Insurance Information

In today's complex and dynamic world, understanding the intricacies of insurance is crucial. It plays a pivotal role in our lives, safeguarding us from unforeseen events and providing a safety net during challenging times. This comprehensive guide aims to unravel the complexities of insurance, offering a detailed and expert-level analysis. By exploring various facets, from the fundamental principles to real-world applications, we aim to empower readers with the knowledge to make informed decisions about their insurance needs.

The Fundamentals of Insurance: A Comprehensive Overview

Insurance, at its core, is a financial mechanism designed to mitigate risk. It involves a contract, known as an insurance policy, between an individual or entity (the insured) and an insurance company (the insurer). This contract outlines the specific risks covered, the duration of coverage, and the financial terms, including premiums and potential payouts.

The concept of insurance is rooted in the principle of risk sharing. By pooling resources from a large group of individuals, insurance companies can provide financial protection to those who experience covered losses. This collective risk-sharing model ensures that the financial burden of unexpected events is distributed fairly, providing a safety net for policyholders.

Key Components of an Insurance Policy

An insurance policy is a legally binding document that details the rights and responsibilities of both the insured and the insurer. Here are some essential components to understand:

- Coverage: This specifies the types of risks or events that the policy covers. For instance, a health insurance policy may cover medical expenses, while a property insurance policy might cover damage caused by natural disasters.

- Premiums: The insured pays a regular premium, typically monthly or annually, to the insurer. This premium is determined based on various factors, including the type of coverage, the level of risk, and the insured's personal circumstances.

- Deductibles and Co-Payments: These are the amounts the insured must pay out-of-pocket before the insurer covers the rest. Deductibles are typically a fixed amount, while co-payments are a percentage of the claim.

- Policy Limits: Every policy has a maximum amount it will pay out for a covered loss. Exceeding these limits means the insured is responsible for the additional costs.

- Exclusions: These are specific risks or events that the policy does not cover. Understanding exclusions is crucial to avoid surprises when making a claim.

Types of Insurance: Navigating the Options

Insurance is a diverse field, offering various types of coverage to cater to different needs. Here’s an overview of some common insurance categories:

| Type of Insurance | Coverage Overview |

|---|---|

| Health Insurance | Covers medical expenses, including hospital stays, surgeries, and prescriptions. It may also include preventive care and mental health services. |

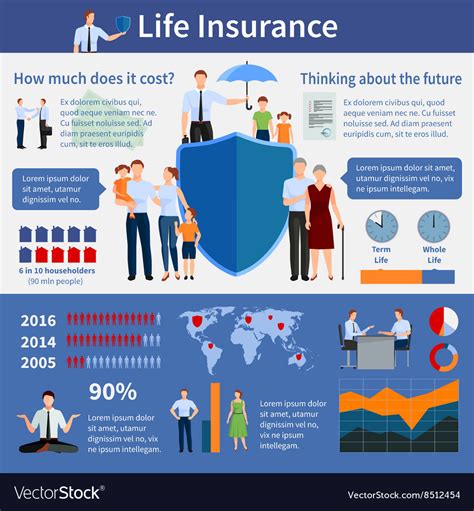

| Life Insurance | Provides financial protection to beneficiaries upon the insured's death. It can include term life insurance, whole life insurance, and universal life insurance. |

| Auto Insurance | Covers damage or theft of vehicles, as well as liability for bodily injury or property damage caused by the insured. |

| Homeowners/Renters Insurance | Protects against damage or loss to a home and its contents, as well as liability for injuries that occur on the property. |

| Business Insurance | Covers a wide range of risks for businesses, including property damage, liability, and business interruption. |

| Travel Insurance | Provides coverage for unexpected events during travel, such as trip cancellations, medical emergencies, or lost luggage. |

| Pet Insurance | Covers veterinary costs for illnesses, injuries, and sometimes routine care for pets. |

The Insurance Industry: A Dynamic Landscape

The insurance industry is a complex and ever-evolving sector, shaped by regulatory frameworks, technological advancements, and changing consumer needs. Understanding this landscape is crucial for both industry professionals and consumers alike.

