Insurance For Military Families

Ensuring the financial security and peace of mind of military families is a critical aspect of supporting those who serve our country. Military life is filled with unique challenges and uncertainties, and having the right insurance coverage can make a significant difference during times of transition, deployment, or unexpected events. This comprehensive guide explores the world of insurance specifically tailored for military families, offering insights, strategies, and real-world examples to help navigate this essential aspect of financial planning.

Understanding the Unique Insurance Needs of Military Families

Military families face distinct circumstances that set them apart from their civilian counterparts. Frequent relocations, deployments, and the potential for medical emergencies or injuries can create complex insurance requirements. From ensuring continuous healthcare coverage to protecting against property damage during transitions, the insurance landscape for military families is multifaceted.

One of the key challenges is maintaining consistency in coverage. Frequent moves can disrupt standard insurance plans, leaving families vulnerable during critical periods. Additionally, the nature of military service often involves unique risks, such as combat-related injuries or exposures to hazardous materials, which may not be adequately covered by traditional insurance policies.

Tailored Solutions for Military Life

Recognizing these challenges, specialized insurance providers have developed tailored solutions specifically for military families. These plans are designed to offer comprehensive coverage that addresses the unique needs and risks associated with military service. Here’s a closer look at some of the critical aspects:

- Healthcare Coverage: Military families have access to the TRICARE network, which provides comprehensive medical care. However, understanding the intricacies of TRICARE, including eligibility, coverage limits, and out-of-pocket expenses, is essential. Additionally, supplemental health insurance plans can fill gaps in coverage, ensuring access to specialized care or providing financial protection against high-cost procedures.

- Life and Disability Insurance: Life insurance is a critical component of financial planning for military families. It provides a safety net for the family in the event of the service member's death or disability. Specialized life insurance policies for military personnel often offer enhanced benefits, such as waiver of premium features or additional coverage for specific military-related risks.

- Home and Property Insurance: With frequent relocations, military families may need flexible home insurance options. Specialized policies can provide coverage during transitions, ensuring protection even when a home is temporarily vacant. Additionally, these policies often include enhanced coverage for specific risks, such as damage during deployment or protection against identity theft.

- Auto Insurance: Military personnel often require unique auto insurance coverage, especially when deploying to high-risk areas. Specialized policies can provide additional liability protection, coverage for vehicle storage during deployment, and even assistance with vehicle maintenance or repairs.

The Role of the Military in Providing Insurance Benefits

The military plays a pivotal role in supporting its members and their families by offering a range of insurance benefits. These benefits are designed to address the specific needs and challenges faced by those in service. Here’s an overview of some of the key insurance programs provided by the military:

Servicemembers Group Life Insurance (SGLI)

SGLI is a low-cost group life insurance program offered to active-duty service members, reservists, and National Guard members. It provides up to $400,000 in coverage, with the option to purchase additional insurance through the Family SGLI (FSGLI) program. SGLI is a critical component of financial planning for military families, offering a safety net in the event of a service member’s death.

Uniformed Services Beneficiary Association (USBA)

The USBA is a non-profit association that provides a range of insurance and financial services to military members and their families. They offer competitive life insurance policies, as well as dental, vision, and hearing coverage. Additionally, the USBA provides specialized insurance plans for specific military branches, ensuring tailored coverage for unique needs.

Military Service and Veteran’s Group Life Insurance (MSVGLI)

MSVGLI is a continuation of SGLI coverage for veterans who have left active service. It allows veterans to maintain their life insurance coverage after their military career, providing ongoing protection for themselves and their families. MSVGLI is particularly valuable for veterans who may face challenges in obtaining traditional life insurance due to age or health conditions.

Military Installations and Family Support

Military installations often have dedicated Family Support Centers that provide resources and assistance for a range of needs, including insurance. These centers can offer guidance on understanding and maximizing insurance benefits, helping military families make informed decisions about their coverage. Additionally, they may host workshops or events focused on financial planning and insurance, providing valuable education and support.

Maximizing Insurance Benefits: Strategies and Tips

Navigating the world of insurance as a military family can be complex, but with the right strategies and insights, it’s possible to maximize benefits and ensure comprehensive coverage. Here are some expert tips and best practices:

Regularly Review and Update Insurance Policies

Life is constantly changing, especially for military families. Regularly reviewing insurance policies ensures that coverage remains aligned with current needs. Factors such as deployment, relocation, or changes in family composition (e.g., marriage, birth of a child) can impact insurance requirements. Staying proactive and updating policies accordingly is crucial to maintaining adequate protection.

Utilize Military-Specific Insurance Providers

As mentioned earlier, specialized insurance providers offer tailored plans that cater to the unique needs of military families. These providers often have a deep understanding of military culture and the specific risks associated with service. By working with military-specific insurers, families can access comprehensive coverage and benefit from expert guidance.

