Insurance Quotes Online Home

In today's digital age, obtaining insurance quotes has become more accessible and convenient than ever before. The traditional process of visiting an insurance agent's office or making phone calls to compare rates is gradually being replaced by the ease and efficiency of online insurance quotes. This innovative approach has revolutionized the way people shop for insurance, empowering them to take control of their coverage needs and make informed decisions from the comfort of their homes.

Understanding the Evolution of Insurance Quotes

The insurance industry has witnessed a significant transformation over the years, especially with the advent of the internet and digital technologies. The concept of insurance quotes has evolved from a manual, time-consuming process to a streamlined, digital experience. Initially, individuals seeking insurance coverage had to rely on face-to-face meetings with insurance agents, who would then manually calculate quotes based on various factors such as risk assessment, policy features, and individual circumstances.

However, with the emergence of online insurance platforms, the process has become significantly more efficient and user-friendly. These platforms utilize advanced algorithms and data analytics to generate personalized insurance quotes in real-time. By simply providing some basic information about themselves and their insurance needs, individuals can now receive multiple quotes from various insurance providers within minutes.

The Benefits of Obtaining Insurance Quotes Online

The shift towards online insurance quotes offers a plethora of advantages for consumers. Firstly, it provides unparalleled convenience. Individuals can obtain quotes at any time, from the comfort of their homes or even on the go, eliminating the need for time-consuming appointments or phone calls.

Secondly, online insurance quotes empower consumers with greater control over their insurance journey. They can easily compare multiple quotes from different providers, allowing them to make informed decisions based on factors such as coverage, premiums, and policy features. This transparency and accessibility foster a more competitive insurance market, ultimately benefiting the consumer.

Additionally, the online insurance quote process is often faster and more efficient. Advanced algorithms and data-driven technologies enable insurance providers to generate accurate quotes quickly, reducing the time and effort required from both the consumer and the insurance company.

Streamlined Application Process

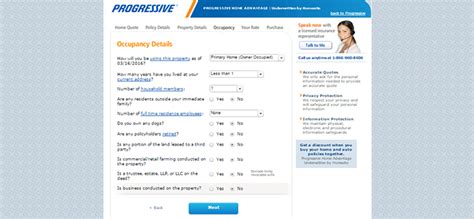

Obtaining insurance quotes online often leads directly to a streamlined application process. Many insurance providers now offer digital application forms that can be completed and submitted online. This not only saves time but also reduces the administrative burden associated with traditional paper-based applications.

Furthermore, the digital application process often incorporates e-signature technology, allowing consumers to sign and finalize their insurance policies electronically. This eliminates the need for physical documents and further expedites the overall insurance acquisition process.

Personalized Coverage Options

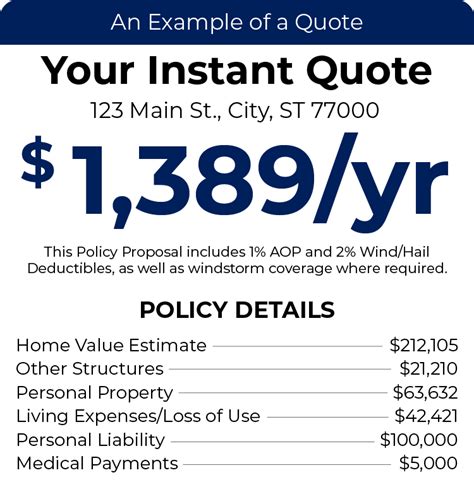

One of the significant advantages of online insurance quotes is the ability to receive personalized coverage options tailored to individual needs. Advanced algorithms and data analytics enable insurance providers to offer customized quotes based on a comprehensive assessment of the consumer’s risk profile and desired coverage.

