Insurance Homeowners Quote

Securing the right homeowners insurance is crucial to protecting your home and belongings, yet the process can be complex and daunting. With numerous options and factors to consider, it's essential to approach the task with knowledge and strategy. This comprehensive guide aims to demystify the process, offering insights and tips to help you obtain the best insurance quote for your unique needs.

Understanding Homeowners Insurance: More Than Just a Quote

Homeowners insurance is a contract between you and an insurance company, providing financial protection for your home and its contents. It’s a vital investment for homeowners, offering peace of mind and coverage for various risks and liabilities. However, obtaining a quote is just the first step; understanding the intricacies of homeowners insurance is key to making an informed decision.

Homeowners insurance policies typically include coverage for the dwelling itself, personal property, liability, and additional living expenses if you're displaced due to a covered incident. The coverage limits and deductibles you choose, along with the specific policy provisions, will determine the cost of your premium.

Let's delve into the key components of a homeowners insurance policy and explore how they impact your quote and overall coverage.

Dwelling Coverage

This coverage is the cornerstone of your policy, protecting the physical structure of your home. It’s essential to ensure that your dwelling coverage limit aligns with the current replacement cost of your home, which may differ from your home’s market value. An accurate assessment of your home’s replacement cost will help you avoid underinsurance, ensuring you can rebuild your home if it’s destroyed.

Factors influencing your dwelling coverage quote include the age, size, and construction materials of your home, as well as its location and any special features or upgrades. For instance, a home with a unique architectural design or specialized construction may incur higher replacement costs, impacting your quote.

| Dwelling Coverage Considerations | Impact on Quote |

|---|---|

| Home's Age | Older homes may require additional endorsements or specialized policies to cover unique construction methods or outdated materials. |

| Home's Size | Larger homes generally require higher coverage limits and may result in a higher premium. |

| Construction Materials | Homes built with fire-resistant materials or those that meet modern building codes may qualify for discounts or reduced premiums. |

Personal Property Coverage

Personal property coverage safeguards your belongings against perils such as theft, fire, and natural disasters. This coverage is typically an extension of your dwelling coverage, with the limit representing a percentage of your dwelling coverage (often 50% to 70%). However, it’s important to note that high-value items like jewelry, artwork, or electronics may require additional coverage or endorsements.

When assessing your personal property coverage needs, consider the replacement cost of your belongings. Regularly updating your home inventory can help you accurately assess your coverage requirements and ensure you're not underinsured.

Liability Coverage

Liability coverage is a vital aspect of homeowners insurance, protecting you against lawsuits and claims arising from accidents or injuries that occur on your property. This coverage can help cover medical expenses, legal fees, and potential settlements or judgments against you. It’s essential to ensure your liability coverage limit is sufficient to protect your assets.

The amount of liability coverage you require depends on your unique circumstances, including the value of your assets and your risk tolerance. Experts often recommend carrying liability coverage of at least $1 million, as lawsuits can quickly exceed lower limits.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, additional living expenses coverage steps in to cover the cost of temporary housing and other necessary expenses. This coverage is crucial to ensuring you have a place to stay and can maintain your daily routine while your home is being repaired or rebuilt.

When selecting your additional living expenses coverage limit, consider the cost of temporary housing in your area and the potential duration of repairs. A limit that covers at least 20% of your dwelling coverage is often recommended.

Factors Influencing Your Homeowners Insurance Quote

Beyond the coverage components, several other factors come into play when obtaining a homeowners insurance quote. Understanding these factors can help you navigate the process and potentially reduce your premium.

Your Location

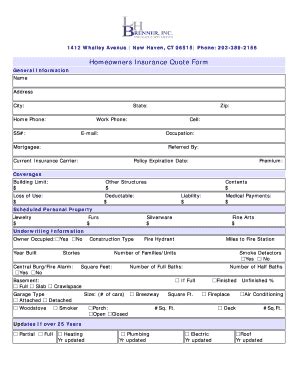

Where you live significantly impacts your homeowners insurance quote. Factors such as crime rates, natural disaster risks, and proximity to fire stations and hydrants can all influence your premium. For instance, areas prone to hurricanes, wildfires, or earthquakes may carry higher insurance costs.

When obtaining quotes, compare rates from multiple insurers to ensure you're getting the best deal for your location. Additionally, consider taking proactive measures to mitigate risks, such as installing security systems or making your home more resilient to natural disasters.

Your Home’s Construction and Age

The construction and age of your home play a pivotal role in determining your insurance quote. Older homes may require more maintenance and repairs, potentially leading to higher insurance costs. Similarly, homes with outdated electrical or plumbing systems may pose a higher risk of fire or water damage, impacting your premium.

Investing in home upgrades, such as modernizing your electrical or plumbing systems, can not only enhance your home's functionality and value but also potentially reduce your insurance costs. Insurers often offer discounts for homes with updated safety features.

Your Claims History

Your claims history is a critical factor in determining your homeowners insurance quote. Insurers closely examine your claims record, as frequent claims can suggest a higher risk of future losses. Consequently, a history of multiple claims may lead to higher premiums or even difficulty finding an insurer willing to cover you.

It's essential to strike a balance between protecting your assets and avoiding excessive claims. Only file claims for significant losses, and consider your deductible amount when deciding whether to file a claim. A higher deductible can lower your premium but may require you to pay more out of pocket when a claim is made.

Your Credit Score

Your credit score is another factor that insurers consider when providing a homeowners insurance quote. A higher credit score generally indicates a lower risk to the insurer, which can result in a lower premium. Conversely, a lower credit score may lead to a higher premium or even difficulty finding an insurer willing to cover you.

