Insurance Collision

Collision insurance is a crucial component of vehicle coverage, offering essential protection for drivers. This type of insurance provides financial coverage in the event of an accident, helping policyholders repair or replace their vehicles. It plays a vital role in ensuring peace of mind and mitigating the financial impact of accidents. In this comprehensive article, we will delve into the world of insurance collision, exploring its key aspects, benefits, and real-world implications.

Understanding Insurance Collision

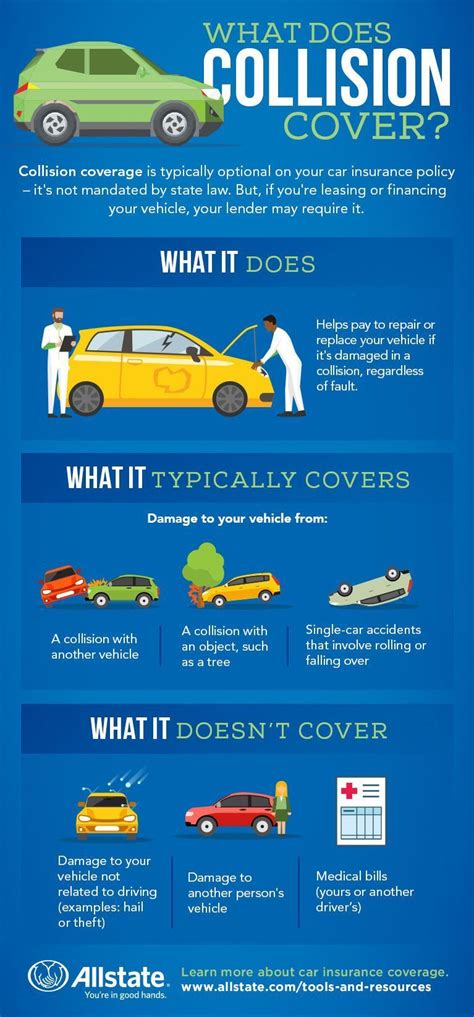

Collision insurance is a specific type of auto insurance coverage that steps in when a policyholder’s vehicle is involved in an accident, regardless of who is at fault. It covers the cost of repairing or replacing the insured vehicle, providing a safety net against potentially significant financial losses. This coverage is particularly valuable for individuals who rely heavily on their vehicles for personal or professional purposes, ensuring they can get back on the road promptly after an incident.

The scope of collision insurance can vary depending on the policy and provider. Typically, it covers damages resulting from collisions with other vehicles, objects, or structures. However, it's essential to note that collision insurance does not cover damages caused by natural disasters, theft, or vandalism, which are often covered by comprehensive insurance.

Real-World Collision Scenarios

Consider the following scenarios to understand the practical applications of collision insurance:

- You’re driving down a busy street when another vehicle suddenly swerves into your lane, causing a collision. In this case, collision insurance would cover the repairs to your vehicle, ensuring you don’t bear the full financial burden.

- While backing out of your driveway, you accidentally strike a utility pole, causing significant damage to your car’s front end. Collision insurance would provide the necessary funds to fix the damage, allowing you to continue using your vehicle safely.

- During a snowy winter storm, you lose control of your vehicle and collide with a guardrail. Collision insurance would help cover the costs of repairing your vehicle, even in adverse weather conditions.

Benefits of Collision Insurance

Collision insurance offers several advantages that make it an essential consideration for vehicle owners:

Financial Protection

The primary benefit of collision insurance is the financial protection it provides. Accidents can result in costly repairs or even total vehicle losses. With collision insurance, policyholders can have peace of mind knowing that they are shielded from these substantial financial burdens.

Quick Repair or Replacement

In the event of an accident, collision insurance ensures that the policyholder’s vehicle can be repaired or replaced promptly. This timely response minimizes downtime and inconvenience, allowing individuals to maintain their daily routines and transportation needs.

Increased Safety

By covering the costs of repairs, collision insurance encourages vehicle owners to address any damages promptly. This proactive approach enhances safety on the roads, as well-maintained vehicles are less likely to experience further complications or accidents.

Peace of Mind

Knowing that you have collision insurance provides a sense of security and peace of mind. It alleviates the stress and anxiety associated with potential accidents, allowing drivers to focus on their journeys with confidence.

Collision Insurance vs. Comprehensive Insurance

While collision insurance focuses on accidents and collisions, comprehensive insurance provides broader coverage. Comprehensive insurance covers a wider range of incidents, including natural disasters, theft, vandalism, and even damages caused by animals.

| Coverage Type | Collision Insurance | Comprehensive Insurance |

|---|---|---|

| Accidents | ✔️ | ✔️ |

| Natural Disasters | ❌ | ✔️ |

| Theft | ❌ | ✔️ |

| Vandalism | ❌ | ✔️ |

| Animal-Related Incidents | ❌ | ✔️ |

It's important to note that some insurance providers offer bundled policies that include both collision and comprehensive coverage, providing a comprehensive protection package for vehicle owners.

Collision Insurance and Deductibles

When opting for collision insurance, policyholders typically choose a deductible, which is the amount they agree to pay out of pocket before the insurance coverage kicks in. Deductibles can vary, and higher deductibles often result in lower insurance premiums.

For instance, if you select a $500 deductible and are involved in an accident with estimated repairs costing $3,000, you would pay the first $500, and your insurance provider would cover the remaining $2,500.

Choosing the Right Deductible

Selecting an appropriate deductible involves balancing cost savings with potential risks. A higher deductible can lead to lower premiums, but it also means you’ll pay more out of pocket in the event of a claim. On the other hand, a lower deductible provides more financial protection but may result in higher premiums.

