Insurance Liability

In the complex world of insurance, liability coverage stands as a cornerstone, offering crucial protection to individuals, businesses, and organizations against a myriad of potential risks and legal responsibilities. This article delves into the intricacies of insurance liability, exploring its fundamental concepts, various types, and the vital role it plays in safeguarding financial stability and peace of mind.

Understanding Insurance Liability

At its core, insurance liability is a form of coverage that shields policyholders from financial losses arising from legal claims and liabilities. It acts as a safety net, providing the means to cover expenses related to accidents, injuries, property damage, and other unforeseen events that may lead to legal action.

The concept of insurance liability is grounded in the principle of risk transfer. Policyholders pay premiums to insurance companies, which, in turn, assume the financial responsibility for potential losses. This transfer of risk ensures that individuals and entities are protected from the often devastating financial consequences of unforeseen events, enabling them to focus on their core activities without the burden of uncertainty.

Types of Insurance Liability

Insurance liability comes in various forms, each tailored to address specific risks and scenarios. Here’s an exploration of some common types of insurance liability coverage:

General Liability Insurance

General liability insurance is a broad category that covers a wide range of potential liabilities. It provides protection against bodily injury, property damage, and personal and advertising injury claims. This type of insurance is particularly crucial for businesses, as it safeguards them from lawsuits arising from customer injuries, product defects, or advertising-related issues.

| Category | Coverage |

|---|---|

| Bodily Injury | Medical expenses, pain and suffering, and legal defense costs for claims related to injuries on business premises. |

| Property Damage | Repairs or replacements for property damage caused by the business's operations or products. |

| Personal and Advertising Injury | Protection against claims of libel, slander, copyright infringement, and false advertising. |

Product Liability Insurance

Product liability insurance is designed specifically for businesses that manufacture, distribute, or sell tangible goods. It provides coverage for claims arising from product defects, design flaws, or other issues that may cause harm to consumers. This type of insurance is essential for businesses to mitigate the risks associated with product recalls, lawsuits, and the potential for significant financial losses.

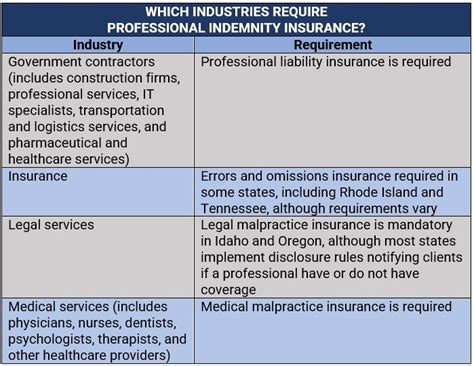

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, often referred to as “errors and omissions” insurance, is tailored for professionals such as doctors, lawyers, consultants, and other service providers. It covers legal expenses and damages resulting from mistakes, negligence, or failures to meet professional standards. This insurance is vital for professionals to protect their reputations and financial stability in the face of potential lawsuits.

Auto Liability Insurance

Auto liability insurance is a critical component of vehicle ownership and operation. It provides coverage for bodily injury and property damage caused by the policyholder’s vehicle. This insurance is mandated by law in most jurisdictions and is essential for protecting individuals and businesses from the financial consequences of accidents and other vehicle-related incidents.

Umbrella Liability Insurance

Umbrella liability insurance is an additional layer of protection that supplements existing liability policies. It kicks in when the limits of primary policies are reached, providing coverage for excess liability claims. This type of insurance is particularly beneficial for high-net-worth individuals and businesses that face the risk of significant financial losses from catastrophic events or high-value lawsuits.

The Importance of Insurance Liability

Insurance liability is of paramount importance for several key reasons:

- Financial Protection: The primary function of insurance liability is to provide financial protection against potential liabilities. It ensures that policyholders have the means to cover legal expenses, damages, and settlements without compromising their financial stability.

- Risk Mitigation: By transferring the risk of financial losses to insurance companies, policyholders can effectively mitigate the potential impact of unforeseen events. This allows individuals and businesses to focus on their core operations and strategic goals without the distraction of managing risk.

- Legal Defense: Insurance liability policies often include legal defense coverage, which provides the necessary resources for policyholders to mount a robust defense in the event of a lawsuit. This ensures that they have access to skilled legal representation, increasing their chances of a favorable outcome.

- Peace of Mind: Knowing that one is protected by insurance liability coverage provides a sense of security and peace of mind. Policyholders can rest assured that they have the support and resources to navigate through potential legal challenges, allowing them to focus on their daily lives and business activities with confidence.

