Insurance Apartment Renters

Renters insurance, an often-overlooked yet crucial aspect of financial planning, is a cornerstone for individuals and families residing in apartment communities. Beyond offering peace of mind, this coverage safeguards tenants against various unforeseen events that can lead to substantial financial losses. In this comprehensive guide, we delve into the world of insurance for apartment renters, exploring its significance, the coverage it provides, and how it empowers tenants to navigate life's uncertainties with confidence.

Understanding the Importance of Renters Insurance

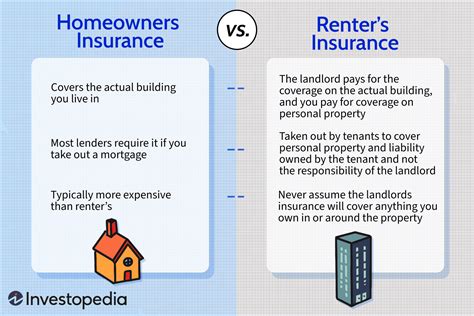

For those living in apartments, renters insurance is a protective shield against unforeseen circumstances. It’s a vital tool in an individual’s financial arsenal, ensuring that the belongings one accumulates over time are safeguarded. While many associate insurance with property owners, renters also face unique challenges that can lead to financial strain. From natural disasters to accidental damage, the need for adequate coverage is ever-present.

Consider the scenario of a tenant whose apartment experiences a fire, resulting in the loss of valuable possessions. Without renters insurance, the financial burden of replacing these items can be overwhelming. Additionally, liability concerns arise when guests are injured within the apartment, potentially leading to costly legal battles. Renters insurance steps in to provide a safety net, offering coverage for personal property, liability, and even additional living expenses in the event of a covered loss.

Comprehensive Coverage for Apartment Renters

Renters insurance is designed to cater to the specific needs of apartment dwellers, offering a range of coverage options that address common risks. Let’s explore some key components of this essential insurance type:

Personal Property Coverage

This is the cornerstone of renters insurance, providing financial protection for the tenant’s belongings. It covers a wide array of items, including furniture, electronics, clothing, and even collectibles. In the unfortunate event of a covered loss, such as a burglary or fire, the insurance policy reimburses the tenant for the cost of replacing these possessions. Personal property coverage ensures that renters can rebuild their lives and restore their homes without bearing the full financial brunt.

It's important to note that renters insurance typically covers personal property on a replacement cost basis. This means that the insured receives the amount needed to purchase new items, equivalent to their current value, rather than their depreciated value. For instance, if a laptop is stolen, the insurance company will reimburse the tenant for the cost of a new laptop, ensuring they can quickly replace it without financial strain.

Liability Protection

Liability coverage is a critical component of renters insurance, offering protection against claims arising from accidents or injuries that occur within the insured’s apartment. Imagine a scenario where a guest trips and falls, sustaining an injury. Without liability coverage, the tenant could be held responsible for medical expenses and potential legal fees. Renters insurance steps in to cover these costs, providing a vital layer of protection against unexpected legal battles.

Moreover, liability coverage extends beyond physical injuries. It also safeguards tenants against claims resulting from property damage caused by their negligence. For instance, if a water pipe bursts due to the tenant's oversight, resulting in damage to neighboring apartments, liability coverage can provide financial relief. This coverage ensures that tenants are not left financially burdened by accidents that are beyond their control.

Additional Living Expenses

In the event of a covered loss that renders an apartment uninhabitable, additional living expenses coverage kicks in. This provision covers the cost of temporary housing and related expenses, ensuring that tenants can maintain their normal standard of living during the restoration process. It covers items like hotel stays, meals, and transportation, providing a sense of stability during a challenging time.

For example, if a tenant's apartment is damaged due to a severe storm and they are unable to reside there while repairs are made, additional living expenses coverage steps in. It reimburses the tenant for the cost of staying in a hotel and any extra expenses incurred during this period, ensuring they can continue their daily routines with minimal disruption.

Tailoring Coverage to Individual Needs

One of the key advantages of renters insurance is its adaptability. Insurance providers offer various coverage options and limits, allowing tenants to customize their policies to fit their unique circumstances and budgetary considerations. This ensures that renters receive adequate protection without paying for coverage they don’t need.

For instance, a tenant with high-value art collections may opt for increased personal property coverage to ensure their valuable possessions are adequately insured. On the other hand, a student living in a furnished apartment may prioritize liability coverage to protect against potential accidents involving guests.

