Insurance Auto

In today's fast-paced world, having comprehensive automotive insurance is not just a legal requirement but a necessity for every vehicle owner. It provides financial protection and peace of mind, ensuring that you and your vehicle are covered in various situations. This article delves into the world of insurance auto, exploring its benefits, coverage options, and the factors that influence premiums. Whether you're a seasoned driver or a new car owner, understanding the intricacies of auto insurance is crucial to making informed decisions.

The Importance of Insurance Auto

Auto insurance is a cornerstone of responsible vehicle ownership, offering a safety net for unforeseen circumstances. It protects against financial losses resulting from accidents, theft, natural disasters, and other unforeseen events. By having adequate coverage, you can avoid the potentially devastating financial consequences of an accident or vehicle damage.

Moreover, insurance auto plays a vital role in maintaining road safety. It encourages drivers to practice defensive driving and adhere to traffic rules, knowing that their actions have financial implications. This culture of responsibility contributes to a safer driving environment for everyone on the road.

Understanding Coverage Options

Auto insurance policies offer a range of coverage options, each tailored to address specific risks and needs. Let’s explore some of the key components:

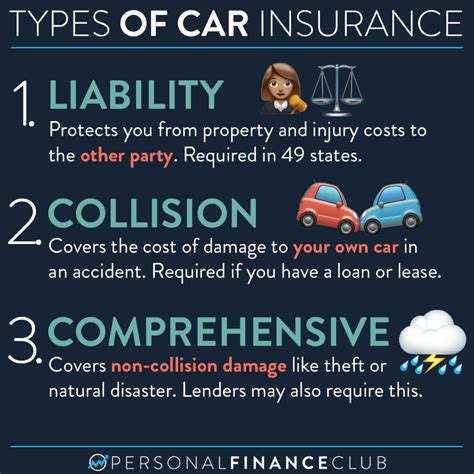

Liability Coverage

Liability insurance is a fundamental aspect of any auto insurance policy. It covers the costs associated with injuries or damages caused to others in an accident for which you are at fault. This includes medical expenses, property damage, and legal fees. Having sufficient liability coverage is essential to protect your financial well-being and ensure you can meet your obligations in the event of an accident.

Collision and Comprehensive Coverage

Collision coverage provides protection for damages to your vehicle resulting from collisions with other vehicles or objects. It covers repairs or replacements, ensuring your vehicle is back on the road promptly. Comprehensive coverage, on the other hand, offers protection against non-collision incidents such as theft, vandalism, natural disasters, and damage caused by animals. This type of coverage is crucial for protecting your vehicle against a wide range of unforeseen events.

Personal Injury Protection (PIP) and Medical Payments

Personal Injury Protection, or PIP, covers medical expenses for you and your passengers, regardless of who is at fault in an accident. It provides comprehensive medical coverage, including hospitalization, rehabilitation, and even lost wages. Medical Payments coverage, on the other hand, offers more limited medical coverage but can be a cost-effective option for those with comprehensive health insurance.

Uninsured/Underinsured Motorist Coverage

This coverage protects you in the event of an accident with a driver who has little or no insurance. It covers damages and injuries sustained, ensuring you are not left financially burdened due to the negligence of others. Uninsured/Underinsured Motorist coverage is a crucial aspect of auto insurance, especially in areas with high uninsured driver rates.

Additional Coverages

Auto insurance policies often offer additional coverages to cater to specific needs. These may include rental car reimbursement, gap insurance (covering the difference between the vehicle’s value and the loan balance), and custom parts and equipment coverage. These add-ons provide further peace of mind and financial protection for specialized vehicles or unique situations.

Factors Influencing Premiums

The cost of auto insurance, known as premiums, varies significantly based on a multitude of factors. Understanding these factors can help you make informed choices when selecting a policy and potentially reduce your costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it play a significant role in determining your insurance premiums. Generally, sports cars, luxury vehicles, and high-performance cars are more expensive to insure due to their higher repair costs and increased risk of accidents. Additionally, vehicles used for business or commercial purposes may attract higher premiums.

Driver Profile

Your driving history and personal characteristics are key considerations for insurance providers. Factors such as age, gender, driving experience, and credit score can influence premiums. Younger drivers, especially males, often face higher premiums due to their statistically higher accident rates. Similarly, drivers with a history of accidents or traffic violations may see increased costs.

Location and Driving Environment

The area where you live and drive can impact your insurance premiums. Urban areas with higher population densities and traffic congestion often result in increased accident risks and higher premiums. Additionally, regions with a history of severe weather conditions or high crime rates may also see elevated insurance costs.

Coverage and Deductibles

The level of coverage you choose and the deductibles you select directly affect your premiums. Higher coverage limits and lower deductibles typically result in higher premiums. It’s essential to strike a balance between adequate coverage and affordable premiums, considering your specific needs and financial situation.

Discounts and Bundling

Insurance providers often offer discounts to encourage safe driving and policy loyalty. These may include discounts for safe driving records, multiple policy bundles (e.g., auto and home insurance), and loyalty rewards. Additionally, certain vehicle safety features, such as anti-theft systems and advanced driver assistance technologies, can qualify for discounts, making your insurance more affordable.