Improving your credit score can not only benefit your financial health but also potentially reduce your insurance costs. Regularly monitor your credit report and take steps to improve your score, such as paying bills on time, reducing credit card balances, and correcting any errors on your report.

Strategies for Obtaining the Best Homeowners Insurance Quote

Now that we’ve explored the key components and influencing factors, let’s delve into some strategies to help you obtain the best homeowners insurance quote for your needs.

Shop Around

Obtaining multiple quotes is essential to finding the best deal. Compare rates from various insurers, including traditional carriers, online providers, and local mutual companies. Each insurer has its own underwriting guidelines and pricing structures, so shopping around can reveal significant variations in premiums.

Utilize online quote tools and independent insurance agents to streamline the comparison process. Online tools can provide quick, preliminary quotes, while independent agents can offer personalized guidance and access to multiple insurers.

Bundle Your Policies

Bundling your insurance policies, such as combining your homeowners and auto insurance, can often lead to substantial savings. Insurers typically offer discounts when you bundle policies, as it reduces their administrative costs and increases your loyalty.

When shopping for homeowners insurance, inquire about bundling discounts and consider the overall value of the bundle. Ensure that the bundled policies meet your unique needs and provide adequate coverage.

Choose a Higher Deductible

Selecting a higher deductible can lower your premium, as it reduces the insurer’s potential liability. However, it’s important to choose a deductible amount that you can comfortably afford in the event of a claim. A higher deductible may make sense if you have significant savings or an emergency fund to cover potential out-of-pocket expenses.

Remember, while a higher deductible can save you money on your premium, it also means you'll pay more out of pocket when a claim is made. Assess your financial situation and risk tolerance to determine the deductible amount that's right for you.

Make Your Home More Insurable

Taking steps to make your home more insurable can potentially reduce your insurance costs. This may include investing in home upgrades to enhance safety and security, such as installing smoke detectors, fire extinguishers, and burglar alarms. Upgrading your home’s electrical and plumbing systems can also reduce the risk of fires and water damage.

Additionally, maintaining your home's exterior and ensuring proper maintenance of its systems can demonstrate responsible homeownership and potentially lead to lower insurance costs. Regularly inspect and maintain your roof, gutters, and foundation to prevent water damage and structural issues.

Seek Out Discounts

Insurers often offer various discounts to policyholders. These may include discounts for loyalty, multi-policy bundles, safety features, and more. When obtaining quotes, inquire about all available discounts and ensure you’re taking advantage of any applicable savings.

Common homeowners insurance discounts include:

- Loyalty Discounts: Insurers often reward long-term customers with loyalty discounts.

- Multi-Policy Discounts: Bundling your homeowners insurance with other policies, such as auto insurance, can result in significant savings.

- Safety Features Discounts: Installing safety features like smoke detectors, burglar alarms, and sprinkler systems can qualify you for discounts.

- Claim-Free Discounts: Insurers may offer discounts to policyholders who haven't made claims in a certain period.

- Homeowners Association Discounts: If you live in a community with a homeowners association, you may be eligible for discounts.

The Future of Homeowners Insurance

The homeowners insurance landscape is evolving, with technological advancements and changing consumer expectations driving innovation. As the industry adapts, several trends and developments are shaping the future of homeowners insurance.

Digital Transformation

The digital revolution has transformed the insurance industry, making it more efficient and customer-centric. Online quote tools, digital policy management, and mobile apps are becoming standard, offering convenience and ease of access to policyholders.

Additionally, the use of artificial intelligence and machine learning is enhancing risk assessment and claims processing. Insurers are leveraging data analytics to identify trends and potential risks, enabling more accurate underwriting and pricing.

Personalized Coverage

As consumers become more discerning, insurers are adapting by offering personalized coverage options. This trend allows policyholders to customize their policies to better suit their unique needs and preferences.

Personalized coverage may include tailored coverage limits, optional endorsements, and flexible payment options. By offering more customizable policies, insurers can better meet the diverse needs of their customers.

Sustainable Practices

With growing environmental awareness, insurers are increasingly embracing sustainable practices. This trend includes offering incentives and discounts for policyholders who adopt green initiatives, such as installing solar panels or using energy-efficient appliances.

Insurers are also investing in research and development to mitigate the risks associated with climate change, such as developing more resilient construction materials and improving disaster response capabilities.

Enhanced Claims Management

The claims process is a critical aspect of homeowners insurance, and insurers are continually striving to improve efficiency and customer satisfaction. This includes implementing streamlined claims processes, utilizing advanced technology for faster assessments, and offering more flexible payment options.

Additionally, insurers are investing in customer education and outreach to help policyholders better understand their coverage and navigate the claims process. This proactive approach can help reduce misunderstandings and expedite claims resolution.

FAQs

How often should I review my homeowners insurance policy?

+It’s recommended to review your homeowners insurance policy annually or whenever your circumstances change significantly. Regular reviews ensure that your coverage remains adequate and aligned with your needs. Factors such as home renovations, significant purchases, or life changes (e.g., marriage, birth of a child) may warrant adjustments to your policy.

What should I do if I receive a homeowners insurance quote that’s significantly higher than my current premium?

+If you receive a quote that’s notably higher than your current premium, it’s important to investigate the reasons behind the increase. It could be due to changes in your home’s value, location-based risks, or your claims history. Contact your insurer or a trusted insurance agent to discuss the quote and explore options for reducing your premium.

How can I improve my chances of obtaining a lower homeowners insurance quote?

+To improve your chances of obtaining a lower homeowners insurance quote, focus on making your home more insurable. This may involve investing in home upgrades, such as modernizing electrical or plumbing systems, installing safety features, and maintaining your home’s exterior. Additionally, maintain a good credit score and explore bundling discounts by combining your insurance policies.