Insurance Open Enrollment 2025

The Insurance Open Enrollment period is a crucial time for individuals and families to review their health insurance options and make informed decisions about their coverage for the upcoming year. With the 2025 Open Enrollment approaching, it's essential to understand the key aspects, deadlines, and strategies to navigate this annual event effectively.

Understanding the Insurance Open Enrollment Period

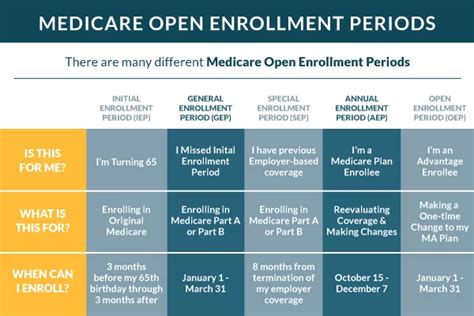

The Open Enrollment period is a designated timeframe when individuals and employees have the opportunity to enroll in or make changes to their health insurance plans without requiring a qualifying life event. This annual event ensures that everyone has a chance to assess their insurance needs and adjust their coverage accordingly.

During Open Enrollment, you can typically expect the following:

- Review of Current Coverage: Take the time to carefully examine your existing health insurance plan. Assess whether it still meets your needs, including coverage for any ongoing medical conditions, prescription medications, and anticipated healthcare requirements for the upcoming year.

- Explore New Options: Research and compare different insurance plans offered by your employer or through the Health Insurance Marketplace. Consider factors such as premiums, deductibles, co-pays, and the network of healthcare providers associated with each plan.

- Consider Family Changes: If there have been changes in your family's situation, such as marriage, divorce, birth, or adoption, these events may impact your insurance needs. Ensure that your chosen plan accommodates the needs of your entire family.

- Review Cost-Sharing Options: Evaluate the cost-sharing arrangements, including deductibles, co-pays, and out-of-pocket maximums, to understand how much you may need to contribute towards your healthcare expenses.

- Understand Network Coverage: Determine if your preferred healthcare providers are included in the network of the insurance plan you're considering. Out-of-network care can lead to higher out-of-pocket costs.

- Evaluate Additional Benefits: Some insurance plans offer additional benefits such as vision, dental, or wellness programs. Assess if these benefits align with your family's healthcare needs.

