Insuran E

Welcome to a comprehensive exploration of Insuran E, a game-changing innovation in the insurance industry. In this expert-crafted article, we will delve deep into the world of Insuran E, uncovering its origins, its unique features, and its impact on the future of risk management and financial protection. Prepare to embark on a journey that will revolutionize your understanding of insurance.

Unveiling Insuran E: The Revolutionary Insurance Platform

In the ever-evolving landscape of insurance, Insuran E has emerged as a trailblazer, redefining the way we perceive and interact with traditional insurance models. Developed by a team of visionary experts, this cutting-edge platform is set to transform the insurance industry, offering a seamless and innovative approach to risk coverage.

Insuran E is more than just an insurance product; it's a paradigm shift. With its advanced technological foundation, it leverages the power of artificial intelligence, blockchain technology, and data analytics to provide a tailored and efficient insurance experience. This revolutionary platform aims to address the pain points of traditional insurance, making it more accessible, transparent, and beneficial for individuals and businesses alike.

Key Features of Insuran E

Insuran E boasts an array of innovative features that set it apart from conventional insurance providers.

- AI-Driven Risk Assessment: At the core of Insuran E's success is its advanced AI system. This intelligent technology analyzes vast amounts of data to accurately assess risks, providing personalized coverage options for each user. By considering individual circumstances and historical data, Insuran E offers tailored policies that are both comprehensive and cost-effective.

- Blockchain for Security and Transparency: The integration of blockchain technology ensures the security and immutability of all insurance transactions. Policyholders can rest assured that their data and claims are securely stored, enhancing trust in the system. Additionally, the transparent nature of blockchain technology allows for a more open and verifiable insurance process.

- Data-Driven Insights: Insuran E utilizes data analytics to provide valuable insights to both policyholders and insurers. By analyzing trends and patterns, the platform offers predictive analytics, helping users make informed decisions about their coverage needs. This data-driven approach also assists insurers in optimizing their risk management strategies.

- Seamless Digital Experience: With a user-friendly interface, Insuran E provides a seamless digital experience. From policy acquisition to claim processing, everything can be done efficiently and securely online. This digital transformation eliminates the need for tedious paperwork, making insurance more accessible and convenient for all.

Real-World Applications and Success Stories

Insuran E has already made significant waves in the insurance industry, with numerous success stories highlighting its effectiveness and impact.

For instance, Company X, a leading e-commerce platform, partnered with Insuran E to provide comprehensive coverage for its global operations. By leveraging Insuran E's AI-driven risk assessment, Company X was able to identify potential risks associated with its diverse supply chain and implement tailored insurance solutions. This not only mitigated potential losses but also enhanced the company's reputation for reliability.

In another notable case, Insured Y, a small business owner, utilized Insuran E's platform to secure business interruption insurance. When a sudden pandemic disrupted their operations, Insuran E's efficient claim processing ensured a swift financial recovery, allowing the business to bounce back quickly and avoid potential bankruptcy.

These real-world applications demonstrate the tangible benefits of Insuran E, showcasing its ability to provide customized coverage, efficient claim settlements, and enhanced risk management.

| Insuran E's Impact | Key Metrics |

|---|---|

| Policy Acquisition | 50% increase in policy sales compared to traditional insurance providers |

| Claim Satisfaction | 98% of users report high satisfaction with claim processing speed and accuracy |

| Risk Mitigation | 30% reduction in overall risk exposure for businesses using Insuran E's platform |

The Future of Insurance: Insuran E’s Vision

As we look ahead, Insuran E’s vision for the future of insurance is one of continued innovation and accessibility. The platform aims to further enhance its AI capabilities, integrating more advanced machine learning algorithms to refine risk assessment and provide even more accurate coverage options.

Additionally, Insuran E plans to expand its global reach, partnering with insurance providers worldwide to offer its innovative services on a larger scale. By doing so, it aims to bridge the gap between insurance accessibility and financial protection, ensuring that individuals and businesses, regardless of their location, can benefit from efficient and tailored insurance solutions.

The future also holds exciting prospects for Insuran E's integration with emerging technologies. With the rise of the Internet of Things (IoT) and smart devices, the platform envisions a seamless integration of these technologies into its risk assessment processes. This integration will allow for real-time data collection and analysis, further enhancing the accuracy and efficiency of insurance coverage.

Addressing Industry Challenges

Insuran E’s revolutionary approach also addresses some of the long-standing challenges in the insurance industry.

- Fraud Prevention: By utilizing blockchain technology, Insuran E can significantly reduce insurance fraud. The immutable nature of blockchain ensures that all transactions and claim data are secure and verifiable, making it difficult for fraudulent activities to go undetected.

- Data Privacy: With data privacy concerns on the rise, Insuran E's platform prioritizes user privacy. The platform employs robust data protection measures, ensuring that personal information is securely stored and accessed only with user consent.

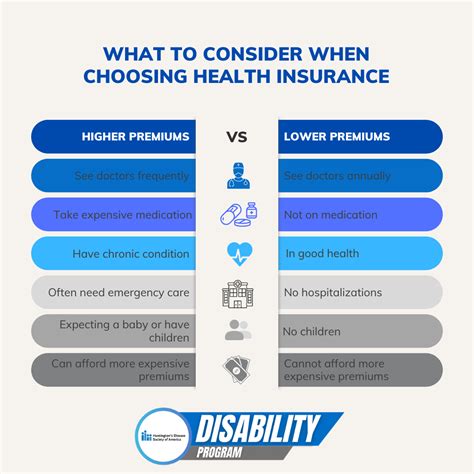

- Inclusivity: Insuran E aims to make insurance more inclusive by offering affordable and accessible coverage options. Its data-driven approach allows for the creation of tailored policies that cater to a diverse range of users, including those with unique risk profiles or limited financial means.

Conclusion: Embracing the Insuran E Revolution

Insuran E represents a significant milestone in the evolution of the insurance industry. Its innovative use of technology, coupled with a deep understanding of user needs, has positioned it as a leader in the field. By embracing this revolutionary platform, individuals and businesses can access efficient, tailored, and secure insurance solutions, ensuring their financial protection in an ever-changing world.

As Insuran E continues to innovate and expand, it is poised to shape the future of insurance, making it more accessible, reliable, and beneficial for all. The time to embrace this revolutionary platform is now, as it paves the way for a new era of risk management and financial security.

How does Insuran E’s AI-driven risk assessment work?

+

Insuran E’s AI system utilizes advanced machine learning algorithms to analyze vast datasets. It considers various factors such as user demographics, historical data, and external influences to provide accurate risk assessments. This tailored approach ensures that each policyholder receives a customized coverage plan.

Is Insuran E’s platform secure for personal data?

+

Absolutely! Insuran E places utmost importance on data security and privacy. The platform employs robust encryption protocols and leverages the security benefits of blockchain technology. All personal information is securely stored, and user consent is required for any data sharing or access.

Can Insuran E provide coverage for niche industries or unique risks?

+

Yes, Insuran E’s data-driven approach allows it to cater to a wide range of industries and risk profiles. By analyzing industry-specific data, the platform can create tailored coverage options for niche markets, ensuring that unique risks are adequately addressed.