Insurance Agencies

The insurance industry is a vital part of our modern economy, providing financial protection and peace of mind to individuals, families, and businesses. Insurance agencies, as intermediaries between insurance companies and policyholders, play a crucial role in this complex ecosystem. In this comprehensive article, we delve into the world of insurance agencies, exploring their functions, services, and the impact they have on the insurance landscape.

Understanding Insurance Agencies

Insurance agencies are businesses that act as trusted advisors and facilitators in the insurance market. They serve as a bridge, connecting individuals and entities seeking insurance coverage with the vast array of insurance products offered by various carriers. These agencies are typically independent, allowing them to offer a wide range of options to their clients, ensuring a tailored and unbiased approach to insurance needs.

Key Functions of Insurance Agencies

Insurance agencies provide a multitude of services, each designed to cater to the diverse needs of their clientele. Here are some of the critical functions they perform:

- Risk Assessment and Analysis: Insurance agencies work closely with their clients to assess their unique risks and vulnerabilities. This involves a thorough understanding of the client’s personal or business profile, including their assets, liabilities, and potential hazards. By analyzing these factors, agencies can recommend suitable insurance policies that provide adequate coverage.

- Policy Comparison and Selection: With numerous insurance companies offering countless policy options, navigating the market can be daunting. Insurance agencies simplify this process by comparing policies from different carriers based on coverage, premiums, and additional benefits. They present their clients with a curated selection of policies, ensuring an informed decision.

- Policy Procurement and Management: Once a policy is chosen, insurance agencies assist in the procurement process, ensuring smooth and timely transactions. They handle the paperwork, facilitate payments, and ensure the policy is activated. Additionally, agencies often provide ongoing management services, including policy updates, endorsements, and renewals, ensuring their clients’ coverage remains up-to-date and effective.

- Claims Assistance: Perhaps the most critical role of insurance agencies is their support during the claims process. When a policyholder experiences a loss or damage, agencies guide them through the often complex claims procedure. They help with documentation, provide necessary forms, and advocate for their clients to ensure fair and prompt settlement of claims.

- Risk Management Consulting: Beyond traditional insurance services, many agencies offer risk management consulting. This involves identifying potential risks and developing strategies to mitigate them. By implementing risk management plans, agencies can help their clients avoid losses and reduce the need for insurance payouts, thereby saving costs in the long run.

The Impact of Insurance Agencies

Insurance agencies have a profound impact on the insurance industry and the lives of their clients. Their presence ensures a more accessible and efficient insurance market, benefiting both policyholders and insurance companies alike.

Benefits to Policyholders

For individuals and businesses seeking insurance coverage, insurance agencies offer a multitude of advantages. Here are some key benefits:

- Expert Guidance: Insurance agencies provide specialized knowledge and expertise in the complex world of insurance. Their advisors can navigate the vast array of policies, ensuring their clients receive suitable coverage tailored to their unique needs. This expert guidance is invaluable, especially for those new to insurance or those with complex risk profiles.

- Choice and Flexibility: By representing multiple insurance carriers, agencies offer their clients a broad range of policy options. This choice allows policyholders to compare prices, coverage, and additional benefits, ensuring they find the best fit for their budget and requirements. The flexibility to switch between carriers also ensures policyholders can adapt their coverage as their needs evolve.

- Personalized Service: Insurance agencies build long-term relationships with their clients, offering personalized service and support. This includes regular reviews of policies to ensure they remain adequate, as well as providing prompt assistance during claims. The personalized touch ensures policyholders receive the attention and care they deserve.

- Claims Advocacy: One of the most significant advantages of working with an insurance agency is their advocacy during the claims process. Agencies act as intermediaries between policyholders and insurance companies, ensuring fair and efficient claims settlement. They help navigate the often confusing claims procedures, providing much-needed support during challenging times.

Benefits to Insurance Companies

Insurance agencies also play a crucial role in supporting insurance companies. Here are some key advantages insurance companies gain from their partnership with agencies:

- Market Penetration: Insurance agencies act as an extended sales force for insurance companies, helping them reach a broader market. By representing multiple carriers, agencies can promote the unique features and benefits of each company’s policies, increasing their market presence and attracting new clients.

