Insurance Car Florida

In the sunny state of Florida, navigating the world of car insurance can be a complex journey. Florida is known for its unique insurance regulations and a high number of uninsured drivers, making it crucial for residents and visitors alike to understand the ins and outs of car insurance coverage. This comprehensive guide aims to shed light on the essential aspects of insurance car Florida, offering expert insights and practical advice to ensure you're adequately protected on the roads.

Understanding Florida’s Car Insurance Requirements

Florida stands out among states with its specific car insurance regulations. While many states require drivers to carry liability insurance, Florida has a unique no-fault system. This means that regardless of who caused an accident, each driver’s own insurance policy typically covers their medical expenses and a portion of lost wages, up to the policy limits.

The minimum required coverage in Florida is known as Personal Injury Protection (PIP) and Property Damage Liability (PDL). PIP covers 80% of medical bills and 60% of lost wages, up to $10,000. PDL, on the other hand, covers property damage caused by the policyholder up to $10,000. It's important to note that while these are the minimum requirements, many drivers opt for higher coverage limits to ensure they're fully protected in the event of an accident.

Additionally, Florida law requires drivers to carry bodily injury liability coverage, which pays for the injuries or death of others in an accident caused by the policyholder. The minimum required limits are $10,000 for one person injured and $20,000 for multiple people injured in an accident. However, experts often recommend carrying higher limits to provide more comprehensive protection.

Uninsured Motorist Coverage: A Must-Have in Florida

Florida’s high rate of uninsured drivers underscores the importance of uninsured motorist coverage. This coverage protects policyholders from financial losses if they’re involved in an accident with an uninsured or underinsured driver. It’s highly recommended, especially given the state’s unique no-fault system.

Uninsured motorist coverage typically includes two components: bodily injury and property damage. The former covers medical expenses and lost wages if the policyholder is injured by an uninsured driver, while the latter covers the cost of repairing or replacing the policyholder's vehicle if it's damaged by an uninsured driver.

| Coverage Type | Minimum Requirement |

|---|---|

| Personal Injury Protection (PIP) | $10,000 |

| Property Damage Liability (PDL) | $10,000 |

| Bodily Injury Liability | $10,000 (per person), $20,000 (per accident) |

| Uninsured Motorist Coverage | Recommended, no specific minimum |

Navigating Car Insurance Costs in Florida

Car insurance rates in Florida can vary significantly depending on several factors, including the driver’s age, gender, driving history, and the type of vehicle insured. The state’s unique no-fault system and high uninsured driver rate also contribute to the overall cost of insurance.

Factors Influencing Car Insurance Rates

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance premiums due to their perceived higher risk of accidents. Gender can also play a role, with some insurers charging slightly higher rates for male drivers.

- Driving History: A clean driving record can lead to significant savings on insurance premiums. On the other hand, violations such as speeding tickets or accidents can increase rates. Florida’s points system can also impact insurance costs, as insurers may surcharge policies for points accumulated on a driver’s license.

- Vehicle Type: The make, model, and year of your vehicle can affect insurance costs. Sports cars and luxury vehicles often come with higher premiums due to their higher repair costs and potential for theft. Conversely, sedans and economy cars may be more affordable to insure.

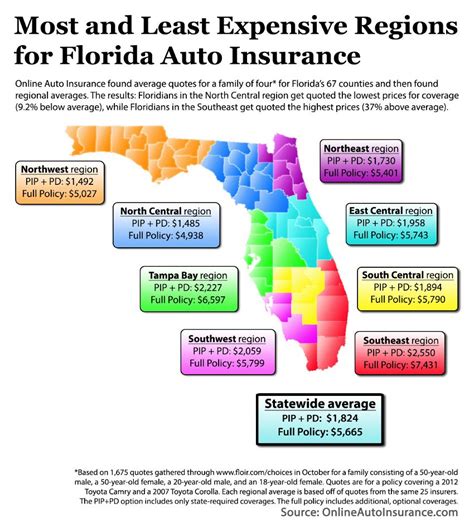

- Location: Where you live and where you typically drive can impact your insurance rates. Urban areas with higher population density and more traffic tend to have higher insurance rates due to increased accident risk. Similarly, areas with high rates of theft or vandalism may also see higher premiums.

Tips for Reducing Car Insurance Costs

While insurance rates can vary significantly, there are strategies to help reduce your car insurance costs in Florida:

- Shop Around: Obtain quotes from multiple insurers to compare rates and coverage options. Different insurers may offer different rates for similar coverage, so shopping around can help you find the best deal.

