Insurance Antique Cars

The Ultimate Guide to Insuring Your Antique Car: Navigating the World of Vintage Vehicle Coverage

If you're the proud owner of an antique car, you understand the unique blend of pride, passion, and responsibility that comes with preserving a piece of automotive history. As your vintage vehicle rolls down the road less traveled, it's essential to ensure it's protected with the right insurance coverage. In this comprehensive guide, we'll delve into the world of antique car insurance, exploring the key considerations, coverage options, and expert tips to help you secure the perfect policy for your cherished ride.

Understanding the Value of Your Antique Car

Antique cars, often referred to as classic or vintage vehicles, hold a special place in the hearts of collectors and enthusiasts. These vehicles are more than just modes of transportation; they are cherished relics of a bygone era, embodying the spirit of automotive innovation and design. Whether it's a meticulously restored 1960s muscle car or a rare pre-war European sports car, each antique vehicle has its own unique story and intrinsic value.

When it comes to insuring your antique car, the first step is to understand its true worth. The value of an antique vehicle can be influenced by various factors, including its make, model, year, condition, rarity, and historical significance. Here are some key considerations to help you determine the value of your antique car:

- Market Value: Research the current market value of similar antique cars. Consult classic car price guides, auction results, and online forums to get an idea of what your vehicle might fetch in the current market.

- Restoration Costs: Consider the expenses incurred in restoring your antique car to its current condition. This includes the cost of parts, labor, and any specialized services required for vintage vehicles.

- Historical Significance: Some antique cars have a rich history or were owned by notable individuals, which can significantly increase their value. Research the background of your vehicle and its potential historical significance.

- Condition: The overall condition of your antique car plays a crucial role in determining its value. Assess the body, interior, engine, and mechanical components to gauge its current state.

- Rarity: Rare models or limited-edition vehicles tend to have higher values. Research the production numbers and availability of parts for your specific make and model.

By thoroughly understanding the value of your antique car, you can ensure that your insurance policy adequately covers its worth. This is especially important when it comes to total loss or damage claims, as you want to be compensated fairly for your precious vintage vehicle.

Specialized Antique Car Insurance Policies

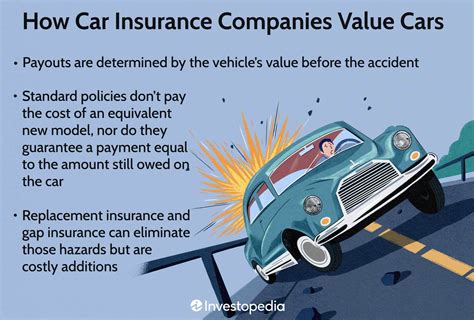

Standard auto insurance policies are typically designed for modern vehicles and may not provide adequate coverage for antique cars. Fortunately, the insurance industry recognizes the unique needs of antique vehicle owners and offers specialized antique car insurance policies. These policies are tailored to meet the specific requirements and considerations of vintage vehicles.

Here's what you need to know about specialized antique car insurance:

Agreed Value Coverage

One of the key features of antique car insurance is Agreed Value coverage. This type of policy is based on an agreed-upon value between you and the insurance company, rather than the actual cash value of the vehicle. With Agreed Value coverage, you can rest assured that in the event of a total loss or damage claim, you will receive the agreed-upon amount, which is typically higher than the market value of your antique car.

Agreed Value coverage provides several benefits for antique car owners:

- Fair Compensation: It ensures you receive adequate compensation for your unique vehicle, taking into account its historical value and rarity.

- Peace of Mind: With Agreed Value coverage, you don't have to worry about depreciation or fluctuating market values affecting your insurance payout.

- Specialized Appraisal: To determine the Agreed Value, your antique car will undergo a specialized appraisal process, which considers its unique characteristics and market demand.

Limited Use and Storage Considerations

Antique cars are often driven sparingly and stored with care. Specialized insurance policies recognize this limited use and offer coverage options tailored to your driving habits. Here's how they accommodate these considerations:

- Limited Mileage Discounts: Many antique car insurance policies offer discounts for limited mileage. If you only drive your vintage vehicle to car shows, rallies, or special events, you may be eligible for reduced premiums.

- Storage Coverage: When your antique car is in storage, it still requires protection. Specialized policies often include coverage for damage or theft while in storage, ensuring your vehicle is safeguarded even when it's not in use.

- Modified Vehicle Coverage: Antique cars often undergo modifications to enhance their performance or appearance. Specialized insurance policies can accommodate these modifications, ensuring that any upgrades or custom features are covered.

Comprehensive Coverage Options

Antique car insurance policies typically offer a comprehensive range of coverage options to address various risks associated with vintage vehicles. These may include:

- Liability Coverage: Protects you from financial loss if you're found at fault in an accident, covering bodily injury and property damage claims.

- Collision Coverage: Pays for repairs or replacement of your antique car if it's involved in a collision, regardless of fault.

- Comprehensive Coverage: Covers damage caused by non-collision events such as fire, theft, vandalism, or natural disasters.

