Insurance Quotes Allstate

Insurance is an essential aspect of modern life, providing individuals and businesses with financial protection and peace of mind. When it comes to choosing an insurance provider, many people opt for well-established brands known for their reliability and comprehensive coverage. One such company that has built a solid reputation over the years is Allstate.

In this comprehensive guide, we will delve into the world of Allstate insurance quotes, exploring the factors that influence their rates, the process of obtaining a quote, and the benefits that Allstate offers to its customers. By the end of this article, you will have a deeper understanding of Allstate's insurance offerings and how to navigate the quote process effectively.

Understanding Allstate Insurance Quotes

Allstate, a leading insurance provider in the United States, offers a wide range of insurance products, including auto, home, life, and business insurance. The quotes provided by Allstate are tailored to individual needs and circumstances, taking into account various factors that impact insurance rates.

Here are some key aspects to consider when understanding Allstate insurance quotes:

Personalized Rates

Allstate understands that every customer is unique, and thus, their insurance needs vary. When requesting a quote, you will be asked a series of questions to assess your specific circumstances. Factors such as your age, gender, driving record, credit score, and the type of vehicle you own all play a role in determining your personalized insurance rate.

By providing accurate and honest information, you can ensure that your quote reflects your true insurance needs and helps you make an informed decision.

Coverage Options

Allstate offers a comprehensive suite of coverage options to cater to different lifestyles and preferences. Whether you’re looking for basic liability coverage or more extensive protection, Allstate has plans to suit your needs. Their coverage options include:

- Auto Insurance: Protects you against financial losses arising from accidents, theft, or damage to your vehicle.

- Homeowners Insurance: Provides coverage for your home, its contents, and any additional structures on your property.

- Renters Insurance: Essential for tenants, covering personal belongings and providing liability protection.

- Life Insurance: Offers financial security to your loved ones in the event of your untimely demise.

- Business Insurance: Tailored coverage for small businesses, including property, liability, and business interruption insurance.

Each coverage option can be further customized to meet your specific requirements, ensuring you receive the right level of protection.

Discounts and Savings

Allstate is known for its commitment to helping customers save on their insurance premiums. They offer a variety of discounts that can significantly reduce your insurance costs. Some common discounts available include:

- Safe Driver Discount: Recognizes and rewards drivers with a clean driving record, often resulting in lower premiums.

- Good Student Discount: Provides savings for young drivers who maintain good grades in school.

- Multi-Policy Discount: Offers a discounted rate when you bundle multiple insurance policies with Allstate.

- Loyalty Discount: Rewards long-term customers for their continued trust and business.

- Telematics Discount: Utilizes telematics devices to monitor driving behavior, rewarding safe drivers with lower rates.

By taking advantage of these discounts, you can potentially reduce your insurance costs and make your coverage more affordable.

The Process of Obtaining an Allstate Insurance Quote

Obtaining an insurance quote from Allstate is a straightforward and convenient process. You have the option to request a quote online, over the phone, or by visiting an Allstate agency near you.

Online Quote Request

Allstate’s website provides a user-friendly platform for obtaining insurance quotes. Here’s a step-by-step guide to requesting an online quote:

- Visit the Allstate Website: Navigate to Allstate's official website, where you'll find a dedicated section for insurance quotes.

- Select Your Insurance Type: Choose the type of insurance you're interested in, such as auto, home, or life insurance.

- Provide Basic Information: Enter your personal details, including your name, date of birth, and contact information. You'll also be asked about the specific coverage you require.

- Answer Questions: Complete a series of questions related to your insurance needs and circumstances. Be as accurate as possible to ensure an accurate quote.

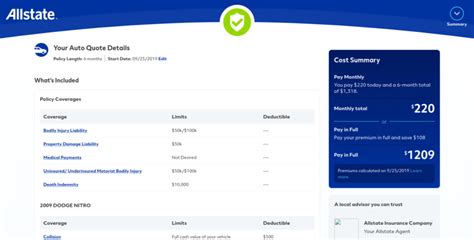

- Review and Compare: After submitting your information, you'll receive a personalized insurance quote. Take the time to review the details, including coverage limits, deductibles, and any applicable discounts.

- Make an Informed Decision: Compare the quote with other insurance providers to ensure you're getting the best value for your money. Allstate's quotes are often competitive, but it's always wise to explore multiple options.

The online quote process is quick and efficient, allowing you to obtain a quote within a matter of minutes.

Phone or Agency Quote Request

If you prefer a more personalized approach, you can choose to request an insurance quote over the phone or by visiting an Allstate agency. Here’s what you can expect:

- Phone Quote: Call Allstate's customer service hotline and speak to a knowledgeable insurance representative. They will guide you through the quote process, asking relevant questions to tailor the quote to your needs.

