Insurance Quote Boat

In the vast and diverse world of marine insurance, one of the most sought-after policies is undoubtedly boat insurance. Whether you're a seasoned sailor, a recreational boater, or a fishing enthusiast, understanding the intricacies of boat insurance is essential to ensure a smooth sailing experience on the open waters. From comprehensive coverage to tailored policies, the options are vast, and navigating them can be challenging. In this comprehensive guide, we delve into the world of boat insurance, exploring the key considerations, coverage options, and expert tips to help you secure the best insurance quote for your beloved boat.

Understanding the Need for Boat Insurance

Boating is an exhilarating pastime, offering a unique blend of adventure and relaxation. However, like any recreational activity, it comes with its fair share of risks. From unpredictable weather conditions to mechanical failures and potential collisions, the perils of boating can lead to significant financial liabilities. This is where boat insurance steps in as a crucial safeguard, providing peace of mind and financial protection for boat owners.

Boat insurance is not merely a legal requirement in many jurisdictions; it is a responsible choice that can mitigate the potential financial fallout of an unfortunate incident. Whether you own a luxury yacht, a modest fishing boat, or a sleek speedboat, having adequate insurance coverage is essential to protect your investment, cover potential liabilities, and ensure that you can continue enjoying the open waters without worry.

Assessing Your Boat Insurance Needs

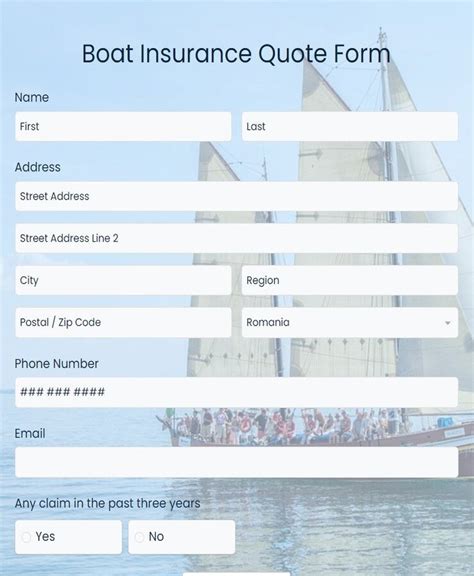

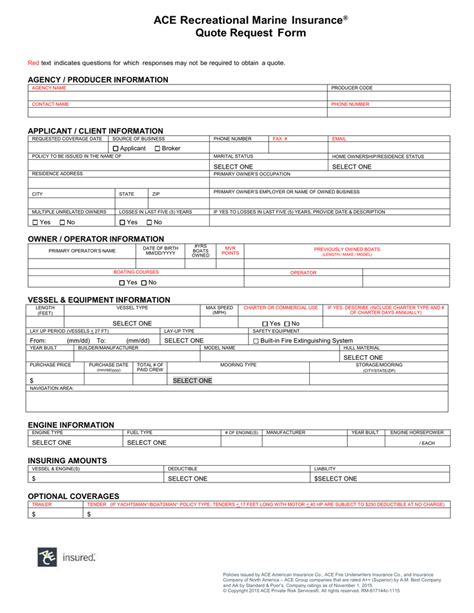

The first step in securing the right boat insurance quote is understanding your specific needs. Every boat owner’s situation is unique, and so are their insurance requirements. Factors such as the type of boat, its value, the frequency of use, and the intended purpose all play a role in determining the most suitable insurance coverage.

Boat Type and Value

The type and value of your boat are fundamental considerations when it comes to insurance. Different boat types, such as sailboats, powerboats, or personal watercraft, carry varying levels of risk and consequently, insurance premiums. Similarly, the boat’s value, including any modifications or upgrades, will influence the coverage and cost of your insurance policy.

| Boat Type | Average Insurance Cost |

|---|---|

| Sailboat (28-35 ft) | $500 - $1,200 annually |

| Powerboat (22-28 ft) | $400 - $800 annually |

| Personal Watercraft (jet ski) | $300 - $600 annually |

These average insurance costs are estimates and can vary significantly based on individual circumstances and the chosen coverage.