- Roadside Assistance: Provides emergency services, towing, and assistance in case your antique car breaks down or experiences mechanical issues.

- Medical Payments Coverage: Covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

Finding the Right Antique Car Insurance Provider

With a clear understanding of your antique car's value and the specialized coverage options available, it's time to find the right insurance provider to safeguard your precious ride. Here are some key factors to consider when choosing an antique car insurance company:

Reputation and Expertise

Look for insurance providers with a solid reputation in the antique car insurance industry. Seek out companies that have a proven track record of successfully insuring vintage vehicles and a deep understanding of the unique needs and challenges associated with these specialty cars.

Customizable Policies

Antique cars come in all shapes and sizes, and so should your insurance policy. Choose an insurance provider that offers customizable policies, allowing you to tailor the coverage to your specific needs. This ensures that you're not paying for unnecessary coverage while still protecting your vintage vehicle adequately.

Claims Handling

In the unfortunate event of an accident or damage claim, you want to work with an insurance company that has a streamlined and efficient claims process. Research the claims handling reputation of potential providers, looking for companies that prioritize timely and fair claim settlements. Consider factors such as response time, communication, and customer satisfaction ratings.

Specialized Repair Networks

Antique cars often require specialized repair services, and not all auto body shops are equipped to handle vintage vehicles. Look for insurance providers that have partnerships with trusted repair networks specializing in antique car restoration and repair. This ensures that your vehicle is in capable hands when it needs repairs, preserving its integrity and value.

Additional Benefits and Perks

Some antique car insurance providers offer additional benefits and perks to enhance your ownership experience. These may include access to exclusive car shows, discounts on vintage car parts and services, or even concierge services for event transportation and registration.

Protecting Your Antique Car: Practical Tips

While insurance provides financial protection, there are practical steps you can take to safeguard your antique car and minimize the risk of accidents or damage. Here are some expert tips to keep your vintage vehicle in pristine condition:

Regular Maintenance and Inspection

Just like any other vehicle, antique cars require regular maintenance to ensure they run smoothly and safely. Schedule routine inspections and services with a trusted mechanic who specializes in vintage vehicles. This includes checking the engine, transmission, brakes, electrical system, and other critical components.

Secure Storage

When your antique car is not in use, store it in a secure location. Ideally, choose a climate-controlled garage or storage facility that provides adequate protection from weather elements, theft, and vandalism. Ensure the storage area is well-ventilated to prevent moisture buildup and potential corrosion.

Event Participation

Antique car events, such as car shows, rallies, and concours d'elegance, provide a great opportunity to showcase your vintage vehicle and connect with fellow enthusiasts. These events often have strict requirements for participation, including vehicle condition and presentation. Ensure your antique car is in top shape and properly prepared for these special occasions.

Driver Education and Training

Antique cars may have different handling characteristics compared to modern vehicles. Consider enrolling in driver education programs or vintage car racing schools to enhance your driving skills and understanding of your antique car's performance capabilities. This can help you navigate your vintage vehicle safely and confidently.

Document and Preserve

Maintain a comprehensive record of your antique car's history, including maintenance records, restoration documentation, and any upgrades or modifications. These records can be invaluable in the event of an insurance claim or when selling your vintage vehicle. Additionally, consider documenting your antique car's condition through high-quality photographs and videos, which can serve as evidence of its pristine state.

Conclusion: Preserving the Legacy of Your Antique Car

Insuring your antique car is not just a legal requirement; it's an essential step in preserving the legacy of these timeless machines. By understanding the unique value of your vintage vehicle and selecting a specialized insurance policy, you can ensure that your cherished ride is protected against unforeseen events. With the right coverage and practical precautions, you can continue to enjoy the thrill of driving your antique car, knowing it's safeguarded for years to come.

As you embark on your journey as an antique car owner, remember that each vintage vehicle has its own story to tell. By caring for and protecting your antique car, you become a custodian of automotive history, ensuring that these remarkable machines continue to inspire and captivate generations to come.

How often should I have my antique car appraised for insurance purposes?

+It’s recommended to have your antique car appraised every few years or whenever significant upgrades or modifications are made. This ensures that the agreed value of your policy remains up-to-date and accurately reflects the current market value of your vehicle.

Can I drive my antique car as my daily vehicle and still get specialized insurance coverage?

+While specialized antique car insurance policies are typically designed for limited-use vehicles, some providers offer coverage for daily drivers. However, the premiums may be higher, and you may need to demonstrate that your antique car is well-maintained and used primarily for pleasure rather than commuting.

What happens if my antique car is damaged in an accident, and the repairs exceed its agreed value?

+In such cases, your insurance company will typically pay up to the agreed value of your policy. However, if you have comprehensive coverage, you may be able to negotiate additional funds for specialized repairs or restoration, especially if the vehicle holds significant historical value.

Are there any discounts available for antique car insurance?

+Yes, many insurance providers offer discounts for antique car owners. These may include limited mileage discounts, multi-policy discounts (if you have other insurance policies with the same provider), and loyalty discounts for long-term customers.