For instance, when obtaining an online home insurance quote, individuals can input specific details about their home, such as its location, construction type, and any unique features. The online platform then utilizes this information to generate quotes that consider the unique risks and requirements associated with the property.

| Home Feature | Risk Assessment | Coverage Options |

|---|---|---|

| Location in a High-Risk Flood Zone | Increased likelihood of flood damage | Enhanced flood insurance coverage |

| Historical Architecture | Unique restoration requirements in case of damage | Specialized coverage for historical homes |

| Solar Panels | Potential for equipment malfunction or damage | Additional coverage for solar energy systems |

How to Get Accurate Online Insurance Quotes

While the convenience and efficiency of online insurance quotes are undeniable, it’s crucial to ensure the accuracy of the quotes received. Here are some tips to help you obtain precise and reliable online insurance quotes for your home:

- Provide Accurate Information: Online insurance quote platforms rely on the data you provide to generate accurate quotes. Ensure that you input correct and up-to-date information about your home, including its location, square footage, construction materials, and any recent renovations or upgrades.

- Be Comprehensive: When describing your home, don't leave out any essential details. Include information about any unique features, such as swimming pools, hot tubs, or home offices, as these can impact your insurance needs and the corresponding quotes.

- Compare Multiple Quotes: Don't settle for the first quote you receive. Compare quotes from different insurance providers to ensure you're getting the best value for your money. Online insurance comparison tools can be invaluable in this regard, allowing you to view and analyze multiple quotes side by side.

- Understand Coverage Options: Take the time to understand the different coverage options available and how they apply to your specific needs. For instance, understand the difference between replacement cost coverage and actual cash value coverage, and choose the option that provides the most appropriate protection for your home.

- Consider Deductibles: Deductibles can significantly impact your insurance premiums. While higher deductibles may result in lower premiums, they also mean you'll have to pay more out of pocket in the event of a claim. Strike a balance that suits your financial situation and risk tolerance.

Future Trends in Online Insurance Quotes

The landscape of online insurance quotes is continuously evolving, driven by advancements in technology and changing consumer preferences. Here are some emerging trends that are shaping the future of online insurance quotes:

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being integrated into online insurance platforms. These technologies enable more accurate risk assessment and personalized quote generation. By analyzing vast amounts of data, AI and ML algorithms can identify patterns and trends, leading to more precise insurance quotes tailored to individual circumstances.

Enhanced Data Analytics

The insurance industry is leveraging advanced data analytics techniques to gain deeper insights into consumer behavior and risk factors. By analyzing historical data and real-time information, insurance providers can make more informed decisions when generating quotes. This leads to more accurate risk assessments and, consequently, more precise insurance quotes.

Blockchain Technology

Blockchain technology is expected to play a significant role in the future of online insurance quotes. By providing a secure and transparent platform for data storage and transactions, blockchain can enhance the accuracy and efficiency of insurance processes. For instance, it can facilitate the secure sharing of medical records or vehicle history, leading to more precise health or auto insurance quotes.

Telematics and Usage-Based Insurance

Telematics and Usage-Based Insurance (UBI) are gaining traction in the insurance industry. These technologies allow insurance providers to track and analyze real-time data, such as driving behavior or home security measures, to offer more accurate insurance quotes. For example, UBI in auto insurance can reward safe drivers with lower premiums, while smart home devices can provide data on home security systems, influencing home insurance quotes.

What factors influence the accuracy of online insurance quotes for homes?

+

Online insurance quotes for homes are influenced by various factors, including the accuracy of the information provided by the homeowner, the risk assessment algorithms used by insurance providers, and the data available to those algorithms. Accurate quotes depend on homeowners providing precise details about their home’s location, construction, and any unique features that could impact insurance needs.

How can I ensure I’m getting the best insurance quote for my home online?

+

To ensure you’re getting the best insurance quote for your home online, compare quotes from multiple providers. Use insurance comparison websites or directly visit the websites of various insurance companies to obtain quotes. Additionally, carefully review the coverage options and understand the differences between policies to choose the one that best fits your needs and provides adequate protection.

Are online insurance quotes always the same as the final policy premium?

+

Online insurance quotes provide an estimate of what your insurance policy might cost. While they are a good indicator of the final premium, the actual premium can vary slightly based on additional factors that might be considered during the underwriting process, such as your credit score or any claims history. It’s important to review the final policy document to understand the exact terms and conditions.