Insurance Pet

The world of pet insurance is a rapidly growing industry, offering a safety net for pet owners and providing essential coverage for unexpected veterinary costs. As the demand for pet insurance rises, so does the need for comprehensive understanding and awareness among pet owners. This article aims to delve into the intricacies of pet insurance, exploring its various facets, benefits, and considerations, to empower pet owners with the knowledge to make informed decisions about their furry family members' health and well-being.

Understanding Pet Insurance: A Necessary Investment

Pet insurance has emerged as a vital component of responsible pet ownership, offering a range of benefits that extend beyond the financial aspect. It provides peace of mind, knowing that your beloved pet is covered for unexpected illnesses, accidents, or even routine care. With the rising costs of veterinary medicine, pet insurance has become an essential tool to ensure pets receive the best possible care without breaking the bank.

In the United States, the pet insurance market is experiencing significant growth, with an increasing number of pet owners recognizing the value of this coverage. According to the North American Pet Health Insurance Association (NAPHIA), the number of insured pets has been steadily rising, reaching over 2.85 million pets insured in 2021. This growth is driven by a better understanding of the benefits and a desire to provide the best care for beloved pets.

Key Benefits of Pet Insurance

- Coverage for Unexpected Expenses: Pet insurance plans typically cover a wide range of medical conditions, from accidents to illnesses. This includes emergency treatments, surgeries, and even chronic conditions, providing financial support during challenging times.

- Preventative Care: Many pet insurance policies offer coverage for routine care, such as vaccinations, check-ups, and preventive treatments. This encourages regular veterinary visits, ensuring early detection and management of potential health issues.

- Specialist Care and Advanced Treatments: With pet insurance, pet owners can access a broader range of treatment options, including specialist care, advanced diagnostics, and innovative therapies. This ensures that pets receive the best possible care, regardless of the complexity of their condition.

- Peace of Mind and Financial Stability: Knowing that your pet is covered can bring immense peace of mind. Pet insurance helps pet owners avoid the difficult decision between their pet's health and financial constraints, ensuring that the best treatment options are always available.

Choosing the Right Pet Insurance Plan: A Tailored Approach

Selecting the appropriate pet insurance plan is a critical decision that requires careful consideration of various factors. Each pet has unique needs, and understanding these needs is essential for making an informed choice.

Assessing Your Pet's Needs

Begin by evaluating your pet's current health status, age, and breed. Certain breeds are predisposed to specific health conditions, and understanding these predispositions can help in choosing the right coverage. Additionally, consider your pet's lifestyle and any pre-existing conditions they may have. A comprehensive understanding of your pet's health profile is crucial in selecting an insurance plan that offers adequate coverage.

