Insurance In Us

Insurance is a cornerstone of financial security and risk management, playing a pivotal role in the lives of millions across the United States. From safeguarding homes and vehicles to protecting health and providing peace of mind, the insurance industry is a multifaceted and indispensable part of modern life. In this comprehensive exploration, we delve into the intricate world of insurance, uncovering its history, evolution, and the myriad ways it impacts individuals, businesses, and the economy.

The Evolution of Insurance: A Historical Perspective

The concept of insurance, rooted in the ancient civilizations of China, Babylon, and Greece, has evolved over millennia. In its earliest forms, insurance was a means to mitigate the risks associated with trade and commerce, with merchants pooling resources to protect against losses. This ancient practice laid the foundation for the modern insurance industry, which has grown exponentially in complexity and reach.

The United States, with its diverse landscapes and dynamic economic landscape, has played a significant role in shaping the global insurance market. The country's history of innovation and entrepreneurship has fostered a highly competitive insurance sector, offering a vast array of products and services to meet the diverse needs of its population.

Key Milestones in US Insurance History

- 1732: The Philadelphia Contributionship, one of the first property insurance companies in the US, was founded by Benjamin Franklin. This company pioneered the concept of mutual insurance, where policyholders shared in the profits and losses of the company.

- 1837: The New York Life Insurance Company was established, marking a significant step towards the development of life insurance in the US. Life insurance became an increasingly popular tool for wealth transfer and estate planning.

- 1935: The Social Security Act was enacted, establishing a national social insurance program. This marked a pivotal moment in the history of social insurance, providing a safety net for millions of Americans.

- 1944: The National Association of Insurance Commissioners (NAIC) was formed, serving as a vital regulatory body for the insurance industry. The NAIC’s mission is to promote and protect the public interest through comprehensive regulation and supervision of the industry.

- 1965: Medicare and Medicaid were introduced as part of the Social Security Amendments. These programs revolutionized healthcare insurance, providing coverage for millions of seniors and low-income individuals.

The Landscape of Insurance in the US

The insurance industry in the US is characterized by its diversity and complexity. It encompasses a wide range of sectors, each with its own unique challenges and opportunities. From property and casualty insurance to health, life, and specialty lines, the industry caters to a vast array of needs.

Property and Casualty Insurance

Property and casualty insurance, often referred to as P&C insurance, is a cornerstone of the industry. It provides coverage for a wide range of risks, including damage to property, theft, and liability. This segment of the industry is highly competitive, with a large number of insurers offering a variety of products and services.

| Insurance Type | Key Metrics |

|---|---|

| Homeowners Insurance | Covers structural damage, theft, and liability for homeowners. |

| Auto Insurance | Mandated in most states, auto insurance covers vehicle damage, liability, and personal injury. |

| Business Insurance | Caters to the diverse needs of businesses, offering protection against property damage, liability, and business interruption. |

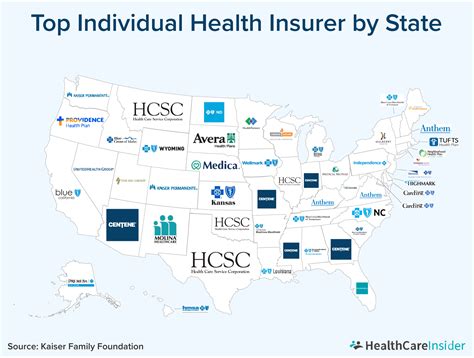

Health Insurance

Health insurance is a critical component of the US healthcare system, providing financial protection against the costs of medical care. With the implementation of the Affordable Care Act (ACA) in 2010, the landscape of health insurance has undergone significant changes, increasing access to coverage for millions of Americans.

- Key Health Insurance Statistics:

- The number of uninsured Americans has decreased significantly since the implementation of the ACA, with over 20 million more people gaining coverage.

- The average annual cost of employer-sponsored health insurance has risen steadily, reaching an average of $22,221 for family coverage in 2023.

Life Insurance

Life insurance is a vital tool for financial planning, offering protection and peace of mind to individuals and their families. It provides a financial safety net in the event of the policyholder’s death, ensuring that their loved ones are taken care of.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Offers coverage for a specified period, typically 10-30 years. It is affordable and ideal for covering short-term needs like mortgage payments or child's education. |

| Whole Life Insurance | Provides coverage for the entire life of the policyholder. It accumulates cash value over time, which can be borrowed against or withdrawn. |

Specialty Lines

The specialty lines of insurance cater to unique and specialized risks. These lines include professional liability insurance, which protects professionals against negligence claims, and cyber insurance, which provides coverage for cyber attacks and data breaches.

Regulatory Framework: Ensuring Consumer Protection

The insurance industry in the US is highly regulated, with a complex network of state and federal laws and regulations. This regulatory framework is designed to protect consumers, ensure financial stability, and promote fair competition.

Key Regulatory Bodies

- National Association of Insurance Commissioners (NAIC): As mentioned earlier, the NAIC plays a critical role in regulating the industry. It develops model laws and regulations, promotes uniformity across states, and provides oversight and guidance to state insurance departments.

- Federal Insurance Office (FIO): Established under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the FIO monitors the insurance industry and makes recommendations to Congress and other federal regulators.

- State Insurance Departments: Each state has its own insurance department, responsible for regulating insurance within its borders. These departments issue licenses to insurers, oversee market conduct, and ensure compliance with state laws.

Regulatory Challenges and Future Outlook

The insurance industry faces ongoing regulatory challenges, particularly in the wake of technological advancements and changing consumer expectations. The rise of digital insurance and the increasing use of data analytics have prompted regulators to adapt their frameworks to ensure consumer protection and market integrity.

Looking ahead, the insurance industry is poised for continued growth and innovation. With the increasing complexity of risks and the evolving needs of consumers, insurers are focused on developing new products and services to meet these demands. The industry is also embracing technological advancements, leveraging data analytics and artificial intelligence to enhance efficiency and improve customer experience.

Conclusion: A Vital Industry, Continually Evolving

The insurance industry in the US is a dynamic and vital sector, playing a critical role in the lives of individuals and the stability of the economy. From its ancient origins to the modern, technologically advanced landscape, insurance has evolved to meet the changing needs of society.

As we navigate an increasingly complex and interconnected world, the insurance industry will continue to adapt and innovate. By staying abreast of emerging risks and leveraging technological advancements, insurers will continue to provide the financial security and peace of mind that millions of Americans rely on.

What is the average cost of health insurance in the US?

+The average cost of health insurance in the US varies widely depending on factors such as age, location, and the level of coverage. According to recent data, the average annual cost of individual health insurance plans in the US is around 5,500, while family plans can cost upwards of 20,000.

How has the Affordable Care Act (ACA) impacted insurance coverage in the US?

+The ACA has had a significant impact on insurance coverage in the US. Since its implementation, the number of uninsured Americans has decreased, with millions gaining access to affordable health insurance. The law introduced various measures to expand coverage, including subsidies for low-income individuals and the establishment of state-based health insurance marketplaces.

What are some emerging trends in the insurance industry?

+The insurance industry is witnessing several emerging trends, including the increasing adoption of digital technologies, the rise of InsurTech startups, and the development of new insurance products to cater to evolving consumer needs. Additionally, the focus on sustainability and environmental risks is leading to the growth of green insurance products.