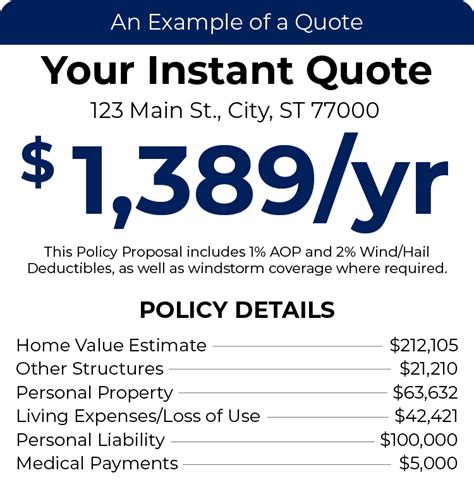

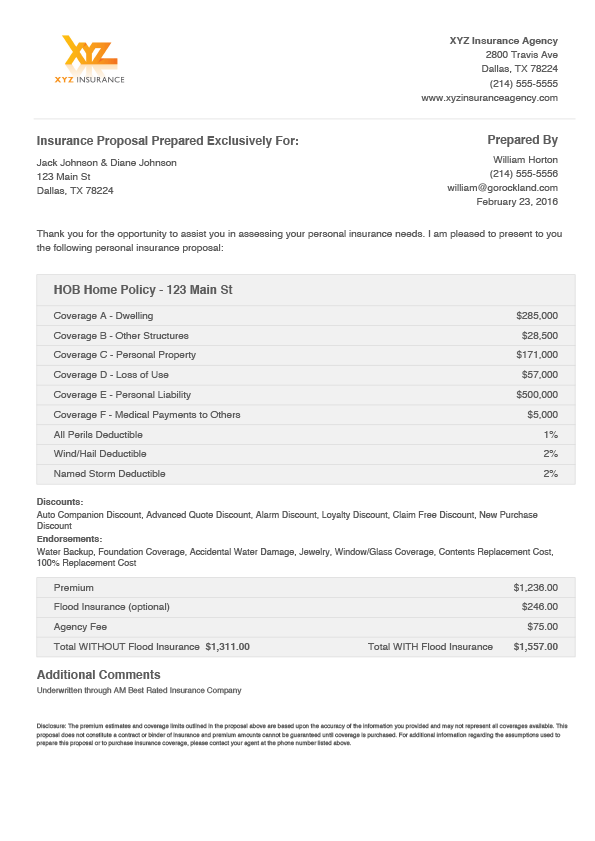

Transparency and Clarity

The instant quote process is designed to be transparent and straightforward. Consumers are provided with a detailed breakdown of their quote, including the cost of different coverage options and any applicable discounts. This clarity empowers individuals to understand their insurance policy inside and out, ensuring they are making an informed purchase decision.

Additionally, the instant quote process often includes interactive tools and resources that educate homeowners about various coverage options. This transparency builds trust and confidence in the insurance provider, fostering a stronger relationship between the company and its customers.

Efficient Claims Process

In the unfortunate event of a claim, instant home insurance quotes can also streamline the claims process. Many insurance providers linked to instant quote platforms offer digital claim filing and tracking, allowing homeowners to initiate and manage their claims online. This efficiency not only reduces the stress associated with the claims process but also ensures a quicker resolution, getting homeowners back on their feet sooner.

| Coverage Type | Average Instant Quote |

|---|---|

| Standard Homeowners Insurance | $1,200 - $1,800 annually |

| High-Value Home Insurance | $2,500 - $5,000 annually |

| Renters Insurance | $150 - $300 annually |

| Landlord Insurance | $500 - $1,200 annually |

While these quotes provide a general idea of the cost, actual premiums can vary based on individual circumstances and the coverage selected. It's always advisable to obtain personalized quotes to ensure accurate pricing.

The Future of Home Insurance Quoting

The introduction of instant home insurance quotes is just the beginning of a new era in the insurance industry. As technology continues to advance, we can expect even more innovative solutions to emerge, further enhancing the quoting and insurance purchasing experience.

One exciting development on the horizon is the integration of artificial intelligence (AI) and machine learning into the quoting process. AI-powered systems can analyze vast amounts of data to provide even more accurate and personalized quotes. These systems can also learn and adapt over time, continuously improving their accuracy and efficiency.

Additionally, the rise of digital insurance platforms and apps will make it even easier for homeowners to manage their insurance needs. These platforms will offer a one-stop shop for all insurance-related tasks, from obtaining quotes to filing claims and managing policy details. This level of convenience and accessibility will further empower consumers and simplify the insurance journey.

Furthermore, the insurance industry is likely to see an increase in data-driven insights and predictive analytics. By analyzing historical data and trends, insurance providers can better understand risk factors and tailor coverage options to meet the evolving needs of homeowners. This data-driven approach will lead to more efficient risk management and potentially lower premiums for consumers.

A New Standard in Home Insurance

The advent of instant home insurance quotes has raised the bar for the entire industry. Consumers now expect a fast, convenient, and transparent quoting process, and insurance providers are rising to the challenge. The days of tedious paperwork and lengthy wait times are fading into the past, making way for a new standard of service and efficiency.

As the insurance landscape continues to evolve, one thing is clear: instant home insurance quotes are here to stay. They have transformed the way we protect our homes and belongings, making the process more accessible, personalized, and transparent. With these innovations, homeowners can focus on what matters most—enjoying their homes and peace of mind—while leaving the insurance details to the experts.

How accurate are instant home insurance quotes?

+Instant home insurance quotes are designed to provide a highly accurate estimate of your insurance premium. These quotes are generated using advanced algorithms that take into account a range of factors, including your home’s location, size, construction materials, and the coverage options you select. While they may not be 100% precise due to the complexity of insurance pricing, they offer a reliable starting point for your insurance journey.

Can I customize my coverage with an instant quote?

+Absolutely! One of the key advantages of instant home insurance quotes is their flexibility. During the quoting process, you’ll have the opportunity to choose from various coverage options, including different levels of protection for your home, personal belongings, liability, and additional living expenses. This allows you to tailor your insurance plan to your specific needs and budget.

Are there any hidden fees or surprises with instant quotes?

+Reputable insurance providers aim for transparency in their quoting process. When you receive an instant home insurance quote, it should include all applicable fees and charges. However, it’s important to carefully review the quote and any accompanying documentation to understand the terms and conditions, including any potential exclusions or limitations.

Can I compare multiple instant quotes from different providers?

+Yes, comparing multiple instant quotes is a smart way to find the best coverage and value for your home insurance needs. Many online platforms allow you to obtain quotes from various insurance providers, making it easy to compare prices, coverage options, and additional benefits. This competition among providers can lead to more competitive pricing and better coverage for consumers.