Insurance Continuing Education Online

Unveiling the World of Insurance Continuing Education Online: A Comprehensive Guide

In the dynamic field of insurance, staying informed and up-to-date is not just a professional obligation; it's a cornerstone for success and client trust. The advent of online continuing education has revolutionized how insurance professionals enhance their skills and knowledge, offering unparalleled convenience and accessibility. This guide aims to delve into the intricacies of online insurance education, exploring its benefits, key considerations, and the vast opportunities it presents.

For insurance professionals, continuous learning is not just an option but a necessity. The industry is ever-evolving, with new regulations, technologies, and best practices emerging regularly. Staying abreast of these changes is crucial for providing accurate advice, ensuring compliance, and maintaining a competitive edge. Online continuing education emerges as a pivotal tool, empowering professionals to navigate this dynamic landscape with confidence.

The Evolution of Insurance Education: Embracing Online Learning

The traditional model of in-person seminars and workshops, while valuable, has its limitations. The rise of online education has addressed these limitations, offering a flexible, cost-effective, and comprehensive approach to professional development. Insurance professionals can now access a wealth of knowledge from the comfort of their homes or offices, at their own pace, without geographical constraints.

Benefits of Online Insurance Continuing Education

- Convenience and Flexibility: Online courses allow professionals to learn on their terms, fitting education into their busy schedules. Whether it's early mornings, late nights, or weekends, the flexibility is unparalleled.

- Cost-Effectiveness: With no travel expenses, accommodation costs, or time away from work, online education is a more affordable option. Many platforms also offer discounted rates for multiple courses or group enrollments.

- Wide Range of Topics: From fundamental concepts to niche specialties, online platforms offer a diverse range of courses. Professionals can choose topics relevant to their interests and career goals, ensuring a personalized learning experience.

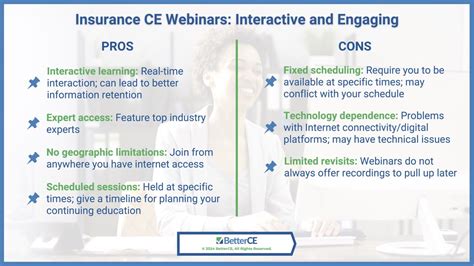

- Interactive and Engaging Content: Modern online courses employ multimedia elements, interactive quizzes, and real-world case studies to make learning more engaging and effective. This approach enhances knowledge retention and practical application.

- Access to Expert Instructors: Online education platforms often collaborate with industry experts, ensuring that professionals learn from the best. These instructors bring real-world experience and insights to the virtual classroom.

Key Considerations for Effective Online Learning

While the advantages are numerous, it's essential to approach online learning with a strategic mindset.

- Course Accreditation and Quality: Ensure the courses you choose are accredited and recognized by relevant insurance boards or associations. Look for platforms that prioritize quality content and have a reputation for excellence.

- Interactive Features and Support: Effective online learning involves more than just video lectures. Seek platforms that offer interactive elements, such as discussion forums, live webinars, and opportunities for peer interaction. Additionally, robust technical support is essential to address any issues promptly.

- Personalized Learning Paths: Consider platforms that allow you to customize your learning journey. The ability to choose courses based on your interests, career stage, and goals can significantly enhance the value of your online education.

- Time Management and Discipline: Online learning requires self-discipline and effective time management. Set clear goals and allocate dedicated time slots for studying to make the most of your courses.

Exploring the Online Insurance Education Landscape

The world of online insurance education is vast, with numerous platforms and providers offering a myriad of courses. Let's explore some of the leading platforms and their unique offerings.

Insurance Institute of America (IIA)

The IIA is a renowned provider of insurance education, offering a comprehensive suite of online courses. Their catalog includes foundational courses for new professionals, advanced topics for seasoned veterans, and specialty courses for niche areas like cyber insurance and health insurance.

| Course Category | Course Titles |

|---|---|

| Fundamentals | Introduction to Insurance, Property & Casualty Insurance Basics |

| Advanced Topics | Advanced Claims Handling, Risk Management Strategies |

| Specialty Areas | Cyber Liability Insurance, Long-Term Care Insurance |

The IIA's courses are known for their comprehensive coverage and practical focus, ensuring professionals gain skills they can apply immediately in their careers.

The National Alliance for Insurance Education & Research

The National Alliance is a trusted name in insurance education, providing a range of online courses and certifications. Their flagship program, the Certified Insurance Counselor (CIC) designation, is highly regarded in the industry. The National Alliance also offers specialized courses in areas like commercial insurance, personal insurance, and risk management.

| Course Category | Course Titles |

|---|---|

| Professional Designations | Certified Insurance Counselor (CIC) |

| Specialized Courses | Commercial Lines Coverage Specialist (CLCS), Personal Lines Coverage Specialist (PLCS) |

The National Alliance's courses are known for their rigor and focus on practical application, ensuring professionals are well-equipped to handle complex insurance scenarios.

