Insurance Auto Rates

Insurance auto rates are a crucial aspect of the automotive industry, impacting both individuals and businesses alike. These rates determine the cost of insurance policies for vehicle owners and play a significant role in their financial planning. In this comprehensive article, we will delve into the world of insurance auto rates, exploring the factors that influence them, the methods used to calculate premiums, and the strategies individuals can employ to secure the best rates available.

Understanding Insurance Auto Rates

Insurance auto rates, often referred to as car insurance premiums, are the financial obligations vehicle owners incur to maintain their insurance coverage. These rates are tailored to each individual or business based on a multitude of factors, ensuring a personalized approach to risk assessment and pricing.

The insurance industry employs a sophisticated process to determine auto rates, considering various elements such as the driver's age, gender, driving history, vehicle type, and geographical location. Additionally, external factors like market conditions, economic trends, and regulatory changes can also impact insurance rates.

Understanding insurance auto rates is essential for vehicle owners as it empowers them to make informed decisions about their insurance coverage. By comprehending the factors that influence rates, individuals can take proactive steps to secure the most advantageous policies for their specific circumstances.

Key Factors Affecting Insurance Auto Rates

Several critical factors influence insurance auto rates, each playing a unique role in the risk assessment process. Here are some of the primary considerations:

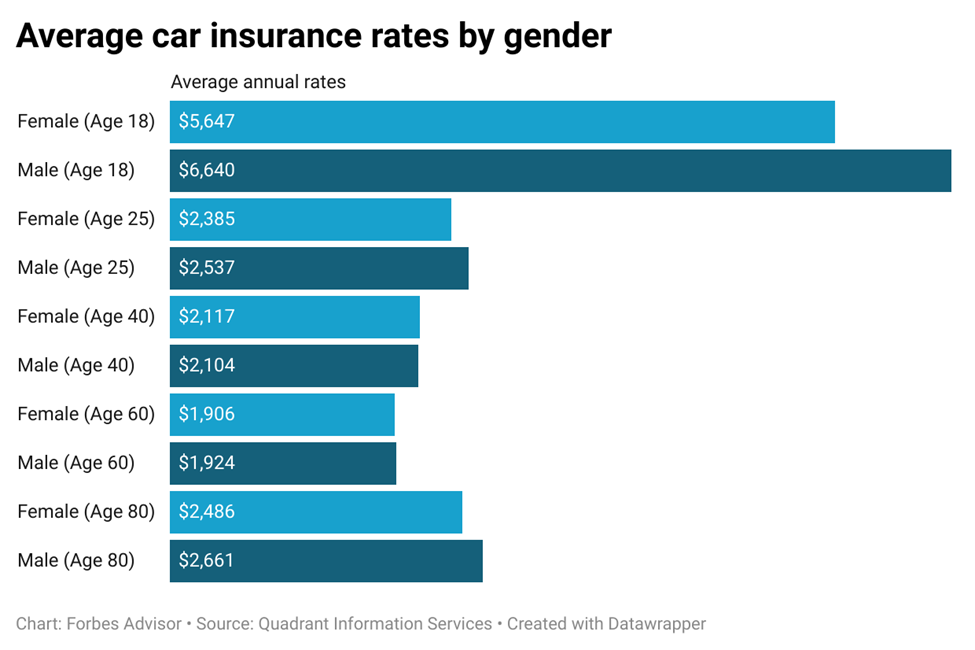

- Driver Profile: Individual characteristics such as age, gender, and driving record significantly impact insurance rates. Younger drivers, for instance, often face higher premiums due to their perceived risk level, while experienced drivers with clean records may enjoy more favorable rates.

- Vehicle Type: The make, model, and year of a vehicle can affect insurance rates. Certain vehicles may be more prone to accidents or theft, leading to higher premiums. Additionally, the vehicle's safety features and overall value can also influence the insurance cost.

- Location: Geographical factors play a pivotal role in determining insurance rates. Areas with higher accident rates, theft occurrences, or dense populations may result in elevated premiums. Conversely, safer regions may offer more competitive rates.

- Usage and Mileage: The purpose for which a vehicle is used and the annual mileage it accumulates can impact insurance rates. Commercial vehicles or those used for business purposes may face higher premiums compared to personal vehicles.

- Coverage Options: The level of coverage chosen by the policyholder also affects the insurance rate. Comprehensive and collision coverage, for example, provide more extensive protection but typically come with higher premiums.

Calculating Insurance Auto Rates

Insurance companies employ complex algorithms and actuarial science to calculate insurance auto rates. These calculations consider the aforementioned factors, historical data, and statistical models to assess the risk associated with each policyholder.

Actuaries, professionals skilled in analyzing risk, play a crucial role in determining insurance rates. They utilize sophisticated tools and methodologies to predict the likelihood of accidents, claims, and other potential risks. By analyzing vast datasets, actuaries can identify patterns and trends that help insurance companies set accurate rates.

