Insurance Prices Compare

Welcome to a comprehensive guide that explores the intricate world of insurance prices and how they are compared and contrasted. In today's market, understanding the factors that influence insurance costs and the strategies for securing the best deals is more important than ever. This article aims to provide an expert-level analysis, offering valuable insights and practical tips to navigate the complex landscape of insurance pricing.

Understanding Insurance Prices: A Complex Equation

The price of insurance is a multifaceted concept, influenced by a myriad of factors. From individual demographics to the specific risks associated with various policy types, the cost of insurance can vary significantly. This section aims to delve into the key elements that contribute to these variations, offering a deeper understanding of the insurance pricing landscape.

Demographics and Risk Assessment

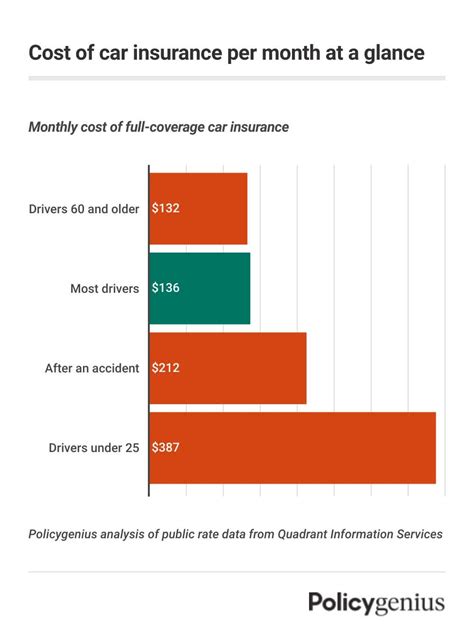

Insurance companies employ intricate risk assessment models to determine the likelihood of a claim being made. These models take into account a range of demographic factors, including age, gender, location, and occupation. For instance, young drivers are often considered higher-risk due to their lack of experience, leading to higher insurance premiums. Similarly, certain occupations, such as those involving heavy machinery or extreme sports, can also result in elevated insurance costs.

Additionally, the insurance industry considers the statistical likelihood of various types of claims. For instance, health insurance premiums may be influenced by factors such as pre-existing conditions, family history, and lifestyle choices. Life insurance prices, on the other hand, might be impacted by variables such as age, health status, and even hobbies or activities that could increase the risk of accidental death.

Policy Coverage and Deductibles

The scope of coverage provided by an insurance policy is a major determinant of its price. Policies with comprehensive coverage, offering protection against a wide range of potential risks, tend to be more expensive. Conversely, policies with more limited coverage, often referred to as “basic” or “standard” plans, are typically more affordable.

The concept of deductibles also plays a significant role in insurance pricing. A deductible is the amount an insured person must pay out of pocket before the insurance company begins to cover the costs. Policies with higher deductibles generally have lower premiums, as the insured assumes more financial responsibility. Conversely, policies with lower deductibles often come with higher premiums, as the insurance company assumes a larger share of the financial risk.

Insurance Company Competition and Market Factors

The insurance market is highly competitive, with numerous companies vying for customers. This competition can drive prices down, as companies strive to offer competitive rates to attract and retain policyholders. However, market factors such as the overall economic climate, regulatory changes, and natural disasters can also influence insurance prices. For instance, a series of severe weather events in a particular region might lead to increased insurance costs for homeowners in that area.

Furthermore, the reputation and financial stability of an insurance company can also impact its pricing. Established companies with a strong financial standing may be able to offer more competitive rates, as they have the resources to manage risks effectively. On the other hand, smaller, less-established companies might charge higher premiums to compensate for their potentially higher risk exposure.

Comparing Insurance Prices: Strategies for Savings

With a deeper understanding of the factors that influence insurance prices, the next step is to explore strategies for comparing and securing the best deals. This section will provide practical tips and insights to help navigate the complex process of comparing insurance prices, ensuring you make informed decisions to protect your financial well-being.

Online Comparison Tools and Websites

In today’s digital age, numerous online platforms and comparison tools have emerged to simplify the process of comparing insurance prices. These tools allow users to input their specific details and preferences, such as coverage requirements and budget constraints, and then generate a list of suitable insurance policies along with their corresponding prices. Some popular comparison websites include InsuranceQuoteHub.com, PolicyGenius.com, and Compare.com, among others.

When using these platforms, it's essential to provide accurate and detailed information to ensure the most relevant and accurate quotes. Additionally, be sure to read the fine print and understand the specific terms and conditions of each policy to ensure it meets your needs.

