Insurance Quote Usaa

Welcome to this in-depth exploration of USAA's insurance quote process. USAA, or United Services Automobile Association, is a unique financial services group that provides a range of products and services exclusively to US military members, veterans, and their families. Their insurance offerings are renowned for their competitive rates and tailored coverage, making them a popular choice for those who qualify. This article will delve into the specifics of obtaining an insurance quote from USAA, offering a comprehensive guide for prospective policyholders.

Understanding USAA’s Eligibility Criteria

Before diving into the quote process, it’s crucial to understand USAA’s eligibility requirements. USAA’s services are designed for:

- Active-duty military members of all branches of the US Armed Forces.

- Veterans who have honorably served in the US military.

- Spouses of USAA members or eligible military personnel.

- Children of USAA members or eligible military personnel up to the age of 21, and beyond if they are full-time students.

- Cadets and midshipmen at the US service academies.

If you meet any of these criteria, you are eligible to apply for insurance coverage with USAA. However, it's important to note that while USAA caters to military families, not all products and services are available to every eligible individual. The availability of certain products may depend on factors such as your duty status, where you live, and your specific needs.

Navigating the Insurance Quote Process

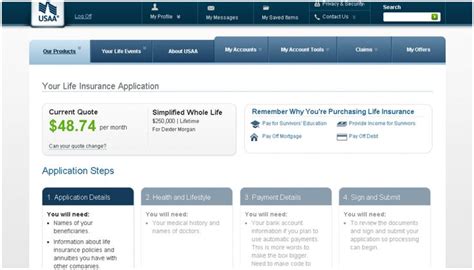

Obtaining an insurance quote from USAA is straightforward and can be done online, over the phone, or through a mobile app. Here’s a step-by-step guide to help you navigate the process:

Online Quote

- Visit the USAA Website: Go to https://www.usaa.com and navigate to the insurance section. You can find this under the “Products & Services” tab.

- Select Your Insurance Type: Choose the type of insurance you’re interested in. USAA offers auto, home, renters, life, health, and more. Click on the relevant link to proceed.

- Start Your Quote: You’ll be prompted to provide some basic information about yourself and your insurance needs. This typically includes your name, date of birth, and the type of coverage you’re seeking.

- Enter Your Vehicle or Property Details: If you’re quoting for auto or home insurance, you’ll need to provide details about your vehicle(s) or property. This may include make, model, year, and VIN for auto insurance, or the address and value of your home for homeowners insurance.

- Answer Underwriting Questions: USAA will ask a series of questions to assess your risk profile. These may include questions about your driving history, any prior claims, and the usage of your vehicle or property.

- Review and Confirm: Once you’ve provided all the necessary information, review your quote carefully. Ensure that the details are accurate and reflect your needs. If you’re satisfied, you can proceed to purchase the policy or save the quote for later.

Phone Quote

If you prefer a more personalized approach, you can call USAA’s customer service team at (800) 531-USAA (8722). A representative will guide you through the quote process, asking the same questions as the online form. This option can be particularly helpful if you have complex insurance needs or if you prefer to discuss your options with an expert.

Mobile App Quote

USAA’s mobile app, available for iOS and Android devices, offers a convenient way to get insurance quotes on the go. Simply download the app, log in to your USAA account, and follow the prompts to start your quote. The app provides a user-friendly interface, making it easy to provide the necessary information and review your quote.

Understanding Your Insurance Quote

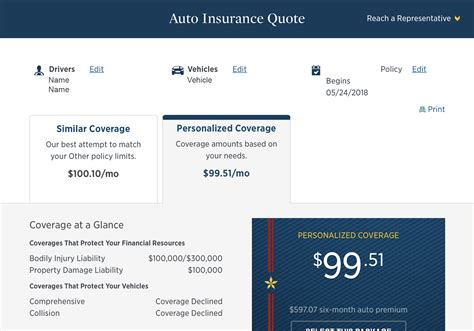

Your USAA insurance quote will provide a detailed overview of the coverage and costs associated with your policy. Here are some key components you should understand:

Coverage Options

USAA offers a range of coverage options to tailor your policy to your specific needs. For auto insurance, this may include liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and more. For homeowners insurance, you’ll typically see coverage for dwelling, other structures, personal property, liability, and additional living expenses.

