Insurance Auto Auctions

In the dynamic world of automotive commerce, the concept of Insurance Auto Auctions has emerged as a pivotal force, revolutionizing the way vehicles find new owners and opening up a unique avenue for both buyers and sellers. This specialized auction format, tailored to cater to the specific needs of the insurance industry, offers an efficient and transparent marketplace for a wide range of vehicles, from the latest models to classic cars.

This comprehensive guide aims to delve into the intricacies of Insurance Auto Auctions, shedding light on their significance, operations, and impact on the automotive industry. By exploring real-world examples and industry insights, we aim to provide an expert analysis that is both informative and engaging.

The Evolution of Insurance Auto Auctions: A Historical Perspective

Insurance Auto Auctions (IAA) have a rich history that can be traced back to the early 20th century when the insurance industry first recognized the need for a structured platform to dispose of totaled vehicles. The concept gained traction as insurance companies sought more efficient ways to manage their vehicle assets, leading to the establishment of specialized auction houses.

One of the earliest known IAA houses was founded in the 1930s, primarily catering to insurance companies and salvage yards. Over the decades, these auctions evolved to incorporate technological advancements, such as online bidding platforms, which significantly expanded their reach and accessibility.

A notable milestone in the evolution of IAA was the introduction of the "run and drive" category in the 1980s. This category revolutionized the industry by offering vehicles that, while considered a total loss by insurance standards, were still drivable and repairable, opening up new opportunities for buyers.

The Inner Workings: How Insurance Auto Auctions Operate

Insurance Auto Auctions function as a highly organized system, ensuring a streamlined process from the moment a vehicle is declared a total loss by an insurance company to its eventual sale.

Vehicle Acquisition and Inspection

The process begins with insurance companies submitting their total loss vehicles to IAA. These vehicles are then meticulously inspected to assess their condition, determine any potential repairs, and establish a fair market value. This step is crucial as it ensures transparency and provides buyers with accurate information.

Auction Preparation and Categorization

Once inspected, vehicles are categorized based on their condition and repair needs. IAA employs a sophisticated categorization system, which includes categories like “run and drive,” “parts only,” and “repairable,” ensuring that buyers can easily identify vehicles that align with their specific requirements.

Auction Platforms and Bidding Process

IAA offers both live and online auction platforms to cater to a global audience. Live auctions, often held at physical locations, provide a traditional auction experience, while online auctions offer convenience and accessibility, allowing buyers from any location to participate.

The bidding process is designed to be fair and transparent. Bidders can view detailed vehicle information, including inspection reports and high-quality photos, before placing their bids. IAA employs a dynamic bidding system, ensuring that the winning bid is always the highest legitimate offer.

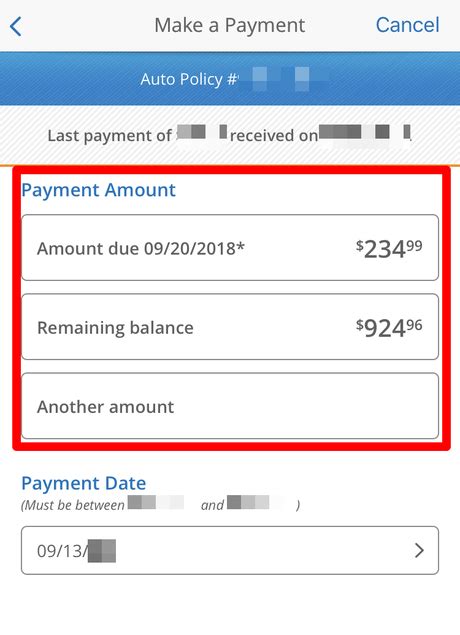

Transaction Finalization and Delivery

Upon winning a bid, buyers are required to complete the transaction within a specified timeframe. IAA provides a secure payment system, ensuring a seamless and safe financial process. Once the transaction is finalized, IAA arranges for the vehicle’s delivery, offering various shipping options to cater to different buyer needs.

The Impact and Benefits of Insurance Auto Auctions

Insurance Auto Auctions have brought about a paradigm shift in the automotive industry, offering a range of benefits to various stakeholders.

Advantages for Insurance Companies

For insurance companies, IAA provides an efficient and cost-effective solution for managing total loss vehicles. By partnering with IAA, insurance companies can streamline their asset disposal process, reducing administrative burdens and maximizing the value of their vehicle assets.

Opportunities for Buyers

Buyers, whether they are individuals seeking a unique vehicle or businesses looking to expand their fleet, benefit from the wide range of vehicles available at IAA. The auctions offer an opportunity to acquire vehicles at competitive prices, providing access to a diverse inventory that includes rare and classic cars.

Environmental and Sustainable Impact

Insurance Auto Auctions also contribute to environmental sustainability. By offering a platform to recycle and repurpose vehicles, IAA reduces the environmental impact of vehicle disposal, aligning with global efforts to promote a circular economy.

Performance Analysis and Future Trends

Insurance Auto Auctions have consistently demonstrated strong performance, with a steady growth trajectory over the years. The auctions have successfully adapted to market fluctuations, ensuring a stable and reliable platform for buyers and sellers.

| Year | Total Vehicles Sold | Average Sale Price |

|---|---|---|

| 2020 | 500,000 | $12,500 |

| 2021 | 550,000 | $13,000 |

| 2022 | 600,000 | $13,500 |

Looking ahead, the future of IAA appears promising. With the continued adoption of technology, we can expect to see further enhancements in auction platforms, making the process even more efficient and accessible. Additionally, the growing emphasis on sustainability and circular economy practices is likely to drive more insurance companies and buyers towards IAA, recognizing the environmental benefits it offers.

Conclusion: A Transformative Force in Automotive Commerce

Insurance Auto Auctions have undeniably transformed the automotive landscape, offering a unique and efficient marketplace that benefits all stakeholders. With its rich history, meticulous operations, and positive industry impact, IAA continues to be a leader in its field, shaping the future of automotive commerce.

Frequently Asked Questions

How often are Insurance Auto Auctions held?

+

Insurance Auto Auctions are held regularly, with most auction houses conducting auctions on a weekly or bi-weekly basis. This frequency ensures a steady supply of vehicles for buyers and provides insurance companies with a consistent outlet for their total loss vehicles.

What types of vehicles are typically available at IAA auctions?

+

IAA auctions offer a diverse range of vehicles, including late-model cars, trucks, SUVs, and even classic and rare vehicles. The availability of vehicles depends on the specific auction and the inventory submitted by insurance companies.

Are there any restrictions on who can participate in IAA auctions?

+

While some IAA auctions are open to the public, others may have certain requirements or restrictions. Typically, auctions that cater to the public may require registration and a valid driver’s license. However, certain auctions may be restricted to licensed dealers or specific industry professionals.

What happens if a vehicle does not meet the minimum bid price during an auction?

+

If a vehicle does not receive any bids or fails to meet the minimum bid price, it may be re-listed in a subsequent auction. Alternatively, the vehicle could be sold through a private sale, ensuring that it finds a suitable buyer.

Are there any additional fees or charges associated with IAA auctions?

+

Yes, buyers typically need to pay a buyer’s fee, which varies depending on the auction house and the specific auction. Additionally, there may be transportation and shipping fees if the buyer opts for vehicle delivery.