Instant Homeowners Insurance Quote

Securing adequate homeowners insurance is a crucial step for every homeowner. The process of obtaining an instant homeowners insurance quote offers a convenient and efficient way to assess your coverage options and find the best policy for your needs. This article will delve into the world of instant homeowners insurance quotes, exploring the benefits, the process, and the factors that influence the accuracy and reliability of these quotes. By understanding the ins and outs of this service, you can make informed decisions about your insurance coverage.

Understanding Instant Homeowners Insurance Quotes

An instant homeowners insurance quote is a quick and accessible way to obtain an estimate of your insurance costs without the traditional lengthy application process. It leverages advanced technology and data analysis to provide an initial assessment of your insurance needs and associated costs. This service is particularly appealing to homeowners who value their time and seek a streamlined approach to insurance procurement.

The concept behind instant quotes is to simplify the insurance shopping experience. By inputting basic information about your home and your insurance preferences, you can receive a personalized quote in a matter of minutes. This quote serves as a starting point for further exploration and comparison, allowing you to make informed decisions about your insurance coverage.

Benefits of Instant Quotes

- Time Efficiency: Instant quotes eliminate the need for extensive paperwork and lengthy application processes. Within minutes, you can receive a quote, saving you valuable time.

- Convenience: The ability to obtain a quote online or through a mobile app offers unparalleled convenience. You can access this service from the comfort of your home at any time.

- Comparison Shopping: With instant quotes, you can easily compare multiple insurance providers and policies. This feature empowers you to find the best coverage at the most competitive rates.

- Personalized Assessment: These quotes are tailored to your specific needs and circumstances, providing a customized view of your insurance requirements.

- Initial Cost Estimate: Instant quotes give you a quick glimpse into your potential insurance costs, helping you plan your budget accordingly.

The Process of Obtaining an Instant Quote

The process of obtaining an instant homeowners insurance quote is straightforward and user-friendly. Here’s a step-by-step breakdown:

- Choose a Provider: Select a reputable insurance provider that offers instant quote services. Research their reputation, customer reviews, and the range of policies they offer.

- Access the Quote Tool: Visit the provider's website or use their mobile app to access the instant quote tool. This tool is typically easy to find and navigate.

- Provide Basic Information: Input essential details about your home, such as its location, size, construction type, and the year it was built. You'll also need to provide information about your personal details, including your name, age, and contact information.

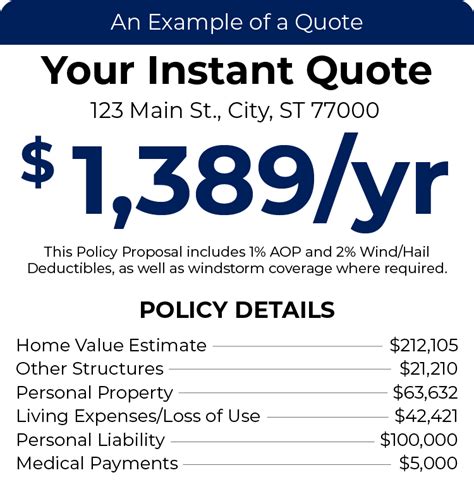

- Specify Coverage Preferences: Indicate the type and level of coverage you're seeking. This may include options for dwelling coverage, personal property coverage, liability coverage, and additional endorsements.

- Review and Confirm: Carefully review the quote and ensure that all the information you provided is accurate. Double-check the coverage limits and any additional features or exclusions.

- Receive Your Quote: Within a matter of minutes, you'll receive an instant quote, which will provide an estimate of your insurance costs. This quote may also include a breakdown of the coverage limits and any applicable discounts.

Factors Affecting the Accuracy of Instant Quotes

While instant homeowners insurance quotes offer a convenient and efficient way to assess your coverage needs, it’s essential to understand the factors that can influence their accuracy. Here are some key considerations:

Home Characteristics

The accuracy of an instant quote heavily relies on the information you provide about your home. Factors such as the age of your home, its construction type, and any recent renovations or additions can significantly impact your insurance costs. It’s crucial to provide accurate and up-to-date information to ensure an accurate quote.

| Home Feature | Impact on Quote |

|---|---|

| Age of Home | Older homes may have higher repair costs and increased risk of certain issues. |

| Construction Type | Different construction materials and methods can affect repair costs and vulnerability to specific risks. |

| Recent Renovations | Upgrades or additions may increase the replacement cost and impact coverage needs. |

Coverage Preferences

The level and type of coverage you choose will directly influence your insurance quote. Different coverage options and limits can result in significant variations in cost. It’s essential to understand your coverage needs and preferences to ensure an accurate quote.