Real-World Scenarios and Examples

To illustrate the significance of insurance liability, let’s explore a few real-world scenarios:

Scenario 1: Slip and Fall Accident

Imagine a customer slips and falls on a wet floor in a retail store. The customer sustains injuries and decides to file a lawsuit against the store owner. In this scenario, general liability insurance would provide coverage for the customer’s medical expenses, pain and suffering, and legal defense costs. Without this insurance, the store owner could face significant financial strain and potential bankruptcy.

Scenario 2: Product Recall

A manufacturing company discovers a defect in one of its products, leading to a nationwide recall. The company faces potential lawsuits from consumers who were injured by the defective product. Product liability insurance would step in to cover the costs associated with the recall, including legal expenses, compensation for injured parties, and public relations efforts to manage the crisis.

Scenario 3: Professional Negligence

A client sues a financial advisor for negligent investment advice, claiming significant financial losses. Professional liability insurance would provide coverage for the advisor’s legal defense and any damages awarded to the client. This insurance ensures that the advisor’s reputation and financial stability remain intact, even in the face of a potential liability claim.

Best Practices for Insurance Liability Coverage

To ensure adequate protection, policyholders should consider the following best practices:

- Assess Risk Profile: Evaluate the specific risks and liabilities associated with your business or personal activities. Identify potential areas of vulnerability and tailor your insurance coverage accordingly.

- Review Policy Limits: Regularly review the limits of your liability insurance policies. As your business grows or your personal circumstances change, you may need to increase coverage limits to ensure adequate protection.

- Understand Policy Exclusions: Carefully read and understand the exclusions in your insurance policies. Be aware of any limitations or conditions that may impact your coverage, and consider additional endorsements or policies to fill any gaps.

- Seek Professional Advice: Consult with insurance professionals or brokers who specialize in liability coverage. They can provide expert guidance tailored to your specific needs, helping you navigate the complex world of insurance liability.

The Future of Insurance Liability

The landscape of insurance liability is constantly evolving, influenced by changing legal landscapes, technological advancements, and emerging risks. Here are some key trends and considerations for the future:

- Cybersecurity Risks: With the increasing prevalence of cyber attacks and data breaches, insurance companies are developing specialized policies to address the unique liabilities associated with digital threats. This includes coverage for data restoration, legal defense, and public relations management in the event of a cyber incident.

- Environmental Liability: As environmental concerns and regulations become more stringent, insurance companies are offering policies to protect businesses and individuals from liabilities related to pollution, waste management, and other environmental issues. These policies provide coverage for cleanup costs, legal expenses, and potential fines.

- Emerging Technologies: The rapid advancement of technologies like artificial intelligence, robotics, and autonomous vehicles presents new liability challenges. Insurance companies are actively researching and developing coverage options to address the unique risks associated with these emerging technologies.

- Data-Driven Underwriting: Insurance companies are leveraging data analytics and advanced risk modeling to more accurately assess and price liability risks. This data-driven approach allows for more precise underwriting, leading to more tailored and efficient insurance policies.

How does insurance liability differ from other types of insurance coverage?

+Insurance liability is distinct from other types of insurance coverage in that it specifically addresses legal liabilities and potential claims against the policyholder. While other forms of insurance, such as property or health insurance, cover damages to specific assets or individuals, liability insurance focuses on protecting the policyholder from financial losses arising from their legal obligations.

What happens if I don’t have adequate insurance liability coverage?

+Insufficient insurance liability coverage can leave individuals and businesses vulnerable to significant financial risks. If you are sued for an amount exceeding your policy limits or if your policy does not cover a specific liability, you may be personally responsible for paying any damages awarded, which can lead to financial strain or even bankruptcy.

Can insurance liability coverage be tailored to my specific needs?

+Yes, insurance liability coverage can be customized to align with your unique risks and circumstances. Insurance professionals can work with you to assess your specific needs and design a policy that provides adequate protection. This may involve selecting specific endorsements, increasing coverage limits, or choosing specialized policies to address unique liabilities.

How often should I review my insurance liability coverage?

+It is recommended to review your insurance liability coverage at least once a year, or whenever significant changes occur in your personal or business circumstances. These changes may include expansions, new products or services, increased revenue, or changes in legal requirements. Regular reviews ensure that your coverage remains up-to-date and aligned with your evolving needs.