InsuranceEd

InsuranceEd is a modern online education platform, offering a wide range of insurance courses tailored for various career stages and interests. Their courses are known for their engaging, multimedia-rich content, making learning interactive and fun.

| Course Category | Course Titles |

|---|---|

| Fundamentals | Insurance Fundamentals, Insurance Ethics and Compliance |

| Specialized Topics | Health Insurance Essentials, Commercial Auto Insurance |

| Industry Insights | The Future of Insurance: Trends and Technologies |

InsuranceEd's platform is particularly appealing to younger professionals or those new to the industry, offering a fresh, modern approach to insurance education.

Maximizing Your Online Learning Experience

To make the most of your online insurance education journey, consider these strategies:

- Set Clear Goals: Define your learning objectives. Are you aiming to gain a new professional designation, enhance your knowledge in a specific area, or stay updated on industry trends? Clear goals will guide your course selection and ensure a focused learning experience.

- Create a Study Schedule: Develop a realistic study plan and stick to it. Consistency is key. Allocate dedicated time slots for studying, and ensure you complete assignments and quizzes promptly.

- Engage with the Material: Online learning doesn't mean passive consumption. Participate in discussions, ask questions, and seek clarifications. The more actively you engage, the more you'll retain and apply the knowledge.

- Network and Collaborate: Online courses often have diverse student bodies. Engage with your peers, share experiences, and collaborate on projects. Building a professional network can lead to valuable connections and insights.

- Apply What You Learn: Insurance is a practical field. Look for opportunities to apply your newfound knowledge in real-world scenarios. This could be through case studies, role-playing exercises, or by implementing new strategies in your daily work.

The Future of Insurance Education: Trends and Innovations

The world of online insurance education is evolving rapidly, driven by advancements in technology and changing learner preferences. Here are some key trends and innovations to watch:

- Microlearning and Short Courses: With busy professionals seeking quick, focused learning experiences, microlearning modules and short courses are gaining popularity. These concise, targeted lessons allow professionals to gain specific skills or knowledge in a matter of hours or days.

- Adaptive Learning: This innovative approach uses technology to personalize the learning experience based on each student's needs and progress. Adaptive learning platforms can adjust the difficulty level, pace, and content delivery based on individual performance, ensuring a tailored and effective learning journey.

- Virtual Reality (VR) and Augmented Reality (AR): VR and AR technologies are increasingly being used to create immersive, interactive learning environments. From simulating insurance claim scenarios to exploring complex insurance products, these technologies offer a unique, engaging learning experience.

- Data-Driven Learning: With the power of data analytics, online learning platforms can now offer personalized recommendations, identify knowledge gaps, and suggest relevant courses based on individual performance and career goals.

- Collaborative Learning Communities: Online learning platforms are fostering collaborative learning environments, where professionals can connect, share experiences, and learn from each other. These communities enhance the sense of belonging and support, making the learning journey more enjoyable and effective.

Conclusion: Empowering Insurance Professionals through Online Education

Online insurance continuing education is not just a convenient alternative to traditional learning methods; it's a powerful tool for professional growth and development. With its flexibility, accessibility, and engaging content, online learning empowers insurance professionals to stay abreast of industry changes, enhance their skills, and provide exceptional service to their clients.

As the insurance landscape continues to evolve, the role of online education will become increasingly vital. By embracing these opportunities and staying committed to lifelong learning, insurance professionals can ensure they remain at the forefront of their field, offering invaluable expertise and guidance to their clients.

What are the key benefits of online insurance continuing education over traditional methods?

+

Online insurance continuing education offers unparalleled convenience, allowing professionals to learn at their own pace and from any location. It’s often more cost-effective, with no travel or accommodation expenses. Additionally, online platforms provide a wide range of topics, ensuring professionals can choose courses relevant to their interests and career goals.

How can I ensure the quality of online insurance education courses?

+

Look for accredited courses recognized by relevant insurance boards or associations. Research the reputation and quality of the online platform, ensuring they prioritize comprehensive, practical content. Check for reviews and testimonials from other professionals who have taken the courses.

What strategies can I use to make the most of my online insurance education experience?

+

Set clear learning goals, create a dedicated study schedule, and actively engage with the course material. Participate in discussions, seek clarifications, and apply what you learn in real-world scenarios. Building a professional network through online courses can also lead to valuable connections and insights.

How can I stay updated on the latest trends and innovations in online insurance education?

+

Stay connected with industry publications, online communities, and thought leaders in insurance education. Attend virtual conferences and webinars, and follow reputable insurance education platforms and their blogs. By staying informed, you can ensure you’re leveraging the latest tools and strategies for your professional development.