Insurance Car Cheap

In today's world, having car insurance is not just a necessity but also a legal requirement in most countries. However, the cost of car insurance can often be a significant expense for vehicle owners, and finding cheap insurance rates can be a challenge. In this comprehensive guide, we will delve into the factors that influence car insurance rates, explore strategies to secure affordable coverage, and provide valuable insights to help you make informed decisions when it comes to protecting your vehicle.

Understanding Car Insurance Premiums

Car insurance premiums, or the cost of your insurance policy, are determined by a complex interplay of various factors. Insurance companies assess a multitude of variables to calculate the risk associated with insuring a particular vehicle and driver. Understanding these factors is crucial in order to identify ways to reduce your insurance costs.

Factors Influencing Car Insurance Rates

Here are some key factors that insurance providers consider when determining your car insurance premium:

- Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role. Insurers consider factors such as the vehicle’s safety features, repair costs, and theft rates. Additionally, how you use your car matters. Commuting long distances or using your vehicle for business purposes can increase your premium.

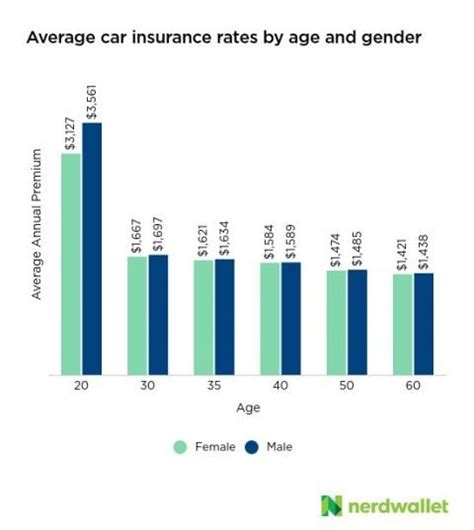

- Driver’s Profile: Your age, gender, and driving history are key considerations. Younger drivers and those with a history of accidents or traffic violations are often charged higher premiums. Insurance companies also assess your credit score, as it is seen as an indicator of responsibility.

- Location and Coverage: Where you live and drive your vehicle matters. Urban areas with higher population densities and crime rates typically have higher insurance costs. The level of coverage you choose, such as liability-only or comprehensive coverage, also affects your premium.

- Claim History: A history of insurance claims can impact your rates. While a single claim may not significantly affect your premium, multiple claims within a short period can lead to higher rates or even non-renewal of your policy.

- Discounts and Bundling: Insurance companies offer various discounts to attract customers. These can include safe driver discounts, loyalty discounts, and multi-policy discounts when you bundle your car insurance with other types of insurance, such as home or life insurance.

By understanding these factors, you can begin to identify areas where you may be able to negotiate or take advantage of discounts to reduce your insurance costs.

Strategies for Finding Cheap Car Insurance

Securing cheap car insurance requires a combination of research, understanding, and negotiation. Here are some effective strategies to help you find the best deals:

Shop Around and Compare Quotes

The insurance market is highly competitive, and rates can vary significantly between providers. Take the time to obtain quotes from multiple insurance companies. Online quote comparison tools can be a convenient way to quickly gather quotes from various insurers. When comparing quotes, ensure you are comparing policies with similar coverage levels to make an accurate assessment.

Understand Your Coverage Needs

Not all drivers require the same level of coverage. Evaluate your specific needs and choose a policy that provides adequate protection without unnecessary extras. For example, if you own an older vehicle, you may not need collision or comprehensive coverage, as the cost of repairs may exceed the vehicle’s value. By tailoring your coverage to your needs, you can reduce your premium.

Improve Your Driving Record

A clean driving record is a powerful tool when it comes to negotiating lower insurance rates. Avoid traffic violations and accidents, as these can stay on your record for several years and affect your premiums. If you have a clean driving record, be sure to highlight this when obtaining quotes and negotiating with insurance providers.

Consider Higher Deductibles

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can significantly reduce your premium. However, this strategy requires careful consideration, as a higher deductible means you will have to pay more in the event of a claim. Assess your financial situation and comfort level with this trade-off before making a decision.

Explore Discounts and Loyalty Programs

Insurance companies offer a variety of discounts to attract and retain customers. These can include discounts for safe driving, defensive driving courses, good student status, and even certain professional affiliations. Additionally, many insurers provide loyalty discounts for long-term customers. By taking advantage of these discounts, you can reduce your insurance costs over time.

Bundle Your Policies

Bundling your insurance policies, such as combining your car insurance with your home or renters insurance, can result in substantial savings. Insurance companies often offer multi-policy discounts as an incentive to keep all your insurance needs with them. This strategy not only saves you money but also simplifies your insurance management.

Utilize Telematics Devices

Some insurance companies offer telematics devices or smartphone apps that monitor your driving behavior. These devices track factors such as hard braking, acceleration, and mileage. By demonstrating safe driving habits, you may be eligible for discounts on your insurance premium. However, it’s important to understand the privacy implications of these devices and ensure you are comfortable with the data collection before opting in.

Maintain a Good Credit Score

Your credit score is an important factor in determining your insurance premium. Insurance companies view credit scores as an indicator of financial responsibility. Maintaining a good credit score can help you negotiate lower rates and improve your overall financial health.