Bundling Policies and Multi-Policy Discounts

Bundling multiple insurance policies with the same provider can often lead to significant savings. Many insurance companies offer multi-policy discounts, providing a reduced rate when you combine different types of insurance, such as auto, home, and life insurance. This strategy not only simplifies your insurance management but can also result in substantial cost savings.

For instance, if you're in the market for both auto and home insurance, consider approaching an insurance company that offers both. By bundling these policies, you might be eligible for a discount of up to 25% or more, depending on the provider and the specific policies involved.

Negotiating with Insurance Agents

Insurance agents, particularly independent agents who work with multiple companies, can be a valuable resource when it comes to negotiating insurance prices. These professionals have a deep understanding of the insurance market and can provide insights into the best deals available. They can also advocate on your behalf, negotiating with insurance companies to secure the most competitive rates.

When negotiating, it's essential to be prepared with a clear understanding of your needs and budget. Provide the agent with detailed information about your circumstances, such as your driving record, health status, and any specific coverage requirements. Be open to discussing alternatives and don't be afraid to ask questions to ensure you fully understand the policies and their associated costs.

Utilizing Loyalty and Renewal Discounts

Many insurance companies offer loyalty discounts to customers who maintain their policies over an extended period. These discounts can be a significant incentive to stay with the same provider, often resulting in savings of up to 10% or more. Additionally, some companies offer renewal discounts, providing a reduced rate when you renew your policy.

To maximize these savings, it's important to be proactive. Keep track of your renewal dates and contact your insurance provider well in advance to inquire about any available discounts. Many companies automatically apply these discounts, but it's always beneficial to confirm and ensure you're taking advantage of all the savings opportunities available to you.

Exploring Alternative Insurance Options

In certain situations, traditional insurance policies may not provide the best value for your needs. In such cases, exploring alternative insurance options can be a wise strategy. These alternatives might include specialized insurance providers that cater to specific demographics or niche markets, or even non-traditional insurance products such as peer-to-peer insurance or usage-based insurance.

For example, if you're a young driver with a clean record, you might consider usage-based insurance, which tracks your driving behavior and offers discounts based on safe driving habits. Alternatively, if you own a classic car, you might benefit from exploring insurance options specifically designed for classic car enthusiasts, which often provide more comprehensive coverage at a competitive price.

Performance Analysis: Evaluating Insurance Companies

When comparing insurance prices, it’s not just about finding the lowest cost. The financial stability and overall performance of the insurance company also play a crucial role in ensuring you receive the coverage you need when you need it. This section will delve into the key metrics and indicators to consider when evaluating insurance companies, helping you make informed decisions about the providers you choose.

Financial Strength Ratings

One of the most critical aspects to consider when evaluating an insurance company is its financial strength. A company with a strong financial foundation is more likely to be able to pay out claims promptly and fully, even in the face of unexpected events or a large volume of claims. Several independent rating agencies, such as A.M. Best, Standard & Poor’s, and Moody’s, provide financial strength ratings for insurance companies, offering a valuable indicator of their stability and reliability.

| Insurance Company | Financial Strength Rating |

|---|---|

| State Farm | A++ (Superior) |

| Geico | A+ (Superior) |

| Allstate | A+ (Superior) |

| Progressive | A (Excellent) |

| Travelers | A+ (Superior) |

Claims Satisfaction and Customer Service

The quality of an insurance company’s claims handling process and customer service can significantly impact your overall experience. A company with a reputation for efficient and fair claims handling, as well as responsive and helpful customer service, is likely to provide a more positive experience. Several independent organizations, such as J.D. Power and Consumer Reports, conduct surveys and research to assess insurance companies’ claims satisfaction and customer service ratings.

| Insurance Company | Claims Satisfaction Rating | Customer Service Rating |

|---|---|---|

| USAA | 4.5/5 | 4.8/5 |

| Erie Insurance | 4.4/5 | 4.6/5 |

| Amica Mutual | 4.3/5 | 4.5/5 |

| Auto-Owners Insurance | 4.2/5 | 4.4/5 |

| Travelers | 4.1/5 | 4.3/5 |

Policy Features and Coverage Options

The range of policy features and coverage options offered by an insurance company can also influence your decision. Some companies provide a more comprehensive set of features and options, allowing you to customize your policy to your specific needs. This can include additional coverage for specific risks, such as flood or earthquake coverage, or optional add-ons like rental car reimbursement or roadside assistance.