- Increase Deductibles: Choosing a higher deductible can lower your insurance premiums. However, it's important to ensure you can afford the deductible in the event of a claim.

- Maintain a Clean Driving Record: A clean driving record can lead to significant savings on insurance premiums. Avoid speeding tickets and other violations, and be cautious to avoid accidents.

- Bundle Policies: Insurers often offer discounts when you bundle multiple policies, such as car insurance with homeowners or renters insurance.

- Take Advantage of Discounts: Many insurers offer discounts for various reasons, such as good student discounts, safe driver discounts, and discounts for completing defensive driving courses.

The Role of Technology in Florida’s Car Insurance

Technology is playing an increasingly significant role in Florida’s car insurance landscape. From usage-based insurance programs to telematics and digital claims processing, insurers are leveraging technology to offer more personalized and efficient services.

Usage-Based Insurance (UBI) Programs

Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, use telematics devices to track a driver’s behavior and offer insurance premiums based on their actual driving habits. These programs can be beneficial for safe drivers, as they offer the potential for significant savings. Insurers in Florida offer UBI programs that track driving habits such as miles driven, time of day, and driving behavior (e.g., harsh braking or acceleration).

By participating in a UBI program, drivers can potentially lower their insurance premiums by demonstrating safe driving habits. These programs provide real-time feedback on driving behavior, helping drivers improve their habits and, in turn, their insurance rates.

Telematics and Digital Claims Processing

Telematics technology is also being used to streamline the claims process in Florida. Insurers are utilizing telematics data to quickly and accurately assess accident severity and vehicle damage. This technology can help speed up the claims process, reducing the time it takes for policyholders to receive compensation for their losses.

Additionally, many insurers are offering digital claims processing, allowing policyholders to report claims online or through mobile apps. This digital approach simplifies the claims process, making it more efficient and convenient for policyholders.

The Future of Car Insurance in Florida

As technology continues to advance, the future of car insurance in Florida is likely to be shaped by innovations in telematics, artificial intelligence, and autonomous vehicles. These advancements have the potential to revolutionize the way insurance is priced and delivered, offering more personalized and efficient coverage.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles (AVs) is expected to have a significant impact on car insurance. As AV technology becomes more prevalent, insurers will need to adapt their policies and pricing models to account for the reduced risk of human error. This could lead to lower insurance premiums for AV owners, as the risk of accidents caused by human error is significantly reduced.

However, the introduction of AVs also raises new challenges and considerations for insurers. For instance, who is liable in the event of an accident involving an AV? The manufacturer, the software developer, or the owner? These questions will need to be addressed as AV technology becomes more widespread.

The Role of Artificial Intelligence

Artificial intelligence (AI) is already being used in the insurance industry to improve pricing accuracy and efficiency. AI algorithms can analyze vast amounts of data, including driving behavior, traffic patterns, and weather conditions, to more accurately assess risk and price insurance policies.

In the future, AI is expected to play an even larger role in insurance, potentially automating much of the claims process. This could lead to faster claim settlements and reduced administrative costs for insurers, which could ultimately benefit policyholders through lower premiums.

The Need for Regulatory Adaptation

As the car insurance landscape evolves with technological advancements, regulatory frameworks will need to adapt to keep pace. Florida’s unique no-fault system, for example, may need to be reevaluated as AV technology reduces the risk of human error. Additionally, regulations surrounding data privacy and usage will need to be addressed to ensure consumer protection as insurers collect and analyze more data.

What is the average cost of car insurance in Florida?

+The average cost of car insurance in Florida varies depending on several factors, including the driver’s age, gender, driving history, and the type of vehicle insured. According to recent data, the average annual premium for a minimum liability policy in Florida is around 1,600, while a full coverage policy can cost upwards of 2,500.

How can I save money on car insurance in Florida?

+There are several ways to save money on car insurance in Florida. Shop around and compare quotes from multiple insurers, as rates can vary significantly. Consider increasing your deductibles, maintaining a clean driving record, bundling policies, and taking advantage of any available discounts.

What happens if I’m involved in an accident with an uninsured driver in Florida?

+If you’re involved in an accident with an uninsured driver in Florida, your uninsured motorist coverage (if you have it) will typically cover your medical expenses and lost wages. It’s important to have this coverage, as Florida has a high rate of uninsured drivers.