Policy Limits and Deductibles

Your quote will include details on the policy limits, which represent the maximum amount USAA will pay for a covered loss. You’ll also see information about deductibles, which is the amount you’ll pay out of pocket before USAA’s coverage kicks in. Deductibles can vary based on the type of insurance and your chosen coverage limits.

| Coverage Type | Policy Limits | Deductibles |

|---|---|---|

| Auto Insurance | Varies based on state and coverage level | Typically $250, $500, or $1000 |

| Homeowners Insurance | Dwelling: Typically 80% or 100% of home value Personal Property: Usually 50% or 70% of dwelling limit |

Varies based on coverage level, typically $500, $1000, or $2500 |

Premium Costs

The premium is the amount you’ll pay for your insurance coverage. USAA calculates premiums based on a variety of factors, including your coverage options, policy limits, deductibles, and your personal risk profile. Your quote will provide a breakdown of the premium costs, often with the option to pay monthly, quarterly, or annually.

Benefits of USAA Insurance

USAA’s insurance products offer a range of benefits that cater specifically to the needs of military families. These include:

Competitive Rates

USAA is known for offering competitive insurance rates. Their extensive understanding of the unique risks and needs of military families allows them to price their policies attractively. USAA’s members often benefit from lower premiums due to the organization’s not-for-profit structure, which passes savings on to policyholders.

Tailored Coverage

USAA offers a wide range of coverage options to ensure you can customize your policy to fit your specific needs. Whether you require comprehensive auto insurance, specialized homeowners coverage for unique property types, or life insurance to protect your family’s financial future, USAA has a policy for you.

Military-Friendly Features

USAA’s insurance products are designed with the military lifestyle in mind. This includes features like:

- Deployment Discounts: Active-duty military members may qualify for discounts when deployed.

- Flexible Payment Options: USAA offers flexible payment plans to accommodate varying pay schedules and deployments.

- Military-Specific Coverage: USAA provides unique coverage options like tactical gear coverage for service members and Protection for Military Members (PMM) for additional protection while deployed.

Future Implications and Industry Insights

USAA’s insurance offerings are poised to continue evolving to meet the changing needs of military families. With a focus on innovation and member satisfaction, USAA is likely to expand its digital capabilities, offering even more convenient ways to obtain quotes and manage policies. Additionally, as the military community’s needs evolve, USAA is well-positioned to adapt its coverage options to provide comprehensive protection.

Looking ahead, USAA's commitment to its members and its focus on competitive rates and tailored coverage are expected to remain cornerstone aspects of its insurance offerings. As the organization continues to grow and adapt, its insurance products are likely to remain a top choice for military families seeking comprehensive, affordable protection.

Can I get an insurance quote from USAA if I’m not a military member or family member?

+Unfortunately, USAA’s insurance products are exclusively for military members, veterans, and their families. However, there are other reputable insurance providers that cater to a wider range of customers.

How does USAA determine insurance rates?

+USAA calculates insurance rates based on a variety of factors, including the type of coverage, policy limits, deductibles, and the insured’s personal risk profile. Their rates are competitive due to their not-for-profit structure and deep understanding of the military community’s needs.

What if I have a unique insurance need that’s not typically covered by standard policies?

+USAA offers a range of specialized coverage options to cater to unique needs. For example, they provide tactical gear coverage for service members and have programs like Protection for Military Members (PMM) to address specific risks faced by military personnel. If you have a unique need, it’s best to speak with a USAA representative to discuss your options.

How can I get the most accurate insurance quote from USAA?

+To get an accurate quote, ensure you provide USAA with all the relevant information about your insurance needs. This includes details about your vehicle(s), property, driving history, and any prior claims. The more accurate the information you provide, the more precise your quote will be.