Insurance Auto Insurance Companies

In today's fast-paced world, auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the globe. With a vast array of insurance providers offering various coverage options, choosing the right auto insurance company can be a daunting task. This comprehensive guide aims to delve into the world of insurance, exploring key considerations, industry insights, and real-world examples to empower you in making an informed decision.

Understanding the Auto Insurance Landscape

The auto insurance market is diverse and dynamic, with numerous companies vying for customers. Each insurer offers a unique set of policies, coverage options, and value-added services. To navigate this landscape effectively, it’s crucial to understand the fundamental aspects of auto insurance and the factors that set companies apart.

Coverage Options and Policy Features

Auto insurance policies come in various forms, catering to different driver needs and preferences. Some standard coverage options include liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. While liability coverage is often mandatory, other types of coverage may be optional but highly recommended.

For instance, collision coverage protects against damages caused by a collision with another vehicle or object, whereas comprehensive coverage provides protection against non-collision incidents like theft, vandalism, or natural disasters. Medical payments coverage assists with medical expenses incurred due to an accident, regardless of fault.

Additionally, many insurance companies offer optional add-ons and endorsements to customize policies. These may include rental car reimbursement, roadside assistance, gap insurance, or accident forgiveness. Understanding these coverage options and their potential benefits is essential in choosing the right policy for your specific needs.

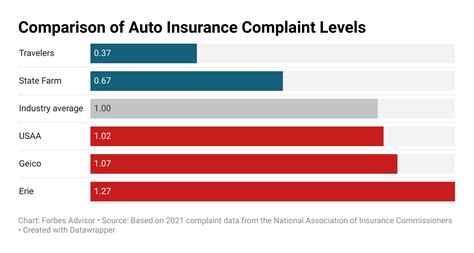

Insurance Companies’ Reputation and Financial Strength

When selecting an auto insurance company, it’s crucial to assess their reputation and financial stability. A reputable insurer should have a track record of providing excellent customer service, prompt claim handling, and fair pricing. Online reviews and industry ratings can offer valuable insights into a company’s performance and customer satisfaction levels.

Furthermore, assessing an insurer’s financial strength is vital. A financially stable company is more likely to honor its policy obligations and pay out claims promptly. Ratings from independent agencies like AM Best or Standard & Poor’s can provide objective assessments of an insurer’s financial health and stability.

Consider real-world examples: Company X, with an excellent financial rating and a strong market presence, offers competitive rates and efficient claim processing. In contrast, Company Y, despite its attractive marketing, has faced financial challenges and received negative feedback from customers regarding claim payouts.

Discounts and Value-Added Services

Auto insurance companies often provide discounts to attract customers and reward safe driving behavior. Common discounts include those for safe driving records, multiple policy bundling, vehicle safety features, and low mileage usage. Some insurers also offer usage-based insurance programs that track driving behavior and provide personalized discounts based on individual driving habits.

Additionally, many insurers offer value-added services to enhance the customer experience. These may include digital tools for policy management, roadside assistance programs, accident forgiveness, or access to a network of preferred repair shops. Understanding the availability and quality of these services can significantly impact your overall satisfaction with an insurance provider.

Comparing Auto Insurance Companies: A Real-World Example

To illustrate the process of comparing auto insurance companies, let’s consider a hypothetical scenario involving three leading insurers: Company A, Company B, and Company C.

Company A: Comprehensive Coverage and Customer Service

Company A, a well-established insurer, boasts a comprehensive range of coverage options, including standard liability, collision, and comprehensive coverage, as well as specialized policies for classic cars and high-value vehicles. Their policies offer flexibility, allowing customers to customize their coverage based on individual needs.

One of Company A’s standout features is its exceptional customer service. With a dedicated team of experienced agents, they provide personalized support and guidance throughout the policy selection and claim process. Customers consistently praise their responsiveness and attention to detail.

Additionally, Company A offers a suite of value-added services, including a mobile app for policy management, roadside assistance, and a network of preferred repair shops. Their claim handling process is efficient, with a fast turnaround time and fair settlements.

Company B: Competitive Pricing and Digital Innovation

Company B, a relatively new player in the market, has gained recognition for its innovative approach to auto insurance. They offer competitive pricing and a range of coverage options, including standard policies and specialized coverage for rideshare drivers and electric vehicles.

What sets Company B apart is its focus on digital innovation. They have developed a user-friendly mobile app that allows customers to manage their policies, track claims, and access real-time assistance. The app also includes a telematics feature, enabling usage-based insurance and personalized discounts based on driving behavior.

While Company B’s customer service team is smaller compared to Company A, they prioritize prompt response times and efficient communication through digital channels. Their claim process is streamlined, with a strong emphasis on transparency and customer satisfaction.

Company C: Financial Stability and Customizable Policies

Company C, a longstanding insurer, is renowned for its financial stability and commitment to long-term customer relationships. With an excellent financial rating, they have consistently demonstrated their ability to honor policy obligations and pay out claims promptly.

Company C offers a wide range of coverage options, including standard policies and customizable add-ons. Their policies can be tailored to meet the specific needs of individual drivers, providing flexibility and personalized protection. They also provide optional endorsements for specific risks, such as pet injury coverage or enhanced rental car reimbursement.

While Company C’s customer service team may not be as large as some competitors, they prioritize personalized attention and building long-term relationships. Their claim process is thorough and fair, with a focus on accurate assessments and timely resolutions.