Consider your financial situation and the potential risks associated with your driving habits when choosing a deductible. Consulting with an insurance professional can also provide valuable insights tailored to your specific needs.

Factors Affecting Collision Insurance Rates

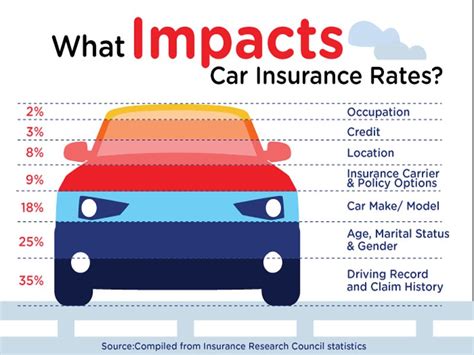

Collision insurance rates can vary based on several factors, including:

- Vehicle Type and Value: More expensive vehicles often have higher collision insurance rates due to the increased cost of repairs or replacements.

- Location: Insurance rates can vary depending on the geographic region, with urban areas often having higher rates due to increased traffic and accident risks.

- Driving History: Individuals with a clean driving record may enjoy lower collision insurance rates, while those with a history of accidents or traffic violations may face higher premiums.

- Age and Experience: Younger drivers, especially those under 25, often pay higher rates due to their limited driving experience. Rates generally decrease as drivers gain more experience on the road.

- Insurance Provider: Different insurance companies offer varying rates and coverage options. Shopping around and comparing quotes from multiple providers can help you find the best deal.

Making a Collision Insurance Claim

In the unfortunate event of an accident, the process of making a collision insurance claim involves the following steps:

- Contact Your Insurance Provider: Immediately notify your insurance company about the accident. They will guide you through the claims process and provide the necessary documentation.

- Gather Information: Collect all relevant information, including photos of the accident scene and damage, contact details of involved parties, and any police reports or witness statements.

- Submit Your Claim: Complete and submit the required claim forms, providing accurate and detailed information about the accident.

- Assessment and Approval: Your insurance provider will assess the claim, determine the extent of the damage, and approve or deny the claim based on the policy coverage and terms.

- Repairs or Settlement: Once the claim is approved, you can proceed with repairs or negotiate a settlement with the insurance company. If repairs are required, choose a reputable repair shop, and ensure the work is done to your satisfaction.

Collision Insurance and Safety Precautions

While collision insurance provides financial protection, it’s equally important to prioritize safety to minimize the likelihood of accidents. Here are some safety precautions to consider:

- Defensive Driving: Practice defensive driving techniques, such as maintaining a safe following distance, being aware of your surroundings, and anticipating potential hazards.

- Regular Vehicle Maintenance: Ensure your vehicle is well-maintained with regular servicing and inspections. This helps identify and address any potential issues that could lead to accidents.

- Safe Driving Habits: Avoid distractions while driving, such as using mobile phones or eating. Always obey traffic laws and drive within the speed limit.

- Emergency Preparedness: Keep an emergency kit in your vehicle, including a first-aid kit, flashlight, and reflective triangles. This can be invaluable in the event of an accident or breakdown.

Future Trends in Collision Insurance

The insurance industry is constantly evolving, and collision insurance is no exception. Here are some potential future trends and developments:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining traction in the insurance industry. Usage-based insurance policies could offer discounts to drivers who exhibit safe driving practices, such as maintaining a steady speed and avoiding sudden maneuvers.

Advanced Driver Assistance Systems (ADAS)

With the rise of autonomous and semi-autonomous vehicles, ADAS technologies are becoming more prevalent. These systems, including lane departure warnings and automatic emergency braking, could reduce the frequency and severity of accidents, potentially leading to lower collision insurance rates.

Artificial Intelligence and Data Analytics

Insurance providers are leveraging AI and data analytics to enhance risk assessment and claims processing. These technologies can identify patterns and trends, allowing for more accurate pricing and personalized insurance plans based on individual driving behaviors.

Increased Focus on Preventative Measures

As the industry continues to evolve, there may be a greater emphasis on preventative measures and driver education. Insurance providers could offer incentives or discounts for completing defensive driving courses or adopting safety technologies in their vehicles.

Conclusion

Collision insurance is a critical component of vehicle coverage, providing essential financial protection in the event of accidents. By understanding the benefits, coverage options, and potential future trends, vehicle owners can make informed decisions to ensure they have the appropriate coverage for their needs. Remember, while collision insurance provides peace of mind, prioritizing safety remains paramount to prevent accidents and ensure a safe driving experience.

How much does collision insurance typically cost?

+

The cost of collision insurance can vary significantly depending on several factors, including the value of your vehicle, your driving history, and the coverage limits you choose. On average, collision insurance can range from 200 to 1,000 annually, but it’s important to note that this is just an estimate, and your specific rate may be higher or lower based on your individual circumstances.

Does collision insurance cover damages caused by natural disasters?

+

No, collision insurance typically covers damages resulting from collisions with other vehicles, objects, or structures. For coverage against natural disasters like hurricanes, floods, or earthquakes, you would need comprehensive insurance or additional endorsements to your policy.

Can I choose my own repair shop for collision repairs?

+

Yes, you generally have the freedom to choose your preferred repair shop for collision repairs. However, some insurance companies may have preferred shops or partnerships, offering discounts or guarantees on the quality of repairs. It’s always a good idea to check with your insurance provider to understand their specific policies and recommendations.

What happens if I’m at fault in an accident but have collision insurance?

+

Collision insurance covers damages to your vehicle regardless of fault. So, even if you are found at fault in an accident, your collision insurance will still provide coverage for the repairs to your vehicle. However, it’s important to note that your insurance premiums may increase after an at-fault accident.