2025 Insurance Open Enrollment: Key Dates and Deadlines

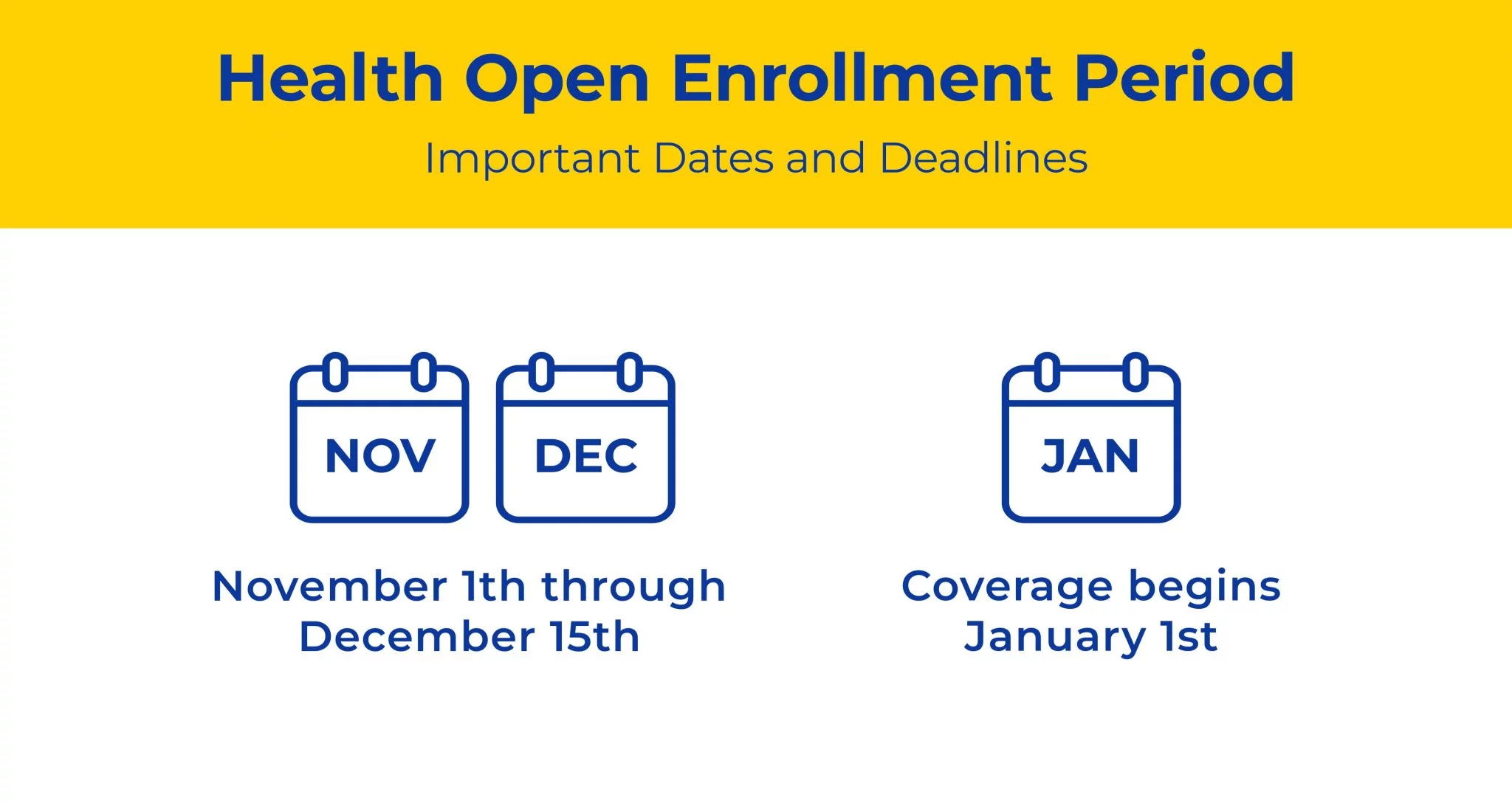

The Open Enrollment period for 2025 is expected to follow a similar schedule as previous years, although specific dates may vary depending on your location and insurance provider.

Here's a general overview of the key dates to keep in mind:

| Event | Estimated Date |

|---|---|

| Open Enrollment Start | November 1, 2024 |

| Open Enrollment End | December 15, 2024 |

| Coverage Effective Date | January 1, 2025 |

It's important to note that these dates are subject to change, and it's advisable to consult your insurance provider or the official Health Insurance Marketplace website for the most up-to-date information specific to your region.

Maximizing Your Open Enrollment Experience

To make the most of your Open Enrollment period and ensure you select the right insurance plan for your needs, consider the following strategies:

1. Start Early and Gather Information

Begin your research well in advance of the Open Enrollment start date. Gather all relevant documents, including your current insurance plan details, prescription medication lists, and any recent medical records. This will help you make informed decisions and compare plans effectively.

2. Understand Your Options

Take the time to understand the different types of insurance plans available to you. Common plan types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and High Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs). Each plan type has unique features and cost structures, so familiarize yourself with the pros and cons of each.

3. Utilize Online Tools and Resources

Many insurance providers and the Health Insurance Marketplace offer online tools and resources to assist you during Open Enrollment. These tools can help you compare plans, estimate costs, and understand the coverage provided. Take advantage of these resources to streamline your decision-making process.

4. Consider Premium and Cost-Sharing

While premiums are an important factor, it’s also crucial to consider the overall cost-sharing arrangements. Evaluate the deductibles, co-pays, and out-of-pocket maximums to understand your potential financial responsibility. Keep in mind that lower premiums may result in higher cost-sharing, so strike a balance that aligns with your budget and healthcare needs.

5. Assess Your Healthcare Utilization

Review your past healthcare utilization, including visits to specialists, emergency room trips, and prescription medication usage. This analysis will help you estimate your future healthcare needs and select a plan that adequately covers those anticipated expenses.

6. Explore Employer-Provided Benefits

If you’re employed, familiarize yourself with the insurance plans offered by your employer. Many employers provide additional benefits, such as flexible spending accounts (FSAs) or health savings accounts (HSAs), which can further reduce your out-of-pocket costs. Understand the contribution limits and eligibility criteria for these accounts.

7. Seek Professional Advice

If you find the Open Enrollment process overwhelming or have complex healthcare needs, consider seeking guidance from a licensed insurance agent or financial advisor. They can provide personalized advice based on your specific circumstances and help you navigate the various insurance options.

Conclusion: Empowering Your Healthcare Decisions

The Insurance Open Enrollment period is a powerful opportunity to take control of your healthcare coverage and ensure you have the right plan to meet your needs. By staying informed, researching your options, and making thoughtful decisions, you can optimize your healthcare experience and financial well-being.

Remember, the choices you make during Open Enrollment have a significant impact on your access to healthcare services and your financial stability. Take the time to review, compare, and select a plan that provides comprehensive coverage at a cost that aligns with your budget.

Stay tuned for further updates and detailed guides as we approach the 2025 Insurance Open Enrollment period, and ensure you're prepared to make the best decisions for yourself and your family.

When is the 2025 Insurance Open Enrollment period?

+The estimated dates for the 2025 Open Enrollment period are November 1, 2024, to December 15, 2024. These dates may vary depending on your location and insurance provider, so it’s advisable to confirm with your specific insurance plan or the official Health Insurance Marketplace.

What happens if I miss the Open Enrollment deadline?

+Missing the Open Enrollment deadline can limit your options for changing or enrolling in a new health insurance plan. In such cases, you may only be able to make changes to your coverage if you experience a qualifying life event, such as marriage, birth, or loss of other coverage. It’s important to stay aware of the deadlines to avoid potential gaps in coverage.

Can I switch insurance providers during Open Enrollment?

+Yes, Open Enrollment is an excellent opportunity to explore different insurance providers and switch plans if you find a better option that meets your needs. Compare the features, coverage, and costs of various plans to make an informed decision.

How do I know if my preferred healthcare providers are in-network for a particular plan?

+When researching insurance plans, pay close attention to the network of healthcare providers associated with each plan. You can typically find this information on the insurance provider’s website or by contacting their customer support. Confirming that your preferred providers are in-network ensures you won’t face unexpected out-of-network costs.