When evaluating insurance companies, consider the flexibility and customization options they provide. While a basic policy might be sufficient for some, others may require more specialized coverage. Ensure that the insurance company you choose offers the features and options that align with your unique circumstances and requirements.

Future Implications: Trends in Insurance Pricing

The insurance industry is continually evolving, influenced by technological advancements, changing consumer behaviors, and emerging risks. Understanding these trends can provide valuable insights into the future of insurance pricing and help you make more informed decisions when it comes to your insurance needs.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology that enables real-time tracking of vehicle data, is increasingly being used in the insurance industry. This technology allows insurance companies to monitor driving behavior, such as speed, braking, and distance traveled, and adjust insurance premiums based on this data. This shift towards usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is expected to gain traction in the coming years.

By incentivizing safe driving behavior, usage-based insurance can lead to lower premiums for drivers who exhibit responsible driving habits. Conversely, those with more risky driving behaviors may see their premiums increase. This trend has the potential to revolutionize the auto insurance market, providing a more personalized and fair pricing model.

The Impact of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming various industries, including insurance. These technologies are being used to automate tasks, enhance risk assessment, and improve fraud detection. By analyzing vast amounts of data, AI and ML algorithms can identify patterns and trends that were previously difficult to detect, enabling insurance companies to make more accurate predictions and better manage risks.

For consumers, this means more precise pricing models and potentially lower premiums. As AI and ML technologies continue to evolve, insurance companies will be able to offer more tailored policies, providing coverage that is more closely aligned with individual needs and circumstances. However, it's important to note that these technologies also raise privacy concerns, and consumers should be aware of how their data is being used and protected.

The Growing Importance of Digital Presence and Online Engagement

In today’s digital age, a strong online presence and effective online engagement strategies are becoming increasingly crucial for insurance companies. Consumers are increasingly turning to online channels to research, compare, and purchase insurance policies. Insurance companies that invest in their digital presence, including user-friendly websites, mobile apps, and robust online customer support, are likely to be more successful in attracting and retaining customers.

Additionally, online engagement through social media and digital marketing campaigns can help insurance companies build brand awareness and trust. This, in turn, can lead to increased customer loyalty and potentially lower customer acquisition costs. As the insurance industry continues to evolve, those companies that embrace digital transformation and effectively engage with customers online will likely be better positioned to thrive in the future.

Conclusion: Navigating the Insurance Landscape

The world of insurance pricing is complex and ever-evolving, influenced by a multitude of factors. From understanding the intricacies of risk assessment and policy coverage to exploring the latest trends in technology and consumer behavior, navigating this landscape requires a strategic approach. By leveraging the insights and strategies outlined in this article, you can make informed decisions, secure the best insurance deals, and protect your financial well-being.

Remember, when comparing insurance prices, it's not just about finding the lowest cost. The financial stability and performance of the insurance company, as well as the range of policy features and coverage options, are equally important considerations. By striking a balance between cost and value, you can ensure you receive the coverage you need at a price that fits your budget.

As you embark on your journey to find the best insurance deals, keep an eye on the latest trends and developments in the industry. By staying informed and proactive, you can navigate the insurance landscape with confidence, making choices that align with your unique needs and circumstances.

How do insurance companies determine prices?

+Insurance companies use complex risk assessment models to determine prices. These models consider various factors, including demographics, risk assessment, policy coverage, and market factors. By analyzing these elements, insurance companies can estimate the likelihood of a claim being made and set premiums accordingly.

What are some strategies for comparing insurance prices effectively?

+Effective strategies for comparing insurance prices include using online comparison tools and websites, bundling policies to take advantage of multi-policy discounts, negotiating with insurance agents, and exploring alternative insurance options. Additionally, staying loyal to a provider and taking advantage of renewal discounts can lead to significant savings.

Why is evaluating insurance companies’ financial strength and performance important?

+Evaluating insurance companies’ financial strength and performance is crucial as it ensures the company is financially stable and can pay out claims promptly. Independent rating agencies provide financial strength ratings, while surveys and research from organizations like J.D. Power and Consumer Reports assess claims satisfaction and customer service ratings.

What are some emerging trends in insurance pricing that consumers should be aware of?

+Emerging trends in insurance pricing include the rise of telematics and usage-based insurance, which rewards safe driving behavior with lower premiums. Additionally, the impact of AI and ML technologies is expected to lead to more precise pricing models and potentially lower premiums for consumers. Finally, the growing importance of a strong digital presence and online engagement will influence how insurance companies attract and retain customers.