Insurance Coverage Auto

In today's fast-paced world, auto insurance is an essential aspect of modern life, providing peace of mind and financial protection for vehicle owners. This comprehensive guide will delve into the intricacies of auto insurance coverage, offering a detailed analysis of the different policies, their benefits, and how they can safeguard individuals against various automotive risks.

Understanding Auto Insurance Coverage

Auto insurance is a contract between an individual and an insurance provider, whereby the insurer promises to financially protect the policyholder against losses and damages resulting from vehicle-related incidents. These incidents can range from accidents, theft, natural disasters, to medical expenses incurred as a result of an accident. The level of protection and the specific risks covered depend on the type of insurance policy purchased.

The primary goal of auto insurance is to ensure that vehicle owners can mitigate the financial burden that often accompanies unexpected vehicle-related events. By understanding the different types of coverage and their associated benefits, individuals can make informed decisions to best protect themselves and their vehicles.

Types of Auto Insurance Coverage

Auto insurance policies can be broadly categorized into three main types: liability coverage, collision coverage, and comprehensive coverage. Each type serves a unique purpose and offers different levels of protection.

Liability Coverage

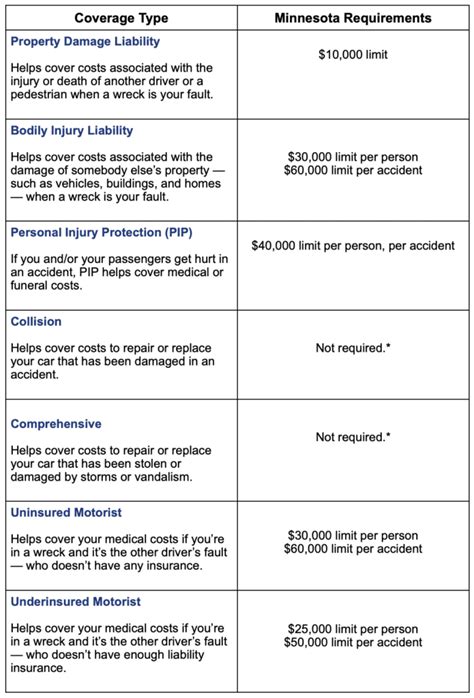

Liability insurance is the most fundamental type of auto insurance. It protects the policyholder against financial losses if they are found to be at fault in an accident that causes bodily injury or property damage to others. This coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for the medical expenses, lost wages, and pain and suffering of individuals injured in an accident caused by the policyholder.

- Property Damage Liability: It covers the cost of repairing or replacing the property damaged in an accident, such as the other party's vehicle, fence, or other structures.

Liability coverage is essential as it protects the policyholder from potentially devastating financial consequences that can arise from causing an accident. In many states, liability insurance is mandatory, with minimum coverage limits set by law.

Collision Coverage

Collision coverage is an optional insurance that pays for the repair or replacement of the policyholder’s vehicle if it is damaged in an accident, regardless of fault. This coverage is particularly useful for newer vehicles or those with high resale values, as it can help cover the cost of repairing or replacing the vehicle after a collision.

However, it's important to note that collision coverage comes with a deductible, which is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower the insurance premium, but it also means the policyholder will have to pay more out of pocket in the event of a claim.

Comprehensive Coverage

Comprehensive insurance, often referred to as other than collision coverage, protects the policyholder’s vehicle against damages caused by events other than collisions. This can include theft, vandalism, natural disasters like hail or floods, and even damage caused by animals.

Like collision coverage, comprehensive insurance also comes with a deductible. Policyholders can choose their deductible amount, with a higher deductible typically resulting in a lower insurance premium.

Additional Coverage Options

Beyond the three main types of coverage, auto insurance policies can also include additional options to provide more comprehensive protection. These may include:

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder if they are involved in an accident with a driver who either has no insurance or has insufficient insurance to cover the damages.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for the policyholder and their passengers, regardless of fault.

- Rental Car Reimbursement: Provides coverage for a rental car if the policyholder's vehicle is in the shop for repairs due to a covered incident.

- Gap Insurance: Covers the difference between the actual cash value of the vehicle and the amount still owed on a lease or loan in the event of a total loss.

