Insurance Bcbs

In the ever-evolving landscape of healthcare, understanding the intricacies of insurance coverage is crucial. This comprehensive article aims to shed light on the Blue Cross Blue Shield (BCBS) insurance plans, offering an in-depth analysis of their features, benefits, and impact on healthcare accessibility.

Unraveling the Blue Cross Blue Shield Network

The BCBS network is a collaboration of independent insurance companies, united under a national brand. This unique structure has fostered a wide-reaching presence, with BCBS plans available in every state and Washington, D.C. As of 2023, the BCBS network encompasses a staggering 155 million members, making it one of the largest healthcare insurance providers in the United States.

The origins of BCBS can be traced back to the early 20th century, with the establishment of the first Blue Cross plan in 1929. Since then, the network has grown exponentially, merging with and acquiring various other insurance providers to create a robust and diverse healthcare ecosystem.

The Benefits of Blue Cross Blue Shield Plans

One of the standout features of BCBS plans is their extensive network of healthcare providers. With over 96% of hospitals and 93% of physicians contracted with BCBS, members enjoy a vast selection of in-network options, ensuring convenient and cost-effective access to healthcare services.

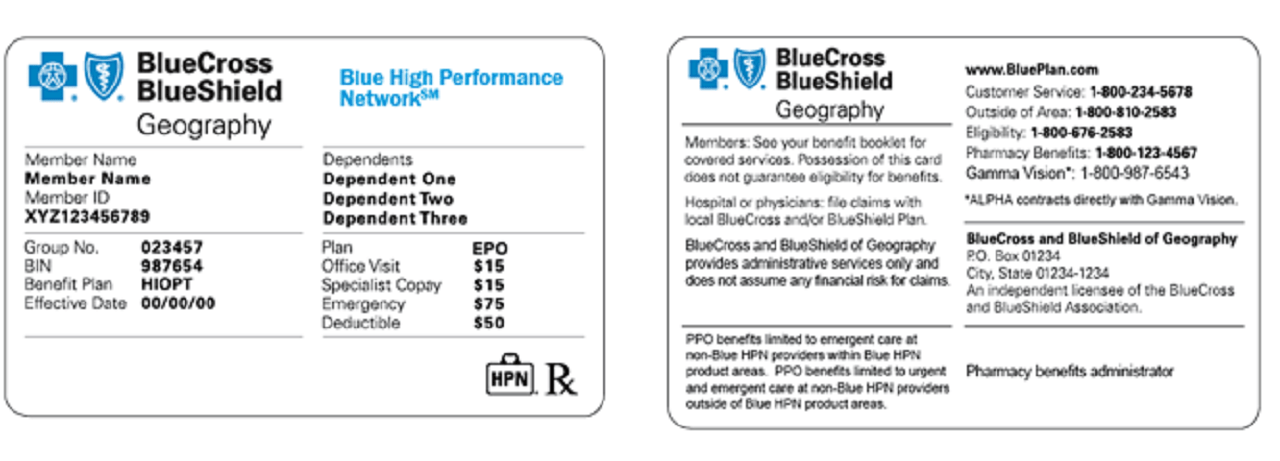

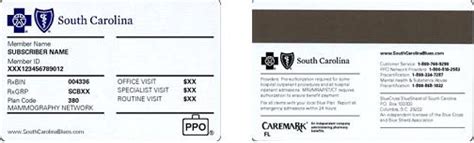

Furthermore, BCBS offers a wide range of plan types to cater to diverse needs. Whether it's HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), or EPO (Exclusive Provider Organization) plans, individuals and families can find a coverage option that aligns with their preferences and budget.

For those seeking additional peace of mind, BCBS plans often include valuable perks such as:

- Travel coverage: Many plans provide coverage for emergency medical services while traveling domestically or internationally.

- Wellness programs: BCBS often partners with wellness platforms to offer members access to personalized health and fitness resources.

- Preventive care: Routine check-ups, screenings, and vaccinations are typically covered at 100%, encouraging proactive healthcare.

- Telehealth services: With the rise of virtual healthcare, BCBS plans often include telemedicine options for convenient and remote consultations.

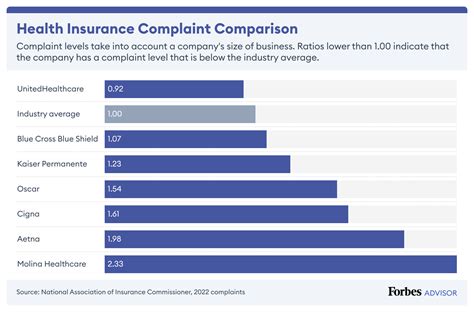

Performance and Member Satisfaction

The performance of BCBS plans is a testament to their reliability and member satisfaction. According to a 2022 survey by J.D. Power, BCBS achieved an impressive score of 823 out of 1,000 in the Individual Commercial Health Insurance segment, surpassing the industry average of 815.

The survey highlighted key areas where BCBS excelled, including:

- Enrollability: BCBS plans were praised for their ease of enrollment and straightforward application processes.

