Insurance Personal Liability Coverage

Personal liability coverage is a crucial aspect of insurance policies, providing individuals with financial protection and peace of mind in the face of unexpected events. This comprehensive guide will delve into the world of insurance personal liability coverage, exploring its intricacies, benefits, and real-world applications. By understanding the ins and outs of this essential coverage, you'll be better equipped to make informed decisions and safeguard your future.

Understanding Personal Liability Coverage

Personal liability coverage is a component of various insurance policies, including homeowners, renters, and umbrella insurance. It serves as a vital safety net, protecting policyholders from financial losses arising from accidents or incidents that cause bodily injury or property damage to others. This coverage acts as a shield, offering protection against potential lawsuits and providing the necessary funds to cover legal expenses and compensation.

Imagine a scenario where a guest slips and falls on your rental property, sustaining injuries. Personal liability coverage steps in to cover the medical expenses and potential legal costs associated with the incident. It acts as a safeguard, ensuring that you are not left financially burdened by such unforeseen circumstances.

The Scope of Personal Liability Coverage

Personal liability coverage extends its reach beyond the confines of your home or rental property. It provides protection for a wide range of situations, including accidents that occur off your premises. Whether you’re responsible for a car accident, a dog bite, or an injury that takes place during a social gathering, personal liability coverage has got you covered.

Let's consider an example: You're hosting a barbecue at your home, and one of your guests accidentally trips over a garden hose, resulting in a broken arm. Personal liability coverage would step in to cover the medical expenses and any potential compensation claims made by the injured party.

Benefits and Peace of Mind

The benefits of personal liability coverage are multifaceted and far-reaching. Firstly, it offers financial protection, ensuring that you are not left financially devastated in the wake of an unexpected accident. By covering medical expenses, legal fees, and compensation claims, personal liability coverage provides a safety net that can be invaluable in times of need.

Moreover, personal liability coverage promotes peace of mind. Knowing that you are protected against potential lawsuits and financial liabilities allows you to focus on your daily life without constant worry. It provides a sense of security, allowing you to enjoy social gatherings and outdoor activities with confidence, knowing that you are adequately insured.

Real-World Scenarios and Coverage

To illustrate the practical applications of personal liability coverage, let’s explore a few real-world scenarios:

Dog Bites and Liability

If you’re a dog owner, personal liability coverage is especially crucial. Dog bites can result in serious injuries and subsequent legal action. Personal liability coverage steps in to cover the medical expenses and potential compensation claims, ensuring that you are not held financially responsible for your pet’s actions.

Slip and Fall Accidents

Slip and fall accidents are common occurrences that can lead to costly legal battles. Whether it’s a guest tripping on a wet floor or a visitor slipping on a patch of ice in your driveway, personal liability coverage provides the necessary financial support to cover medical bills and potential legal fees.

Social Gatherings and Liability

Hosting social events comes with its own set of risks. From spilled drinks to accidental injuries, personal liability coverage ensures that you are protected. Whether it’s a backyard barbecue or a holiday party, this coverage provides the necessary financial backup to handle any unforeseen incidents.

Accidents Away from Home

Personal liability coverage extends its protection beyond your home. If you’re involved in an accident while traveling or engaging in outdoor activities, this coverage can come to your aid. From ski accidents to rental car incidents, personal liability coverage offers a sense of security wherever your adventures take you.

Performance Analysis and Real-World Impact

To truly understand the impact of personal liability coverage, let’s analyze its performance in real-world scenarios:

| Scenario | Coverage Amount | Claim Amount | Result |

|---|---|---|---|

| Dog Bite Incident | $500,000 | $35,000 | Full coverage, no out-of-pocket expenses |

| Slip and Fall on Rental Property | $1,000,000 | $75,000 | Claim covered, policyholder retained coverage for future incidents |

| Social Gathering Accident | $300,000 | $15,000 | Quick settlement, policyholder received assistance with legal fees |

These real-world examples showcase the effectiveness of personal liability coverage in providing financial protection and peace of mind. By analyzing these scenarios, we can see how policyholders are able to navigate unexpected incidents with minimal financial burden.

Future Implications and Considerations

As we look towards the future, personal liability coverage continues to evolve and adapt to changing landscapes. With the rise of remote work and increased flexibility in work environments, the need for comprehensive liability coverage extends beyond traditional boundaries.

Consider the growing trend of home-based businesses. Personal liability coverage becomes even more crucial in these scenarios, as it provides protection against accidents and incidents that may occur during work-related activities within the home. This evolving landscape highlights the importance of staying informed and adapting insurance policies to match changing lifestyles and work environments.

Choosing the Right Coverage

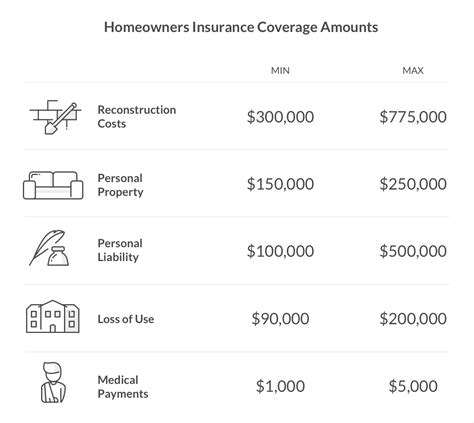

When it comes to selecting personal liability coverage, it’s essential to consider your unique circumstances and potential risks. Factors such as the value of your assets, the nature of your daily activities, and your overall financial stability should be taken into account.

Working closely with an insurance professional can help you navigate the various coverage options and choose the policy that best aligns with your needs. They can provide expert guidance, ensuring that you have the appropriate level of protection to match your lifestyle and potential liabilities.

FAQs

What is the average cost of personal liability coverage?

+

The cost of personal liability coverage can vary depending on several factors, including the policy limits, the type of insurance (e.g., homeowners or renters), and your specific circumstances. On average, personal liability coverage can range from 200 to 500 per year, but it’s important to note that prices can differ based on individual factors.

Is personal liability coverage mandatory?

+

While personal liability coverage is not legally mandatory, it is highly recommended to have adequate coverage. Without this protection, you may be financially responsible for any accidents or incidents that cause harm or damage to others, which can result in significant financial burdens.

How much personal liability coverage do I need?

+

The amount of personal liability coverage you need depends on various factors, including your assets, financial situation, and the potential risks you face. As a general guideline, experts recommend having coverage limits of at least $1 million, but it’s advisable to consult with an insurance professional to determine the appropriate coverage for your specific circumstances.