Usage and Location

The frequency of use and the locations where you plan to sail can also impact your insurance needs. If you’re an avid boater who uses your vessel frequently for long-distance trips, your insurance requirements will differ from someone who only uses their boat for occasional recreational outings in a specific body of water.

Coverage Options

Understanding the available coverage options is crucial to ensure you’re adequately protected. Here are some key coverage types to consider:

- Liability Coverage: This covers damages or injuries caused to others while you’re operating your boat. It’s essential for protecting your financial interests in the event of an accident.

- Physical Damage Coverage: Provides protection for your boat against physical damage or loss, including collision, fire, theft, and vandalism.

- Medical Payments Coverage: Covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

- Uninsured Boater Coverage: Protects you if you’re involved in an accident with an uninsured or underinsured boater.

- Emergency Assistance and Towing: Includes coverage for emergency services and towing, which can be invaluable when you’re far from shore.

Comparing Insurance Providers and Quotes

With a clear understanding of your insurance needs, the next step is to explore the market and compare quotes from different insurance providers. Shopping around is crucial to finding the best coverage at the most competitive price.

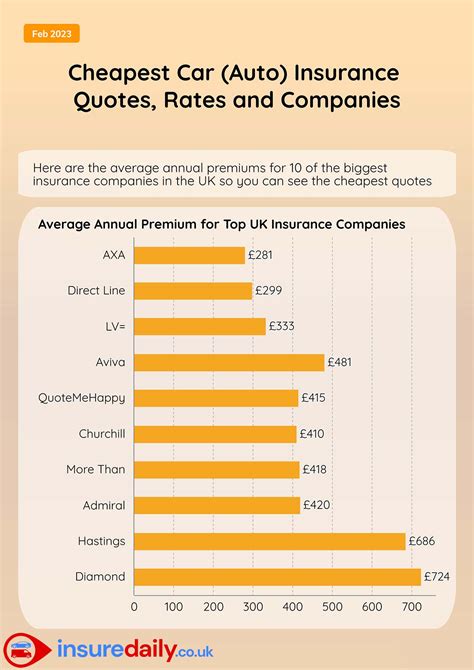

Reputable Insurance Companies

When researching insurance providers, focus on established and reputable companies that specialize in marine insurance. These companies often have a deep understanding of the unique risks associated with boating and can offer tailored policies to meet your specific needs.

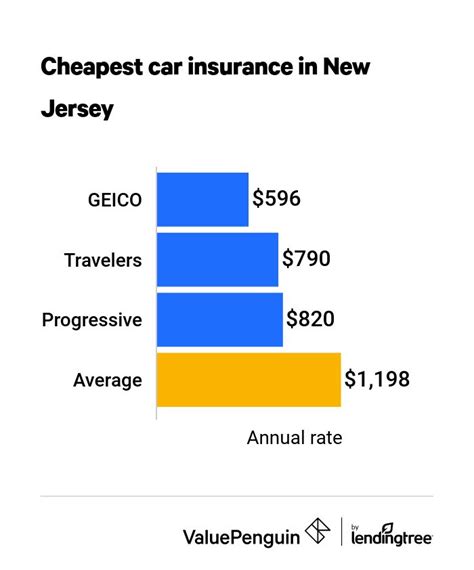

Some of the top marine insurance providers include GEICO Marine Insurance, Progressive Boat Insurance, and BoatUS Insurance. Each of these providers offers a range of coverage options and has a strong reputation in the industry.

Comparing Quotes

Obtaining multiple quotes is essential to ensure you’re getting the best deal. Compare not only the premiums but also the coverage limits, deductibles, and any exclusions or limitations outlined in the policy. A lower premium might not always be the best option if it comes with inadequate coverage or excessive exclusions.