Understand and Leverage Military Insurance Programs

The military provides a range of insurance benefits, and understanding these programs is essential. From SGLI to MSVGLI, each program offers specific advantages. By familiarizing themselves with these benefits, military families can make informed decisions about their insurance coverage, ensuring they maximize the protections available to them.

Seek Professional Guidance

Insurance can be complex, and military families may benefit from seeking professional advice. Financial advisors with expertise in military insurance can provide personalized guidance, helping families navigate the complexities of insurance planning. Additionally, legal professionals with military experience can offer insights into the legal aspects of insurance, ensuring families are adequately protected.

Stay Informed About Insurance Innovations

The insurance industry is constantly evolving, and keeping up with the latest innovations can benefit military families. From new coverage options to digital tools for managing policies, staying informed ensures families can take advantage of the most advanced insurance solutions. Subscribing to industry newsletters, following reputable insurance blogs, or attending webinars focused on military insurance can provide valuable insights.

Case Studies: Real-World Examples of Military Family Insurance Success

Understanding the theoretical aspects of insurance is important, but seeing how these principles play out in real-life scenarios can provide valuable context. Here are a few case studies showcasing how military families have successfully navigated their insurance journeys:

Case Study 1: Healthcare Coverage During Deployment

Sarah, an active-duty Air Force member, was deployed to a remote location for an extended period. Prior to her deployment, she worked with a military insurance specialist to ensure her healthcare coverage remained uninterrupted. They reviewed her TRICARE coverage and identified gaps, particularly regarding specialty care. Sarah then purchased a supplemental health insurance plan that provided access to specialized medical services during her deployment, ensuring she received the care she needed despite her remote location.

Case Study 2: Protecting Against Property Damage During Transition

John, a Navy veteran, was in the process of relocating from one base to another when a severe storm damaged his home. Fortunately, he had taken the proactive step of purchasing specialized home insurance for military families. This policy provided comprehensive coverage during the transition period, including protection against storm damage. John was able to make the necessary repairs and continue his move without significant financial burden.

Case Study 3: Life Insurance for Peace of Mind

Emily, a spouse of an Army officer, recognized the importance of life insurance for her family’s financial security. She worked with a financial advisor who specialized in military insurance to understand her options. Together, they crafted a life insurance plan that provided substantial coverage for her family in the event of her husband’s death. This plan included a waiver of premium feature, ensuring the policy remained in force even if her husband’s service ended.

Conclusion: Empowering Military Families Through Insurance

Insurance is a powerful tool for military families, offering financial security and peace of mind during the unique challenges of military life. By understanding their insurance needs, leveraging specialized providers, and maximizing the benefits offered by the military, families can navigate the complexities of insurance with confidence. With the right coverage in place, military families can focus on what matters most: serving their country and building a secure future.

What is the best insurance for military families?

+The best insurance for military families is tailored to their unique needs. This includes comprehensive healthcare coverage through programs like TRICARE, specialized life insurance plans with enhanced benefits, and flexible home insurance policies that accommodate frequent relocations. Additionally, auto insurance plans that offer coverage for deployments and vehicle storage can be beneficial.

How do I choose the right insurance provider for my military family?

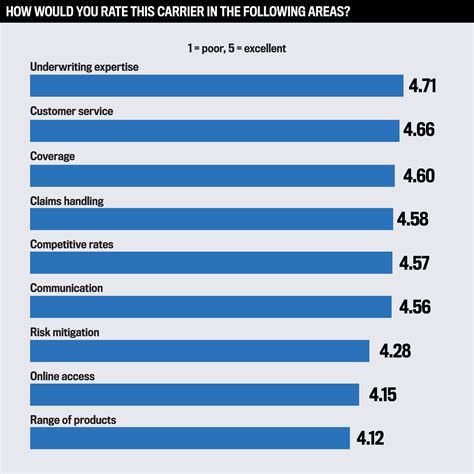

+Choosing the right insurance provider involves researching and comparing options. Look for providers with a strong reputation and experience in serving military families. Consider their range of products, including specialized policies for military personnel. Read reviews and seek recommendations from fellow military families. Finally, ensure the provider offers clear and transparent pricing, as well as excellent customer service.

What are the key insurance programs offered by the military?

+The military offers several key insurance programs, including Servicemembers Group Life Insurance (SGLI), which provides low-cost life insurance coverage, and the Uniformed Services Beneficiary Association (USBA), which offers a range of insurance and financial services. Additionally, the Military Service and Veteran’s Group Life Insurance (MSVGLI) program allows veterans to continue their life insurance coverage after leaving active service.

How can I maximize my insurance benefits as a military family?

+Maximizing insurance benefits involves regular reviews and updates to your policies. Stay informed about your options and leverage military-specific insurance providers who understand your unique needs. Utilize the insurance programs offered by the military, such as SGLI and USBA. Seek professional guidance from financial advisors and legal professionals with military experience. Stay up-to-date with insurance innovations to access the latest coverage options.