Insurance Exam Prep Course

Embarking on the journey to become an insurance professional often begins with the rigorous preparation for licensing exams. These exams are the gateway to a rewarding career in the insurance industry, but they can be challenging. That's why having the right preparation tools and resources is crucial for success. In this comprehensive guide, we'll delve into the world of insurance exam prep courses, exploring their benefits, key features, and how they can empower aspiring insurance professionals to conquer these exams with confidence.

Maximizing Your Potential with Insurance Exam Prep Courses

Insurance exam prep courses are specialized programs designed to equip individuals with the knowledge and skills necessary to excel in licensing exams. These courses serve as a comprehensive roadmap, guiding students through the intricate world of insurance regulations, principles, and practices. By enrolling in a high-quality prep course, aspiring insurance professionals can enhance their understanding, reinforce their grasp of essential concepts, and develop the test-taking strategies needed to navigate the exam successfully.

The insurance industry is known for its complexity, with a vast array of regulations, products, and ethical considerations. Insurance exam prep courses break down these complexities into digestible modules, ensuring that students can grasp each topic thoroughly. Whether it's understanding the nuances of different insurance policies, mastering the art of risk assessment, or comprehending the legal implications, these courses provide a structured learning environment that fosters a deep understanding of the subject matter.

The Benefits of Choosing a Top-Tier Insurance Exam Prep Course

Selecting the right insurance exam prep course can be the difference between a stressful study experience and a confident, well-prepared journey to licensure. Top-tier prep courses offer a multitude of advantages that set students up for success. Here are some key benefits to consider:

Comprehensive Curriculum

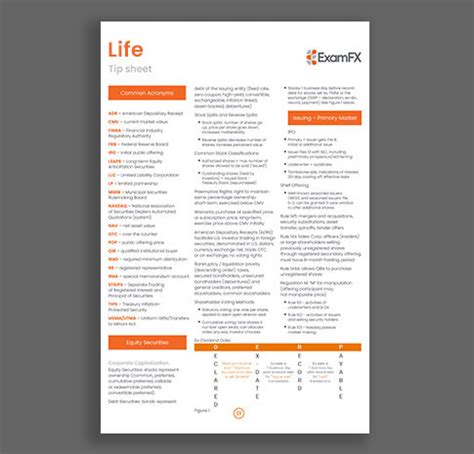

A well-designed insurance exam prep course covers all the essential topics outlined by the licensing authority. This ensures that students receive a holistic education, addressing everything from basic insurance concepts to advanced risk management strategies. By covering the entire curriculum, prep courses give students a competitive edge, leaving no stone unturned in their preparation.

| Curriculum Coverage | Relevance |

|---|---|

| Fundamentals of Insurance | Essential building blocks for a strong foundation. |

| Risk Assessment and Management | Critical skills for evaluating and mitigating risks. |

| Ethics and Compliance | Understanding legal and ethical responsibilities. |

| Insurance Products and Services | In-depth knowledge of various insurance offerings. |

| Claims Handling and Settlement | Key procedures for managing claims efficiently. |

Interactive Learning Experience

Top insurance exam prep courses go beyond static textbooks, offering interactive and engaging learning experiences. This can include multimedia resources, such as video tutorials, interactive quizzes, and practice simulations. By incorporating diverse learning tools, these courses cater to different learning styles, ensuring that information is absorbed more effectively. Interactive elements also help to keep students motivated and invested in their studies.

Expert Instructors

A significant advantage of high-quality prep courses is the presence of industry experts as instructors. These professionals bring a wealth of real-world experience to the classroom, offering insights and perspectives that go beyond the exam curriculum. Their guidance can be invaluable, providing students with practical tips, industry anecdotes, and a deeper understanding of the practical applications of insurance principles.

Personalized Study Plans

Recognizing that every student has unique needs and learning styles, top-tier prep courses often offer personalized study plans. This means that students can tailor their learning journey to their strengths and weaknesses. Whether it’s focusing on specific topics that require more attention or adjusting the pace of study, personalized plans ensure that students can maximize their potential and address their individual learning gaps.

