Insurance Florida Car

When it comes to navigating the complex world of insurance, especially in the sunny state of Florida, having a comprehensive understanding of car insurance policies is crucial. Florida is known for its unique insurance landscape, and ensuring you have the right coverage can be a daunting task. This guide aims to provide an in-depth analysis of car insurance in Florida, covering everything from mandatory requirements to optional add-ons, and offering expert insights to help you make informed decisions.

Understanding the Basics of Florida Car Insurance

Florida is a no-fault state, which means that regardless of who is at fault in an accident, your own insurance policy will be the primary source of coverage for your damages and injuries. This is known as Personal Injury Protection (PIP) coverage. However, Florida also has a unique additional requirement: Property Damage Liability (PDL) coverage.

Personal Injury Protection (PIP) Coverage

PIP coverage is mandatory in Florida and is designed to cover your medical expenses and a portion of your lost wages if you are involved in an accident. It provides up to $10,000 in coverage, which can be used for various medical treatments and even alternative therapies like acupuncture. This coverage is essential, as it ensures you have immediate access to funds for your recovery, regardless of who caused the accident.

Here's a breakdown of what PIP coverage typically includes:

- 80% of all reasonable and necessary medical expenses.

- 60% of lost wages, up to a maximum of $10,000.

- Replacement services, such as childcare or house cleaning, up to $10,000.

- Death benefits of up to $5,000.

Property Damage Liability (PDL) Coverage

PDL coverage is another mandatory component of Florida car insurance. It is designed to protect you financially if your vehicle causes damage to someone else's property, such as another car, a fence, or a building. The minimum required coverage is $10,000, which may not be sufficient for more extensive damages. Consider increasing this coverage to ensure you are adequately protected.

Additional Coverages and Optional Add-Ons

While PIP and PDL are the mandatory coverages in Florida, there are several other important aspects to consider when customizing your car insurance policy:

Bodily Injury Liability Coverage

This coverage protects you if you cause an accident that results in injuries to others. It covers medical expenses, lost wages, and pain and suffering for the injured parties. The minimum required limit is 10,000 per person and 20,000 per accident, but it is often recommended to increase these limits to provide better protection.

Uninsured/Underinsured Motorist Coverage

Despite Florida’s laws, there are drivers on the road who do not carry adequate insurance. Uninsured/Underinsured Motorist coverage steps in to protect you if you are involved in an accident with an uninsured or underinsured driver. This coverage pays for your medical expenses, lost wages, and other damages that would typically be covered by the at-fault driver’s insurance.

Collision and Comprehensive Coverage

Collision coverage protects your vehicle if you are involved in an accident, regardless of fault. It covers repairs or replacement costs if your car is damaged. Comprehensive coverage, on the other hand, protects against non-accident-related incidents, such as theft, vandalism, natural disasters, or damage caused by animals. Both of these coverages are optional but highly recommended to ensure your vehicle is fully protected.

Rental Car Reimbursement

If your car is being repaired after an insured accident, rental car reimbursement coverage provides you with a rental vehicle while your car is in the shop. This coverage can be a lifesaver, especially in a state like Florida where car ownership is a necessity.

Roadside Assistance

Roadside assistance coverage offers peace of mind by providing services such as towing, flat tire changes, jump-starts, and fuel delivery. This optional coverage can be a valuable addition, especially for those who frequently travel long distances.

The Importance of Shopping Around and Comparing Quotes

Florida’s car insurance market is highly competitive, and rates can vary significantly between providers. It’s essential to shop around and compare quotes to ensure you’re getting the best coverage at the most competitive price. Consider using online comparison tools or consulting with an independent insurance agent who can offer a wide range of options.

