Insurance Claim Process

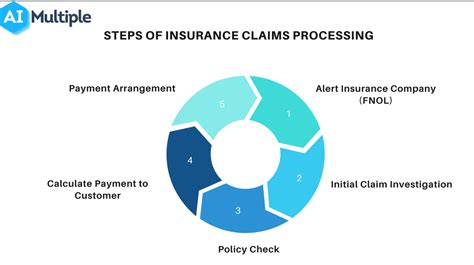

In the complex world of insurance, understanding the intricacies of the claim process is essential for both policyholders and insurance professionals. This in-depth exploration aims to demystify the insurance claim journey, shedding light on each critical step and the challenges and opportunities it presents.

Navigating the Insurance Claim Landscape

The insurance claim process is a crucial yet often misunderstood aspect of the insurance industry. It involves a series of meticulous steps, each with its own challenges and best practices. Whether it’s a car accident, a home disaster, or a health emergency, the claim process can be a make-or-break experience for policyholders, influencing their satisfaction and loyalty.

For insurance companies, it's a delicate balance between prompt, fair resolution and effective cost management. This comprehensive guide aims to explore these dynamics, offering insights for a smoother, more efficient claim journey.

Step 1: Reporting the Claim

The claim process begins with the policyholder reporting an incident. This step is often the first point of contact between the insured and the insurance company, setting the tone for the entire claim journey. It’s crucial to ensure that the reporting process is straightforward and accessible.

Online Claim Portals

Many insurance companies now offer online claim portals, allowing policyholders to initiate and track their claims digitally. These portals often provide a convenient, user-friendly interface, enabling policyholders to report claims quickly and efficiently.

| Insurance Company | Online Portal |

|---|---|

| Allstate | Allstate Claims Center |

| State Farm | State Farm Claims |

| Progressive | Progressive Claims |

These portals often feature step-by-step guides, making the claim reporting process less daunting. For instance, Progressive's Claims Center provides a detailed guide on filing a vehicle claim, offering clarity and ease for policyholders.

Telephone Hotlines

While online portals are efficient, not all policyholders are tech-savvy. Telephone hotlines remain a crucial component of the claim reporting process. These hotlines should be well-staffed, with trained professionals ready to guide policyholders through the initial steps of the claim process.

Step 2: Initial Assessment and Verification

Once a claim is reported, the insurance company initiates an assessment process. This step involves verifying the claim’s legitimacy and understanding the extent of the damage or loss.

Documentation and Evidence

Policyholders are often required to provide documentation and evidence to support their claim. This can include photographs, videos, police reports, medical records, or other relevant documents. The more comprehensive the evidence, the smoother the assessment process tends to be.

For instance, in the case of a car accident, photos of the damage, a police report, and witness statements can provide crucial evidence. Similarly, for a health insurance claim, medical records and doctor's notes are essential.

Claim Adjuster’s Role

The claim adjuster plays a pivotal role in this step. They review the submitted evidence, assess the extent of the loss, and determine the next steps. This often involves a thorough understanding of the policy’s terms and conditions to ensure a fair and accurate assessment.

Step 3: Investigation and Validation

The investigation phase is a critical step, often requiring more in-depth analysis. This is where the insurance company delves deeper into the claim, verifying the details and ensuring there’s no fraud or misuse.

Fraud Detection and Prevention

Insurance fraud is a significant concern for insurers. During this step, companies employ various techniques to detect and prevent fraudulent claims. This can include advanced analytics, data mining, and even field investigations.

For instance, Geico utilizes a combination of technology and human expertise to combat fraud, ensuring that legitimate policyholders receive fair and prompt service.

Field Investigations

In some cases, especially for complex or high-value claims, insurance companies may conduct field investigations. This involves sending a representative to the scene of the incident to gather more information, assess the damage, and verify the claim.

Field investigations can provide crucial insights, especially in cases of potential fraud or when the initial evidence is insufficient.