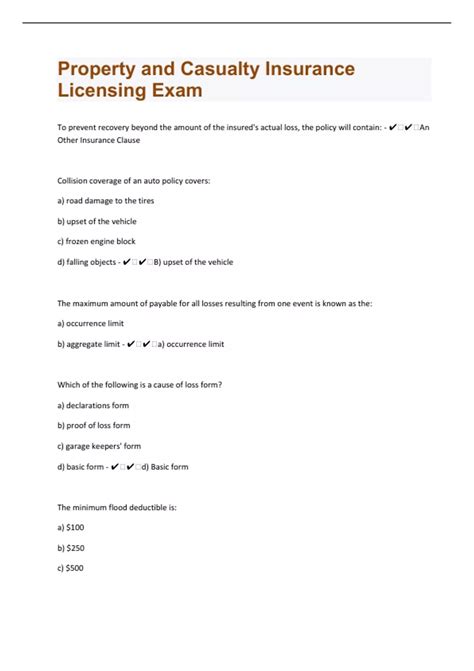

Comprehensive Practice Tests

Practice makes perfect, especially when it comes to high-stakes exams. Reputable insurance exam prep courses provide a wealth of practice tests and question banks, mirroring the actual exam format and content. By familiarizing themselves with the types of questions and the exam structure, students can reduce test anxiety and build their confidence. These practice tests also help identify areas that require further study, allowing students to refine their knowledge and skills effectively.

Maximizing Your Study Efficiency

Efficient study habits are crucial for success in insurance exams. Here are some strategies to make the most of your study time:

- Create a Structured Study Schedule: Divide your study time into manageable sessions, focusing on different topics each day. Consistency is key, so aim for regular study sessions rather than cramming at the last minute.

- Utilize Active Learning Techniques: Engage actively with the material. Take notes, create flashcards, and participate in study groups to reinforce your understanding. Active learning improves retention and makes studying more enjoyable.

- Focus on Understanding, Not Memorization: While memorization has its place, understanding the underlying concepts is crucial. Aim to grasp the logic behind insurance principles, as this will help you apply your knowledge to various scenarios.

- Practice Time Management: Insurance exams often have strict time limits. Practice answering questions within a set timeframe to improve your speed and accuracy. This skill will be invaluable during the actual exam.

The Role of Practice in Exam Success

Practice is an indispensable component of exam preparation. By repeatedly exposing yourself to exam-style questions, you can identify your strengths and weaknesses. Here’s how practice can enhance your exam readiness:

- Identifying Knowledge Gaps: Practice tests help you pinpoint areas where your understanding may be lacking. This allows you to focus your studies on these specific topics, ensuring a more comprehensive understanding.

- Building Confidence: Regular practice builds familiarity with the exam format and question types. As you become more comfortable with the exam structure, your confidence will soar, reducing anxiety on the day of the actual test.

- Improving Time Management Skills: Practice tests help you gauge your pacing. You'll learn to allocate your time effectively, ensuring that you can complete the entire exam within the allotted time frame.

- Mastering Test-Taking Strategies: Different exams may have unique strategies for success. Through practice, you can develop techniques to approach various question types, such as multiple-choice, true/false, or essay questions.

FAQs

What are the eligibility requirements for taking insurance licensing exams?

+

Eligibility requirements can vary based on the state or jurisdiction. Generally, candidates must meet educational and age criteria, and some states may require a background check or specific pre-licensing courses. It’s essential to check the specific requirements for your desired state or jurisdiction.

How long does it typically take to complete an insurance exam prep course?

+

The duration of prep courses can vary, but most comprehensive programs range from several weeks to a few months. The time needed depends on factors such as the complexity of the material, the student’s prior knowledge, and the intensity of the study schedule.

Can I take the insurance licensing exam without enrolling in a prep course?

+

While it’s technically possible to study independently, prep courses offer structured guidance and valuable resources that can significantly enhance your chances of success. These courses provide a comprehensive overview, expert insights, and practice materials, making the exam preparation process more efficient and effective.

Are insurance exam prep courses suitable for individuals with no prior insurance experience?

+

Absolutely! Insurance exam prep courses are designed to cater to individuals from diverse backgrounds. Whether you’re a recent graduate or a career changer, these courses provide a solid foundation in insurance principles, ensuring that you have the knowledge and skills needed to excel in the licensing exam.

Final Thoughts

Investing in a high-quality insurance exam prep course can be a game-changer for aspiring insurance professionals. With a comprehensive curriculum, expert guidance, and interactive learning experiences, these courses empower students to approach their licensing exams with confidence and a solid understanding of the material. By maximizing study efficiency and incorporating regular practice, students can ensure they are well-prepared to navigate the complexities of the insurance industry and achieve success on their licensing journey.