Discounts and Bundles

Insurance providers often offer discounts and bundle options to incentivize customers. These discounts can significantly reduce your insurance costs. However, not all providers offer the same discounts, and the availability of these incentives may not be reflected in an instant quote. It’s advisable to explore these options further during the application process.

Risk Assessment

Insurance providers use advanced algorithms and data analysis to assess the risk associated with insuring your home. This risk assessment considers factors such as your location’s crime rate, natural disaster frequency, and proximity to fire stations. While instant quotes provide an initial estimate, a more comprehensive risk assessment may be required during the application process.

Comparing Instant Quotes and Traditional Quotes

When exploring your insurance options, it’s beneficial to understand the differences between instant quotes and traditional quotes. While instant quotes offer convenience and speed, traditional quotes provide a more comprehensive and personalized assessment of your insurance needs.

Key Differences

- Speed: Instant quotes are designed for quick turnaround, providing an estimate within minutes. Traditional quotes, on the other hand, may take several days or even weeks, as they involve a more detailed review of your circumstances and coverage needs.

- Level of Detail: Instant quotes provide a high-level overview of your insurance costs based on basic information. Traditional quotes offer a more in-depth analysis, considering a broader range of factors and providing a more accurate assessment of your coverage requirements.

- Risk Assessment: While instant quotes use advanced algorithms, they may not capture all the nuances of your individual risk profile. Traditional quotes involve a more thorough risk assessment, taking into account your specific circumstances and any unique factors that may impact your insurance costs.

- Customization: Instant quotes are often based on standard coverage options and may not accommodate highly customized policies. Traditional quotes allow for greater flexibility and customization, ensuring that your unique needs are met.

When to Choose Instant Quotes

Instant quotes are an excellent choice when you’re in a time crunch or seeking a quick assessment of your insurance costs. They’re particularly useful for homeowners who have a clear understanding of their coverage needs and are looking for a convenient and efficient way to compare multiple providers and policies.

When to Opt for Traditional Quotes

Traditional quotes are ideal when you have complex insurance needs or require a highly customized policy. They’re also recommended when you want a more comprehensive understanding of your coverage options and the associated costs. If you have unique circumstances or specific concerns, a traditional quote can provide a more tailored solution.

Tips for Maximizing the Benefits of Instant Quotes

To make the most of instant homeowners insurance quotes, consider the following tips:

- Gather Essential Information: Before obtaining an instant quote, ensure you have all the necessary information about your home, including its age, construction type, and any recent upgrades. This will help you provide accurate details and receive a more precise quote.

- Explore Coverage Options: Familiarize yourself with the different types of coverage and their implications. Understanding your coverage needs will help you make informed decisions when reviewing instant quotes.

- Compare Multiple Quotes: Don't settle for the first quote you receive. Compare quotes from several providers to identify the best coverage at the most competitive rates.

- Consider Additional Discounts: While instant quotes may not reflect all available discounts, you can explore these options further during the application process. Ask about bundle discounts, loyalty rewards, and other incentives that can reduce your insurance costs.

- Consult an Insurance Professional: If you have complex insurance needs or require a highly customized policy, consider consulting an insurance professional. They can provide expert guidance and help you navigate the intricacies of homeowners insurance.

Conclusion

Instant homeowners insurance quotes offer a convenient and efficient way to assess your insurance needs and explore your coverage options. While they provide a quick estimate, it’s essential to understand their limitations and consider the benefits of traditional quotes for a more comprehensive assessment. By leveraging the advantages of instant quotes and seeking professional guidance when needed, you can make informed decisions about your homeowners insurance and secure the coverage that best suits your needs.

How accurate are instant homeowners insurance quotes?

+Instant quotes provide a reasonably accurate estimate based on the information you provide. However, they may not capture all the nuances of your individual risk profile. For a more precise assessment, consider obtaining a traditional quote.

Can I customize my coverage with an instant quote?

+Instant quotes often offer standard coverage options. For highly customized policies, it’s recommended to explore traditional quotes or consult an insurance professional.

Are there any hidden fees or charges with instant quotes?

+Instant quotes typically provide a transparent estimate of your insurance costs. However, it’s essential to review the policy details and any applicable fees or charges during the application process.

Can I switch to a different insurance provider after receiving an instant quote?

+Yes, you have the freedom to explore multiple insurance providers and compare quotes. Instant quotes are a great starting point for comparison shopping.