Insurance Companies Quotes

The insurance industry is a complex and highly regulated sector that plays a crucial role in providing financial protection and risk management to individuals, businesses, and societies at large. At its core, insurance serves as a mechanism to transfer and mitigate risks, offering peace of mind and a safety net against unforeseen events. Obtaining insurance quotes is a fundamental step in this process, as it empowers individuals and entities to make informed decisions about their coverage needs.

In this comprehensive guide, we delve into the world of insurance quotes, exploring the factors that influence quote generation, the technologies driving this process, and the strategies individuals can employ to secure the most favorable quotes for their specific circumstances.

Understanding Insurance Quotes

Insurance quotes, at their essence, are the estimated costs presented by insurance companies to provide coverage for a particular policy. These quotes are based on a careful assessment of the risks associated with the insured entity and the coverage required. The quote-generation process is intricate, involving a meticulous evaluation of various factors that contribute to the overall risk profile.

Risk Assessment and Personalized Quotes

Insurance companies employ sophisticated risk assessment methodologies to generate personalized quotes. This process takes into account a myriad of variables, including the insured’s age, gender, location, occupation, and even their health status or driving record (for auto insurance). For businesses, factors such as industry, size, location, and historical claims data are considered.

For instance, let's consider auto insurance. The quote for a young, urban driver with a history of accidents will differ significantly from that of a middle-aged, rural driver with a spotless record. This personalized approach ensures that insurance quotes are tailored to the unique circumstances of each individual or business, making them more accurate and reflective of the actual risks involved.

| Risk Factor | Impact on Quote |

|---|---|

| Age | Younger individuals often face higher premiums due to increased risk of accidents or claims. |

| Location | Urban areas may have higher rates due to factors like traffic density and crime rates. |

| Occupation | High-risk occupations (e.g., construction workers) may result in higher premiums. |

| Health Status | Pre-existing health conditions can influence life and health insurance quotes. |

The Evolution of Quote Generation

The process of obtaining insurance quotes has undergone a significant transformation with the advent of digital technologies. Traditionally, seeking insurance quotes involved time-consuming and often tedious interactions with insurance agents or brokers. However, the digital age has brought about a paradigm shift, making the quote-generation process more efficient, accessible, and consumer-centric.

Online Quote Platforms

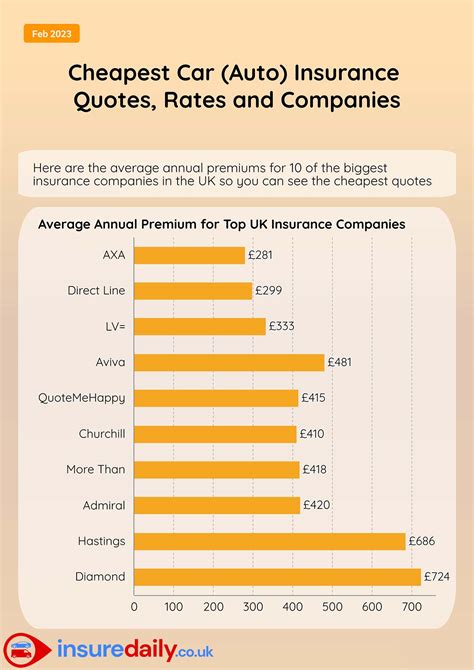

One of the most notable advancements is the proliferation of online quote platforms. These digital tools allow individuals to input their information and instantly receive multiple quotes from various insurance providers. This not only saves time but also empowers consumers to compare options and make informed choices.

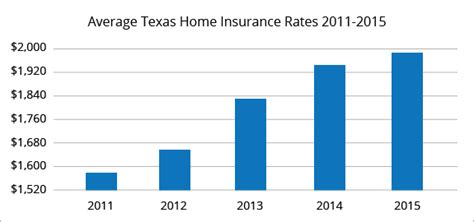

For example, a homeowner seeking insurance for their newly purchased property can use an online platform to input their details, such as the property's location, square footage, and construction materials. Within minutes, they receive quotes from multiple insurers, allowing them to assess coverage options and prices side by side.

Advanced Risk Assessment Technologies

Insurance companies have also embraced advanced technologies to enhance their risk assessment capabilities. Machine learning algorithms and data analytics play a pivotal role in analyzing vast datasets to identify patterns and trends that influence risk profiles. These technologies enable insurers to make more accurate predictions about potential claims, leading to more precise quote generation.

Furthermore, the integration of IoT (Internet of Things) devices, such as smart home sensors or telematics devices in vehicles, provides insurers with real-time data. This data-driven approach allows for more dynamic and responsive quote adjustments based on actual behavior and risk exposure.

Strategies for Securing the Best Insurance Quotes

While insurance quotes are influenced by numerous factors beyond an individual’s control, there are strategies one can employ to improve their chances of obtaining favorable quotes. Here are some expert tips to navigate the insurance quote landscape successfully.