Benefits of Auto Insurance Coverage

Auto insurance coverage offers a multitude of benefits to policyholders, providing both financial protection and peace of mind. Here are some key advantages:

Financial Protection

One of the primary benefits of auto insurance is the financial protection it provides. In the event of an accident or other covered incident, insurance can help cover the cost of repairs, medical expenses, and even legal fees. This protection can be especially crucial for individuals who may not have the financial means to cover these expenses out of pocket.

For example, imagine being involved in a severe accident that totals your vehicle. Without collision and comprehensive coverage, you would be responsible for the full cost of replacing your vehicle, which could run into tens of thousands of dollars. However, with these coverages in place, your insurance provider would cover a significant portion of these costs, minimizing the financial impact on you.

Peace of Mind

Auto insurance not only provides financial protection but also peace of mind. Knowing that you are protected against a wide range of potential risks can reduce stress and anxiety, allowing you to focus on other aspects of your life. With the right coverage, you can rest assured that you are prepared for the unexpected.

Legal Compliance

In many jurisdictions, having auto insurance is a legal requirement. Liability insurance, in particular, is often mandatory to ensure that drivers can cover the costs of any accidents they cause. By obtaining auto insurance, you not only protect yourself but also comply with the law, avoiding potential legal consequences.

Choosing the Right Coverage

Selecting the appropriate auto insurance coverage can be a complex decision, as it involves balancing your specific needs, the value of your vehicle, and your budget. Here are some key factors to consider when choosing the right coverage for you:

Vehicle Value and Age

The value and age of your vehicle play a significant role in determining the type and amount of coverage you need. For newer or more expensive vehicles, comprehensive and collision coverage are often recommended to protect against potential losses. However, for older vehicles with lower resale values, these coverages may not be as cost-effective.

Risk Profile

Your individual risk profile is another crucial factor. If you live in an area prone to natural disasters or have a higher-than-average risk of theft or vandalism, comprehensive coverage may be a wise choice. Additionally, if you frequently drive in congested areas or have a history of accidents, liability coverage with higher limits may be beneficial.

Budget Considerations

Of course, your budget is an essential consideration when choosing auto insurance coverage. Different types of coverage and varying deductibles can significantly impact your insurance premium. It’s important to find a balance between the coverage you need and what you can afford.

One strategy to manage costs is to increase your deductible. While this means you'll pay more out of pocket in the event of a claim, it can lead to lower premiums, making insurance more affordable.

Performance Analysis and Future Implications

Auto insurance coverage has proven to be an effective tool in managing the financial risks associated with vehicle ownership. The insurance industry has seen a steady increase in the adoption of comprehensive policies, indicating a growing awareness among policyholders of the benefits offered by these plans. This shift towards more inclusive coverage reflects a broader trend of consumers taking a proactive approach to risk management.

Furthermore, the introduction of new technologies in the automotive sector, such as advanced driver-assistance systems and autonomous vehicles, is likely to have a significant impact on auto insurance in the future. These technologies could potentially reduce the number of accidents and claims, leading to adjustments in insurance premiums and coverage requirements. As the automotive industry continues to innovate, the insurance sector will need to adapt its offerings to remain relevant and effective.

| Type of Coverage | Description |

|---|---|

| Liability | Protects against financial losses if the policyholder is at fault in an accident, covering bodily injury and property damage to others. |

| Collision | Covers the repair or replacement of the policyholder's vehicle if it is damaged in an accident, regardless of fault. |

| Comprehensive | Protects against damages caused by events other than collisions, such as theft, vandalism, and natural disasters. |

Frequently Asked Questions

What is the difference between collision and comprehensive coverage?

+

Collision coverage specifically addresses damages resulting from accidents, regardless of fault. It covers the repair or replacement of the policyholder’s vehicle. On the other hand, comprehensive coverage protects against a broader range of incidents, including theft, vandalism, and natural disasters. This type of coverage is often referred to as “other than collision” coverage.

Is auto insurance mandatory?

+

In many jurisdictions, having auto insurance is a legal requirement. Liability insurance, which covers bodily injury and property damage to others, is often mandatory to ensure that drivers can cover the costs of any accidents they cause.

How do deductibles work in auto insurance?

+

A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower the insurance premium, but it also means the policyholder will have to pay more out of pocket in the event of a claim.

What factors determine auto insurance premiums?

+

Auto insurance premiums are determined by a variety of factors, including the type and amount of coverage, the policyholder’s driving history, the value of the vehicle, and the location. Other factors, such as age, gender, and credit score, may also be considered by some insurance providers.