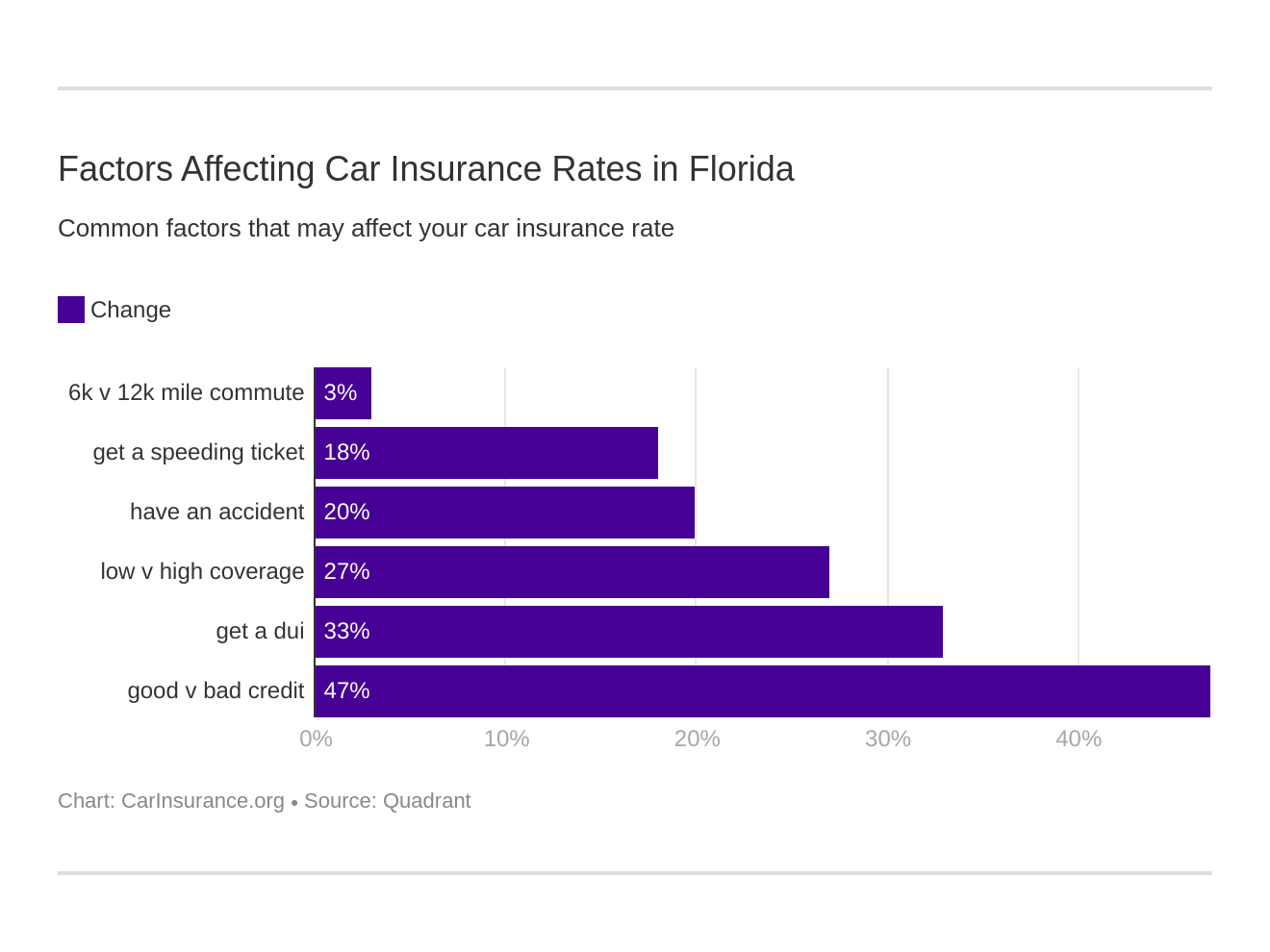

Factors Affecting Insurance Rates in Florida

Several factors influence car insurance rates in Florida. These include your age, gender, driving record, the make and model of your vehicle, and your credit score. Additionally, the insurance provider and the specific coverage options you choose will impact your premium.

To give you an idea, here's a table showcasing average car insurance rates in Florida for different driver profiles:

| Driver Profile | Average Annual Premium |

|---|---|

| Male, Age 25, Clean Record | $1,500 |

| Female, Age 35, Clean Record | $1,200 |

| Male, Age 50, Clean Record | $900 |

| Female, Age 60, Clean Record | $800 |

It's important to note that these are just averages, and your actual premium may be higher or lower depending on your individual circumstances.