The Impact of Deductibles

Like most insurance policies, renters insurance policies come with deductibles, which are the amounts the insured must pay out of pocket before the insurance coverage kicks in. Deductibles can vary based on the policy and the insurer, and choosing the right deductible is a critical decision that affects both the cost of the policy and the level of protection.

A higher deductible typically results in a lower premium, as the insured assumes a larger portion of the financial risk. This can be a strategic choice for individuals who are comfortable with managing smaller, more frequent expenses. Conversely, a lower deductible means the insured pays less out of pocket in the event of a claim but results in a higher premium. It's essential for tenants to carefully consider their financial situation and risk tolerance when selecting a deductible.

Discounts and Bundle Options

Insurance companies often provide discounts and bundle options to make renters insurance more affordable and attractive. Some common discounts include:

- Multi-Policy Discounts: Renters can save by bundling their renters insurance with other policies, such as auto insurance, from the same insurer.

- Loyalty Discounts: Insurers may offer reduced rates to long-term customers who have maintained their policies without interruptions.

- Security Discounts : Tenants who install security systems or smoke detectors in their apartments may be eligible for discounts, as these measures reduce the risk of claims.

Additionally, insurance companies may offer package deals or endorsements to enhance coverage. These options can include coverage for specific items, such as jewelry or musical instruments, or provide additional protection for scenarios like identity theft or damage from natural disasters.

The Process of Obtaining Renters Insurance

Securing renters insurance is a straightforward process that involves a few key steps. Here’s a simplified breakdown:

- Assess Your Needs: Start by evaluating your personal circumstances and the items you want to insure. Consider the value of your possessions, your liability risks, and any specific coverage requirements.

- Research Insurance Providers: Explore different insurance companies and their offerings. Compare policies, coverage limits, deductibles, and additional benefits to find the best fit for your needs.

- Obtain Quotes: Request quotes from multiple insurers. This allows you to compare prices and coverage options, ensuring you get the most value for your money.

- Review Policy Details: Carefully examine the policy documents, including the coverage limits, exclusions, and conditions. Ensure you understand the terms and conditions before proceeding.

- Choose a Provider and Policy: Select the insurance company and policy that best meets your needs and budget. Consider factors like customer service, claims handling, and overall reputation.

- Purchase the Policy: Complete the necessary paperwork and make the initial payment to activate your renters insurance coverage.

It's essential to review your policy periodically, especially if your circumstances change. Life events such as marriage, the addition of family members, or acquiring new possessions may require adjustments to your coverage. Regular policy reviews ensure that your insurance remains up-to-date and provides the protection you need.

The Role of Insurance Agents

Insurance agents play a crucial role in guiding tenants through the process of obtaining renters insurance. These professionals are knowledgeable about the various coverage options and can provide personalized recommendations based on individual needs. They can explain the intricacies of policies, answer questions, and offer insights into the best practices for protecting one’s possessions and managing liability risks.

Working with an insurance agent can be especially beneficial for tenants who are new to the world of insurance or those with unique circumstances that require specialized coverage. Agents can tailor policies to fit specific needs, ensuring that renters receive the protection they deserve without paying for unnecessary coverage.

Conclusion: Empowering Apartment Renters with Confidence

Renters insurance is more than just a financial safeguard; it’s a tool that empowers apartment dwellers to face life’s uncertainties with resilience and peace of mind. By understanding the importance of this coverage and tailoring it to their unique needs, tenants can protect their possessions, manage liability risks, and navigate the complexities of modern living with confidence. Whether it’s safeguarding against unforeseen events or providing a financial safety net, renters insurance is an essential component of responsible financial planning for those calling apartments home.

What is the average cost of renters insurance?

+The average cost of renters insurance can vary based on several factors, including location, the value of your possessions, and the coverage limits you choose. On average, renters insurance policies can range from 15 to 30 per month, or around 180 to 360 annually. However, it’s important to note that costs can be higher or lower depending on your specific circumstances and the insurance provider.

Is renters insurance mandatory for apartment dwellers?

+While renters insurance is not legally mandatory in most states, it is highly recommended for all apartment residents. Renters insurance provides valuable protection for your personal belongings and can safeguard you against liability claims. Additionally, many apartment complexes require renters to have insurance as a condition of their lease agreement.

How do I file a claim with my renters insurance policy?

+To file a claim with your renters insurance policy, you’ll typically need to contact your insurance provider and provide them with details about the incident. They may require documentation, such as police reports or repair estimates, to support your claim. It’s essential to review your policy’s specific claim process and timeframes to ensure a smooth and timely resolution.