Regulatory Environment: A Balancing Act

Insurance is highly regulated to protect consumers and ensure fair practices. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Insurance Regulatory and Development Authority (IRDAI) in India, oversee the industry. They set rules on matters like solvency requirements, claim settlement ratios, and consumer protection.

For instance, the FCA in the UK has implemented stringent rules on the presentation of insurance products to ensure consumers are provided with clear and accurate information. Similarly, the IRDAI in India has mandated the use of standardized policy wordings to simplify the understanding of insurance contracts.

Technological Disruption: Transforming the Industry

Technology has revolutionized the insurance sector, making it more efficient and customer-centric. Insurtech, a portmanteau of insurance and technology, refers to the use of innovative technologies to improve various aspects of insurance, from risk assessment to claims processing.

For example, telematics in auto insurance uses sensors and GPS to monitor driving behavior, allowing for more accurate risk assessment and potentially lower premiums for safe drivers. Blockchain technology is also being explored to enhance the security and transparency of insurance transactions, particularly in the settlement of claims.

Consumer Behavior and Changing Trends

Consumer preferences and behaviors are evolving, driven by factors like increased digital literacy and a desire for more personalized services. Today’s consumers expect insurance to be easily accessible, customizable, and digitally integrated.

The rise of on-demand insurance, often referred to as 'pay-as-you-go' or 'usage-based' insurance, is a response to this shift in consumer behavior. This model allows consumers to pay for insurance coverage only when they need it, offering flexibility and cost-efficiency. Additionally, the use of big data analytics enables insurers to offer more tailored products, taking into account an individual's unique circumstances and behaviors.

The Insurance Claim Process: A Step-by-Step Guide

Understanding the insurance claim process is essential to ensure a smooth and timely settlement. While the specifics may vary depending on the type of insurance and the insurer, the general process follows a similar pattern.

Initiating a Claim

The first step is to notify your insurer about the loss or damage. This is typically done by filing a claim form, which can often be done online or over the phone. You will need to provide details about the incident, including the date, time, and circumstances.

For instance, if you've been involved in a car accident, you would need to provide details such as the location, the other driver's information (if applicable), and any relevant witness statements. In the case of a health insurance claim, you would need to provide details of the medical treatment received, including dates and costs.

Claim Assessment and Investigation

Once your claim is received, the insurer will assess it to determine its validity and the extent of coverage. This process may involve an investigation, especially for larger or complex claims. The insurer may request additional information, documents, or even an inspection of the property or vehicle involved.

In the case of a property insurance claim, for example, an adjuster may visit the property to assess the damage. For a life insurance claim, the insurer may require proof of death, such as a death certificate, and may conduct an investigation to ensure the claim is legitimate.

Claim Settlement

If the claim is approved, the insurer will proceed with settlement. This typically involves paying out the agreed-upon amount, either directly to the insured or to a third party, such as a hospital or repair shop. The method of payment may vary, and it’s important to understand your options, whether it’s a direct deposit, a check, or another method.

It's worth noting that the timeline for claim settlement can vary widely. Simple claims may be settled within a few days or weeks, while more complex or disputed claims can take significantly longer. Factors such as the type of insurance, the nature of the claim, and the insurer's workload can all impact the settlement time.

Insurance in Practice: Real-World Scenarios

To truly understand the value of insurance, let’s explore some real-world scenarios where insurance played a critical role.

Case Study: Natural Disaster and Home Insurance

Imagine a family living in a region prone to hurricanes. Despite taking precautions, their home is damaged during a severe storm. Without home insurance, they would be left to cover the costs of repairs themselves, potentially facing financial hardship.

However, with comprehensive home insurance, they can file a claim to cover the costs of repairs. The insurer will assess the damage and, if the policy covers the specific type of damage, provide a payout to help restore the home to its pre-disaster condition. This not only protects the family's financial stability but also provides peace of mind during a stressful time.