Insurance companies also consider external factors such as economic conditions, market trends, and regulatory changes when setting rates. These factors can influence the overall cost of insurance, as they impact the insurance company's profitability and ability to manage risks effectively.

The Impact of Claims History

A driver’s claims history is a critical factor in determining insurance auto rates. Insurance companies carefully analyze past claims to assess the risk associated with a policyholder. A history of frequent claims or severe accidents can result in higher premiums, as it indicates a higher likelihood of future claims.

Conversely, a clean claims history can lead to more favorable insurance rates. Insurance companies often reward policyholders who have maintained a safe driving record and avoided accidents or claims. These individuals may be eligible for discounts or more affordable premiums as a result.

Discounts and Savings Opportunities

Insurance companies offer various discounts and savings opportunities to policyholders. These incentives are designed to encourage safe driving practices and reduce the overall risk associated with certain policyholders.

- Multi-Policy Discounts: Insuring multiple vehicles or combining auto insurance with other policies, such as homeowners' insurance, can result in significant discounts. Insurance companies often provide incentives for bundling policies, recognizing the reduced risk associated with responsible policyholders.

- Safe Driver Discounts: Individuals with a clean driving record and a history of safe driving may be eligible for safe driver discounts. These discounts reward policyholders for their responsible behavior and can lead to substantial savings on insurance premiums.

- Pay-As-You-Drive Programs: Some insurance companies offer pay-as-you-drive programs that allow policyholders to pay premiums based on their actual driving behavior. These programs use telematics devices to track driving habits, rewarding safe drivers with lower premiums.

- Loyalty Discounts: Insurance companies often provide loyalty discounts to policyholders who have maintained their insurance coverage with the same provider for an extended period. Loyalty discounts recognize the reduced risk associated with long-term policyholders and can result in lower premiums.

Strategies for Securing the Best Insurance Auto Rates

Securing the best insurance auto rates requires a combination of careful planning, research, and proactive measures. Here are some strategies individuals can employ to obtain the most favorable insurance rates:

Shop Around and Compare Quotes

One of the most effective ways to find the best insurance auto rates is to shop around and compare quotes from multiple insurance providers. Each insurance company uses its own rating system and considers different factors when calculating premiums. By obtaining quotes from various providers, individuals can identify the most competitive rates for their specific circumstances.

Online insurance comparison platforms can be valuable tools for this process. These platforms allow users to input their details and receive quotes from multiple insurers in a matter of minutes. This streamlined approach saves time and effort, making it easier to compare rates and identify the most affordable options.

Improve Your Driving Record

A clean driving record is one of the most influential factors in determining insurance auto rates. Individuals with a history of accidents, traffic violations, or DUI convictions may face significantly higher premiums. Conversely, maintaining a safe driving record can lead to more favorable rates.

To improve your driving record, focus on defensive driving practices, obey traffic laws, and avoid risky behaviors such as speeding or distracted driving. By demonstrating a commitment to safe driving, you can enhance your chances of securing lower insurance rates.

Choose the Right Coverage

When selecting insurance coverage, it’s essential to choose the right level of protection for your specific needs. While comprehensive coverage provides extensive protection, it also comes with higher premiums. On the other hand, basic coverage may offer more affordable rates but provide limited protection.

Evaluate your individual circumstances and assess the level of risk you're comfortable with. Consider factors such as the value of your vehicle, your financial situation, and the potential costs associated with accidents or claims. By choosing the appropriate coverage, you can strike a balance between affordability and adequate protection.

Utilize Discounts and Savings Opportunities

Insurance companies offer a wide range of discounts and savings opportunities to policyholders. By taking advantage of these incentives, individuals can significantly reduce their insurance premiums.

- Multi-Policy Discounts: As mentioned earlier, insuring multiple vehicles or combining policies can lead to substantial discounts. Explore the possibility of bundling your auto insurance with other policies, such as homeowners' insurance or life insurance, to maximize your savings.

- Safe Driver Discounts: If you have a clean driving record, inquire about safe driver discounts with your insurance provider. These discounts can result in significant savings and are often available to policyholders who have maintained a safe driving history.

- Pay-As-You-Drive Programs: Consider enrolling in pay-as-you-drive programs, which use telematics devices to track your driving behavior. These programs reward safe driving habits with lower premiums, providing an incentive to maintain a responsible driving record.

- Loyalty Discounts: If you've been a loyal customer with your insurance provider for an extended period, inquire about loyalty discounts. Insurance companies often reward long-term policyholders with reduced premiums, recognizing their reduced risk profile.

Explore Group or Association Discounts

Many insurance companies offer discounts to individuals who are members of specific groups or associations. These discounts are typically available to members of professional organizations, alumni associations, or even certain employee groups. By joining these groups or exploring your eligibility for such discounts, you may be able to access more favorable insurance rates.

