Insurance Ppo Meaning

The concept of Preferred Provider Organizations (PPOs) has revolutionized the healthcare industry, offering a unique approach to insurance coverage. Understanding the PPO model is crucial for anyone navigating the complex world of health insurance. In this comprehensive guide, we delve into the meaning and implications of PPOs, exploring their advantages, network dynamics, and how they shape the healthcare experience for individuals and families.

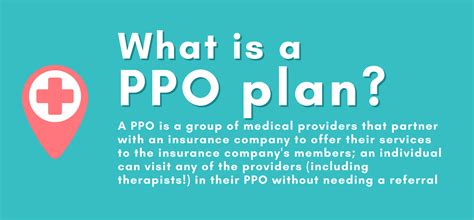

Unraveling the PPO Concept

A Preferred Provider Organization (PPO) is a type of health insurance plan that grants policyholders the flexibility to choose their healthcare providers from a designated network of preferred medical professionals and facilities. Unlike traditional fee-for-service plans, PPOs encourage enrollees to utilize the preferred network by offering cost savings and enhanced benefits when they do so.

The fundamental principle of PPOs is to incentivize policyholders to access healthcare services within the preferred network. This network typically consists of healthcare providers who have negotiated discounted rates with the insurance company, ensuring cost-effective and efficient healthcare delivery. When an individual opts for care within this network, they often benefit from reduced out-of-pocket expenses and streamlined claim processes.

Key Characteristics of PPOs

- Provider Flexibility: PPO enrollees can choose their doctors, specialists, and hospitals from a wide range of options within the preferred network, providing a level of freedom not typically found in other insurance models.

- Cost Savings: By steering policyholders towards the preferred network, PPOs facilitate lower healthcare costs, as providers within this network agree to charge reduced rates.

- Enhanced Benefits: PPO plans often come with additional perks, such as reduced copayments, lower deductibles, and expanded coverage for certain services when using preferred providers.

- Out-of-Network Options: While PPOs encourage network utilization, they also allow policyholders to seek care outside the network, albeit at a higher cost. This feature caters to individuals with specific healthcare needs or preferences.

Navigating the PPO Network

The network of preferred providers is a cornerstone of the PPO model. Insurance companies carefully curate these networks to include a diverse range of healthcare professionals and facilities, ensuring that policyholders have access to a comprehensive range of services.

Within the network, PPO enrollees can expect to find primary care physicians, specialists, hospitals, laboratories, and other medical services. These providers have negotiated contracts with the insurance company, agreeing to accept reduced payments in exchange for a steady stream of patients. As a result, policyholders benefit from more affordable healthcare costs.

One of the key advantages of the PPO network is its size and scope. PPOs often boast extensive networks, covering a broad geographical area, which can be especially beneficial for individuals who travel frequently or live in rural areas with limited healthcare options. The network's breadth ensures that policyholders have access to a wide range of healthcare services, regardless of their location.

| PPO Network Advantages |

|---|

| Wide geographical coverage |

| Diverse range of healthcare providers |

| Access to specialized services |

| Negotiated rates for cost savings |

Network Size and Specialization

PPO networks can vary in size, from small, tightly-knit groups to expansive networks spanning multiple states. The size of the network often correlates with the insurance company’s scope and reach. Larger networks offer greater flexibility and access to a wider range of healthcare services, while smaller networks may provide more personalized care in specific regions.

Within these networks, policyholders can find a variety of specialized healthcare providers. This includes specialists in fields such as cardiology, oncology, pediatrics, and many others. Having access to these specialized services is crucial for individuals with specific healthcare needs, ensuring they can receive expert care without incurring excessive out-of-pocket expenses.

PPOs and Cost Savings

One of the primary attractions of PPO plans is their potential for cost savings. By steering policyholders towards the preferred network, insurance companies can negotiate discounted rates with providers, which translates into lower healthcare costs for enrollees.

When an individual chooses a healthcare provider within the PPO network, they benefit from reduced charges for services. This is because the provider has agreed to accept a lower payment rate from the insurance company. As a result, policyholders typically pay less out-of-pocket for their healthcare, whether it's through reduced copayments, deductibles, or other cost-sharing mechanisms.

Cost-Sharing and PPO Plans

PPO plans employ various cost-sharing mechanisms to further incentivize policyholders to utilize the preferred network. These mechanisms include:

- Copayments: A fixed amount paid by the policyholder for each healthcare service received. Copayments are often lower within the PPO network, encouraging network utilization.

- Deductibles: The amount an individual must pay out-of-pocket before the insurance coverage kicks in. PPO plans may offer lower deductibles for network services, making healthcare more affordable.

- Coinsurance: A percentage of the healthcare cost that the policyholder pays, with the insurance company covering the remainder. PPO plans often have lower coinsurance rates for network providers.

By implementing these cost-sharing strategies, PPO plans aim to encourage policyholders to choose preferred providers, leading to cost savings for both the individual and the insurance company. This cost-saving dynamic is a key advantage of PPO plans and a significant factor in their popularity among healthcare consumers.