Shop Around and Compare

One of the most effective ways to secure competitive insurance quotes is to shop around and compare offers from multiple insurers. Different companies have varying risk appetites and pricing strategies, so it’s essential to explore a range of options. Online comparison tools and quote platforms can streamline this process, making it easier to identify the most suitable and cost-effective coverage.

Understand Your Coverage Needs

Before seeking quotes, it’s crucial to have a clear understanding of your coverage needs. Consider the specific risks you want to protect against and the level of coverage that aligns with your financial capabilities. Overinsuring can lead to unnecessary expenses, while underinsuring may leave you vulnerable to significant financial losses.

For instance, when insuring a home, assess the value of your property, the cost of rebuilding, and the value of your belongings. This information will guide you in choosing the right coverage limits and deductibles.

Improve Your Risk Profile

Certain actions can positively impact your risk profile, potentially leading to more favorable insurance quotes. For auto insurance, maintaining a clean driving record and taking defensive driving courses can demonstrate responsible behavior and lower your risk level. Similarly, for health insurance, adopting a healthy lifestyle and managing pre-existing conditions can improve your overall health status and reduce insurance costs.

Bundle Policies for Discounts

Many insurance companies offer multi-policy discounts, where purchasing multiple types of insurance from the same provider results in reduced premiums. This strategy is particularly effective for individuals with multiple insurance needs, such as auto, home, and life insurance. By bundling policies, you not only simplify your insurance management but also enjoy cost savings.

Negotiate and Ask for Discounts

Don’t hesitate to negotiate with insurance providers. Many insurers are open to discussions about premiums, especially if you have a long-standing relationship or a favorable claims history. Additionally, inquire about available discounts, such as loyalty discounts, good student discounts, or safety feature discounts (for auto insurance). These discounts can significantly reduce your overall insurance costs.

Explore Alternative Insurance Options

In some cases, traditional insurance may not be the most cost-effective option. Alternative insurance models, such as peer-to-peer insurance or parametric insurance, offer unique approaches to risk sharing and coverage. These options can provide more affordable coverage for specific risks, especially for niche markets or emerging technologies.

The Future of Insurance Quotes

As technology continues to advance, the insurance industry is poised for further innovation in quote generation and risk assessment. The integration of artificial intelligence, blockchain, and big data analytics is expected to revolutionize the way insurance quotes are determined and delivered.

AI-Driven Risk Assessment

Artificial intelligence (AI) is already transforming the insurance landscape. AI-powered risk assessment tools can analyze vast amounts of data, including social media behavior, purchase histories, and even biometric data, to provide more accurate and personalized quotes. This technology can identify subtle patterns and correlations that traditional risk assessment methods might overlook.

Blockchain for Secure and Transparent Quotes

Blockchain technology has the potential to enhance the transparency and security of insurance transactions. By creating an immutable ledger of insurance contracts and claims, blockchain can reduce fraud and streamline the quote-generation process. Insurers and consumers can have greater confidence in the accuracy and integrity of quotes, fostering a more trust-based relationship.

Predictive Analytics for Dynamic Quotes

Predictive analytics, powered by advanced machine learning algorithms, can provide insurers with insights into future risk trends. This technology can analyze historical data, weather patterns, and even social media sentiment to predict potential claims and adjust quotes accordingly. Dynamic quotes, updated in real-time based on changing risk factors, can ensure that insurance coverage remains relevant and cost-effective.

The Rise of On-Demand Insurance

The concept of on-demand insurance, where coverage is purchased for specific periods or events, is gaining traction. This model, often facilitated by mobile apps or digital platforms, allows individuals to purchase insurance when they need it, such as for a short-term rental or a single event. On-demand insurance offers flexibility and cost savings, as individuals only pay for the coverage they require, when they require it.

Conclusion

The world of insurance quotes is dynamic and ever-evolving, driven by technological advancements and a consumer-centric mindset. By understanding the factors that influence quotes, embracing digital tools, and adopting strategic approaches, individuals and businesses can navigate the insurance landscape with confidence. As the industry continues to innovate, the future of insurance quotes promises increased accessibility, personalization, and efficiency, ultimately benefiting consumers and society as a whole.

How often should I review my insurance quotes and policies?

+It’s recommended to review your insurance quotes and policies annually, or whenever your circumstances change significantly. Life events like marriage, purchasing a new home, or starting a business can impact your insurance needs. Regular reviews ensure your coverage remains adequate and cost-effective.

What are some common discounts offered by insurance companies?

+Common insurance discounts include multi-policy discounts (bundling home and auto insurance), loyalty discounts for long-term customers, good student discounts for young drivers with good grades, and safety feature discounts for vehicles equipped with advanced safety technologies.

How can I improve my chances of getting lower insurance quotes for my business?

+For businesses, maintaining a strong safety record, investing in risk management strategies, and implementing robust security measures can positively impact insurance quotes. Additionally, exploring alternative insurance models like captive insurance or parametric insurance can provide cost-effective coverage tailored to your industry’s specific risks.