- Customer service: Members reported positive experiences with BCBS representatives, citing their helpfulness and responsiveness.

- Provider network: The extensive provider network was a significant advantage, ensuring members could access their preferred healthcare professionals.

Analyzing Plan Options: A Deep Dive

The BCBS network offers a diverse range of plan types, each with its own set of features and benefits. Let’s explore some of the most popular options:

HMO Plans: Focus on Coordination

HMO plans are known for their emphasis on coordination of care. Members typically select a primary care physician (PCP) who acts as a gatekeeper, referring them to specialists within the network when needed. This structure ensures a comprehensive and integrated approach to healthcare.

One of the key advantages of HMO plans is their affordability. With a lower premium, these plans are ideal for those seeking cost-effective coverage. However, it's important to note that HMO plans may have more limited provider choices and may require prior authorization for certain services.

PPO Plans: Flexibility and Choice

PPO plans offer members greater flexibility and choice in their healthcare decisions. Unlike HMO plans, PPO members can visit any healthcare provider, whether in-network or out-of-network. While out-of-network visits may incur higher costs, the freedom to choose one’s healthcare team is a significant advantage.

Additionally, PPO plans often include valuable features such as:

- Direct access to specialists: Members can schedule appointments with specialists without a referral, saving time and effort.

- Lower out-of-pocket costs: With a higher premium, PPO plans typically have lower deductibles and copays, making them a popular choice for those seeking financial predictability.

EPO Plans: A Middle Ground

EPO plans strike a balance between the coordination of HMO plans and the flexibility of PPO plans. Members have direct access to specialists within the network, eliminating the need for referrals. However, like HMO plans, EPO plans may have a more limited provider network compared to PPO plans.

The key advantage of EPO plans lies in their cost-effectiveness. With a moderate premium, these plans offer a balance between affordability and flexibility, making them an attractive option for those seeking a middle ground in their healthcare coverage.

Impact on Healthcare Accessibility

The presence of BCBS plans has had a profound impact on healthcare accessibility across the United States. With their extensive network and diverse plan options, BCBS has played a pivotal role in ensuring that individuals and families have access to quality healthcare services.

One of the notable contributions of BCBS is its focus on community engagement. Through partnerships with local healthcare providers and organizations, BCBS has helped bridge gaps in healthcare access, particularly in underserved areas. This commitment to community-based care has resulted in improved health outcomes and a more equitable healthcare system.

Moreover, BCBS has been at the forefront of innovative healthcare solutions. From embracing telemedicine to developing value-based care models, the network has adapted to the evolving needs of its members. This commitment to innovation ensures that BCBS remains a trusted partner in the ever-changing healthcare landscape.

Future Outlook and Potential Innovations

As the healthcare industry continues to evolve, BCBS is poised to play a pivotal role in shaping the future of insurance coverage. With a focus on member-centric approaches and technological advancements, the network is well-positioned to meet the evolving needs of its members.

One area where BCBS is expected to make significant strides is in personalized healthcare. By leveraging data analytics and artificial intelligence, BCBS plans could offer members tailored care plans and predictive health insights. This shift towards personalized medicine has the potential to revolutionize healthcare, improving outcomes and enhancing member satisfaction.

Additionally, the network's commitment to value-based care models is likely to gain momentum. By incentivizing healthcare providers to deliver high-quality, cost-effective care, BCBS can drive down healthcare costs and improve overall health outcomes. This shift towards value-based care has the potential to transform the industry, making healthcare more accessible and affordable for all.

In conclusion, the Blue Cross Blue Shield network stands as a cornerstone of the healthcare insurance landscape. With its extensive reach, diverse plan options, and commitment to member satisfaction, BCBS has established itself as a trusted partner in the pursuit of quality healthcare. As the industry evolves, the network's innovative spirit and focus on accessibility will undoubtedly continue to shape the future of healthcare insurance.

How do I choose the right BCBS plan for my needs?

+Selecting the right BCBS plan depends on your unique circumstances. Consider factors such as your healthcare needs, budget, and preferred level of flexibility. HMO plans are cost-effective but offer more limited provider choices, while PPO plans provide greater flexibility but may have higher costs. EPO plans strike a balance between the two. Assess your priorities and consult with a BCBS representative to find the best fit.

What is the BCBS member portal, and how can I use it?

+The BCBS member portal is an online platform that provides members with convenient access to their healthcare information. Through the portal, you can view your coverage details, review claims and explanations of benefits, find in-network providers, and manage your personal health records. It’s a valuable tool for staying informed and in control of your healthcare journey.

Are there any discounts or programs available for BCBS members?

+Absolutely! BCBS offers a range of discounts and programs to enhance the member experience. These can include wellness incentives, such as discounts on gym memberships or healthy lifestyle programs. Additionally, BCBS may partner with retailers and service providers to offer exclusive discounts to members. It’s always worth exploring the benefits and programs available to maximize the value of your BCBS plan.