PPO Plans and Out-of-Network Options

While PPO plans strongly encourage the use of preferred providers, they also understand that there may be situations where out-of-network care is necessary or preferred. To accommodate these scenarios, PPO plans typically offer some level of coverage for out-of-network services, albeit at a higher cost.

When an individual seeks care from an out-of-network provider, they may be subject to higher out-of-pocket expenses. This could include increased copayments, higher deductibles, or a larger percentage of coinsurance. However, it's important to note that PPO plans often provide some coverage for out-of-network services, ensuring that policyholders have access to the care they need, even if it's outside the preferred network.

Out-of-Network Considerations

- Emergency Care: In emergency situations, PPO plans typically cover out-of-network care, recognizing the urgency and potential life-threatening nature of such circumstances.

- Specialist Referrals: If a policyholder requires specialized care that is not available within the PPO network, their primary care physician may refer them to an out-of-network specialist. In such cases, the PPO plan may cover a portion of the costs.

- Network Availability: In certain regions or for specific medical conditions, the preferred network may not offer the necessary services. In these situations, PPO plans allow policyholders to access out-of-network care to ensure comprehensive healthcare coverage.

It's crucial for PPO enrollees to understand their plan's specific policies regarding out-of-network care. While PPO plans aim to encourage network utilization, they also recognize the importance of flexibility and access to a broad range of healthcare services, ensuring that policyholders receive the care they need, regardless of network boundaries.

The Future of PPOs: Trends and Innovations

As the healthcare landscape continues to evolve, PPO plans are adapting and innovating to meet the changing needs of policyholders. Here are some key trends and developments shaping the future of PPOs:

Telehealth Integration

The integration of telehealth services into PPO plans has gained momentum in recent years. Telehealth allows policyholders to access healthcare services remotely, often through video consultations with medical professionals. This innovation enhances convenience and accessibility, especially for individuals in remote areas or with limited mobility.

PPO plans are increasingly incorporating telehealth services into their networks, offering policyholders the option to receive care from the comfort of their homes. This trend is particularly beneficial for routine check-ups, mental health services, and follow-up appointments, reducing the need for in-person visits and associated travel costs.

Value-Based Care Models

The shift towards value-based care models is influencing the design of PPO plans. Value-based care focuses on delivering high-quality healthcare outcomes while reducing costs. PPOs are exploring ways to align their networks and coverage policies with value-based principles, incentivizing providers to deliver efficient and effective care.

Under value-based care models, PPO plans may offer enhanced benefits and cost savings for policyholders who choose providers with a track record of delivering quality care at lower costs. This approach aims to drive healthcare providers towards more efficient practices, ultimately benefiting both policyholders and the healthcare system as a whole.

Data-Driven Insights

The healthcare industry is embracing data analytics and technology to enhance decision-making and improve patient outcomes. PPO plans are leveraging data-driven insights to optimize their networks and coverage strategies. By analyzing healthcare utilization patterns and cost trends, PPOs can identify areas for improvement and make informed decisions to benefit policyholders.

For instance, PPOs can use data analytics to negotiate better rates with preferred providers, leading to cost savings for policyholders. Additionally, data-driven insights can help PPOs identify gaps in their network coverage, allowing them to expand their provider base and ensure comprehensive healthcare access for enrollees.

Conclusion

Preferred Provider Organizations (PPOs) have established themselves as a dynamic and flexible approach to health insurance, offering policyholders the freedom to choose their healthcare providers while incentivizing cost-effective care. The PPO model, with its extensive networks, cost savings, and out-of-network options, provides a comprehensive and adaptable healthcare coverage solution.

As the healthcare industry continues to evolve, PPO plans are at the forefront of innovation, integrating telehealth services, adopting value-based care models, and leveraging data analytics to enhance the healthcare experience for policyholders. By staying attuned to the changing needs of individuals and families, PPOs are poised to remain a vital component of the healthcare insurance landscape, ensuring accessible and affordable healthcare for all.

What distinguishes a PPO from other insurance plans?

+

PPOs stand out from other insurance plans due to their flexibility and cost-saving benefits. They offer policyholders the freedom to choose their healthcare providers from an extensive network, with reduced costs and enhanced benefits for using preferred providers. Unlike traditional fee-for-service plans, PPOs incentivize network utilization, providing a unique balance between choice and cost-effectiveness.

How do I find providers within my PPO network?

+

Most insurance companies provide online tools and directories to help policyholders find providers within their PPO network. These resources often include search functions based on location, specialty, and provider name. Additionally, your insurance company may offer a mobile app or customer service hotline to assist you in finding the right provider.

Are there any disadvantages to PPO plans?

+

While PPO plans offer numerous advantages, there are a few potential drawbacks. One consideration is the cost of out-of-network care, which can be higher than network rates. Additionally, PPO networks may not cover all specialized services or providers, limiting access in certain situations. However, PPO plans typically provide some coverage for out-of-network services, ensuring a degree of flexibility.