Insurance Qote

The world of insurance is vast and complex, with numerous options and policies available to cater to diverse needs. Obtaining an insurance quote is a crucial step towards securing adequate coverage for individuals and businesses alike. In this comprehensive guide, we will delve into the intricacies of insurance quotes, exploring the factors that influence them, the steps involved in obtaining them, and the strategies to ensure you receive the best possible coverage at the most competitive rates.

Understanding Insurance Quotes

An insurance quote, in essence, is an estimate of the cost of an insurance policy based on the information provided by the potential policyholder. It serves as a preliminary step before purchasing insurance, allowing individuals to compare prices and coverage options from various providers. Quotes are influenced by a multitude of factors, each playing a significant role in determining the overall cost and terms of the policy.

Factors Affecting Insurance Quotes

The insurance industry operates on the principle of risk assessment. The higher the perceived risk, the higher the insurance premium. Here are some key factors that influence insurance quotes:

- Type of Insurance: Different types of insurance, such as auto, home, health, or life insurance, have distinct coverage needs and associated risks. Each type of insurance has its own set of factors that influence quotes.

- Coverage Requirements: The extent of coverage desired by the policyholder greatly impacts the quote. Higher coverage limits often result in higher premiums.

- Deductibles and Co-payments: Choosing higher deductibles (the amount the policyholder pays before insurance coverage kicks in) can lower premiums. Similarly, co-payments (the amount paid by the insured for healthcare services) can affect health insurance quotes.

- Personal and Business Factors: Individual characteristics like age, gender, health status, and driving record can affect insurance quotes. For businesses, factors such as industry, location, and size play a significant role.

- Claims History: A history of insurance claims can impact future quotes. Frequent claims may lead to higher premiums or even difficulty in securing coverage.

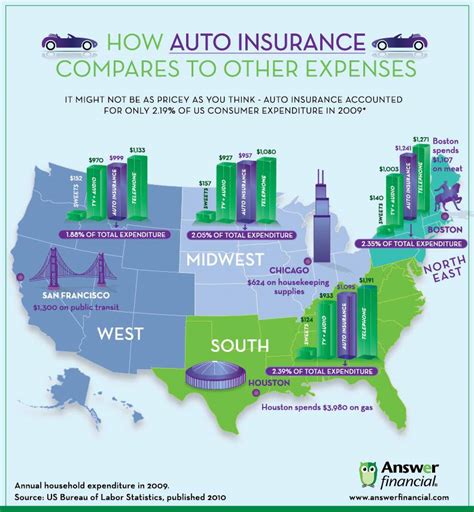

- Location: The geographic location of the insured property or vehicle can influence quotes due to variations in risk factors like crime rates, weather conditions, or accident frequencies.

The Insurance Quote Process

Obtaining an insurance quote involves a series of steps aimed at assessing the risk and determining the appropriate coverage and premium. Here’s a simplified breakdown of the process:

- Research and Comparison: Start by researching different insurance providers and the types of coverage they offer. Compare policies, coverage limits, and premiums to get a sense of the market.

- Gather Information: Compile the necessary information required for an accurate quote. This may include personal details, property or vehicle specifications, business details, and any relevant documents or reports.

- Contact Insurance Providers: Reach out to insurance companies or brokers to request quotes. Provide the collected information and be prepared to answer any additional questions to ensure an accurate quote.

- Review and Analyze Quotes: Once you receive quotes, carefully review and compare them. Consider not only the premium but also the coverage limits, deductibles, and any additional benefits or exclusions.

- Negotiate and Finalize: If you’re seeking the best value, negotiate with insurance providers. Explain your specific needs and requirements, and inquire about discounts or adjustments to coverage limits to achieve a more favorable quote.

- Purchase the Policy: After selecting the most suitable insurance provider and policy, finalize the purchase. Provide the necessary payments and documentation to activate your insurance coverage.

Tips for Securing the Best Insurance Quotes

Navigating the insurance landscape to secure the most advantageous quotes requires a strategic approach. Here are some tips to help you in your quest for the best insurance coverage:

- Understand Your Needs: Clearly define your insurance requirements. Are you looking for comprehensive coverage or just the basics? Understanding your needs will help you avoid overpaying for unnecessary features.

- Shop Around: Don’t settle for the first quote you receive. Compare quotes from multiple insurance providers to find the best combination of coverage and price. Online quote comparison tools can be particularly useful.

- Bundle Policies: Consider bundling multiple insurance policies, such as auto and home insurance, with the same provider. Many insurance companies offer discounts for bundling, making it a cost-effective option.

- Improve Risk Profile: Take steps to reduce your perceived risk. For auto insurance, this could mean installing anti-theft devices or taking defensive driving courses. For health insurance, maintaining a healthy lifestyle can lead to lower premiums.

- Explore Discounts: Insurance providers often offer a variety of discounts. Common discounts include safe driving records, good student discounts, loyalty discounts, and multi-policy discounts. Inquire about all available discounts to maximize your savings.

- Review Regularly: Insurance needs and quotes can change over time. Regularly review your insurance policies and quotes, especially during significant life events like marriage, home purchases, or career changes. This ensures your coverage remains adequate and cost-effective.

The Future of Insurance Quotes

The insurance industry is undergoing a digital transformation, and insurance quotes are no exception. Here’s a glimpse into the future of insurance quotes:

- Artificial Intelligence and Machine Learning: AI and machine learning technologies are being leveraged to analyze vast amounts of data, improve risk assessment, and provide more accurate and personalized quotes. This technology can also streamline the quote process, making it faster and more efficient.

- Digital Platforms and Online Quotes: Online insurance platforms and comparison websites are becoming increasingly popular, providing a convenient and efficient way to obtain quotes. These platforms often offer real-time quotes, allowing potential policyholders to make quick and informed decisions.

- Telematics and Usage-Based Insurance: Telematics technology is transforming the auto insurance industry by providing real-time driving data. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer personalized premiums based on actual driving behavior, encouraging safer driving habits.

- Data-Driven Risk Assessment: Advanced analytics and big data are enabling insurance providers to make more accurate risk assessments. By analyzing vast datasets, insurance companies can identify patterns and trends, leading to more precise quotes and better-tailored coverage.

Conclusion

Obtaining an insurance quote is a critical step in securing the right coverage for your needs. By understanding the factors that influence quotes, following a strategic process, and staying informed about industry trends, you can navigate the insurance landscape with confidence. Remember, the best insurance quote is not always the cheapest, but rather the one that provides the most comprehensive coverage at a competitive price. Stay informed, shop around, and make insurance work for you.

How often should I review my insurance quotes and policies?

+It is recommended to review your insurance quotes and policies annually, or whenever there is a significant change in your personal or business circumstances. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary features.

Can I negotiate my insurance quote?

+Absolutely! Negotiating your insurance quote is a common practice. Insurance providers often have some flexibility in their pricing, especially for loyal customers or those with specific coverage needs. Explain your requirements and inquire about any available discounts or adjustments to coverage limits to potentially secure a better deal.

What documents do I need to provide when obtaining an insurance quote?

+The specific documents required can vary depending on the type of insurance and your circumstances. Generally, for auto insurance, you may need to provide your driver’s license, vehicle registration, and proof of prior insurance (if applicable). For home insurance, you might need to provide details about your home, such as its age, square footage, and any recent renovations. For health insurance, personal health information and income details may be required. It’s best to consult with your insurance provider or broker to understand the specific documentation needed.