Insurance Florida Auto

The Sunshine State, Florida, is known for its vibrant culture, stunning beaches, and, unfortunately, a unique set of challenges when it comes to automotive insurance. With a diverse population, a bustling tourism industry, and a climate that attracts both residents and visitors alike, Florida presents a distinct insurance landscape. In this comprehensive guide, we'll delve into the intricacies of Florida auto insurance, exploring the state's regulations, the factors that influence premiums, and the strategies to ensure you're adequately covered while navigating the beautiful roads of Florida.

Navigating Florida’s Auto Insurance Landscape

Florida stands out among US states for its unique auto insurance requirements and regulations. Understanding these is crucial for both residents and visitors to ensure they are legally compliant and financially protected.

State-Mandated Minimum Coverage

Florida is a no-fault state, which means that, in the event of an accident, each party’s insurance company pays for their respective damages, regardless of fault. This simplifies the claims process but also requires specific insurance coverage. Florida’s minimum insurance requirements include:

- Personal Injury Protection (PIP): Covers medical expenses and a portion of lost wages for the policyholder and their passengers, up to 10,000. PIP also covers funeral expenses.</li> <li><strong>Property Damage Liability (PDL)</strong>: Covers damages caused by the policyholder's vehicle to another person's property, with a minimum requirement of 10,000.

It's important to note that while these are the minimum requirements, many drivers opt for additional coverage to ensure they are fully protected.

Factors Influencing Auto Insurance Premiums

Florida’s diverse population and unique weather patterns create a complex environment for insurance providers. Several factors can influence the cost of your auto insurance premium, including:

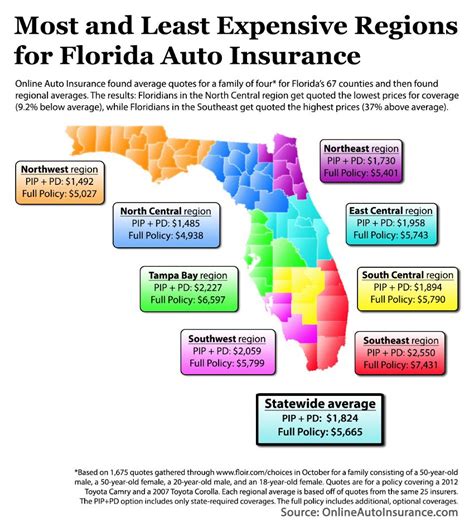

- Location: Urban areas, particularly those with high crime rates or dense traffic, often result in higher premiums. For instance, drivers in Miami might pay more than those in smaller towns.

- Driving History: A clean driving record is crucial. Any traffic violations, accidents, or DUI convictions can significantly increase your insurance rates.

- Age and Gender: Younger drivers, especially males under 25, are often considered high-risk and may face higher premiums. However, mature drivers with a clean record can benefit from reduced rates.

- Vehicle Type: The make, model, and age of your vehicle play a role. Sports cars or luxury vehicles, for example, are more expensive to insure.

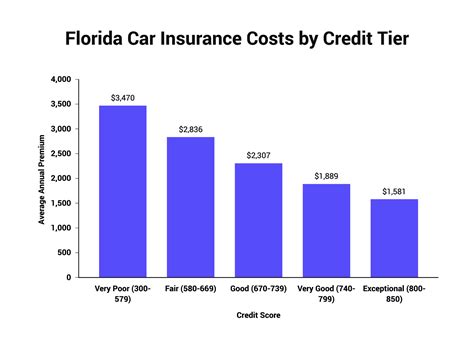

- Credit Score: In Florida, insurance companies are allowed to use credit-based insurance scores when determining rates. A higher credit score can lead to lower premiums.

Understanding these factors can help you make informed decisions when choosing an insurance policy.

Navigating Florida’s Unique Insurance Challenges

Florida presents several unique challenges when it comes to auto insurance. One of the most notable is the prevalence of uninsured drivers. Florida has one of the highest rates of uninsured motorists in the US, which can pose significant risks for insured drivers. To protect yourself, it’s advisable to consider purchasing Uninsured Motorist (UM) coverage, which provides compensation if you’re involved in an accident with an uninsured driver.

Additionally, Florida's tropical climate and hurricane season bring their own set of insurance considerations. While comprehensive coverage typically includes damage from storms and natural disasters, it's essential to review your policy carefully to understand the specific coverage provided. For those living in high-risk areas, it might be beneficial to explore additional coverage options.