- Risk Assessment and Management: Insurance agencies, through their risk assessment and management consulting services, help insurance companies identify and mitigate potential risks. This reduces the likelihood of large-scale claims and minimizes losses, ensuring the financial stability of insurance carriers.

- Policyholder Retention: The personalized service and support provided by insurance agencies contribute to higher policyholder retention rates. By ensuring policyholders receive the coverage and assistance they need, agencies foster loyalty, reducing the churn rate and providing a stable customer base for insurance companies.

- Claims Efficiency: With insurance agencies assisting policyholders during the claims process, insurance companies benefit from more efficient claims handling. Agencies help with documentation, provide necessary forms, and advocate for fair settlements, reducing the administrative burden on insurance companies and speeding up the claims process.

The Future of Insurance Agencies

The insurance industry is evolving, driven by technological advancements and changing consumer expectations. Insurance agencies must adapt to these shifts to remain relevant and effective.

Digital Transformation

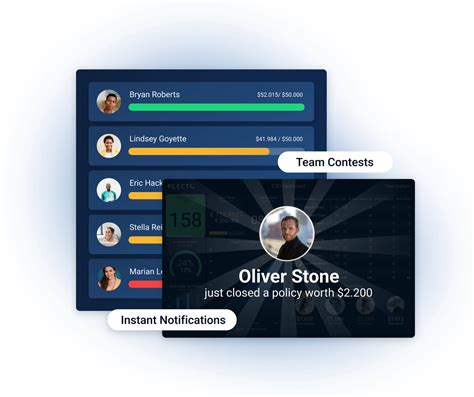

The digital age has brought about significant changes in the way insurance is sold and serviced. Insurance agencies are increasingly adopting digital technologies to enhance their operations and provide better customer experiences. Here are some key trends:

- Online Policy Comparison: Insurance agencies are leveraging online platforms to provide policyholders with easy access to compare multiple policies. These platforms offer real-time quotes, allowing clients to make informed decisions quickly and efficiently.

- Digital Claims Processing: Agencies are integrating digital tools into their claims management processes. This includes online claim submission, electronic documentation, and real-time claim tracking, streamlining the claims process and providing policyholders with greater convenience and transparency.

- Data Analytics: Advanced data analytics is transforming the way insurance agencies assess risks and manage policies. By analyzing vast amounts of data, agencies can identify patterns, predict risks, and develop more accurate and efficient risk management strategies.

Specialization and Niche Markets

As the insurance market becomes increasingly competitive, insurance agencies are recognizing the value of specialization. By focusing on specific industries or risk segments, agencies can develop expertise and offer tailored solutions to niche markets. This approach allows agencies to build deeper relationships with their clients and provide highly specialized services.

Enhanced Customer Service

In an era of instant gratification and rising customer expectations, insurance agencies are prioritizing customer service. This includes providing 24⁄7 support, offering multiple channels of communication, and ensuring prompt response times. By investing in customer service, agencies can differentiate themselves and build long-lasting relationships with their clients.

Conclusion

Insurance agencies are a vital component of the insurance ecosystem, offering expertise, choice, and personalized service to policyholders. They provide a crucial link between individuals and businesses seeking coverage and the diverse array of insurance products available. As the insurance landscape continues to evolve, insurance agencies will play a pivotal role in shaping the industry, ensuring it remains accessible, efficient, and responsive to the needs of its clients.

How do insurance agencies select the insurance companies they represent?

+Insurance agencies carefully choose the insurance companies they represent based on factors such as financial stability, reputation, product offerings, and customer service. They conduct thorough research and due diligence to ensure the carriers they partner with align with their agency’s values and provide quality coverage to their clients.

What types of insurance do agencies typically offer?

+Insurance agencies offer a wide range of insurance products, including but not limited to: auto insurance, home insurance, life insurance, health insurance, business insurance, and specialty insurance (e.g., cyber liability, professional liability, etc.).

How do insurance agencies handle client confidentiality and privacy?

+Insurance agencies prioritize client confidentiality and privacy. They adhere to strict data protection regulations and implement robust security measures to safeguard client information. Agencies ensure that only authorized personnel have access to sensitive data and provide training to their staff on privacy best practices.