Expert Tips for Lowering Your Insurance Premiums

While car insurance is a necessary expense, there are strategies you can employ to potentially lower your premiums. Here are some expert tips to consider:

Bundling Policies

If you have multiple insurance needs, such as home, life, or health insurance, consider bundling these policies with your car insurance. Many providers offer discounts when you insure multiple aspects of your life with them.

Safe Driving Habits

Maintaining a clean driving record is crucial. Avoid speeding, driving under the influence, and engaging in aggressive driving behaviors. These habits not only keep you and others safe on the road but also help keep your insurance premiums low.

Increase Your Deductible

Opting for a higher deductible can reduce your premium. A deductible is the amount you pay out of pocket before your insurance kicks in. By increasing this amount, you take on more financial responsibility, which can result in lower premiums.

Discounts and Rewards

Many insurance providers offer discounts for various reasons. These can include safe driving, good student discounts, loyalty rewards, and even discounts for certain professions or membership organizations. Be sure to inquire about available discounts when shopping for insurance.

Maintain a Good Credit Score

Insurance providers often consider your credit score when determining your premium. Maintaining a good credit score can lead to lower insurance rates. If you have a less-than-perfect credit score, consider taking steps to improve it, such as paying bills on time and reducing your overall debt.

Future Implications and Emerging Trends in Florida Car Insurance

The car insurance landscape in Florida is continually evolving, with new technologies and regulatory changes shaping the industry. Here are some key trends and potential future implications to consider:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining popularity in the insurance industry. Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, offer discounts to drivers who exhibit safe driving behaviors. These programs could potentially reward Florida drivers for their safe driving habits, leading to lower insurance premiums.

Autonomous Vehicles and Liability Shifts

As autonomous vehicles become more prevalent, the question of liability in accidents shifts. Insurance providers are already considering how to adapt their policies to cover these new technologies. Florida, with its diverse road network and weather conditions, could be at the forefront of these liability shifts, impacting insurance coverage and premiums.

Natural Disaster Coverage

Florida is known for its tropical storms and hurricanes, which can cause significant property damage. While comprehensive coverage typically includes damage from these events, it’s important to understand the specific terms and limitations of your policy. As extreme weather events become more frequent, insurance providers may adjust their coverage and pricing structures to account for these risks.

Consumer Empowerment through Digital Tools

The rise of digital insurance platforms and comparison websites empowers consumers to make more informed decisions about their car insurance. These tools allow Florida residents to easily compare policies, providers, and prices, ensuring they get the best value for their insurance needs.

In Conclusion

Understanding the intricacies of car insurance in Florida is crucial for ensuring you have the right coverage at the best price. By familiarizing yourself with the mandatory requirements, exploring optional add-ons, and employing expert strategies to lower your premiums, you can navigate the Florida insurance landscape with confidence. As the industry continues to evolve, staying informed about emerging trends and potential future implications will help you make smart decisions to protect yourself and your vehicle.

What is the minimum car insurance coverage required in Florida?

+The minimum car insurance coverage required in Florida includes Personal Injury Protection (PIP) with a limit of 10,000 and Property Damage Liability (PDL) with a limit of 10,000.

How much does car insurance typically cost in Florida?

+The cost of car insurance in Florida can vary significantly based on individual factors. On average, drivers in Florida can expect to pay between 900 and 1,500 per year for basic coverage. However, rates can be higher or lower depending on various factors such as age, driving record, and vehicle type.

Can I get car insurance without a driver’s license in Florida?

+No, you typically need a valid driver’s license to purchase car insurance in Florida. Insurance providers require proof of a valid license as part of the application process.

Are there any discounts available for Florida car insurance?

+Yes, there are several discounts available for Florida car insurance. These can include safe driver discounts, good student discounts, multi-policy discounts, loyalty rewards, and discounts for certain professions or membership organizations. It’s worth shopping around and inquiring about available discounts to potentially lower your premiums.

What should I do if I’m involved in an accident in Florida?

+If you’re involved in an accident in Florida, it’s important to stay calm and follow these steps: first, ensure the safety of yourself and others involved; call the police to report the accident; exchange contact and insurance information with the other driver(s); and notify your insurance company as soon as possible. Remember to document the accident scene with photos or videos if possible.