Check with your insurance provider to inquire about any group or association discounts they offer. Additionally, research online or consult with your group's membership services to identify potential insurance partnerships or discounts that may be available to you.

Future Trends and Implications

The insurance industry is constantly evolving, and several trends are expected to shape the future of insurance auto rates. These trends have the potential to impact both insurance providers and policyholders alike.

The Rise of Telematics and Usage-Based Insurance

Telematics technology, which involves the use of devices to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, utilize telematics to monitor factors such as mileage, driving habits, and even location. These programs provide insurance companies with more accurate data on individual driving behavior, allowing for more precise risk assessment and pricing.

The rise of telematics and usage-based insurance is expected to revolutionize the way insurance rates are calculated. Insurance providers can offer more personalized rates based on an individual's actual driving behavior, rather than relying solely on historical data or assumptions. This shift towards more accurate pricing can benefit both safe drivers, who may see reduced premiums, and insurance companies, who can better manage their risks.

Increased Focus on Data Analytics

The insurance industry is embracing the power of data analytics to improve risk assessment and pricing accuracy. Advanced data analytics techniques, such as machine learning and artificial intelligence, enable insurance companies to analyze vast amounts of data and identify patterns and trends that were previously difficult to detect.

By leveraging data analytics, insurance providers can make more informed decisions when setting insurance auto rates. They can identify high-risk drivers or regions more accurately, leading to more precise pricing. Additionally, data analytics can help insurance companies develop targeted marketing strategies and offer personalized insurance products to meet the unique needs of different customer segments.

Impact of Autonomous Vehicles

The advent of autonomous vehicles (AVs) is expected to have a significant impact on the insurance industry. As self-driving technology becomes more prevalent, the nature of accidents and liability will evolve, potentially reducing the number of accidents caused by human error. This shift could lead to a reduction in insurance claims and, consequently, lower insurance rates.

However, the introduction of AVs also presents new challenges and considerations for the insurance industry. Issues such as determining liability in AV-related accidents, establishing regulations for AV insurance coverage, and understanding the unique risks associated with this technology will need to be addressed. Insurance providers will need to adapt their underwriting and pricing strategies to accommodate the changing landscape brought about by autonomous vehicles.

Embracing Sustainability and Green Initiatives

Sustainability and environmental consciousness are becoming increasingly important considerations for consumers and businesses alike. The insurance industry is recognizing this trend and exploring ways to incorporate sustainability into its operations and product offerings.

Insurance companies may offer incentives or discounts to policyholders who drive electric or hybrid vehicles, as these vehicles are generally considered more environmentally friendly and have lower accident rates. Additionally, insurance providers may develop specialized insurance products for sustainable transportation options, such as bike-sharing or ride-sharing services, to meet the growing demand for alternative transportation methods.

Conclusion

Insurance auto rates are a complex and dynamic aspect of the automotive industry, influenced by a multitude of factors. Understanding these rates and the factors that impact them empowers individuals to make informed decisions about their insurance coverage. By shopping around, improving driving records, choosing the right coverage, and utilizing available discounts, vehicle owners can secure the best insurance auto rates for their specific circumstances.

As the insurance industry continues to evolve, trends such as the rise of telematics, increased focus on data analytics, the impact of autonomous vehicles, and the embrace of sustainability will shape the future of insurance auto rates. By staying informed about these developments, individuals can adapt their insurance strategies and continue to secure the most advantageous rates available.

How often should I review my insurance auto rates?

+It’s advisable to review your insurance auto rates annually or whenever significant life changes occur. Life events such as getting married, purchasing a new vehicle, or moving to a different location can impact your insurance rates. Regularly reviewing your rates allows you to stay informed about any changes and take advantage of potential savings opportunities.

Can I negotiate my insurance auto rates with my provider?

+While insurance rates are largely determined by complex algorithms and actuarial science, it’s worth discussing your options with your insurance provider. Some providers may offer flexibility in pricing or provide customized quotes based on your specific circumstances. Negotiating or seeking alternative quotes can help you secure the most favorable rates.

What should I do if I receive a quote with a significantly higher premium than expected?

+If you receive a quote with a significantly higher premium than you anticipated, it’s essential to review your policy and the factors that may have influenced the rate. Check for any changes in your driving record, vehicle usage, or other relevant factors. If you believe the rate is inaccurate, contact your insurance provider to discuss your concerns and explore potential solutions.

Are there any alternative insurance providers I should consider?

+When seeking the best insurance auto rates, it’s beneficial to explore multiple insurance providers. Online comparison platforms can be valuable tools for comparing quotes from various insurers. Additionally, consider reaching out to local insurance brokers who can provide personalized advice and assist you in finding the most suitable insurance provider for your needs.