Insurance News

Unveiling the Latest Insurance Industry Trends: Insights and Updates

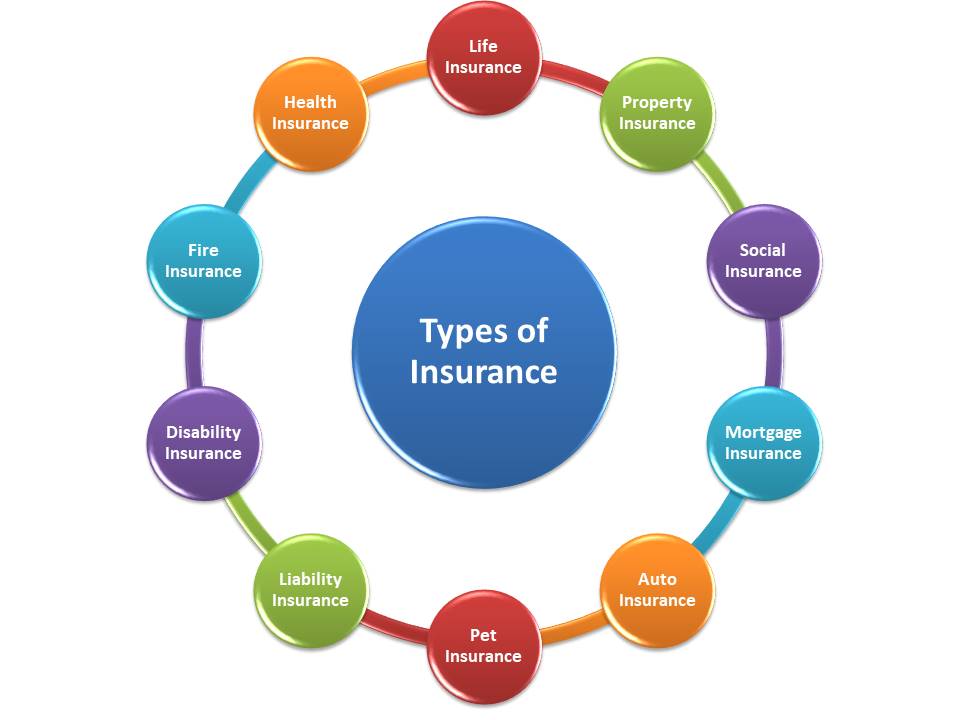

The insurance landscape is undergoing a transformative shift, and staying abreast of the latest trends is crucial for industry professionals, investors, and consumers alike. In this comprehensive guide, we delve into the emerging developments shaping the future of insurance, offering an in-depth analysis and expert insights to help you navigate the evolving world of risk management.

The Digital Revolution in Insurance

The digital age has brought about a paradigm shift in the insurance industry, revolutionizing the way policies are purchased, claims are processed, and risks are assessed. With the advent of insurtech, traditional insurance models are being disrupted, and a new era of innovation is upon us.

Online Insurance Portals

One of the most significant developments is the rise of online insurance platforms. These digital marketplaces provide consumers with a one-stop shop for comparing policies, obtaining quotes, and purchasing coverage. Companies like PolicyGenius and Insureon have streamlined the insurance shopping experience, making it more accessible and efficient.

| Company | Specialization |

|---|---|

| PolicyGenius | Personal Insurance (Life, Health, Auto) |

| Insureon | Small Business Insurance |

Data-Driven Underwriting

Insurtech companies are leveraging big data and advanced analytics to revolutionize underwriting processes. By analyzing vast datasets, these firms can assess risks more accurately and offer tailored insurance products. Lemonade, for instance, uses AI to provide renters and homeowners insurance with lightning-fast quotes and claims processing.

Blockchain and Smart Contracts

The integration of blockchain technology is another exciting development. Blockchain's distributed ledger system enhances security, transparency, and efficiency in insurance transactions. Smart contracts, self-executing contracts with predefined rules, are being utilized to automate various insurance processes, reducing administrative burdens.

The Rise of Parametric Insurance

Parametric insurance is gaining traction as an innovative approach to risk management. Unlike traditional insurance, which relies on post-event loss assessment, parametric insurance uses predefined triggers and pays out based on the occurrence of a specific event. This model is particularly attractive for covering natural disasters and climate-related risks.

Case Study: Caribbean Catastrophe Risk Insurance Facility (CCRIF)

The CCRIF is a pioneering example of parametric insurance. It provides rapid payouts to participating Caribbean governments after a hurricane or earthquake, helping them respond quickly to the aftermath of such events. The payouts are based on the intensity of the event rather than the actual damage sustained, offering a swift injection of capital for recovery efforts.

The Impact of Climate Change on Insurance

Climate change is one of the most significant challenges facing the insurance industry. The increasing frequency and severity of natural disasters pose a significant risk to insurers' balance sheets. In response, insurers are:

- Refining their models to better assess climate-related risks.

- Collaborating with governments and environmental organizations to mitigate the impact of climate change.

- Developing new insurance products to cover emerging risks.

Green Insurance Initiatives

Insurers are increasingly incorporating sustainability and environmental considerations into their business models. Some companies are offering green insurance products that incentivize policyholders to adopt eco-friendly practices. For instance, Allstate provides discounts on auto insurance for drivers who choose eco-conscious vehicles or use alternative transportation methods.

The Future of Insurance: AI and Automation

Artificial Intelligence (AI) and automation are set to play a pivotal role in the insurance industry's future. These technologies will further streamline processes, enhance customer experiences, and improve risk assessment accuracy.

AI in Claims Processing

AI-powered claims processing is already transforming the way insurers handle claims. By analyzing images, videos, and other data, AI algorithms can assess damages and determine payouts with greater efficiency and accuracy. This not only speeds up the claims process but also reduces the potential for fraud.

Automated Policy Management

Automation is also being leveraged for policy management. Intelligent systems can automatically renew policies, update coverage based on changing needs, and provide real-time alerts to policyholders. This level of automation improves customer satisfaction and reduces administrative costs for insurers.

How is the insurance industry addressing the challenges posed by climate change?

+

Insurers are adopting a multi-faceted approach. They are enhancing their risk models to better understand and price climate-related risks, collaborating with stakeholders to mitigate these risks, and developing new insurance products to address emerging challenges. Many insurers are also incorporating sustainability into their operations and offering incentives for policyholders to adopt eco-friendly practices.

What are the benefits of parametric insurance for insurers and policyholders?

+

Parametric insurance offers several advantages. For insurers, it provides a more predictable payout structure, reducing the uncertainty associated with traditional insurance. For policyholders, it offers faster payouts based on predefined triggers, ensuring rapid access to funds when they need it most. Parametric insurance is particularly valuable for covering hard-to-assess risks like natural disasters.

How is AI transforming the insurance industry?

+

AI is revolutionizing various aspects of the insurance industry. In underwriting, it enables more accurate risk assessment and pricing. In claims processing, AI speeds up payouts by automating damage assessments. AI-powered chatbots and virtual assistants are also enhancing customer service, providing policyholders with real-time support. Additionally, AI is improving fraud detection, helping insurers identify and prevent fraudulent claims.