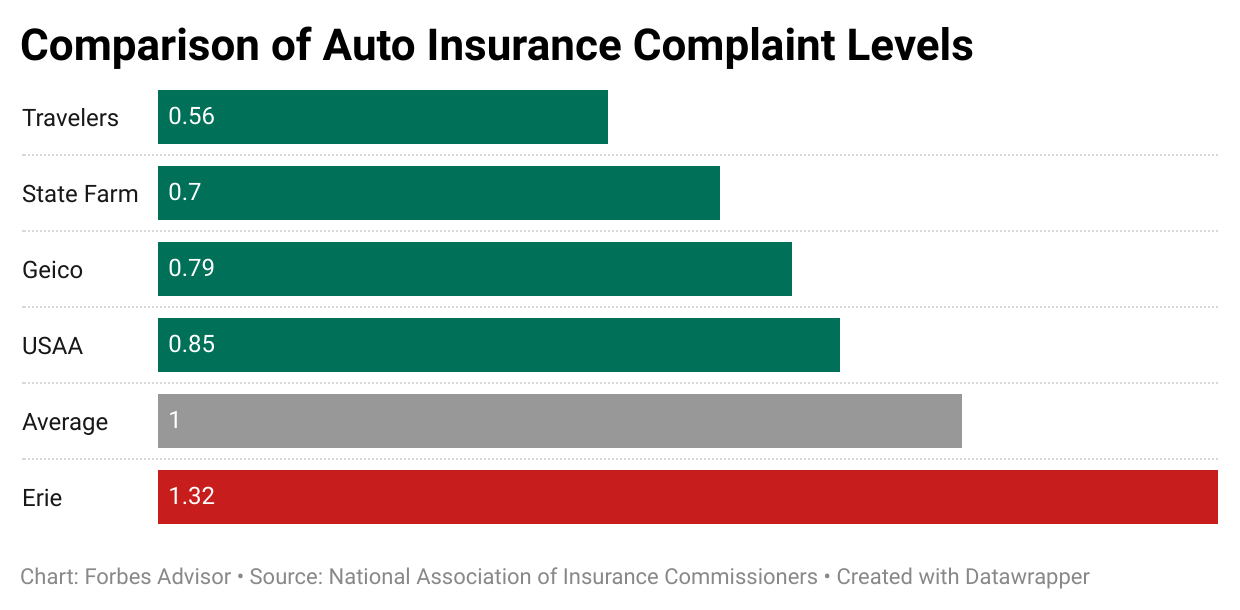

Research Insurance Provider Reputation

When choosing an insurance provider, it’s essential to research their reputation and customer service record. Look for providers with a history of prompt claim settlements and positive customer experiences. A reliable insurance company can provide peace of mind and potentially better rates in the long run.

Performance Analysis: Real-World Savings

To illustrate the potential savings you can achieve by implementing these strategies, let’s consider a real-world example. Meet Sarah, a 28-year-old professional living in an urban area. Sarah has a clean driving record and is looking to reduce her car insurance costs.

By shopping around and comparing quotes, Sarah was able to find an insurance provider that offered a significantly lower premium for similar coverage. Additionally, she negotiated a higher deductible, which further reduced her premium. By taking advantage of a multi-policy discount and maintaining her good driving record, Sarah was able to save over 20% on her annual insurance costs.

| Initial Premium | New Premium | Savings |

|---|---|---|

| $1,200 annually | $960 annually | $240 annually (20% savings) |

Future Implications and Industry Trends

The car insurance industry is continuously evolving, and new technologies and trends are shaping the future of insurance. Here are some key developments to watch:

Telematics and Usage-Based Insurance

Telematics technology is gaining traction, allowing insurance companies to offer usage-based insurance policies. These policies provide real-time data on driving behavior, rewarding safe drivers with lower premiums. As this technology advances, we can expect more personalized and affordable insurance options.

AI and Data Analytics

Artificial Intelligence (AI) and advanced data analytics are being utilized by insurance companies to improve risk assessment and pricing accuracy. By analyzing vast amounts of data, insurers can more accurately predict and manage risks, potentially leading to more competitive pricing for consumers.

Autonomous Vehicles and Liability

The rise of autonomous vehicles presents a unique challenge for the insurance industry. As self-driving cars become more prevalent, questions arise regarding liability in the event of an accident. Insurance providers are actively researching and developing coverage options to address this evolving landscape.

Digital Transformation and Online Platforms

The insurance industry is undergoing a digital transformation, with online platforms and mobile apps becoming increasingly popular for policy management and claims processing. These digital tools enhance convenience and efficiency for customers, allowing for faster and more streamlined interactions with insurance providers.

Climate Change and Natural Disasters

Climate change is impacting the frequency and severity of natural disasters, such as hurricanes, floods, and wildfires. As a result, insurance companies are adapting their policies and rates to account for these changing risks. This may lead to fluctuations in insurance costs, especially in areas prone to natural disasters.

Conclusion: Navigating the Insurance Landscape

Finding cheap car insurance requires a combination of research, understanding, and negotiation. By exploring the factors that influence insurance rates, shopping around for the best deals, and implementing cost-saving strategies, you can secure affordable coverage that meets your needs. Remember, the insurance landscape is dynamic, and staying informed about industry trends and advancements can help you make the most informed decisions when it comes to protecting your vehicle.

How often should I review my car insurance policy?

+It is recommended to review your car insurance policy annually, or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and allows you to take advantage of any new discounts or promotions.

Can I negotiate my car insurance premium with my current provider?

+Yes, negotiation is an important aspect of securing the best insurance rates. By discussing your driving record, safety measures, and any other relevant factors, you may be able to negotiate a lower premium with your current provider.

Are there any government programs or initiatives to help reduce car insurance costs?

+Some governments offer programs or incentives to reduce car insurance costs, especially for certain demographics or in specific regions. It’s worth researching any available programs in your area to see if you are eligible for additional savings.