The Process of Obtaining Insurance Auto

Securing the right auto insurance policy involves a series of steps to ensure you get the coverage you need at a competitive price. Here’s a simplified guide to the process:

Research and Compare

Start by researching and comparing different insurance providers and their offerings. Look for reputable companies with a solid financial standing and positive customer reviews. Consider factors such as coverage options, customer service, and claim handling processes. Online comparison tools and insurance brokerages can be valuable resources for this step.

Obtain Quotes

Request quotes from multiple insurance providers, providing accurate and detailed information about your vehicle, driving history, and desired coverage levels. Be sure to inquire about any applicable discounts and consider bundling multiple policies to potentially save more.

Review Policy Details

Once you’ve received quotes, carefully review the policy details, including coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy aligns with your specific needs and provides adequate protection. Don’t hesitate to seek clarification or additional information from the insurance provider if needed.

Choose the Right Policy

Based on your research, quotes, and policy reviews, select the insurance provider and policy that best meet your needs and budget. Consider factors such as coverage quality, price, and the provider’s reputation for customer service and claim handling. Remember, the cheapest policy may not always be the best option, as it might lack sufficient coverage.

Complete the Application Process

Once you’ve chosen your preferred policy, complete the application process, providing all the necessary information and documentation. This may include your driver’s license, vehicle registration, and proof of prior insurance (if applicable). Be sure to review the policy documents thoroughly before finalizing your decision.

Future Trends and Innovations

The world of insurance auto is continually evolving, driven by technological advancements and changing consumer needs. Here are some trends and innovations shaping the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle usage, is gaining traction in the insurance industry. Usage-Based Insurance (UBI) policies offer personalized premiums based on real-time driving data, encouraging safe driving habits. This technology provides a more accurate assessment of risk and can lead to cost savings for responsible drivers.

Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing the insurance industry, enhancing claim processing and fraud detection. These technologies enable faster and more accurate claims assessments, improving customer satisfaction. Additionally, AI-powered chatbots and virtual assistants are enhancing customer service, providing instant support and streamlining policy management.

Connected Car Technologies

The integration of connected car technologies is transforming the way insurance providers assess risk and interact with customers. These technologies enable real-time vehicle monitoring, allowing insurers to offer personalized coverage and premiums based on driving behavior. Additionally, connected car data can assist in claim verification and accident reconstruction, improving the overall claim handling process.

Blockchain and Smart Contracts

Blockchain technology is being explored to enhance data security and streamline insurance processes. Smart contracts, self-executing contracts with predefined rules, can automate certain insurance processes, such as claim settlements. This technology has the potential to reduce administrative costs and increase transparency in the insurance industry.

Sustainable and Eco-Friendly Initiatives

With growing environmental concerns, insurance providers are exploring sustainable initiatives. Some companies offer discounts for electric or hybrid vehicles, encouraging the adoption of eco-friendly transportation. Additionally, initiatives focused on reducing carbon emissions and promoting sustainable driving practices are gaining traction, aligning with the industry’s commitment to environmental responsibility.

Conclusion

Insurance auto is an indispensable aspect of vehicle ownership, providing financial protection and peace of mind. Understanding the various coverage options and factors influencing premiums is crucial for making informed decisions. As the industry continues to evolve, technological advancements and innovative approaches are shaping a more personalized and efficient insurance landscape. By staying informed and engaged, you can navigate the world of auto insurance with confidence, ensuring you have the right coverage for your needs.

How do I know if I have adequate coverage for my vehicle?

+Assessing adequate coverage involves evaluating your specific needs and financial situation. Consider the value of your vehicle, the level of protection you require, and your ability to pay deductibles. It’s recommended to consult with an insurance professional who can guide you through the process and ensure you have the right coverage limits for liability, collision, and comprehensive coverage.

What are some common mistakes to avoid when choosing auto insurance?

+Common mistakes include selecting the cheapest policy without considering coverage adequacy, failing to review policy details thoroughly, and neglecting to explore available discounts. It’s essential to strike a balance between cost and coverage, ensuring you have the protection you need without overspending. Additionally, regular policy reviews can help you stay up-to-date with changing needs and potential savings opportunities.

How can I reduce my auto insurance premiums?

+To reduce premiums, consider increasing your deductible, as higher deductibles often result in lower premiums. Additionally, maintain a clean driving record, as a history of accidents or violations can lead to increased costs. Explore discounts for safe driving, multiple policies, and vehicle safety features. Finally, regularly shop around for quotes to ensure you’re getting the best deal.

What should I do if I’m involved in an accident?

+In the event of an accident, remain calm and ensure the safety of yourself and others involved. Exchange information with the other driver(s), including names, contact details, and insurance information. Document the scene by taking photos and collecting witness statements. Notify your insurance provider promptly, providing all relevant details. Follow their guidance on the claim process and cooperate fully to ensure a smooth resolution.