Insurance Quotes Cheap

When it comes to insurance, finding cheap quotes is a common goal for many individuals and businesses alike. The cost of insurance policies can vary significantly depending on various factors, and understanding how to navigate the market to secure the best rates is crucial. This comprehensive guide will delve into the world of insurance quotes, exploring the factors that influence their affordability, the steps to obtain competitive rates, and strategies to ensure you're getting the best value for your insurance needs.

Understanding the Dynamics of Insurance Quotes

Insurance quotes are essentially the estimated costs of an insurance policy tailored to an individual’s or entity’s specific circumstances. These quotes are determined by a myriad of factors, each contributing to the overall affordability of the policy.

Key Factors Affecting Insurance Costs

The cost of insurance is influenced by a combination of personal and external factors. These include, but are not limited to:

- Risk Assessment: Insurance companies evaluate the level of risk associated with insuring a particular individual or entity. Higher-risk profiles often result in higher premiums.

- Coverage Requirements: The scope and extent of coverage play a significant role. More comprehensive policies tend to cost more.

- Location: Geographical location can impact insurance costs. Areas prone to natural disasters or with higher crime rates may have higher insurance premiums.

- Age and Gender: In certain cases, age and gender can influence insurance rates, especially for specific types of insurance like auto insurance.

- Credit History: Some insurance providers consider credit scores when calculating premiums, assuming that individuals with better credit are more responsible.

The Importance of Comparative Analysis

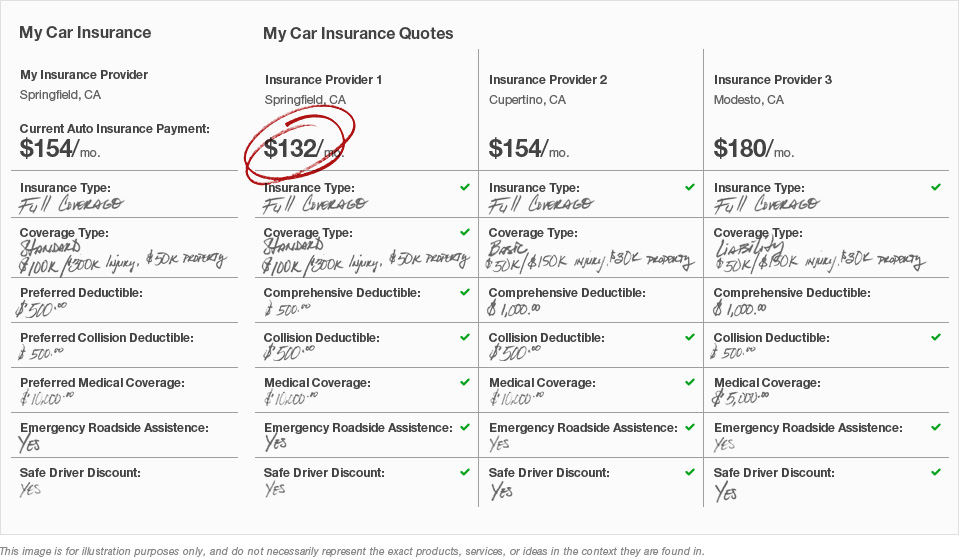

Comparing insurance quotes is a critical step in the process of securing the best rates. By evaluating quotes from multiple providers, individuals can identify the most cost-effective options that align with their coverage needs.

A comparative analysis should consider not only the premium but also the coverage details, deductibles, and any additional benefits or exclusions. It's essential to ensure that the policies being compared offer similar coverage to make an accurate assessment.

Strategies for Obtaining Affordable Insurance Quotes

Securing cheap insurance quotes requires a strategic approach. Here are some key strategies to consider:

Research and Understand Your Coverage Needs

Before seeking insurance quotes, it’s crucial to understand your specific coverage requirements. Identify the risks you want to insure against and the level of coverage you need. This ensures that you’re not overpaying for unnecessary coverage or, conversely, underinsured.

Consider factors like your financial situation, the value of your assets, and any legal or regulatory requirements that may impact your insurance needs.

Shop Around and Compare Providers

Insurance providers offer a wide range of policies, and their premiums can vary significantly. Shopping around and comparing quotes from multiple providers is essential to finding the best deal. Online comparison tools and insurance brokers can be valuable resources for this process.

When comparing quotes, pay attention to the fine print. Ensure that the policies offer comparable coverage and that any differences in premiums are justified by the level of coverage provided.