Discounts and Savings

Insurance providers often offer discounts to encourage safe boating practices and loyalty. Some common discounts include:

- Multi-Policy Discounts: If you already have other insurance policies with the same provider (e.g., home or auto insurance), you may be eligible for a discount on your boat insurance.

- Safety Course Discounts: Completing a certified boating safety course can lead to reduced premiums, as it demonstrates a commitment to safe boating practices.

- Loyalty Discounts: Many insurance companies offer loyalty discounts to customers who have been with them for an extended period.

Tailoring Your Boat Insurance Policy

Once you’ve compared quotes and selected a reputable insurance provider, it’s time to tailor your policy to your specific needs. This step is crucial to ensure you’re not overpaying for coverage you don’t need or, conversely, underinsured for potential risks.

Assessing Your Risks

Evaluate the unique risks associated with your boating activities. For instance, if you frequently sail in areas with high boat traffic or known hazards, you may want to consider higher liability limits to protect yourself in the event of an accident.

Customizing Your Coverage

Work with your insurance provider to customize your policy. Discuss your specific needs and any additional coverage options that might be beneficial. For example, if you have expensive fishing gear or other valuable equipment on board, you may want to consider adding personal property coverage to your policy.

Understanding Deductibles

Deductibles are an essential aspect of any insurance policy. A higher deductible can lower your premium, but it means you’ll have to pay more out of pocket if you need to make a claim. Weigh the potential savings against the risk of a higher deductible to make an informed decision.

Expert Tips for Securing the Best Boat Insurance Quote

Securing the best boat insurance quote requires a thoughtful approach and a thorough understanding of your needs. Here are some expert tips to help you navigate the process effectively:

- Understand the coverage limits and exclusions in your policy. Don't assume that all policies offer the same level of protection.

- Be transparent about your boating activities and the value of your boat. Misrepresenting information can lead to policy cancellation or claims being denied.

- Consider adding wreckage removal coverage if you frequently sail in areas with known hazards. This coverage can be invaluable if your boat becomes grounded or sunk.

- If you have a boat that's not in use during certain months, discuss the option of lay-up coverage with your insurance provider. This can provide a cost-effective solution for periods of non-use.

- Keep a detailed inventory of your boat and its contents. This will streamline the claims process if you ever need to make a claim.

Conclusion: Navigating the Open Waters with Confidence

Securing the right boat insurance quote is an essential step in your boating journey. By understanding your needs, comparing quotes, and tailoring your policy, you can enjoy the open waters with the peace of mind that comes from knowing you’re adequately protected. Remember, the right insurance policy is not just a financial safeguard; it’s a testament to your commitment to safe and responsible boating practices.

As you set sail on your next adventure, let the knowledge gained from this guide empower you to make informed decisions about your boat insurance. Happy boating, and may your voyages be smooth and your horizons wide!

What is the average cost of boat insurance in the United States?

+The average cost of boat insurance in the U.S. varies widely based on factors such as boat type, value, location, and coverage limits. However, as a general guideline, you can expect to pay anywhere from 300 to 1,500 annually for basic liability and physical damage coverage. More comprehensive policies with higher coverage limits can exceed this range.

Are there any discounts available for boat insurance?

+Yes, many insurance providers offer discounts to encourage safe boating practices and loyalty. Common discounts include multi-policy discounts, safety course discounts, and loyalty discounts. Be sure to inquire about these options when obtaining quotes to potentially reduce your insurance premiums.

What happens if I need to make an insurance claim for my boat?

+If you need to make an insurance claim for your boat, the first step is to contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves submitting documentation and photographs of the damage or loss. The insurance company will then assess the claim and determine the appropriate compensation based on your policy’s coverage limits and deductibles.

Can I add additional coverage to my boat insurance policy after purchasing it?

+Yes, most insurance providers allow policyholders to add additional coverage options at any time. This can be particularly useful if your boating activities or the value of your boat change. Discuss your needs with your insurance provider to ensure you have the appropriate coverage.