Making an Informed Decision: Factors to Consider

When deciding between auto insurance companies, it’s essential to consider various factors that align with your specific needs and priorities. Here are some key considerations to guide your decision-making process:

Coverage Options and Flexibility

Assess your driving needs and risks to determine the coverage options that are most relevant to you. Consider factors such as your vehicle type, driving habits, and potential risks (e.g., living in an area prone to natural disasters). Look for an insurer that offers comprehensive coverage options and the flexibility to customize your policy.

Pricing and Value for Money

Compare insurance quotes from different companies to assess their pricing. While cost is an important factor, it should not be the sole determinant. Evaluate the value you receive for your money, considering the coverage provided, discounts available, and any value-added services offered.

Look for insurers that offer competitive rates without compromising on coverage quality. Additionally, consider the potential long-term savings through discounts and the overall financial stability of the insurer.

Customer Service and Claim Handling

The quality of customer service and claim handling can significantly impact your overall satisfaction with an insurance company. Assess the insurer’s reputation for prompt and efficient claim processing, fair settlements, and customer support. Online reviews and industry ratings can provide valuable insights into their performance in these areas.

Consider the availability of dedicated customer service representatives, the ease of communication, and the insurer’s commitment to transparency throughout the claim process.

Digital Innovation and Convenience

In today’s digital age, many insurance companies offer online and mobile tools for policy management, claims reporting, and other services. Assess the digital capabilities of each insurer, considering factors such as user-friendliness, functionality, and the availability of real-time assistance.

Look for insurers that provide a seamless digital experience, allowing you to manage your policy and access support efficiently. Additionally, consider the potential benefits of usage-based insurance programs and other innovative features that can enhance your overall experience.

Future Trends and Considerations

The auto insurance industry is continually evolving, driven by technological advancements, changing consumer preferences, and emerging risks. As you navigate the insurance landscape, it’s essential to stay informed about the latest trends and considerations that may impact your insurance decisions.

Emerging Technologies and Telematics

The integration of emerging technologies, such as telematics and connected car devices, is transforming the auto insurance industry. Telematics-based insurance programs use real-time data to assess driving behavior and offer personalized premiums and discounts. These programs can provide significant savings for safe drivers and encourage safer driving habits.

Consider insurers that embrace technological advancements and offer telematics-based insurance options. While these programs may not be suitable for everyone, they represent a significant shift in how insurance is priced and can provide valuable insights into your driving behavior.

Ridesharing and Autonomous Vehicles

The rise of ridesharing services and the impending arrival of autonomous vehicles present unique challenges and opportunities for auto insurance. Insurers are adapting their policies and coverage options to address the specific risks associated with these emerging modes of transportation.

If you are a rideshare driver or plan to utilize autonomous vehicles in the future, ensure that your insurer offers specialized coverage options to protect you in these unique scenarios. Stay informed about industry developments and the evolving insurance landscape to make informed decisions as these technologies become more prevalent.

Environmental and Sustainability Considerations

As sustainability and environmental concerns become increasingly important, some insurance companies are incorporating green initiatives and sustainable practices into their operations. These initiatives may include offering discounts for eco-friendly vehicles, promoting eco-driving practices, or supporting community sustainability projects.

Consider insurers that align with your sustainability values and offer incentives for environmentally conscious choices. By supporting these initiatives, you can contribute to a greener future while also potentially benefiting from reduced insurance premiums.

Conclusion: Navigating the Auto Insurance Landscape

Choosing the right auto insurance company is a crucial decision that can impact your financial well-being and peace of mind. By understanding the key considerations, industry insights, and real-world examples outlined in this guide, you are better equipped to navigate the complex auto insurance landscape.

Remember to assess coverage options, financial stability, customer service, and value-added services when comparing insurance companies. Consider your specific needs, priorities, and the evolving trends in the industry to make an informed decision that aligns with your expectations.

As you embark on your insurance journey, stay proactive, educate yourself about the options available, and don’t hesitate to seek expert advice. With the right auto insurance coverage, you can drive with confidence, knowing you are protected against unforeseen circumstances.

FAQ

What factors should I consider when comparing auto insurance quotes?

+

When comparing auto insurance quotes, consider factors such as coverage options, policy limits, deductibles, discounts available, and the insurer’s financial stability and customer service reputation. Assess your specific needs and priorities to determine which aspects are most important to you.

How can I improve my chances of obtaining lower auto insurance rates?

+

To obtain lower auto insurance rates, focus on maintaining a clean driving record, shopping around for quotes from multiple insurers, and taking advantage of available discounts. Consider factors such as your credit score, vehicle safety features, and usage-based insurance programs, which can help reduce your premiums.

What should I do if I’m involved in an auto accident and need to file a claim?

+

If you’re involved in an auto accident, prioritize your safety and the safety of others involved. Exchange information with the other parties, document the scene with photos or videos, and notify your insurance company as soon as possible. Follow their instructions for filing a claim and provide accurate and detailed information to ensure a smooth claim process.

Are there any alternative auto insurance options available for high-risk drivers?

+

Yes, there are specialized auto insurance options available for high-risk drivers, such as those with multiple accidents or violations on their record. These programs, often referred to as high-risk or non-standard auto insurance, cater to drivers who may face challenges in obtaining traditional insurance. Consider seeking advice from an insurance broker who can guide you toward suitable options.

How can I ensure my auto insurance policy covers my specific needs and risks?

+

To ensure your auto insurance policy covers your specific needs and risks, thoroughly assess your driving habits, the value of your vehicle, and any unique circumstances. Discuss your coverage options with your insurance agent or broker, and consider adding endorsements or additional coverage to address specific risks, such as pet injury coverage or rental car reimbursement.