Step 4: Coverage Determination and Settlement

Once the claim has been thoroughly investigated and validated, the insurance company moves to the coverage determination stage. This is where the policy’s terms and conditions come into play, and the insurer decides what is covered and the extent of the settlement.

Policy Review

The insurance company carefully reviews the policy, considering the type of coverage, deductibles, and any specific exclusions or limitations. This step is crucial to ensure a fair and accurate settlement, reflecting the policyholder’s original agreement.

Settlement Negotiations

After determining the coverage, the insurance company engages in settlement negotiations. This can involve discussions with the policyholder, their representative, or a third-party adjuster. The goal is to reach a mutually agreeable settlement, ensuring both parties are satisfied.

In some cases, mediation or arbitration may be required to resolve complex disputes. These processes provide a neutral ground for both parties to find a resolution.

Step 5: Payment and Finalization

Once the settlement is agreed upon, the insurance company moves to the final step: payment. This is the moment of truth for policyholders, as they receive the financial support they need to recover from the incident.

Prompt Payment

Prompt payment is a key aspect of the claim process. Insurance companies aim to make payments as quickly as possible, often within a set timeframe defined by regulatory bodies or their own policies.

For instance, Farmers Insurance strives to resolve claims within 30 days, ensuring policyholders receive their settlements promptly.

Methods of Payment

Insurance companies offer various payment methods, catering to the preferences of policyholders. This can include direct deposit, checks, or even specialized payment solutions like prepaid cards.

For instance, Liberty Mutual offers a range of payment options, including direct deposit and prepaid cards, providing flexibility and convenience for policyholders.

Challenges and Opportunities in the Claim Process

While the insurance claim process is designed to be straightforward, it often faces challenges that can impact its efficiency and fairness.

Common Challenges

- Communication Gaps: Misunderstandings or miscommunications can lead to delays and confusion, especially when dealing with complex policies or technical terms.

- Lack of Transparency: Policyholders often seek clear, transparent information about the claim process. Lack of transparency can lead to frustration and distrust.

- Lengthy Procedures: Some claim processes can be lengthy, especially for complex or high-value claims. This can cause frustration and anxiety for policyholders.

Opportunities for Improvement

- Enhanced Digital Tools: Investing in user-friendly digital platforms can streamline the claim process, making it more accessible and efficient.

- Clear Communication: Providing clear, concise information to policyholders throughout the process can build trust and satisfaction.

- Fraud Prevention Technologies: Advanced analytics and AI can help insurers detect and prevent fraud, ensuring fair treatment for legitimate policyholders.

Conclusion: A Journey to Fair and Efficient Claims

The insurance claim process is a critical aspect of the insurance industry, impacting the satisfaction and loyalty of policyholders. By understanding the steps involved and the challenges faced, insurers can work towards creating a fair, efficient, and satisfying claim journey.

With a focus on clear communication, digital innovation, and fraud prevention, the insurance industry can continue to evolve, offering a smoother, more reliable experience for policyholders.

How long does the typical insurance claim process take?

+

The duration of the claim process can vary widely based on the type of claim, its complexity, and the insurer’s policies. Simple claims can be resolved within days, while more complex ones may take weeks or even months. Regulatory requirements and the insurer’s internal processes also play a significant role in the timeline.

What happens if my claim is denied?

+

If your claim is denied, the insurer will provide a written explanation detailing the reasons for the denial. This could be due to policy exclusions, insufficient evidence, or other factors. You have the right to appeal the decision and provide additional information or evidence to support your claim.

Can I expedite the claim process in an emergency situation?

+

Yes, insurers often have emergency claim procedures for urgent situations. These procedures can fast-track the claim process, ensuring you receive the necessary support as quickly as possible. It’s important to contact your insurer immediately in such situations and provide all relevant details.

What documentation do I need to provide for a claim?

+

The required documentation can vary based on the type of claim. Generally, you’ll need to provide proof of the incident, such as photos or videos, and any relevant reports or statements. For health claims, medical records and doctor’s notes are often required. It’s best to check with your insurer for a comprehensive list of required documents.