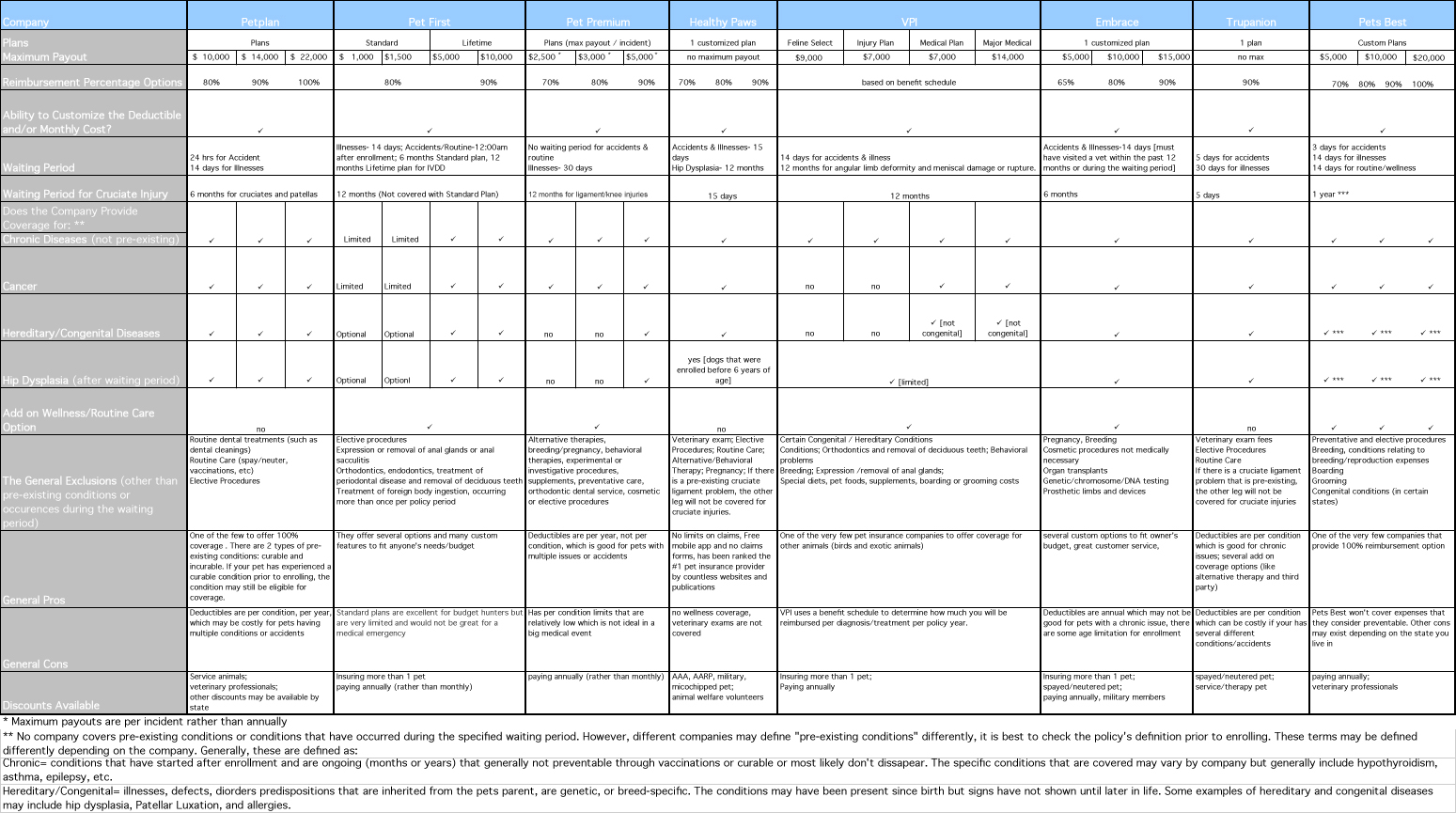

Understanding Different Plan Options

Pet insurance plans can vary significantly in their coverage, limits, and costs. Here's a breakdown of some common plan types:

- Accident-Only Plans: As the name suggests, these plans cover accidents but not illnesses. They are typically more affordable but may not provide sufficient coverage for long-term health issues.

- Accident and Illness Plans: These plans offer a more comprehensive coverage, including both accidents and illnesses. They are ideal for pet owners seeking broad protection for their pets' health.

- Wellness Plans: Focused on preventive care, wellness plans cover routine procedures and treatments, such as vaccinations, dental care, and annual check-ups. They are a great option for maintaining your pet's overall health and well-being.

- Lifetime Policies: Lifetime policies provide continuous coverage for your pet's entire life, offering a stable and reliable insurance option. They typically have higher premiums but provide peace of mind and consistent coverage.

| Plan Type | Coverage | Pros | Cons |

|---|---|---|---|

| Accident-Only | Covers accidents but not illnesses | Affordable, simple to understand | Limited coverage, may not cover common health issues |

| Accident and Illness | Broad coverage for accidents and illnesses | Comprehensive, suitable for most pets | Higher premiums compared to accident-only plans |

| Wellness | Focuses on preventive care and routine procedures | Encourages regular veterinary visits, ideal for maintaining health | Does not cover major illnesses or accidents |

| Lifetime | Continuous coverage throughout your pet's life | Stable and reliable, peace of mind | Typically the most expensive option |

The Process of Claiming: A Step-by-Step Guide

Understanding the claiming process is essential for a smooth experience with pet insurance. Here's a simplified guide to help you navigate the process:

Step 1: Understand Your Policy

Before making a claim, ensure you have a clear understanding of your policy's terms and conditions. This includes knowing the covered conditions, any waiting periods, and the claiming process outlined by your insurance provider.

Step 2: Gather Necessary Documents

When your pet requires veterinary care, keep a record of all relevant documents. This includes veterinary invoices, treatment notes, and any diagnostic test results. These documents are essential for making a successful claim.

Step 3: Initiate the Claim Process

Contact your insurance provider to initiate the claim process. Most providers have an online portal or a dedicated claim form that needs to be completed. Ensure you provide accurate and detailed information about the condition and the treatment received.

Step 4: Submit Your Claim

Once you have gathered all the necessary information and completed the claim form, submit your claim through the provider's preferred method. This could be via email, post, or their online portal.

Step 5: Follow-Up and Tracking

After submitting your claim, keep track of its progress. Most insurance providers offer online claim tracking, allowing you to monitor the status of your claim and receive updates.

Common Misconceptions and Frequently Asked Questions

Is pet insurance only for emergency situations?

+Pet insurance can cover a wide range of situations, including routine care, accidents, and illnesses. While it's often associated with emergencies, many policies also provide coverage for preventive care and chronic conditions.

How do I choose the right pet insurance provider?

+Research is key! Compare different providers based on their coverage, reputation, customer service, and policy features. Read reviews, seek recommendations, and understand the fine print to ensure you choose a provider that aligns with your pet's needs and your expectations.

What happens if my pet has a pre-existing condition?

+Pre-existing conditions are typically excluded from coverage. However, some providers offer waiting periods or specific plans for pets with pre-existing conditions. It's important to disclose all pre-existing conditions when applying for insurance to avoid any issues with future claims.

Can I switch pet insurance providers if I'm not satisfied with my current plan?

+Yes, you have the freedom to switch providers if you're not happy with your current plan. However, it's essential to understand the implications, such as new waiting periods and potential coverage gaps. Carefully review the terms of your new policy to ensure a seamless transition.

How much does pet insurance typically cost?

+The cost of pet insurance varies widely depending on factors such as your pet's breed, age, location, and the type of coverage you choose. On average, accident-only plans can start at around $20 per month, while accident and illness plans can range from $40 to $80 per month. Wellness plans may cost an additional $10 to $20 per month. It's important to shop around and get quotes from multiple providers to find the best value for your pet's needs.

In conclusion, pet insurance is a valuable tool for pet owners, offering financial protection and peace of mind. By understanding the different plan options, carefully reviewing policy details, and staying informed about the claiming process, pet owners can ensure their furry companions receive the best possible care without financial strain. Remember, choosing the right pet insurance is an investment in your pet’s health and your own peace of mind.