Case Study: Medical Emergency and Health Insurance

Consider an individual who experiences a sudden medical emergency, requiring an unexpected hospital stay and surgery. Without health insurance, the costs of these medical services could be prohibitively expensive, potentially leading to financial ruin.

Health insurance, however, can provide coverage for these expenses. The insured would need to provide the insurer with details of the medical treatment received, including invoices and receipts. If the treatment is covered under the policy, the insurer will reimburse the insured for a portion or all of the costs, depending on the policy terms.

The Future of Insurance: Trends and Innovations

The insurance industry is continuously evolving, adapting to new technologies and consumer demands. Here are some trends and innovations that are shaping the future of insurance.

Artificial Intelligence and Machine Learning

AI and machine learning are being leveraged to improve various aspects of insurance, from risk assessment to fraud detection. These technologies can analyze vast amounts of data, identifying patterns and trends that humans might miss. For example, AI can be used to predict natural disasters, helping insurers better assess and manage risk.

Parametric Insurance: A New Approach

Parametric insurance is a novel concept that provides payouts based on the occurrence of a specific event, rather than the actual loss incurred. This type of insurance is particularly useful for events that are difficult to measure, such as natural disasters or extreme weather events. By setting parameters in advance, insurers can provide quick payouts when these events occur, offering a more efficient and predictable claims process.

Collaborative Models: Insurtech Partnerships

Insurtech startups are disrupting the industry with innovative solutions, and established insurers are taking notice. Collaborative models, where insurers partner with Insurtech companies, are becoming increasingly common. These partnerships allow insurers to leverage cutting-edge technologies and digital solutions, enhancing their services and keeping up with consumer expectations.

Environmental and Socially Responsible Insurance

With growing awareness of environmental and social issues, insurance is adapting to offer more sustainable and responsible products. For instance, some insurers are offering green home insurance policies that provide incentives for eco-friendly home improvements. Others are developing policies that support social causes, such as providing coverage for volunteer work or offering discounts for environmentally conscious behaviors.

How do I choose the right insurance policy for my needs?

+Choosing the right insurance policy involves assessing your specific needs and understanding the coverage options available. Consider factors such as the likelihood of potential risks, the financial impact of those risks, and your budget. It's often beneficial to consult with an insurance professional who can guide you through the process and help tailor a policy to your requirements.

What should I do if my claim is denied?

+If your claim is denied, the first step is to understand the reason for the denial. Insurers are required to provide a clear explanation. You can then review your policy to see if the claim was legitimately outside the scope of coverage. If you believe the denial was unfair or incorrect, you can appeal the decision, providing additional evidence or seeking assistance from an insurance advocate or legal professional.

How can I reduce my insurance premiums?

+There are several strategies to reduce insurance premiums. For auto insurance, maintaining a clean driving record and taking defensive driving courses can lead to lower premiums. For home insurance, investing in security measures like alarm systems or fire-resistant roofing can qualify you for discounts. Additionally, bundling multiple policies with the same insurer can often result in cost savings. However, it's important to balance cost savings with adequate coverage.

What is the difference between term life insurance and whole life insurance?

+Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It is often more affordable but only pays out if the insured dies during the term of the policy. Whole life insurance, on the other hand, provides coverage for the insured's entire life. It is more expensive but builds cash value over time, which can be borrowed against or used to pay premiums.

How does insurance help in the event of a business interruption?

+Business interruption insurance provides coverage for lost income and additional expenses incurred when a business is forced to close due to a covered event, such as a fire or natural disaster. It can help businesses stay afloat during these challenging times, covering expenses like employee salaries, rent, and other ongoing costs until the business can resume normal operations.

In conclusion, insurance is a powerful tool for managing risk and ensuring financial security. By understanding the fundamentals, exploring the diverse types of insurance, and staying abreast of industry trends, individuals and businesses can make informed decisions to protect themselves and their assets. As the insurance landscape continues to evolve, staying informed is key to harnessing the full potential of this vital industry.