- Agency Visit: Locate your nearest Allstate agency and schedule an appointment. An insurance agent will meet with you in person, discuss your insurance requirements, and provide a personalized quote based on your circumstances.

Both options offer the advantage of personalized assistance, allowing you to clarify any doubts or ask specific questions about your insurance coverage.

Benefits of Choosing Allstate Insurance

Allstate is not just about providing insurance quotes; they offer a range of benefits and services that make them a trusted choice for many customers.

Financial Strength and Stability

Allstate is a well-established insurance provider with a strong financial foundation. They have been in business for decades, and their financial stability ensures that they can provide reliable coverage and meet their obligations to policyholders.

This financial strength is evidenced by their high ratings from reputable rating agencies, such as AM Best and Standard & Poor's, which assess the financial health and stability of insurance companies.

Innovative Technology

Allstate embraces technology to enhance the customer experience and streamline insurance processes. Their online platform offers convenient tools for policy management, claim filing, and quote requests.

Additionally, Allstate utilizes telematics devices and mobile apps to provide customers with real-time insights into their driving behavior, encouraging safe driving practices and potentially lowering insurance premiums.

Claim Support and Assistance

When an unfortunate event occurs, Allstate is committed to providing prompt and efficient claim support. Their dedicated claims team works tirelessly to ensure a smooth and hassle-free claims process.

Allstate offers 24/7 claim reporting, allowing you to initiate the claims process at any time, day or night. They also provide guidance and assistance throughout the claims journey, helping you navigate the complexities of insurance claims.

Customer Satisfaction and Service

Allstate places a strong emphasis on customer satisfaction and strives to deliver exceptional service. Their customer support team is readily available to address any queries or concerns you may have.

Allstate also offers educational resources and tools to help customers better understand their insurance coverage and make informed decisions. Their commitment to customer service has earned them recognition and accolades from various industry organizations.

Future Implications and Innovations

As the insurance industry continues to evolve, Allstate remains at the forefront of innovation. They are constantly exploring new technologies and strategies to enhance the customer experience and improve insurance offerings.

Telematics and Usage-Based Insurance

Allstate is at the forefront of implementing telematics and usage-based insurance models. By utilizing telematics devices and mobile apps, they can gather real-time data on driving behavior, rewarding safe drivers with lower insurance premiums.

This approach not only promotes safer driving habits but also allows Allstate to offer more personalized and accurate insurance quotes based on individual driving patterns.

Digital Transformation

Allstate recognizes the importance of digital transformation in the insurance industry. They continue to invest in developing user-friendly digital platforms and mobile apps, making it easier for customers to manage their policies, file claims, and obtain insurance quotes online.

By embracing digital technology, Allstate aims to provide a seamless and efficient customer experience, ensuring that insurance services are accessible and convenient for all.

Expanding Coverage Options

Allstate understands the changing needs of its customers and is committed to expanding its coverage options to meet those needs. They continuously evaluate and introduce new insurance products, ensuring that their customers have access to a comprehensive range of protection.

From specialty insurance for unique risks to enhanced coverage for emerging technologies, Allstate strives to stay ahead of the curve and provide relevant insurance solutions.

Conclusion

Allstate insurance quotes offer a personalized and comprehensive approach to insurance coverage. By understanding the factors that influence your quote and exploring the various benefits and services Allstate provides, you can make an informed decision about your insurance needs.

Whether you choose to obtain a quote online, over the phone, or by visiting an agency, Allstate's commitment to customer satisfaction and financial stability ensures a positive insurance experience. With their innovative technologies and expanding coverage options, Allstate remains a trusted partner in safeguarding your future.

How accurate are Allstate insurance quotes?

+Allstate insurance quotes are designed to be as accurate as possible, based on the information provided during the quote process. However, it’s important to note that the final insurance rate may vary slightly when you purchase a policy, as it is subject to underwriting guidelines and additional factors that may arise during the policy issuance process.

Can I negotiate my Allstate insurance quote?

+While Allstate strives to provide competitive and fair insurance quotes, the rates are generally non-negotiable. However, you can explore the various discounts and coverage options available to potentially lower your insurance costs. Speaking with an Allstate agent can help you identify opportunities to save on your premiums.

What happens if I need to make changes to my insurance policy after purchasing it?

+Allstate understands that life circumstances can change, and they offer flexibility when it comes to policy modifications. You can reach out to your Allstate agent or contact their customer service team to discuss any changes you wish to make to your insurance policy. They will guide you through the process and provide options to ensure your coverage remains up-to-date.