Maximizing Your Auto Insurance Coverage

While meeting the state’s minimum insurance requirements is essential, it’s equally important to ensure you have adequate coverage to protect yourself and your assets. Here are some strategies to consider when maximizing your auto insurance coverage in Florida:

Understanding Your Coverage Needs

Before selecting an insurance policy, assess your specific needs. Consider factors such as the value of your vehicle, your financial situation, and your personal risk tolerance. For instance, if you own a high-end vehicle, you’ll want to ensure it’s adequately covered in the event of theft or damage. Similarly, if you have significant assets, you might want to explore higher liability limits to protect your finances in the event of a serious accident.

Comparing Insurance Providers

Florida has a competitive insurance market, which can work to your advantage. Compare quotes from multiple providers to find the best coverage at the most competitive rates. When comparing, pay attention to the specific coverage offered, as well as the reputation and financial stability of the insurance company. Online tools and insurance comparison websites can simplify this process.

Exploring Additional Coverages

Beyond the state-mandated minimums, there are several additional coverages you might want to consider:

- Collision Coverage: Pays for damage to your vehicle in the event of an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides compensation if you’re involved in an accident with a driver who has little or no insurance.

- Rental Car Coverage: Covers the cost of renting a vehicle if your car is being repaired due to an insured loss.

- Medical Payments Coverage: Provides additional medical expense coverage for you and your passengers, regardless of fault.

Each of these coverages can add significant value to your policy, but it's important to carefully weigh the cost against the potential benefits.

Discounts and Savings

Insurance providers often offer discounts to policyholders. Some common discounts include:

- Safe Driver Discount: For drivers with a clean record, this discount can significantly reduce premiums.

- Multi-Policy Discount: If you bundle your auto insurance with other policies, such as homeowners or renters insurance, you might be eligible for a discount.

- Advanced Safety Features Discount: Vehicles equipped with advanced safety features, such as lane departure warnings or automatic emergency braking, may qualify for reduced rates.

- Loyalty Discount: Many providers offer discounts to long-term customers.

Be sure to inquire about these discounts when shopping for insurance to maximize your savings.

Staying Informed and Protected

Navigating Florida’s auto insurance landscape requires staying informed and proactive. Regularly review your policy to ensure it aligns with your current needs and circumstances. Keep an eye on your credit score and driving record, as improvements in these areas can lead to reduced premiums. Additionally, stay updated on any changes to Florida’s insurance regulations, as these can impact your coverage and costs.

Future Trends and Innovations

The auto insurance industry is evolving rapidly, and Florida is no exception. As technology advances, we can expect to see the following trends shaping the industry:

- Telematics and Usage-Based Insurance (UBI): With the rise of connected cars and telematics, insurance providers can offer policies based on individual driving behavior. UBI policies can provide personalized rates, rewarding safe drivers with lower premiums.

- Digital Transformation: Insurance companies are increasingly moving towards digital platforms, offering online quote comparisons, policy management, and claims filing. This shift can simplify the insurance process and make it more accessible.

- Enhanced Data Analytics: Advanced data analytics can help insurance providers more accurately assess risk, leading to fairer and more personalized premiums.

Staying informed about these trends can help you leverage new opportunities and ensure you're getting the most value from your auto insurance coverage.

| Coverage Type | Description |

|---|---|

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for policyholders and passengers, up to $10,000. |

| Property Damage Liability (PDL) | Covers damages to another person's property caused by the policyholder's vehicle, with a minimum requirement of $10,000. |

| Collision Coverage | Pays for damage to the policyholder's vehicle in the event of an accident, regardless of fault. |

| Comprehensive Coverage | Covers non-collision events like theft, vandalism, fire, or natural disasters. |

How often should I review my auto insurance policy in Florida?

+It’s recommended to review your policy annually, or whenever your circumstances change significantly. This ensures your coverage remains aligned with your needs.

Can I get auto insurance if I have a poor credit score in Florida?

+Yes, but a poor credit score can lead to higher premiums. Consider working on improving your credit score to potentially reduce your insurance costs.

What should I do if I’m involved in an accident in Florida?

+First, ensure the safety of all involved. Exchange insurance information with the other driver(s) and document the scene with photos if possible. Then, promptly report the accident to your insurance company and follow their guidance on filing a claim.