Consider Bundling Policies

Bundling multiple insurance policies with the same provider can often lead to significant savings. Many insurance companies offer discounts when you purchase multiple policies, such as auto and home insurance, or life and health insurance.

Bundling can simplify your insurance management and provide a more streamlined experience, making it a win-win situation for both the insurer and the policyholder.

Explore Discounts and Special Offers

Insurance providers often have various discounts and special offers available to attract new customers or reward loyalty. These discounts can be based on factors such as:

- Safe driving records (for auto insurance)

- Home safety features (smoke detectors, security systems)

- Membership in certain organizations or professional groups

- Loyalty discounts for long-term customers

Ask your insurance provider about any available discounts, and be sure to explore options with other providers to ensure you're getting the best deal.

Maintain a Good Credit Score

As mentioned earlier, some insurance providers consider credit scores when calculating premiums. Maintaining a good credit score can not only improve your financial health but also potentially lower your insurance costs.

If your credit score is not where you want it to be, consider taking steps to improve it. This could involve paying off debts, reducing credit card balances, or disputing any errors on your credit report.

Performance Analysis and Future Implications

Evaluating the performance of your insurance policy is an ongoing process. Regularly reviewing your coverage and premiums ensures that you remain adequately insured while managing costs.

Assessing Value and Coverage

When analyzing the value of your insurance policy, consider the following:

- Value for Money: Is the premium you’re paying aligned with the coverage and benefits you receive? Assess whether you’re getting a good deal relative to other providers.

- Coverage Adequacy: Regularly review your coverage to ensure it still meets your needs. Life circumstances can change, and your insurance policy should adapt accordingly.

Keeping Up with Market Trends

The insurance market is dynamic, and rates can fluctuate over time. Staying informed about market trends and changes in insurance regulations can help you anticipate and respond to shifts in the industry.

Pay attention to news and updates from insurance providers, and consider consulting with an insurance broker or financial advisor to stay ahead of any significant changes that may impact your insurance needs and costs.

Future Innovations in Insurance

The insurance industry is continually evolving, with technological advancements and changing consumer preferences driving innovation. Keep an eye on emerging trends such as:

- Telematics and Usage-Based Insurance: This technology allows insurance providers to track driving behavior in real-time, offering more personalized and potentially cheaper insurance rates based on actual usage.

- Digitalization and Automation: The rise of digital insurance platforms and automated processes is streamlining the insurance experience, making it more efficient and potentially reducing costs for both providers and policyholders.

- Insurtech Startups: Innovative startups are disrupting the traditional insurance model, offering new approaches to risk assessment and coverage that could lead to more affordable options for consumers.

Staying informed about these developments can help you make more informed decisions about your insurance needs and potentially unlock new opportunities for more cost-effective coverage.

Conclusion: Navigating the Insurance Landscape

Securing cheap insurance quotes is a balance between understanding your coverage needs, comparing providers, and staying informed about market trends and innovations. By adopting a strategic approach and regularly reviewing your insurance policies, you can ensure you’re getting the best value for your insurance dollar.

Remember, insurance is a vital tool for managing risk, and finding affordable coverage should not compromise the protection you require. With the right knowledge and resources, you can navigate the insurance landscape with confidence and peace of mind.

FAQs

What is the best way to compare insurance quotes?

+

The most effective way to compare insurance quotes is to use online comparison tools or work with an insurance broker. These resources allow you to quickly and easily compare quotes from multiple providers, ensuring you get the best rates for your specific needs.

How often should I review my insurance coverage and quotes?

+

It’s recommended to review your insurance coverage and quotes at least once a year, or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary features.

Are there any downsides to bundling insurance policies with the same provider?

+

While bundling policies can lead to significant savings, it’s important to ensure that you’re not sacrificing coverage or benefits to achieve those savings. Always compare bundled quotes with individual policies to ensure you’re getting the best overall value.

What are some common mistakes to avoid when seeking cheap insurance quotes?

+

Common mistakes include neglecting to compare quotes from multiple providers, not understanding your specific coverage needs, and failing to take advantage of available discounts. Additionally, be cautious of policies with extremely low premiums, as they may offer inadequate coverage.

How can I improve my chances of getting lower insurance rates over time?

+

To improve your chances of getting lower insurance rates, focus on maintaining a good credit score, practicing safe behaviors (e.g., safe driving), and staying informed about insurance market trends. Regularly reviewing and adjusting your coverage as needed can also help you manage costs effectively.